Introduction

Talk about Kitchen supplies; this company is sure to find a space on your kitchen shelves. It sells most of the essential kitchen commodities, including edible oil, wheat flour, rice, pulses, and sugar for Indian consumers. Yes, we are talking about Adani Wilmar.

Adani Wilmar owns some of the biggest brands like Fortune, Kohinoor, Saffola, Nutrela, and many more. It recently had its IPO in Jan 2022. Let’s check what is working for the company and its impact on Adani Wilmar’s share price.

Adani Wilmar Overview

Adani Wilmar is one of India’s largest FMCG food companies, offering essential kitchen commodities to Indian consumers, including edible oil, wheat flour, rice, pulses, and sugar. The company was incorporated in January 1999 as a joint venture between the Adani Group and the Wilmar Group, one of Asia’s leading agri-business groups.

The company manufactures packaged food, edible oils, bakery & lauric products, personal care products, and industry essentials (including oleo chemicals, castor oil and its derivatives, and de-oiled cakes). Its operations are diversified into value-added edible oil products such as rice bran health oil, fortified foods, ready-to-cook soya chunks, khichdi, and other fast-moving consumer goods.

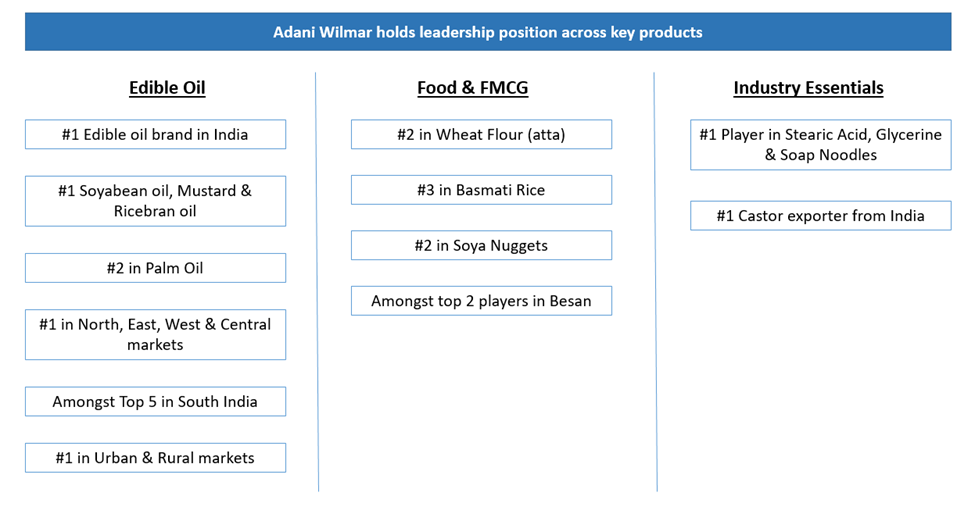

Adani Wilmar boasts the widest pan-India distribution network among branded edible oil companies. As of 31st March 2022, its Fortune brand has a presence in one out of three households in India, reaching 113 million households. The company holds a leadership position across key products, as shown below –

Adani Wilmar Company Journey

Here is a historical timeline of Adani Wilmar Limited:

- 1999: Adani Wilmar Limited is established as a joint venture between the Adani Group, a leading Indian multinational conglomerate, and Wilmar International Limited, a Singapore-based agribusiness group.

- 2001: The Company launches its flagship brand, Fortune, which becomes one of India’s leading edible oil brands; the Company commissioned an edible oil refinery of 600 TPD at Mundra.

- 2005: Acquisition of Mantralayam Unit

- 2006: Acquisition of Bundi and Haldia Units

- 2009: Acquisition of Shujalpur, Nagpur, Chhindwara, and Neemuch units

- 2010: Acquisition of Rajshri Packagers Limited, Mangalore; Acquisition of Satya Sai Agroils Private Limited; Launched ‘King’s,’ ‘Bullet’ and ‘Ivory’ brands and ‘Raag Gold’ refined palmolein oil

- 2011: Acquisition of Acalmar Oils and Fats Limited; Launch of ‘Pilaf Gold Pure Basmati Rice.’

- 2012: Addition of the Alwar and Mundra Castor units

- 2013: ‘Fortune Rice Bran Health Oil’ was launched

- 2014: Commenced production of state-of-the-art oleochemical manufacturing complex at Mundra; Launch of ‘Fortune Besan’; Launch of ‘Fortune Pulses.’

- 2015: Launch of ‘Fortune Soya Nuggets’ and ‘Fortune Basmati Rice.’

