The global economy is going through a very rough patch. With inflation in both developed and developing economies reaching decadal highs, an impending energy crisis due to the standoff between the West and Russia, and a food crisis has derailed GDP growth globally.

And, if that is not enough, central banks worldwide have opted for aggressive interest rate hikes to rein in inflation. However, compared to any other economy, the aggressive Fed rate hikes and its hawkish stance may prove to be a significant cause of worry for the market.

This blog will help you to understand the impact of the Fed’s Powell policy on your portfolio and the overall market.

Jackson Hole Event

Against rising inflation, the Fed’s Powell policy delivered four rate hikes in 2022 so far, including the big hikes of 0.75% in June and July. However, the rate hikes were on the expected line, but Fed Chair Jerome Powell’s recent speech at the Jackson Hole event, the Federal Reserve’s three-day annual conference, has surprised investors.

At the three-day conference, he said that Fed’s primary focus would be to bring down inflation to within the 2% target, and they will continue to have a hawkish stance, prioritizing lowering inflation and increasing interest rates despite its effect on economic growth.

The US Federal Reserve has hiked interest rates by 150bps in 2022 and may raise another 200bps during the rest of the year. Cumulatively, that turns out to be a hike of 350bps, making it one of the most aggressive rate hike cycles, according to an Acuite Ratings report.

The Dollar Index

The US Dollar has been the world’s reserve currency for almost 60 years. As a result, most financial transactions, international debt, and global trade are dollar-denominated, and nearly 60% of the world’s reserves are in dollars.

So, when the Fed raises interest rates, it encourages people and financial institutions to save more and move their money parked in risk-on assets to risk-off assets. It sucks out the liquidity from the system, reducing the circulation of dollars in the market. It helps the dollar strengthen against other currencies.

The US Dollar Index measures the strength of the USD against the basket of six foreign currencies, viz., Euro, Pound, Swiss Franc, Yen, Canadian Dollar, and Swedish Krona, which have appreciated by almost 15% since Feb 2022.

How Fed’s Powell Policy will Impact Your Portfolio?

Rate hikes by the Fed and the strong dollar are a dual hit for any economy. The following are the ways how Fed’s Powell Policy impacts your portfolio.

Weaker Rupee

In India, the rupee has depreciated by almost 7.3% against the US dollar in 2022; further Fed rate hikes will worsen the situation. However, despite depreciating against the US dollar, it appreciated against other currencies like the euro, GBP, and the yen.

While the falling rupee is good news for exporters as they can get substantial value for their goods and services, it’s the opposite for importers. India is known to have a negative trade balance, meaning imports are higher than exports, which adds pressure to the country’s foreign reserve. As a result, India’s forex reserve fell by $89 billion in the ten months to $553 billion as of September 2022.

Higher Inflation

While a strong dollar helps the US fight inflation more effectively, it creates inflationary pressure for other economies. A weaker rupee has significantly increased the input costs resulting in inflationary pressure on the economy. Higher input costs always impact the company’s bottom lines and capital expenditure plans, resulting in the stock’s underperformance.

High Cost of Credit

The Reserve Bank of India must resort to increasing the repo rate to tame the inflationary pressure, which increases the cost of borrowing in the country, impacting the value creation process.

In 2022, RBI has hiked the repo rate by 90 basis points, and if inflation persists, it may raise the rates further in the next monetary policy meet. The increased cost of borrowing will drive down consumption, impacting growth stocks as they rely heavily on both capital and steady consumption.

The Outflow of Foreign Institutional Investors

The Powell policy Fed rate hikes make the US treasury yields more attractive for investors. They motivate foreign institutional investors to shift their money from emerging economies to invest more in debt instruments in the US market. And the returns from investing in the US treasury are entirely risk-free, making it the best investment alternative in these volatile and uncertain market conditions.

Primarily, selling by foreign institutional investors results in share market corrections and crashes. Such corrections can create panic and fear among domestic investors, who may sell, impacting their portfolio profoundly.

Impending Liquidity Crisis

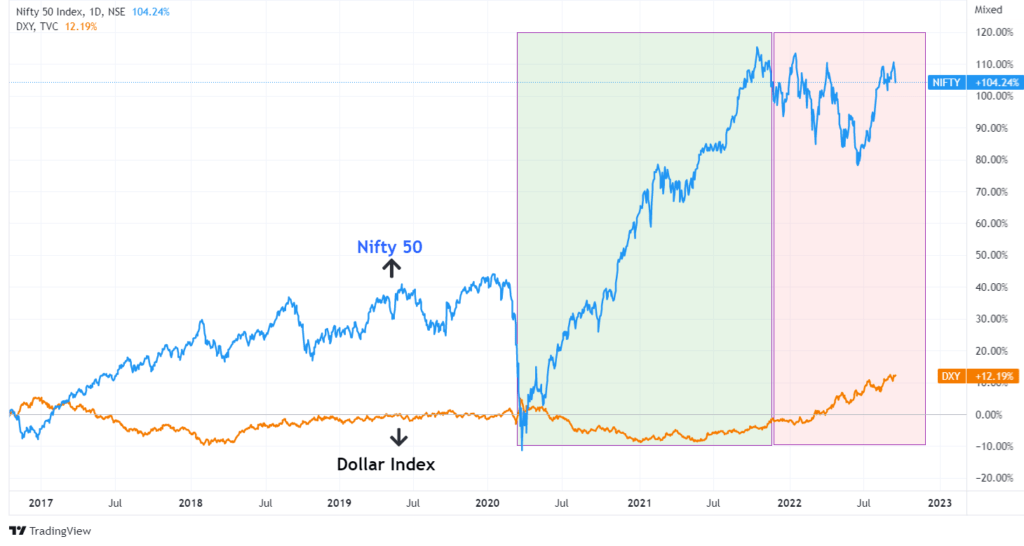

A stock market requires sustained liquidity to grow and create value for investors. It was evident during the period between 2020 and 2021 when central banks worldwide opted for an ultra-beneficial monetary policy to reduce the impact of the pandemic. As a result, nifty 50 and BSE Sensex recorded more than 100% increase in value during the period.

In the chart above comparing the movement of the Nifty 50 and Dollar Index, there are two zones marked in green and red. In the green zone between 2020 and 2022, a soft dollar index helped the Nifty 50 move higher due to a better liquidity position in the market. But, from the period starting 2022, a rise in the Dollar Index due to the Powell policy resulted in higher volatility and the Nifty 50 struggling to break higher.

But Fed’s Powell policy with aggressive and long rate hike cycles may trigger liquidity crises, high volatility, and a fall in the price of stocks. Moreover, an extended period of tighter monetary policy may spook investors and shift their money towards low-risk options to save capital.

Conclusion

So, the big question is, what should you do? Trim down your positions, stop investing, or continue buying the dip?

The answer to this question is simple, stick to your investment objectives and strategies. If you are a long-term investor, such short-term volatility should not matter to you. Furthermore, the Fed rate hikes don’t happen overnight. Instead, they discuss and debate these policies publicly weeks in advance. So, you get ample time to plan and manage your investments.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.