Introduction

Deepak Nitrite led the Chemical stocks during the Covid-19 bull run and became almost a 10x multi-bagger between March 2020 and October 2021. The company is also considered the poster boy for China plus one and import substitution. Let us understand what the company does and analyze the share price of Deepak Nitrite.

Deepak Nitrite Overview

Deepak Nitrite started in 1970, is a diversified chemical manufacturer; their essential products, Sodium Nitrite, Sodium Nitrate, Xylidines, Toluidines, DASDA, Optical Brightening agents, Phenol, Acetone, Iso Propyl Alcohol, etc., hold market leadership globally.

Deepak Nitrite’s products find applications in diverse industries like agrochemicals, pharmaceuticals, dyes, pigments, textiles, paper processing, detergents, explosives, etc.

Deepak Nitrite’s manufacturing presence is spread across six facilities in India, having strong customer relationships with BASF, Loreal, HPCL, BPCL, Henkel, Clariant, EASTMAN, Reliance, Bayer CropScience, etc.

Deepak Nitrite Company Journey

Deepak Nitrite has had a journey of planned transformation. Its expansion, in terms of product portfolio and geographical presence, is already taking share and bearing fruits for various stakeholders. Today, Deepak Nitrite is a robust and diversified company with a strong position in India and globally. Following is a timeline of how the company has evolved over the last 40+ years:

- 1970: Incorporation of Deepak Nitrite Ltd

- 1971: Listed on BSE with landmark over-subscription

- 1972: Commissioned Sodium Nitrate and Nitrate Plant at Vadodara, Gujarat

- 1984: Acquisition of Sahyadri Dyestuffs and Chemicals unit from Mafatlal Industries

- 1992: Commissioned Nitro Aromatic Plant at Nandesari

- 1995: Commissioned a full-fledged Hydrogenation Plant at Taloja

- 2003: Acquisition of management & control of Aryan Pesticides Ltd

- 2007: Acquisition of DASDA Division from Vasant Chemicals at Telangana

- 2010: Foray into the Fuel Additives business

- 2012: Accredited with Responsible Care, a global benchmark of environment, safety, and health management

- 2013: Brownfield expansion for manufacturing Sodium Nitrite & Nitrate at Nandesari; Turnover crosses INR 1,000 crore

- 2014: Commissioned a world-class facility to manufacture Optical Brightening Agents (OBA)

- 2015: Promoted Deepak Phenolics Limited for manufacturing of Phenol & Acetone

- 2016: Raised INR 83 crore via QIP (1st Round) to fund the phenol project

- 2017: Raised INR 150 crore via QIP (2nd Round) to fund the phenol project

- 2018: Raised INR 150 crore via QIP (3rd Round) to fund the phenol project. Deepak Phenolics Limited’s commercial production starts

- 2019: Deepak Phenolics reached 2000 Cr. Revenue

- 2020: Deepak Phenolics commissioned IPA plant (Isopropyl alcohol)

Deepak Nitrite Management Profile

Mr Deepak C Mehta is the Chairman of Deepak Nitrite. His business acumen, leadership skills, and dynamism have enabled Deepak Nitrite to quickly progress and achieve many milestones in the last 40 years. An active participant in industry forums, he has been the Chairman of the National Chemicals Committee at FICCI. He is a science graduate from the University of Bombay.

Mr Maulik Mehta has been the Executive Director and CEO of the company since June 2020. He has 14 years of experience in business development, strategy, human resources, external relations, patent, and product development. He has been responsible for the day-to-day business of the Company, as well as formulating the Group strategy.

Mr Sanjay Upadhyay is the Group CFO of the company. He has over 40 years of experience in Finance, Treasury, Taxation, Commercial, Secretarial, and Corporate Restructuring. He oversees risk Management, Governance, Investor Relation, and IT functions. Apart from these, he has expertise in growth strategy, acquisitions, restructuring, etc.

Mr Meghav Mehta has been Deepak Phenolics Ltd.’s Executive Director since May 2019. He is an astute strategist and was instrumental in commissioning the Phenol plant as the Company’s wholly-owned subsidiary, Deepak Phenolics Limited. In addition, he has spearheaded multiple digital transformation initiatives in the Deepak Group.

