Introduction

India has set a very ambitious target of meeting 50% of its energy requirements through renewables and reducing cumulative emissions by one billion tonnes by 2030. However, as of February 2023, renewable energy only constituted 12.3% of India’s overall energy mix, opening up massive opportunities for companies operating in the renewable sector.

This article delves into Adani Green Energy Limited, one of India’s prominent players in the renewable energy sector, examining its potential for future growth. Let’s explore this further.

Overview of Adani Green

Adani Green Energy Limited (AGEL) was incorporated in the year 2016 and currently has over 8024 MW operational renewable portfolio. In its initial days, the company began with a 20MW capacity wind power in partnership with Inox Wind. In 2017, AGEL brought all the solar energy portfolio under Adani Enterprise and listed itself on the stock exchanges.

In the following years, Adani Green made a series of acquisitions to expand its renewable portfolio and become a substantial player in India’s renewable energy story.

Some notable acquisitions AGEL made are Essel Group’s solar power portfolio in mid-2019, Inox Wind’s 50 MW wind power project at Dayapur, Kutch, and Softbank Group-backed SB Energy Holdings Limited in May 2021. In January 2021, French energy giant Total Energies acquired 20% minority interest in Adani Green for about $2 billion.

Adani Green Company Analysis

Adani Green is India’s leading renewable energy company engaged in developing, owning, and maintaining solar and wind power plants. Currently, the company has 8,024 MW of operational renewable portfolio in India, of which 4,913 MW is solar, 971 MW is wind, and 2140 MW is hybrid operational capacity spread across 12 states.

The solar portfolio has 24.7% CUF (Capacity Utilization Factor), while the wind energy portfolio has 25.2% CUF. And the hybrid portfolio achieved 35.5% CUF in FY23. Its 2,140 MW wind-solar hybrid power plant in Rajasthan is the world’s largest renewable energy park, entirely executed by Adani Green.

The company has secured its entire renewable portfolio with long-term power purchase agreements (PPAs) with an average portfolio tariff of ₹2.98 per unit. 89% of AGEL’s current portfolio has PPAs with sovereign counterparties such as NTPC, SECI, NHPC, and State DISCOMs, helping it to have a predictable cash flow.

In the solar segment, the plant availability averaged above 99% in FY23. While in the wind segment, it was 94.3%.

Projects Under Execution

Adani Green has a locked-in portfolio of 12,348 MW, with 1,889 MW nearing completion and 10,449 MW in various stages of development and approvals. In the medium term, the company’s total locked-in growth is 20.4 GW.

The company plans to have a total installed capacity of 45 GW, around 10% of India’s renewable energy target by 2030. To fuel the growth, the company has identified about 2 lakh acres of land in strategic locations in Rajasthan and Gujarat, predominantly owned by the government.

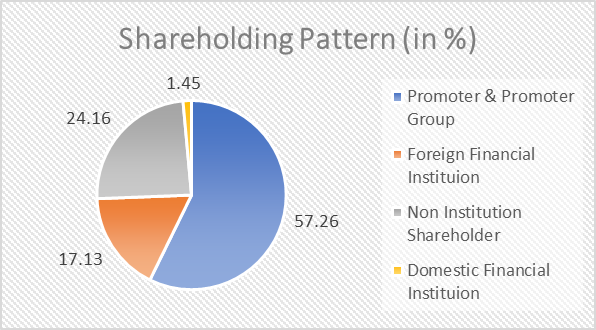

Shareholding Pattern

Key Management Personnel

Mr. Amit Singh is the Chief Executive Officer and was appointed on 11th May 2023. He is an IIT Delhi graduate with over 22 years of experience in the oilfield, energy transition, and digital transition in the energy sector, working in multiple geographies, including middle-east and Europe. Mr. Singh joined AGEL from Schlumberger, based in London.

Mr. Vineet S. Jaain is the Managing Director at AGEL and was previously the CEO. He has been associated with the Adani Group for more than 15 years. Under his able leadership and deep technical understanding of the sector, the group executed the world’s largest solar plant of that time at Kamuthi and India’s largest solar module manufacturing facility. Mr. Jaain joined the Adani Group as Joint President of Adani Power in 2006 from Jindal Steel & Power Ltd.

