Introduction

In a world driven by digitalization, where financial transactions are becoming seamlessly integrated into our daily lives, the Reserve Bank of India (RBI) has taken a monumental stride to enhance accessibility to credit. In this news-driven blog, we will delve into RBI’s latest initiative, which allows banks to issue pre-sanctioned credit lines through the Unified Payments Interface (UPI), revolutionizing the scope of the UPI payment system.

A Paradigm Shift

Traditionally, the UPI system solely permitted transactions involving deposited amounts. However, with RBI’s recent announcement, the landscape has significantly transformed. RBI has broadened the horizons of UPI by incorporating credit lines extended by scheduled commercial banks for individual financial transactions.

Paving the Way for Convenience

In simple terms, the UPI network will now facilitate payments financed by credit from banks. This game-changing development empowers banks to establish the terms and conditions governing the utilization of these credit lines. The banks will set forth parameters such as the credit limit, duration of the limit, and the applicable interest rate.

Key Takeaways

The journey of UPI has been nothing short of remarkable, recently surpassing the milestone of 10 billion transactions in a single month, specifically in August. RBI’s move carries a dual advantage, benefiting consumers and financial institutions.

For Consumers

For consumers, introducing credit lines on UPI offers a level of convenience comparable to that of a credit card. This is especially beneficial for individuals who do not possess a credit card but require access to credit facilities for various financial needs.

For Banks

On the other side, this initiative opens up new horizons for banks. It enables them to introduce innovative financial products to end-users while reducing operational costs associated with issuing credit cards, swipe machines, and Point of Sale (POS) devices.

Embracing the Digital Age

In conclusion, as the world steadily progresses toward the digital age, India emerges as one of the fastest-growing ecosystems for fintech innovation. RBI’s decision to expand the scope of UPI credit lines reflects its commitment to enhancing financial accessibility for all and fostering a vibrant fintech ecosystem.

FAQs

1. What is UPI, and how does it work?

Unified Payments Interface (UPI) is a real-time payment system in India that allows people to make instant money transfers and payments using smartphones.

2. How do I access the newly introduced UPI credit lines?

To access UPI credit lines, you must have a bank account linked to the UPI system. If your bank offers this service, you can inquire with them about the eligibility criteria and application process.

3. What are the benefits of using UPI credit lines?

Using UPI credit lines provides the convenience of credit card transactions without needing a physical card. It also opens up opportunities for innovative financial products and reduces bank costs.

4. Are there any risks associated with UPI credit lines?

Like any financial service, UPI credit lines come with certain risks. It's essential to read and understand the terms and conditions set by your bank and use credit responsibly to avoid financial difficulties.

5. How does RBI's decision impact the future of fintech in India?

RBI's decision to expand UPI's scope demonstrates a commitment to fostering fintech innovation in India. It will likely encourage further growth in the fintech sector, leading to more innovative financial solutions for consumers.

PMI India Services Remain Robust, Defying Global Trends!

Staying updated with the latest economic indicators is crucial. It’s akin to navigating through the tumultuous waters of the financial world armed with a compass of knowledge.

Over the past week, a flurry of economic indicators has come to light, providing us with valuable insights into the state of the economy. One such indicator recently surfaced is the India Services PMI Business Activity Index.

Understanding the India Services PMI Business Activity Index

The India Services PMI Business Activity Index is a significant metric derived from a comprehensive survey encompassing approximately 400 service-oriented companies in India. These companies hail from diverse sectors, including transportation, information technology, communication, finance, insurance, real estate, and various business services. They willingly share their insights and perspectives on their current business activities and anticipated future endeavors. In the world of PMI (Purchasing Managers’ Index), a reading above 50 signifies expansion in the sector.

Unveiling the Numbers

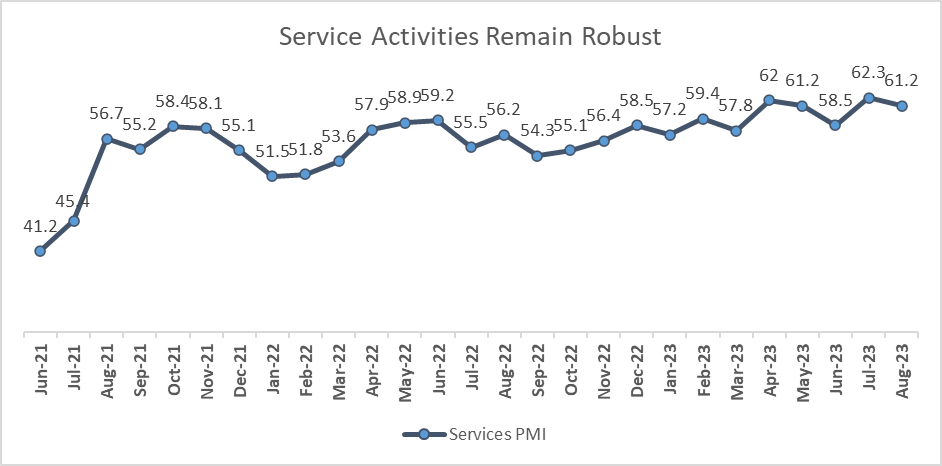

Now, let’s delve into the nitty-gritty of the numbers. The India Services PMI for August has clocked in at 60.1. While this figure is slightly lower than the robust 62.3 recorded in July, it’s essential to note that it still stands as a healthy indicator. If we backtrack a bit to June, the PMI was at 58.5. Looking further back to August 2022, the services PMI in India stood at 56.2. This upward trajectory over the past year is indeed noteworthy.

A Record Surge in New Export Business

One particularly noteworthy development in August was the significant achievement of Indian services companies. They witnessed a record surge in new export business, signaling positive international trade and commerce prospects.

Key Takeaways

So, what’s the key takeaway from all this data? Despite the dip from 62.3 in July to 60.1 in August, the seasonally adjusted S&P Global India Services PMI Business Activity Index indicates one of the most robust output increases since mid-2010.

It speaks volumes about the resilience of the services sector in India, even in the face of elevated inflationary pressures. Furthermore, the reading has consistently remained above the 50-mark, which separates growth from contraction, for an impressive 25th consecutive month. This is the longest stretch we’ve seen since August 2011, signifying a sustained period of growth in the sector.

In the ever-evolving landscape of the Indian economy, the India Services PMI Business Activity Index is a valuable beacon of hope and insight. It provides a clear picture of the current economic scenario and hints at the possibilities. As we progress, keeping a close eye on these indicators will be crucial for individuals and businesses.

FAQs

What does the India Services PMI Business Activity Index signify?

The India Services PMI Business Activity Index is a metric that indicates the level of expansion or contraction in the services sector. A reading above 50 suggests growth.

How does the August PMI compare to previous months?

In August, the PMI stood at 60.1, slightly lower than July’s 62.3 but still robust compared to earlier months.

Why is the surge in new export business significant?

The surge in new export business indicates that Indian services companies are succeeding internationally, which bodes well for the country’s trade prospects.

What is the significance of the PMI consistently remaining above 50 for 25 consecutive months?

This indicates a sustained period of growth in the services sector, demonstrating its resilience in the face of challenges.

How can individuals and businesses benefit from tracking the PMI?

Tracking the PMI provides valuable insights into the health of the services sector, helping individuals and businesses make informed decisions in the dynamic economic environment.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.