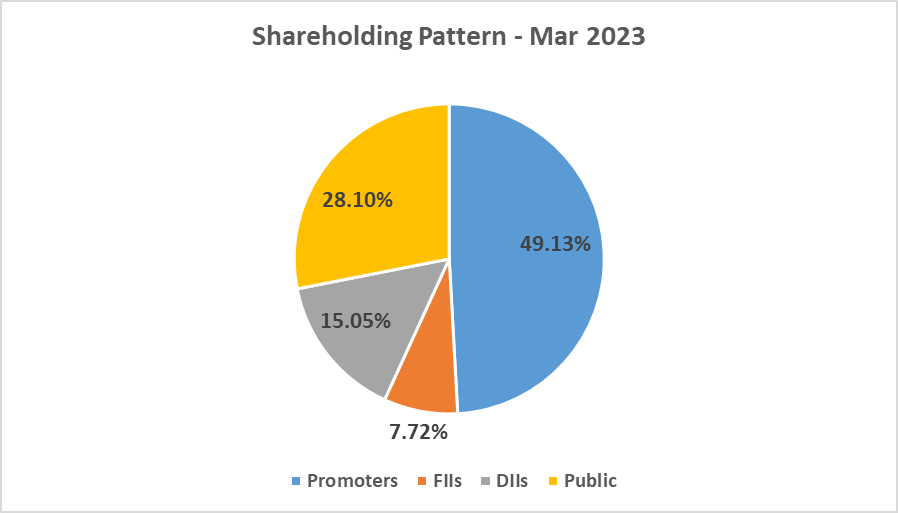

Deepak Nitrite Shareholding Pattern

Deepak Nitrite Company Analysis

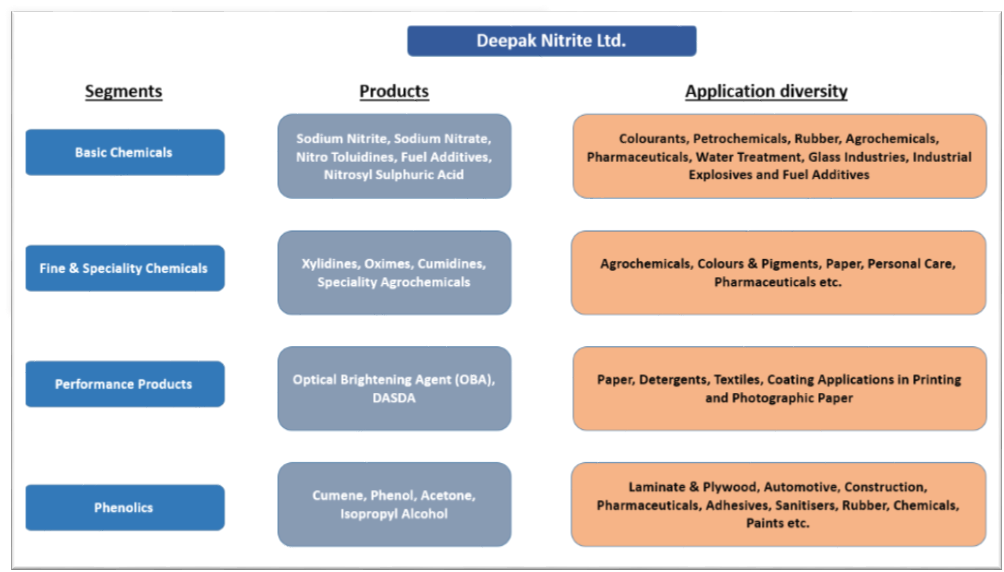

From a bulk commodity products manufacturer, Deepak Nitrite Ltd. (DNL) has evolved into a speciality chemical company operating in four critical divisions as follows:

- Bulk Chemicals and Commodities: These are standard products manufactured in bulk quantities

- Fine & Specialty Chemicals: These are specialized products customized to the client’s specifications

- Performance products: These are products with stringent requirements in terms of performance in the manufacturing process