Mr. Sagar R. Adani is the Executive Director, leading the group’s foray into renewable energy and has been associated with the company since its inception. He holds a degree in Economics from Brown University, USA.

Mr. Phuntsok Wangyal is the Chief Financial Officer and joined AGEL in September 2022 from Engie India. He has substantial experience in the renewable sector and is skilled in mergers and acquisitions, financial structuring, corporate finance, and valuations. Mr. Wangyal specialized in the finance stream from IIM Bangalore and is an alumnus of St. Joseph’s Academy, Dehradun.

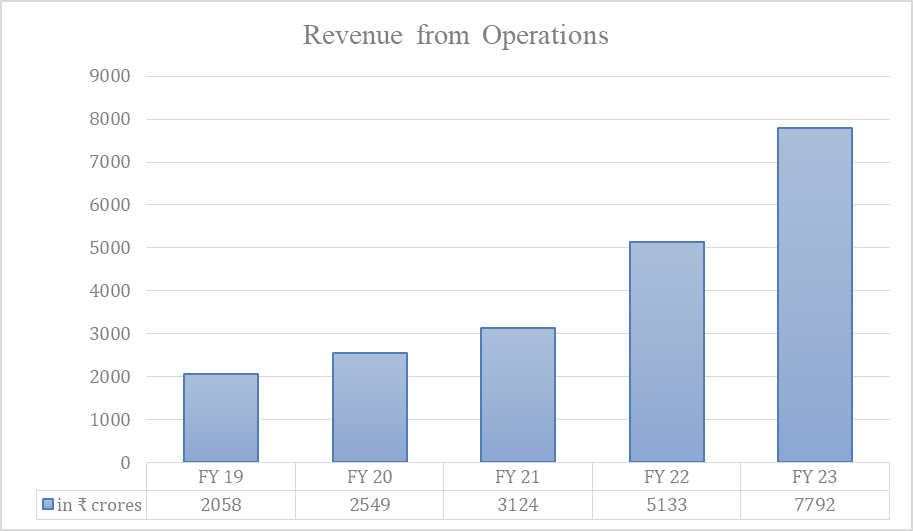

Adani Green Financials

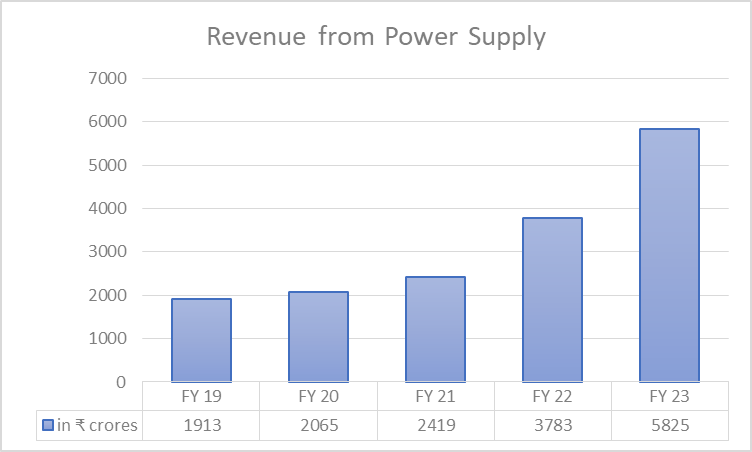

Revenue

In FY23, Adani Green recorded a 54% growth in revenue from power supply to ₹5,825 crores compared to ₹3,783 crores. The company reports all its revenue under a single business segment, and the group’s revenue is from domestic sales.

