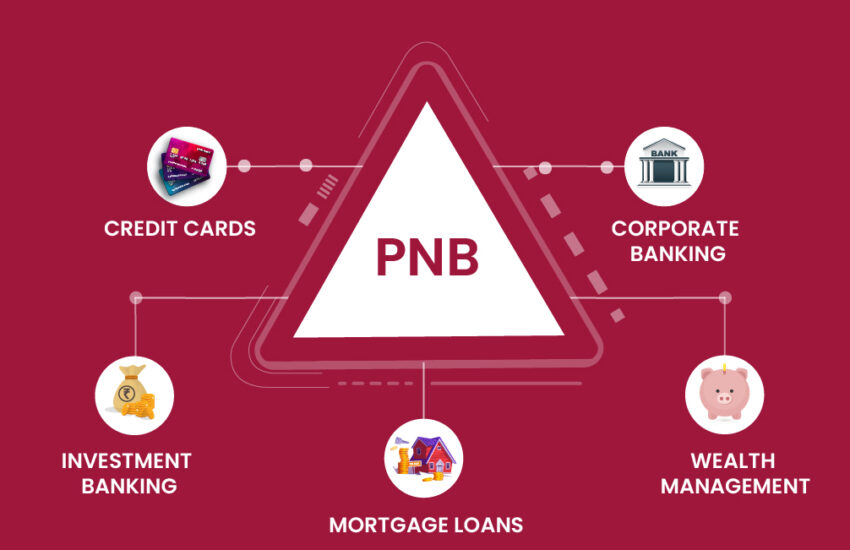

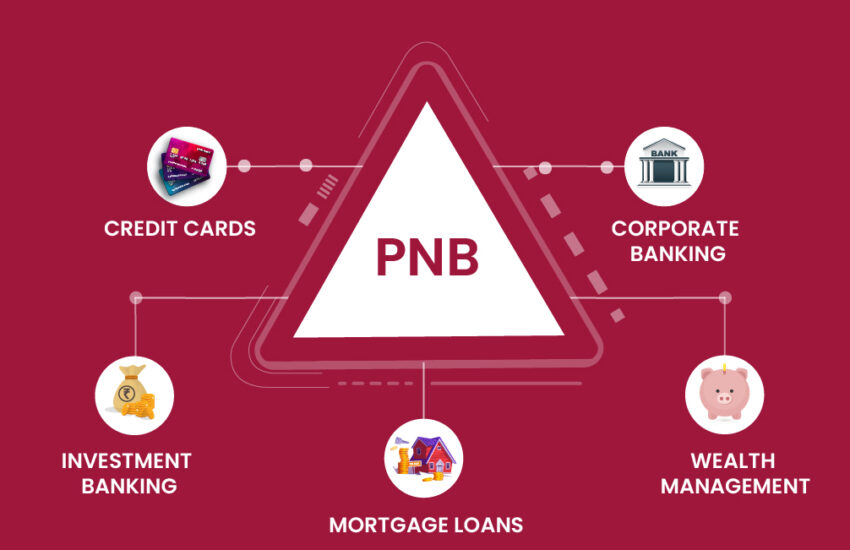

Introduction Punjab National Bank, popularly known as PNB Bank, became the third bank in the public domain to reach a

Continue reading

Fundamental analysis of stocks based on the quarterly and annual reports of the companies.

Introduction Punjab National Bank, popularly known as PNB Bank, became the third bank in the public domain to reach a

Continue reading

Indian Railways is not one organization but a combination of multiple organizations dedicated to the daily operations and functioning of

Continue reading

Several brands have ingrained themselves so deeply in our lives that they have become nearly irreplaceable or synonymous with their