- Phenolics: These are high-volume import substitutes

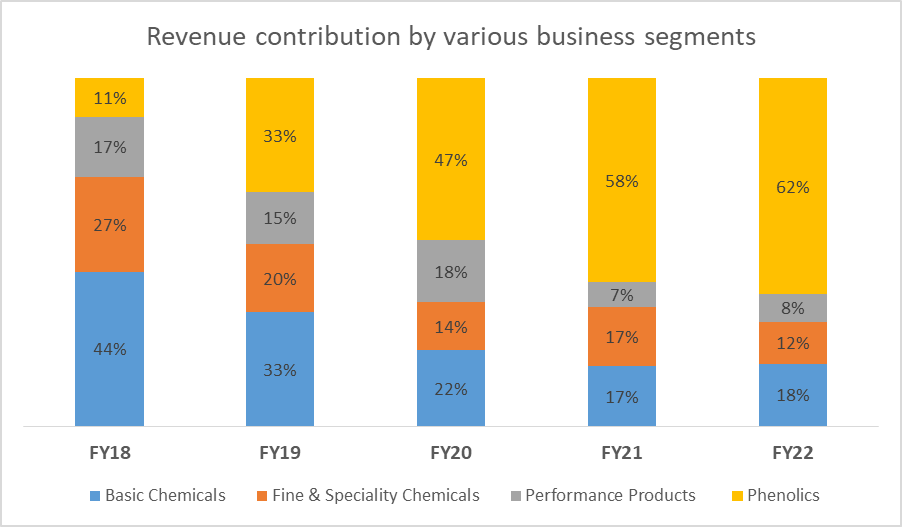

Revenue contribution of various business segments:

Bulk Chemicals and Commodities (Basic intermediates):

High-volume products across organic and inorganic chemicals characterize Deepak Nitrite’s basic chemicals division. The essential products in the Basic Chemicals segment include

- Nitro toluene which is consumed in colorants, agro-chemicals, and rubber chemicals,

- Fuel additives used in refineries and

- Sodium nitrite is consumed in dyes/pigments, pharma intermediates, food colors, and colorants.

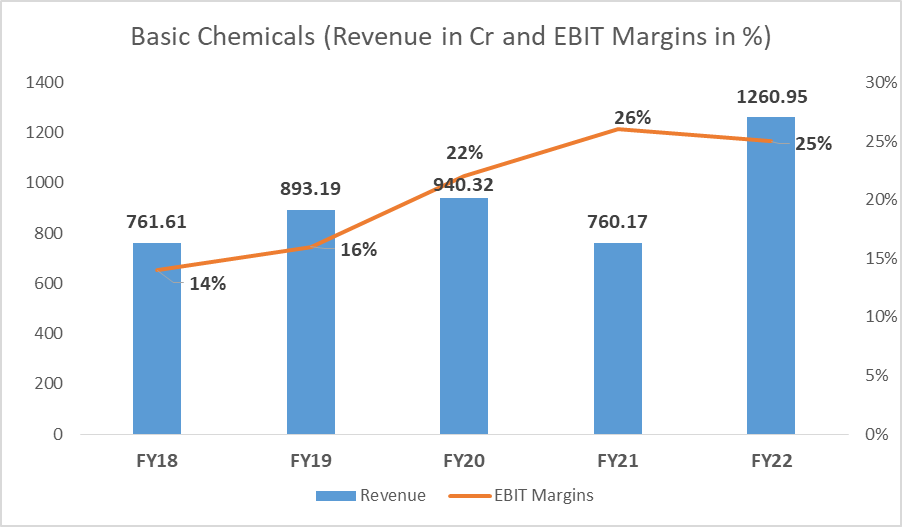

DNL has been the largest sodium nitrite and sodium nitrate producer since 1972. Revenue share from Bulk Chemicals & Commodities stood at 18% in FY22. The following chart shows revenue growth and EBIT margins for this business segment.

Fine & Speciality Chemicals:

The Fine and Specialty Chemicals division (FSC) product profile includes xylidines, cumidines, oximes, nitro oxylene, having applications in agrochemicals, pharmaceutical intermediaries, and personal care sectors.