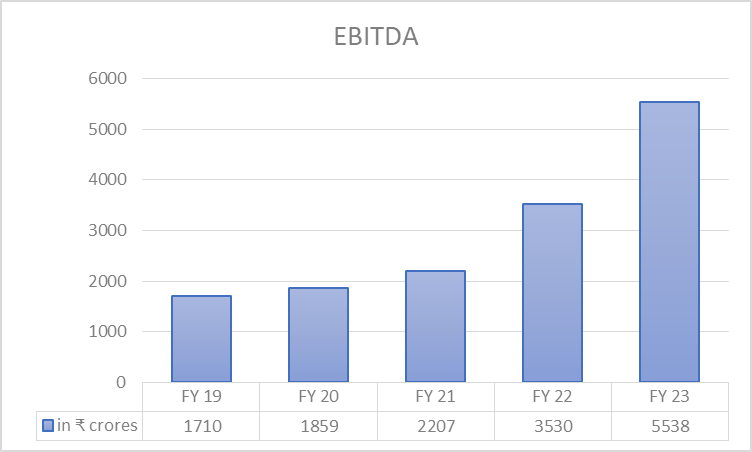

EBITDA

The company recorded 56.88% growth in EBITDA during FY23 at ₹5,538 crores, compared to ₹3,530 crores in FY22.

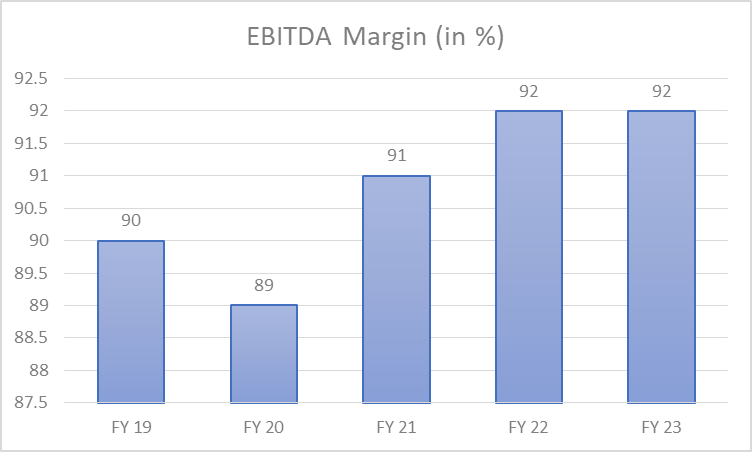

The company consistently records an EBITDA margin of more than 90% in the last three financial years.

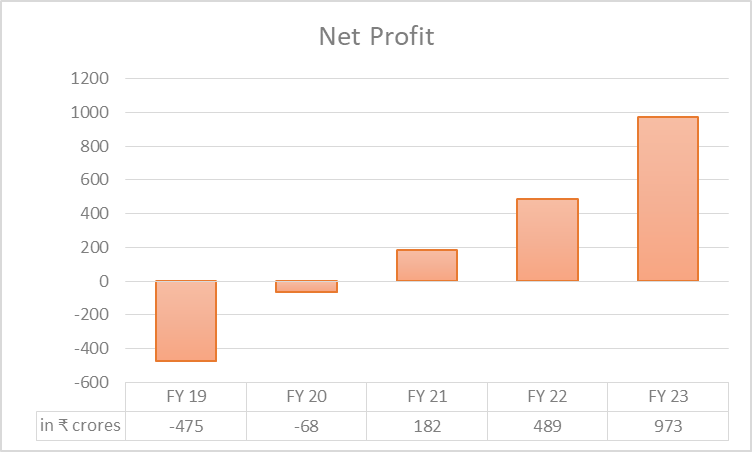

Net Profit

In FY23, Adani Green recorded a 99% growth in net profit at ₹973 crores, up from ₹489 crores in FY22. The company incurs significant expenses toward interest payments, which results in reduced net earnings. During FY23, AGEL expended ₹2,911 crores on interest payments on loans.

Adani Green Ratio Analysis

Current Ratio: At the end of 31 March 2023, Adani Green reported an 18% decline in the current ratio to 0.68 times from 0.83 times in FY22.

Debt-to-equity Ratio: Adani Green’s debt-to-equity ratio improved to 1.96 times in FY23 from 5.13 times in FY22. The decline is due to an increase in shareholder’s equity because of equity share issuance.

Debt service coverage ratio: During the year, the debt service coverage ratio declined to 1.52 times from 1.67 times in FY22.

Return on Capital Employed (ROCE): Adani Green’s ROCE declined to 3.74% in FY23 from 4.34% in FY22.