Continue reading

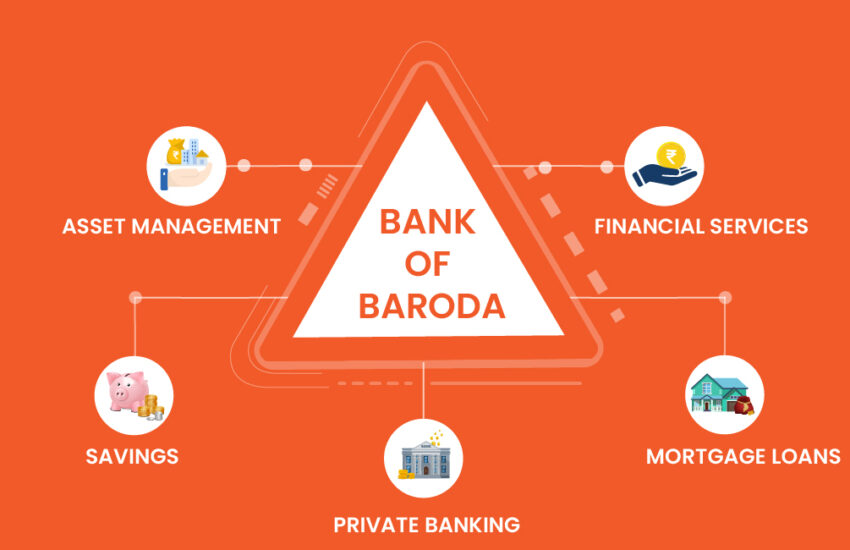

Bank of Baroda’s history is steeped in excellence as one of India’s foremost public sector banks. With a robust legacy,

Continue reading

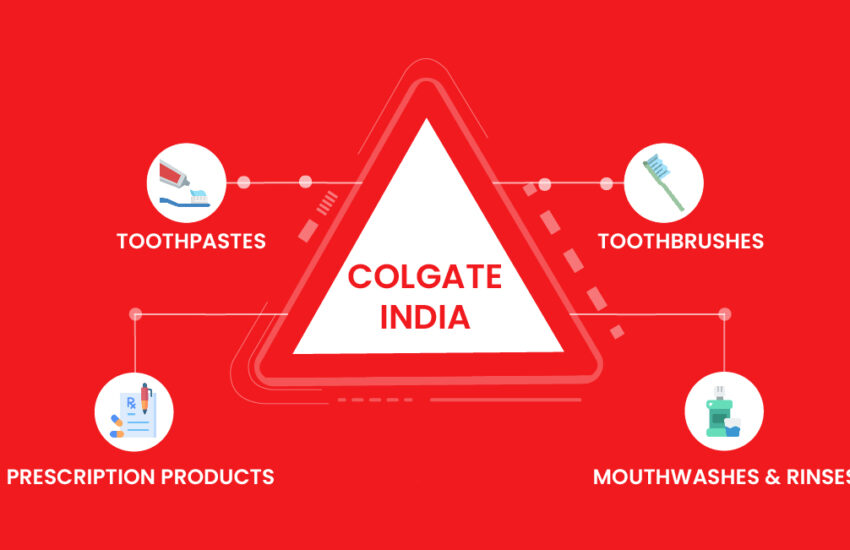

Did you know Colgate originally sold soap and perfume before adding toothpaste to their product portfolio? The company’s roots date

Continue reading

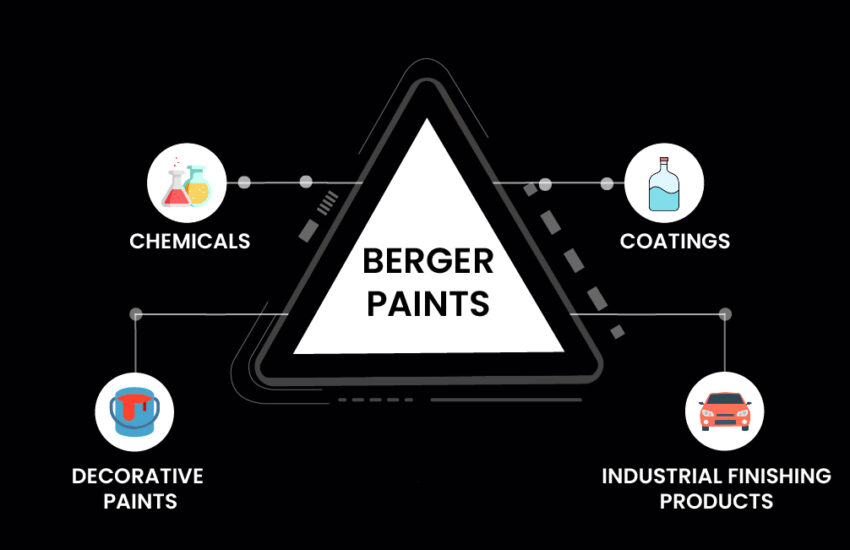

In India, the paint industry has been long characterized by the dominance of two significant players, Asian Paints and Berger