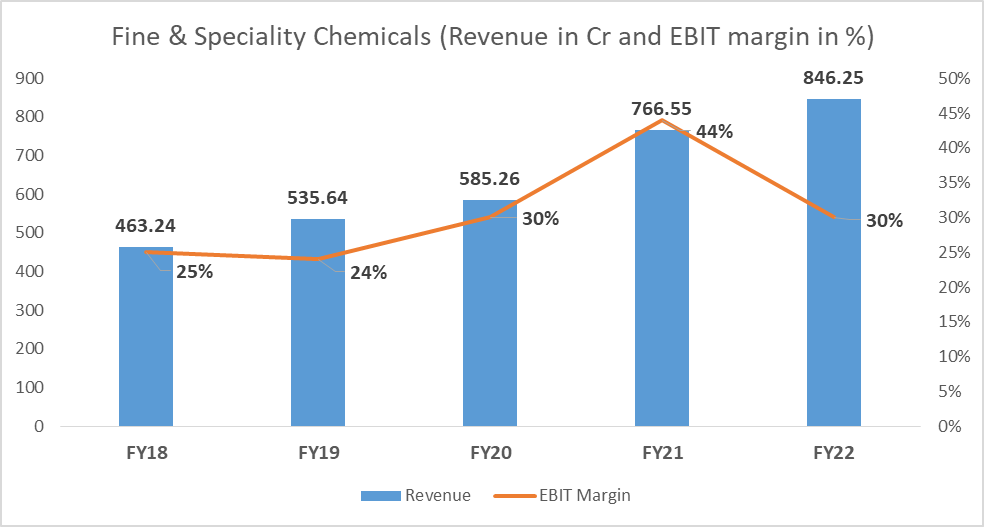

DNL is the sole manufacturer of thermal paper chemicals in India. Revenue share from Fine & Speciality Chemicals stood at 12% in FY22. The following chart shows revenue growth and EBIT margins for this business segment.

Performance Chemicals:

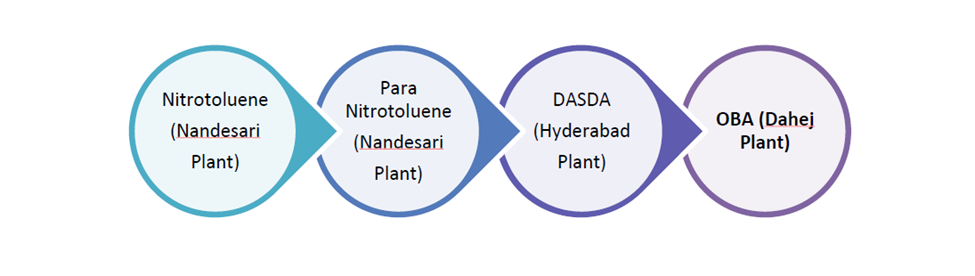

The performance products division consists of two products: optical brightening agents (OBA), where the company enjoys a 75% market share in India, and Di-amino Stilbene Di-sulphuric acid (DASDA), with a market share of 60% in India and 20% globally.

DNL is the only fully integrated manufacturer of OBA with vertical integration from toluene to para nitro toluene (PNT) and further into DASDA and OBA. Key application areas for OBA are detergents, paper, and textiles.