Adani Green Share Price History

Adani Green shares were listed on BSE and NSE on 18th June 2018 after its successful IPO, which was oversubscribed by 5.98 times. However, the stock debuted at ₹30, against its IPO price band of ₹100-125.

Despite losing at debut, Adani Green share price made a remarkable turnaround and has given a CAGR return of 99% in the last five years. The company has not paid dividends to shareholders or had any bonus issues after listing.

Despite the recent crash in Adani Green share price after the Hindenburg saga, it is one of the best-performing stocks in the market. The stock was trading around the ₹30 level in July 2018 and made an all-time high level of ₹3,050 on 19th April 2022, 100X in less than five years.

As of 14th July 2023, Adani Green has a market capitalization of ₹1,52,891 crores.

Adani Green Future Growth Potential

A SWOT analysis to better understand the Adani Green share price future growth potential.

Strengths

- The group’s expertise in executing complex mega projects has helped it become one of India’s best-performing renewable energy companies. The company is reporting year-on-year healthy growth in net profits for the last five years.

- Strong cash generation ability as entire power production is contracted through long-term power purchase agreements. AGEL has tied up with “Diversified Growth Capital” with a revolving facility of $1.64 billion that will fully fund its entire project pipeline

- The company has managed to bring down the average debt cost of 11.1% in FY19 to 9.5% at the end of FY23.

- Earning per share (EPS) more than doubled in FY23 at ₹5.41, from ₹2.41 in FY22

- Favorable government policies and schemes on the promotion of renewable energy, like the PLI scheme on domestic solar PV manufacturing

Weakness

- AGEL’s current average portfolio tariff is ₹2.98 per unit, which is lower than the national

- the average power purchase cost of ₹3.85 per unit.

- The company has huge debt on its book. At the end of FY23, gross debt stood at ₹47,274 crores. A sizeable portion of the company’s earnings goes toward interest payments.

Opportunities

AGEL is going to expand its total installed capacity by 5.5 times to 45,000 MW by 2030. PPAs with tariffs closer to the national average power purchase cost will improve profitability.

AGEL earned 3.9 million carbon credits in FY23, generating revenue of ₹157 crores. An increase in operational capacity will benefit the company in the long term.

Threats

The company has a low debt service coverage ratio, which makes it vulnerable to debt repayment risk. As per the company, the debt repayment risk is low, and the average tenure of the long-term debt is 7.3 years at the end of FY23.

AGEL faces strong competition from domestic and foreign companies that could moderate margins in case the tariff declines. The company is dependent on third-party vendors and manufacturers of silicon wafers and PV modules for solar projects. Any increase in the price of solar modules is difficult to pass on to customers and can impact project viability.

Faces increased scrutiny from regulators worldwide after the Hindenburg saga, impacting the company’s ability to raise capital from the market and hitting investors’ confidence.

Adani Green Share Price Analysis

Despite possessing a robust growth pipeline and a stable and predictable cash flow, the share price of Adani Green Energy Limited appears to be relatively expensive. As of July 14, 2023, the stock is trading at a high price-to-earnings (PE) multiple of 135 times and exhibits a low return on capital employed (ROCE) of 3.74%. These factors can make it challenging for the stock to reach high levels till the profitability margin and book value improve.

Adani Group stocks, including Adani Green, are susceptible to significant volatility and are currently trading at elevated valuations. In the medium to long term, a significant portion of the company’s profits may be allocated to servicing and repaying debt, which may mean a lower return on equity.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

How has Adani Green share price performed in the last 3 and 5 years?

As of 14th July 2023, Adani Green share price has given a CAGR return of 40% and 99% in the last three and five years, respectively. The all-time high Adani Green share price is ₹3,050.

What does Adani Green do?

Adani Green is India’s leading renewable energy company specializing in developing, constructing, owning, and maintaining large-scale grid-connected solar and wind power projects.

When was Adani Green started?

Adani Green was incorporated on 23rd January 2016, and in its initial days, it developed a 20 MW wind project in partnership with Inox Winds. Adani Green share was listed on 18th June 2018 on BSE and NSE.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 10

No votes so far! Be the first to rate this post.