- 2016: Launch of ‘Fortune Vivo Pro Sugar Conscious Oil.’

- 2018: Launch of ‘Fortune Chakki Fresh Atta’ in Delhi NCR and Uttar Pradesh; Acquisition of an edible oil refinery from Gokul Refoils and Solvent Limited at Haldia; Acquisition of an edible oil refinery at Paradip from Cargill India Private Limited; Acquisition of a rice plant at Ferozepur from Ferozepur Foods Energy Private Limited

- 2019: Acquisition of an edible oil refinery from Louis Dreyfus Company India Private Limited at Nellore

- 2020: Launch of the new ‘Fortune’ logo; Launch of ‘Fortune Super Food Khichdi’; Launch of ‘Alife Soap’ in the personal and skin care category

- 2021: Launch of ‘Fortune Sugar’ and ‘Fortune Soya Chunkies’; Launch of personal care products like hand wash and hand sanitizer under the ‘Alife’ range;

- 2022: Adani Wilmar becomes a publicly listed company with an initial public offering (IPO) on the Indian stock exchanges

Adani Wilmar Management Profile

Mr. Dorab Mistry is Adani Group’s Chairman and Independent Director of Adani Wilmar. He has been working with the Godrej Group since 1976 and is currently a director of Godrej International Trading & Investments Pte Ltd., Singapore. He was appointed to the Board of Directors effective June 10, 2021.

Mr. Kuok Khoon Hong is the Non-Executive Chairman of the Company. He holds a bachelor’s degree in business administration from the University of Singapore. He has over 40 years of experience in the agribusiness industry. He is the co-founder of Wilmar International Limited and is currently the Chairman and Chief Executive Officer of Wilmar International Limited. He was appointed to the Board of Directors on February 27, 1999.

Mr. Angshu Mallick is the CEO and MD of Adani Wilmar Limited. He has been with the company for many years and has played a crucial role in its success. He oversees the day-to-day operations and drives the company’s growth strategy.

Mr. Srikant Kanhere is the Chief Financial Officer of the Company. He is a fellow member of the Institute of Chartered Accountants of India. He joined the Company with effect from May 1, 2013. He has over 18 years of experience in finance and accounts. Before joining Adani Wilmar, he worked at Vodafone DigiLink Limited as General Manager – Finance & Accounts, Reliance Industries Limited, and Adani Exports Limited.

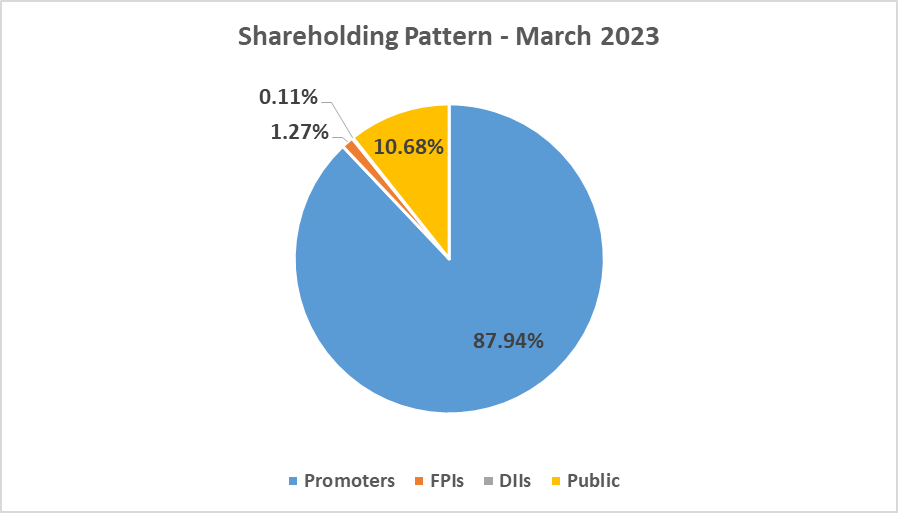

Adani Wilmar Shareholding Pattern

Adani Wilmar Company Analysis

The company mainly operates in the following three business segments:

- Edible Oil

- Food & FMCG

- Industry Essentials

| Net Revenues (INR mn) | Q4FY23 | Q4FY22 | % Growth Y-o-Y | Q3FY23 | % Growth q-o-q |

| Edible Oil | 10,789.75 | 12,372.20 | -13% | 12581.20 | -14% |

| Foods | 1,159.01 | 756.65 | 53% | 1019.56 | 14% |

| Industry essentials | 1,923.88 | 1788.41 | 8% | 1837.28 | 5% |

| EBIT (INR mn) | |||||

| Edible Oil | 75.53 | 393.96 | -81 | 258.43 | -70 |

| Foods | 16.70 | -2.03 | NM | 50.67 | -67 |

| Industry Essentials | 43.55 | 2.18 | 819 | 41.11 | 6 |

| EBIT Margin (%) | Q4FY23 | Q4FY22 | Q3FY23 | ||

| Edible Oil | 0.7 | 3.2 | 2.0 | ||

| Foods | 1.4 | -0.2 | 5.0 | ||

| Industry Essentials | 2.3 | 0.12 | 2.2 |

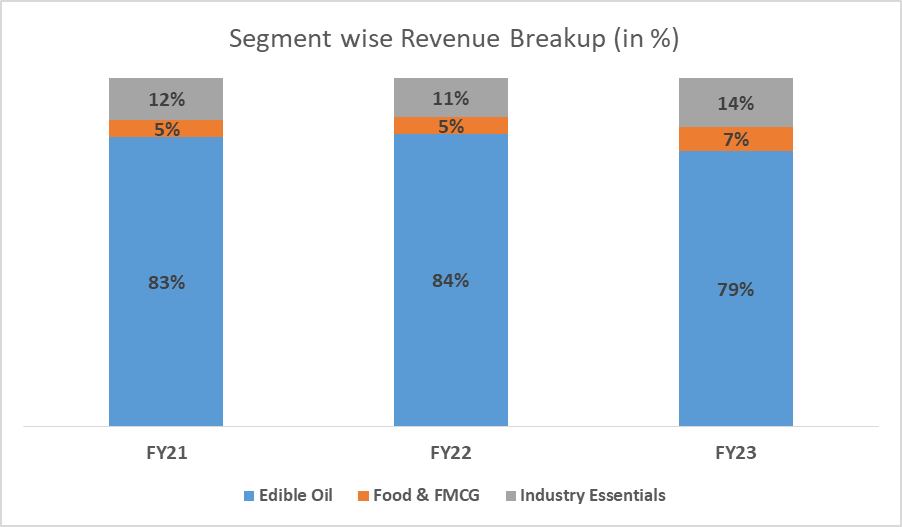

The majority of the revenue and profitability comes from the Edible oil segment. However, margins are highest for the Industry Essentials segment. The share of the high-margin Foods and Industry Essentials feature is increasing gradually, as seen above.

Regarding market share, the company is No.1 in branded edible oil with a 19.5% share, No.2 in wheat flour with a 4.9% share, and No.3 in basmati rice in India with a 10% share. Business scalability has been helped by acquisitions of 17+ units in the staples foods space. With near-term concerns and volatility in edible oil prices subsiding and prices cooling off, volume growth trends have started recovering while margins are on track to normalize.

Key strategic pillars for the company which it is leveraging are –

- Best-in-class distribution network (7,300 distributors and 90 depots with 20% growth CAGR), manufacturing strengths with 23 own and 30 third party units (17 for edible oil, 4 for Besan, 3 for rice, 1 for atta, 2 for nuggets)

- Driving strong cost synergies due to the integrated infrastructure and

- Strong brand equity for the Fortune Master brand has enabled entry into multiple food categories after edible oil.

Adani Wilmar Fundamental Analysis

AWL operates an integrated manufacturing infrastructure to derive cost efficiency across different business lines. Backend scale and efficiency allow for reducing supply chain costs, which is a competitive advantage against smaller players and helps it further consolidate the market leadership.

- Backward and forward integration: Most crushing units are fully integrated with refineries to refine in-house crude oil. Further, they derive de-oiled cakes from crushing and use palm stearin derived from palm oil refining to manufacture oleochemical products, such as soap noodles, stearic acid, glycerin, and FMCG, such as soaps and handwash. For example, the plant in Mundra is an end-to-end integrated plant that produces vanaspati, margarine, oleochemical products, and soap bars with raw materials from the refining process;

- Strong raw material sourcing capabilities: AWL imports a significant portion of raw materials, and market leadership has facilitated it to source raw materials from top global suppliers from international markets. Wilmar International, the holding company of Lence Pte. Ltd., one of the shareholders, is the largest palm oil supplier in the world (Source: Technopak Report) and provides AWL with an extra competitive edge as it need not depend on third-party suppliers for sourcing of palm oil.