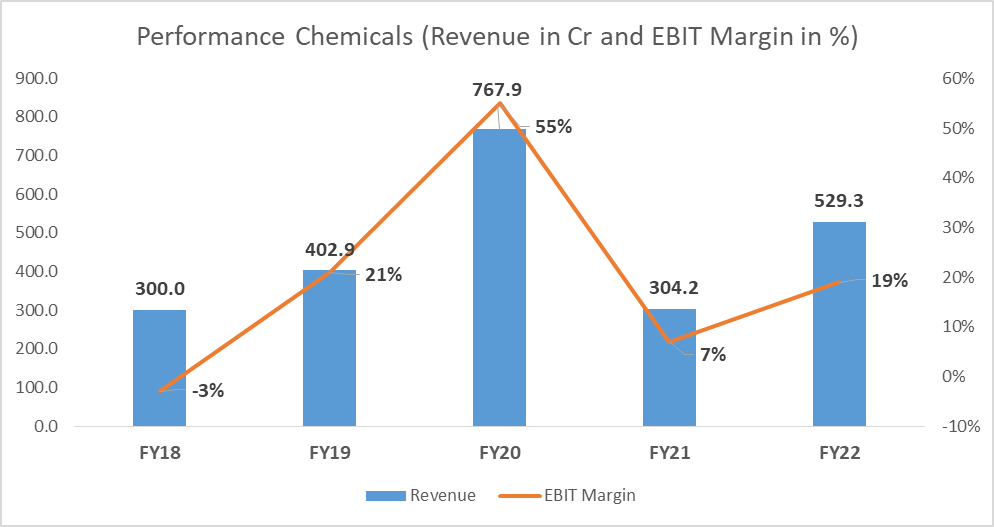

Revenue share from Performance Chemicals stood at 8% in FY22. The following chart shows revenue growth and EBIT margins for this business segment.

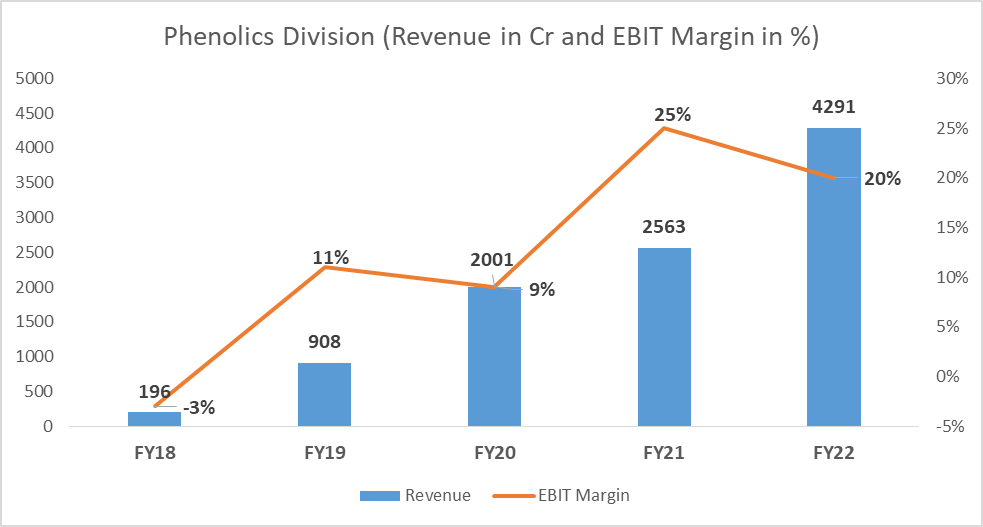

Phenolics:

India was one of the major importers of phenol, with ~80% of the demand being catered through imports and the remaining 20% by domestic players like Hindustan Organics Ltd and Schenectady Herdillia Ltd (SI Group).

Deepak Phenolics Limited (DPL) is a wholly owned subsidiary of Deepak Nitrite, formed to seize the import substitution opportunity in India’s chemical industry. It manufactures phenol, acetone, and IPA and has reportedly achieved a more than 50% market share in the country by substituting most phenol and acetone imports. As a result, revenue share from the Phenolics division stood at 62% in FY22. The following chart shows revenue growth and EBIT margins for this business segment.

Deepak Nitrite Fundamental Analysis

Manufacturing facilities of Deepak Nitrite:

The company has six manufacturing facilities across key chemical hubs of the country.

- Nandesari, Gujarat – Bulk and commodity product manufacturing

- Dahej, Gujarat (2 separate facilities) – Full spectrum stilbenic Optical Brightening Agents (OBAs) production and Phenol and Acetone manufacturing facility

- Taloja, Maharashtra – Hydrogenation and noble metal catalysis speciality

- Roha, Maharashtra – Multispecialty site specializing in pilot plants

- Hyderabad, Telangana – Manufactures DASDA for captive use and commercial sales

Deepak Nitrite’s growth can be categorized into three stages:

- FY11-FY15: De-risked business model through product diversification: During FY11 to FY15, DNL entered into newer products in the Fine and Specialty segment, strengthened its product portfolio, and increased its export.

- FY15-FY19: Expansion of Performance Chemicals and entry into Phenol Acetone:

During FY15-19, DNL forayed into Performance Chemicals, becoming the only company having a fully integrated OBA manufacturing facility [with vertical integration from toluene to para nitro toluene (PNT)]. As a result, DNL enjoys a 75% market share in OBA and a 60% in DASDA (an input RM for OBA).

