India is on its way to becoming the fastest growing economy globally.

Is this just speculation or rumor? No, it is a fact.

India’s economy has grown since October, with expansion in services, manufacturing, and exports. The demand during the festive season added to the economic momentum.

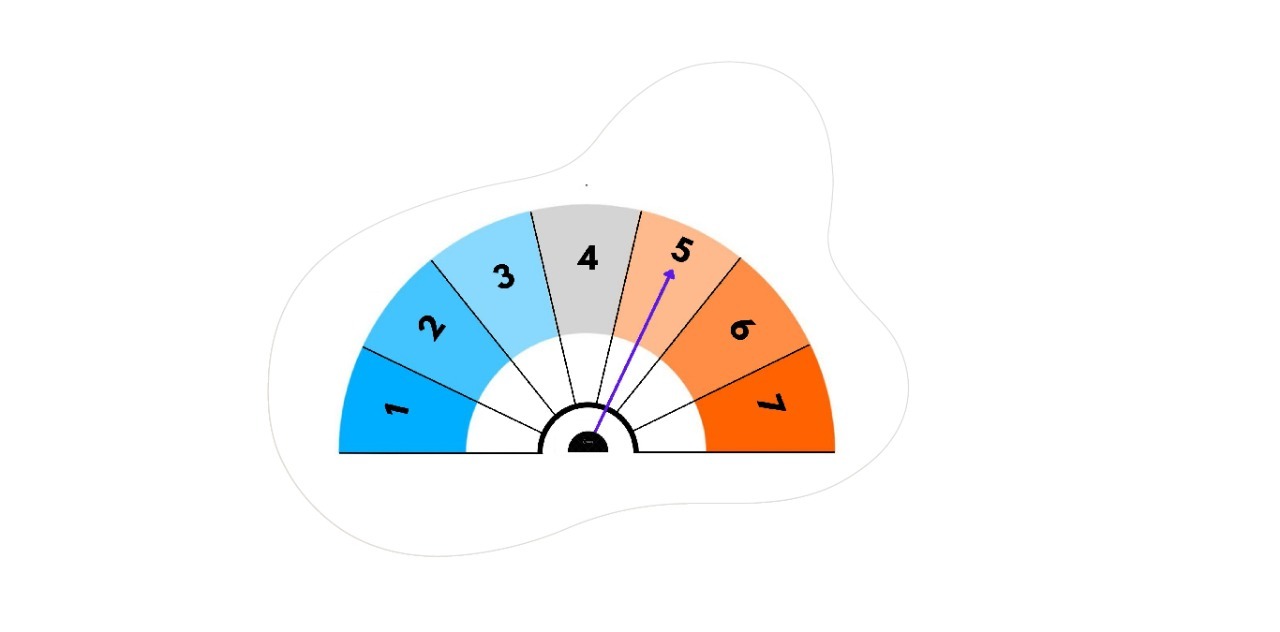

As a result, the momentum remained steady at a 5 on the Bloomberg News “Animal Spirits” gauge of indicators.

The indicators looked at are:

- Markit India Composite PMI

- Output Price Index

- Order Books Index

- Citi Financial Index

- GOI data on exports, industry, and infrastructure sectors

- RBI data on demand for loans.

The Bloomberg study considers a three-month weighted averages to even-out the instability in one-month readings in services, new orders, and growing exports.

Wondering what Animal Spirits have to do with economic recovery and finance?

Renowned British economist John Maynard coined the term Animal spirits to define how people decide on financial matters. It includes the buying and selling of securities; during economic stress or uncertainty.

These animal spirits denote human emotions of confidence, hope, fear, and negativity. Such emotions affect financial decisions that can fuel or hamper growth.

When public spirits are low, the confidence is low, driving down a promising market despite strong economic fundamentals. Similarly, when the spirits are high, buoyancy in the economy is high. This confidence helps the market prices soar.

Now that you have a brief idea of what animal spirits mean. Let\’s see what is helping India stay on its growth trajectory.

The steady growth in several industry sectors, great demand in the services and a rebound in exports will help India stay on the path toward being the world’s fastest-growing economy this year. A Bloomberg survey due on 30th November is likely to show the GDP in Q2FY22 grew 8.2% from the same period year ago, after a high 20.1% growth the previous quarter.

The sectors that added to the high confidence of Animal Spirits.

Business Activity: An IHS Markit survey of purchasing managers of factories and services witnessed robust inflow of new orders helped the business activities grow. They kept the composite index growing for the third month in a row.

The shortage of raw materials and high commodity prices led to an acceleration in input cost inflation. It nullified the advancement new orders gave. Business activity, order books, and output prices score 7, on the Bloomberg ASI based on three-month weighted indicator averages against the 30-month historical data.

Exports and Imports: The exports grew 43% YOY in October. It was nearly double the growth in September due to rising demand for petroleum products, Indian coffee, and engineering goods. However, a surge in the inbound shipment of pulses, coal, crude oil, and newsprint led to a jump of 63% in imports too. Despite the increasing trade deficit, the Indian exports continued to hold onto the growth momentum scoring a 7 on the Bloomberg ASI.

Consumer Activity: Retail auto sales, an indicator of consumer activity, fell 27% to yoy as global chip shortage played havoc with production schedules. Moreover, two-wheeler sales, an animal spirits indicator in smaller towns, declined.

Yet, per RBI data, the bank credit grew 6.8% in October from 6.7% in the previous month. The liquidity in the market is still surplus leaving room for more loans and advances. The credit demand has improved, so consumer activity scored 7 on the Bloomberg ASI.

Industrial Activity: The Government data showed that industrial production rose 3.1% in September. It was a slow pace of growth compared to the first five months of FY22 due to the declining low base effect the pandemic caused.

Likewise, the output at infrastructure industries that makes up 40% of the industrial production index rose 4.4% in September, while the demand for cement, coal and natural gas continue to drive activity. Despite the slower pace of expansion, industrial activity is growing.

You can see the positive effects of stable growth in various activities. Though the pace is slow, it does not mean our economic activities have declined. We may not be jetting off, but India is still moving up on its way to becoming the strongest-growing economy in the world.

Do not fear the recent 5–10% correction in the market as it is transitory. The country’s growth story is still intact. As the economy grows, the financial markets will follow suit.

One must consider the current situation as a buying opportunity. Wondering how to begin, connect with us; we shall get you started on a wealth creation journey.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.