Continue reading

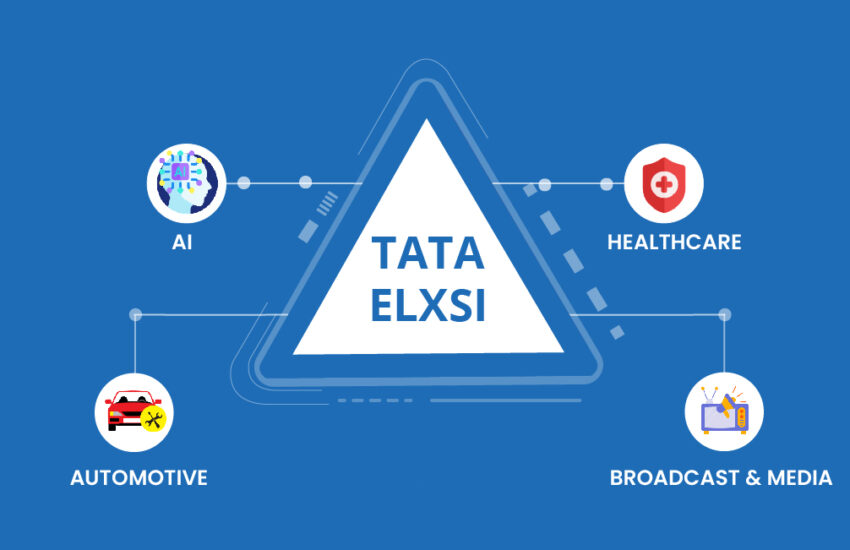

Have you ever noticed how everyday items have become more comfortable in recent years, with ergonomic designs that feel right

Continue reading

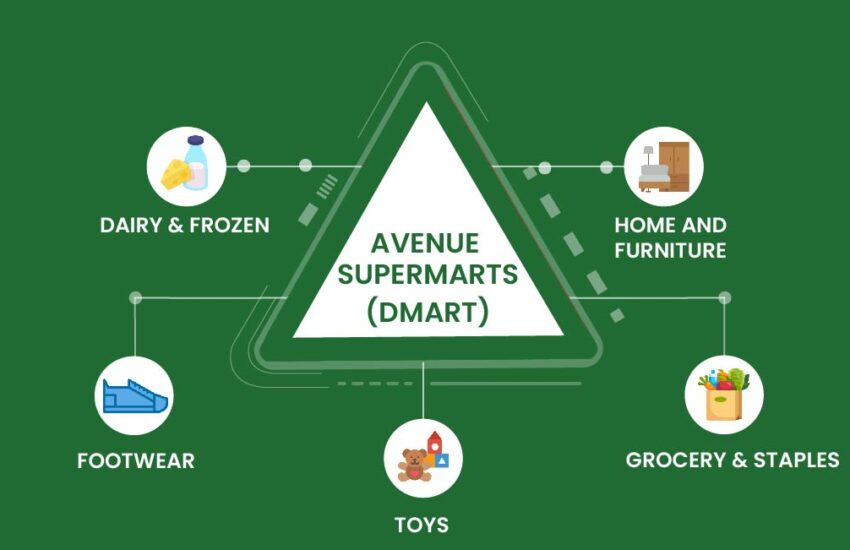

Introduction In a fiercely competitive market, where large and multinational retail chains are struggling to dominate and be profitable, Avenue

Continue reading

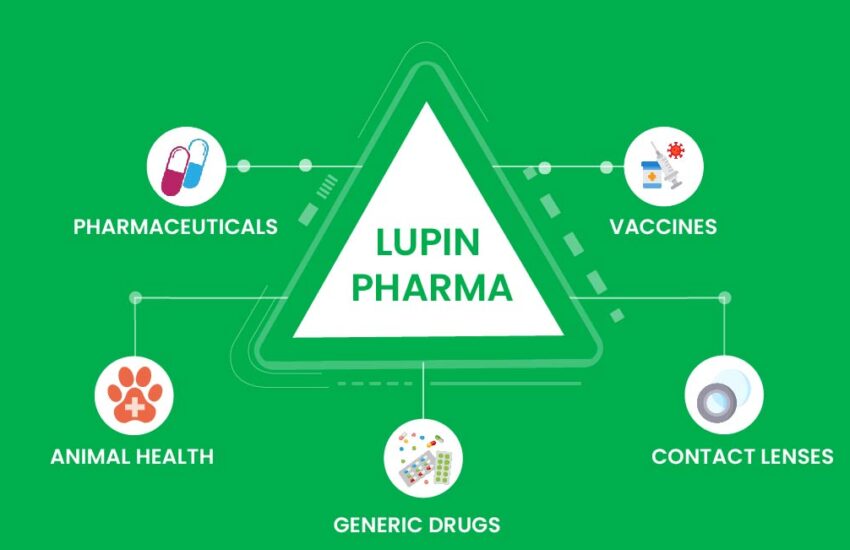

Introduction India is known as the “Pharmacy of the World” because of its ability to produce high-quality, low-cost generic and