DNL further started trading in Phenol Acetone products in the year 2017. Deepak Phenolics Ltd was incorporated in 2015 by DNL as a 100% subsidiary to enter into the Phenol-Acetone manufacturing business (import substitute). The plant got operational in November 2018 and today contributes more than 60% of the revenue for the company.

- FY19-FY25 Value-added products, capacity expansion, and Phenol-Acetone downstream chemistry are expected to drive growth. The company is also looking to get into new chemistries.

Deepak Nitrite Company Financial Analysis

Revenue:

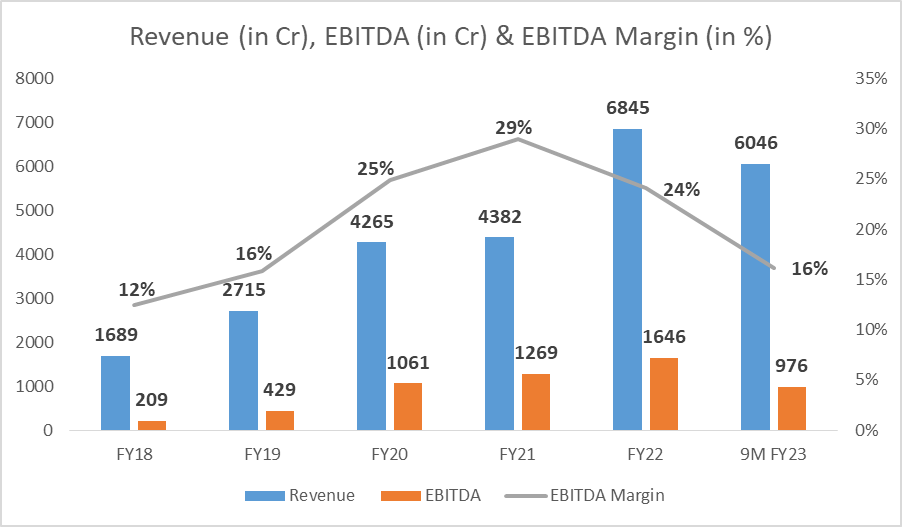

In FY22, Deepak Nitrite posted revenue of INR 6,802 Cr, 56% higher than FY21 revenue of INR 4,360 Cr. While in Q3FY23, the company reported revenue of INR 1,991 Cr, 15.6% higher than Q2FY22 revenue of INR 1,722 Cr. Deepak Nitrite has delivered a five-year revenue CAGR of 38% on the back of significant expansion in the Phenolics business. Revenue growth is expected to normalize going forward due to reduced product prices in the phenol business.

Operating Profit & Operating Margin:

In FY22, Deepak Nitrite posted an EBITDA of INR 1,646 Cr, 29.71% higher than the FY21 EBITDA of INR 1,269 Cr. This translated into an EBITDA margin of 24% in FY22 against 29% in FY21.

Margins have declined over the last six quarters and have come down to 16% in the most recent quarter (Q3FY23) from a high of 31% in Q4FY21.

Net Profit & Net Profit Margin

Deepak Nitrite posted a Net Profit of INR 1,067 Cr in FY22, translating into a PAT Margin of 10.88%. PAT margin peaked during Covid-19, and FY21 was the best-ever year for the company, with a PAT margin of 17.8%.