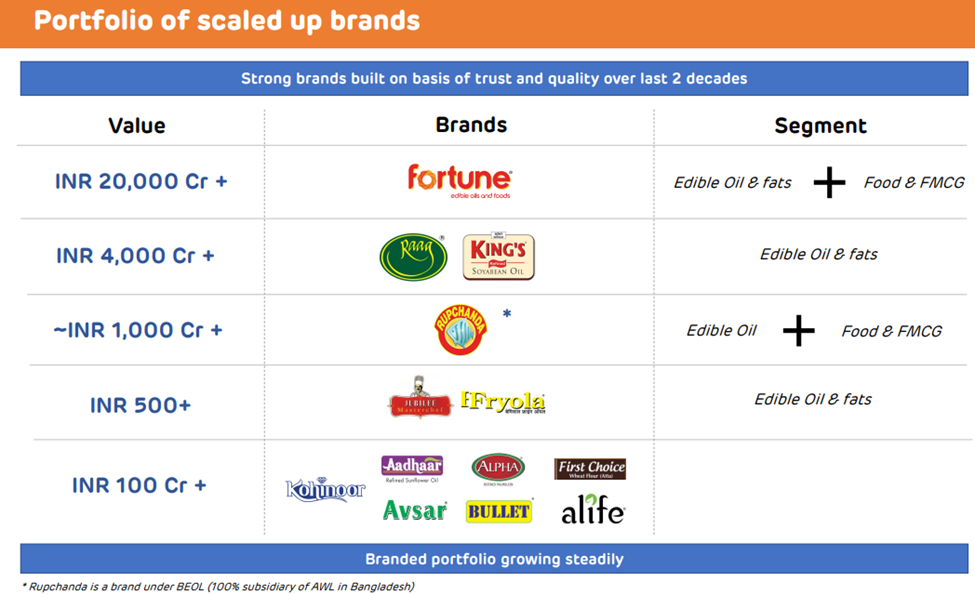

- Focus on growing packaged foods business by utilizing flagship brand “Fortune”: Fortune, the flagship brand, is the largest-selling edible oil brand in India. The company is trying to use this brand to enter into other segments. The brand’s structure of using a single brand identity for multi-categories optimizes marketing costs and enhances brand equity. The company has also been able to scale up other brands, as shown below.

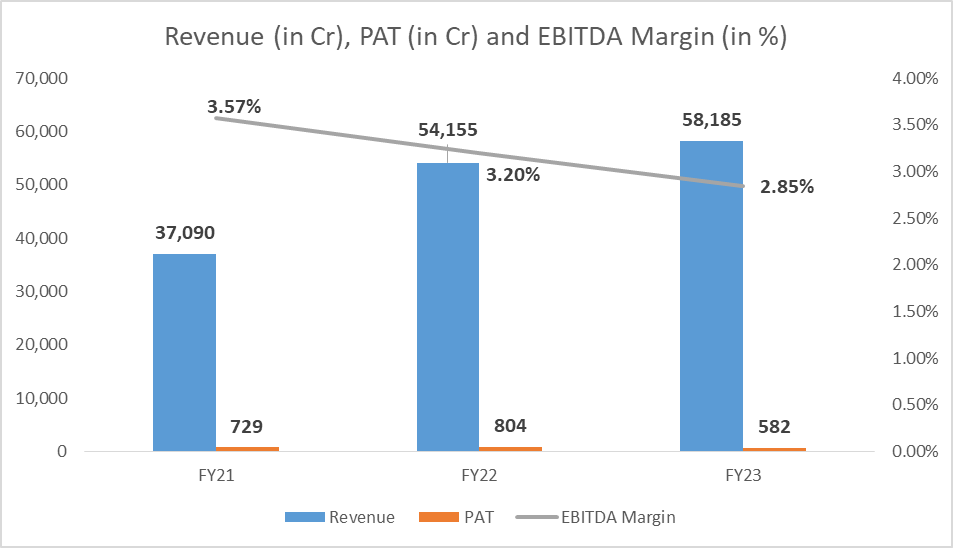

Adani Wilmar Revenue and Profitability

The Company reported consolidated revenue from operations at INR 13,872.6 crore in Q4 FY23, down 7% Y-o-Y compared to INR 14,917.2 crores in Q4 FY22.

It reported consolidated profit after tax (PAT) of INR 93.6 crore for the fourth quarter ended March 2023, a 60% decline Y-o-Y. In the same quarter last year, it posted a net profit of INR 234.29 crore. The drop in margin was due to the high inventory cost due to increased raw material prices.

Meanwhile, the company crossed 5 million metric tonnes of sales during FY23. The food segment doubled its revenue in 2 years to close the year around INR 4,000 crore. Both wheat flour and rice businesses crossed INR 1,000 crore in revenue in FY23.