Continue reading

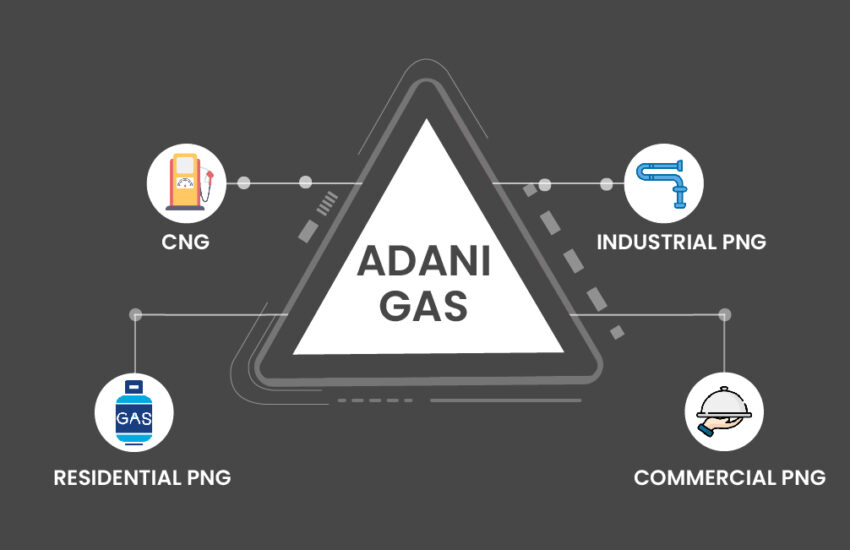

Introduction Adani Group is India’s largest private Energy & Utility company, with a strong presence in Renewables, Power Generation, Transmission

Continue reading

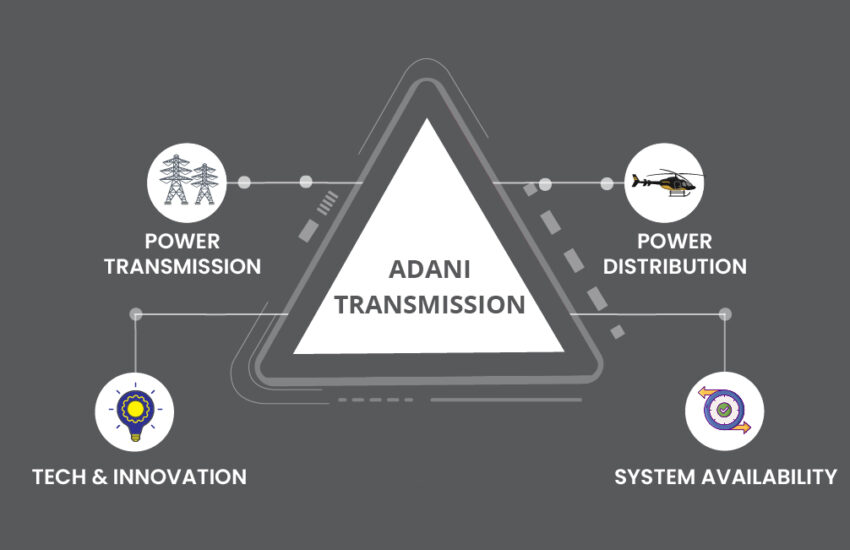

Introduction In the last 10 years, Adani Group has emerged as a leading infrastructure and utility company in India, and

Continue reading

Introduction to HAL Hindustan Aeronautics Ltd. (HAL) is one of the oldest Indian companies specializing in aircraft and helicopter manufacturing

Continue reading

Introduction Over the past two decades, there has been a notable transformation in India’s power market structure. Initially, state electricity

Continue reading

Summary Gautam Adani’s rise to become one of India’s most successful industrialists in recent years can be traced back to

Continue reading

Summary The rise of Polycab India is inspiring by all means and shows the aspirational spirit of the Indians and

Continue reading

Summary IndusInd Bank started under the leadership of Mr. S.P. Hinduja to serve the NRI community. Today, IndusInd is the

Continue reading

Introduction Sona BLW is a prominent Indian company with a global presence that manufactures differential gears, motors, and other components.

Continue reading

Introduction Since independence, Tata Steel and SAIL (The Steel Authority of India Limited) have played a key role in the

Continue reading

Introduction The Indian Pharmaceutical Industry is one of the world’s largest in terms of production by volume and value. It

Continue reading

Introduction Over the last decade, the share of credit disbursed to and by NBFCs in India has experienced significant growth,

Continue reading