Deepak Nitrite Key Financial ratios

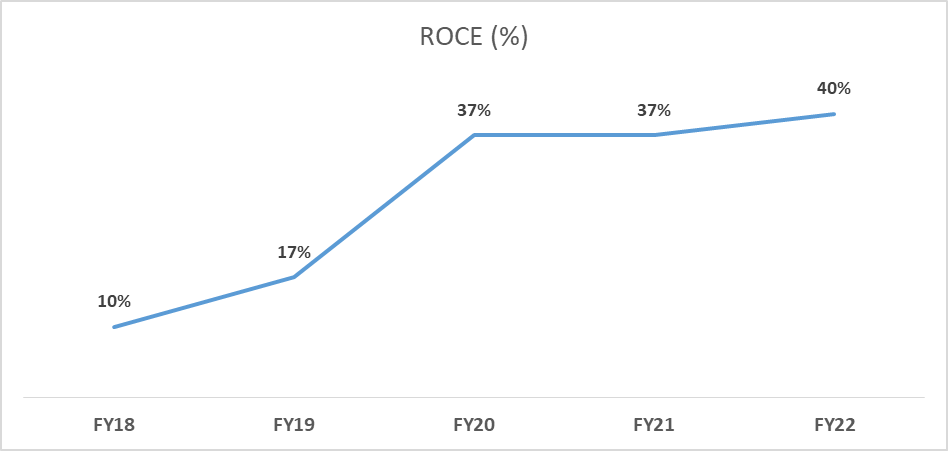

Return on Capital Employed (ROCE)

Deepak Nitrite has consistently improved its ROCE ratio year-on-year from a low of 10% in FY18 to reach 40% in FY22. ROCE has been enhanced on the back of higher profitability and better utilization of assets.

Debt to Equity Ratio

Deepak Nitrite has significantly reduced its long-term borrowing from a high of INR 870 Cr in FY19 to as low as 95 Cr in the Sep 22 quarter. Consequently, the Debt to Equity ratio has reduced to 0.07, which is a massive positive for the company. This allows the company to plan for more capital expenditure going ahead.

Deepak Nitrite Share price analysis

In the last ten years, the chemical stock price increased from INR 17.40 (close price on 21st October 2011 on NSE) to INR 1,858 (comparable price on 26th April 2023 on NSE) — registering around a 10578% rise in this period.

If an investor had invested INR 1 lakh in this multibagger stock ten years ago, buying Deepak Nitrite shares at INR 17.40 levels, and had remained invested in this stock until its INR 1 lakh would have turned to INR 106 Cr as of 26th April 2023. This reflects how important patience is for stock market investors.

Deepak Nitrite Share Price Target and Growth Potential

To date, Deepak Nitrite has strategized its growth story on the backs of

- New product expansion in Basic Chemicals and Fine Speciality segments

- Targeting the optimum mix of performance chemical products and customers for higher margins

- Successful commissioning and scaling of Phenol Acetone plant

Going forward, the company is looking to grow on the back of

- Creating value and developing value-added products of Phenol and Acetone

- Adding new chemistry platforms like fluorination and photo chlorination and

- Investing in upstream and downstream integration projects to improve margins

These measures will further diversify the product portfolio, widen the customer base and increase value-addition across the product portfolio. Moreover, Deepak nitrite will gain significantly from immense opportunities in the sector through the ‘Make in India for the World’ initiative and the strong recurrence of the China+1 strategy.

Key risks

- China’s step towards self-sufficiency in Phenol and increased competition in the region could result in a structural glut in the overall market, which could lead to a reduction in phenol division margins

- Unavailability or procurement challenges of key petrochemicals – Benzene and Propylene

- Failure to adhere to environmental practices and Safe, Health related compliances can call for immediate attention from environmental authorities.

- Risks associated with macro parameters like Crude oil prices and USD/INR equation can cause a significant dent in margins.

Disclaimer Note: This article’s stocks and financials are for education only. They shouldn’t be considered as a recommendation by Research & Ranking. We will not be liable for any losses that may occur. The securities quoted, if any, are for illustration only and are not recommendatory.

FAQs

Is Deepak Nitrite suitable for the long term?

Deepak Nitrite is expected to be a massive beneficiary of China+1 and import substitution. In addition, the company is expanding into existing and new chemistries. The company’s fundamentals look strong; hence, one can expect the company to do well in the long term. That being said, one has to be cautious about their entry valuation, even in outstanding companies.

Is Deepak Nitrite debt free?

As of April 2023, the company is debt free. It has borrowings of INR 270 Cr, cash of 64 Cr and Investments of INR 425 Cr. So, to conclude, the Net debt of the company is zero.

What is the Face Value of Deepak Nitrite?

Deepak Nitrite has a face value of INR 2 per share.

Read more: About Research and Ranking

How Long-term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 4.2 / 5. Vote count: 11

No votes so far! Be the first to rate this post.