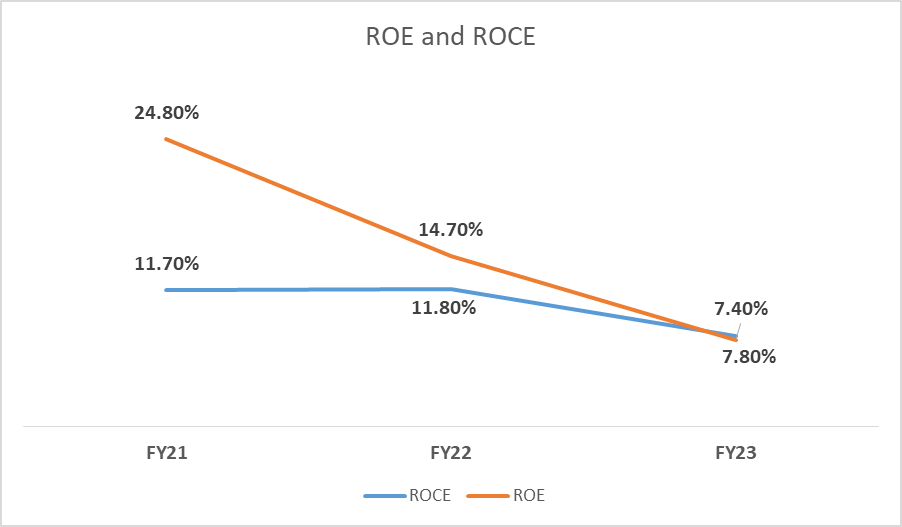

Return on Equity & Return on Capital Employed:

ROE and ROCE have reduced over the last three years due to a margin reduction due to an increase in raw material prices. ROCE has reduced to 7.4% in FY23 from 11.7% in FY21. ROE has declined to 7.8% from 24.8% in FY21.

Adani Wilmar Share Price Analysis

The stock price has seen sharp movement since its IPO, both on the upside and downside. Adani Wilmar stock rallied post IPO in Jan 2022 from INR 230 odd levels to an all-time high of INR 870 on 28th April 2023. Post that, the store started consolidating and saw massive correction due to Adani Hindenburg’s report that led to a sharp fall in prices of all the listed Adani group companies.

Adani Wilmar traded at INR 435 as of 6th June 2023, almost 90% above the IPO price. The Company is expected to do well, given its market leadership in its business segments. It is a good proxy play to India’s high-growth packaged food segment.

Adani Wilmar Share Price Target Growth Potential

Given the growth potential in the Indian packaged food market space and the management’s ambition to diversify and grow faster than the industry, Adani Wilmar may remain a front-runner in the Indian packaged food market.

The packaged food market in India could grow at a healthy rate of 11% CAGR until FY25. Branded products are growing faster than unorganized players and loose products in all major segments of essentials, thereby increasing a share of the overall grocery segment.

In the edible oils segment, the low per capita consumption and the emergence of exotic oils indicate massive headroom for growth. Several packaged food categories have significantly increased overall branded product usage. For instance, branded wheat flour has grown from 3% in FY08 to 15% in FY20, and branded salt has grown by value from 5% in FY07 to 88% in FY20. This shift, accelerated by the covid-19 pandemic, is expected to continue.

Additionally, distribution expansion, gaining share in under-indexed markets, and margin improvement in the consumer pack segment in both Edible Oil and Food segments can lead to the stock doing well in the future. The Company also sees significant opportunities in the HoReCa, institutional part, and exports and is working on plans to exploit those opportunities.

Adani Wilmar Possible Key Risks:

- Fluctuating prices of commodities may impact the company’s profitability significantly

- Currently, edible oil contributes the majority of the revenue. Not diversifying the business in other segments may hamper the company’s progress.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considerea d as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Who is the owner of Adani Wilmar?

The Adani group and Wilmar group jointly own Adani Wilmar—both groups on 43.97% each as of March 2023.

Is Adani Wilmar an excellent stock to buy for the long term?

Adani Wilmar is one of the most prominent players in the oil segment, and in the future, it is expanding into Food and FMCG business. The company owns the “Fortune” brand and is run by two strong promoter groups. That being said, raw material prices can impact the business, so investors should enter the stock at a valuation that provides a reasonable margin of safety.

What is the face value of Adani Wilmar’s share?

Adani Wilmar has a face value of INR 1 per share.

How useful was this post?

Click on a star to rate it!

Average rating 4.2 / 5. Vote count: 14

No votes so far! Be the first to rate this post.