Introduction

The exclusion of Russia from international capital markets has prompted global debt fund managers and the International Monetary Fund (IMF) to focus on India’s sovereign debt. The potential inclusion of India in international bond indices has become a topic of interest, and it could have significant implications for the country’s bond market and foreign investment landscape.

In this blog, we analyze the IMF’s perspective and India’s economic outlook, exploring the possibilities and challenges of India’s sovereign debt inclusion in global indices.

IMF’s Outlook on India’s Sovereign Debt Inclusion: The IMF views India’s inclusion in international bond indices as a crucial move that could positively impact the country’s bond market. By attracting greater foreign participation, India can better finance its current account deficit in the medium term.

The IMF emphasizes that volatile portfolio investments are susceptible to global financial conditions and country risk premiums. Consequently, including India’s sovereign debt in international bond indices may provide stability and confidence to investors.

Also Read: Momentum Investing Strategies

Hesitation from the Finance Ministry: Despite the IMF’s stance, the finance ministry in India has hesitated to offer any tax incentives for including government securities (G-Secs) in global bond indices. Tax incentives, such as rationalizing capital gains tax, could make India’s bonds more attractive to international investors. Nevertheless, the IMF believes India’s inclusion in global indices would pressure the government to maintain fiscal discipline and ensure its bonds retain investment-grade status.

Key Takeaways

Assessment of India’s Economic Landscape: The IMF report highlights that India’s trade and capital account regimes still have some restrictions, despite efforts to promote external trade and liberalize foreign direct investment (FDI) and portfolio flows. The report suggests that further structural reforms and improvements to the investment regime are necessary to enhance external rebalancing and encourage more FDI.

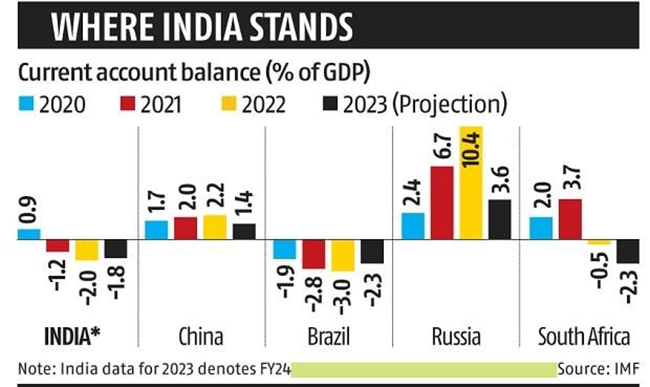

Current Account Deficit Projection: The IMF projects India’s Current Account Deficit to narrow to 1.8% of GDP in FY24, down from 2% in FY23. This positive development is attributed to buoyant services exports and an expected decline in oil import costs. However, the deficit will likely converge to its estimated norm of 2.4% GDP over the medium term. The government’s additional infrastructure spending is expected to temporarily raise the Current Account Deficit soon.

Mitigating External Vulnerabilities: To facilitate external rebalancing, the IMF recommends fiscal consolidation, development of export infrastructure, negotiation of free trade agreements, and liberalization of the investment regime. Structural reforms that encourage deeper integration into global value chains and attract more FDI would also help mitigate external vulnerabilities. Additionally, exchange rate flexibility would serve as a critical shock absorber, with limited intervention to address disorderly market conditions.

India’s Resilient External Position: India is noted to have a moderately strong external position and adequate reserves, which should be sufficient to address disorderly market conditions. In 2022, the depreciation pressures on the Indian rupee resulted from the widening Current Account Deficit and outflows of portfolio investments. However, these pressures eased and reversed in the second half of 2022 and early 2023, leading to an appreciation of the average real effective exchange rate (REER) for the year.

India’s sovereign debt has gained prominence as global debt fund managers and the IMF push for its inclusion in international bond indices. The move could have far-reaching effects on India’s bond market and foreign investment prospects.

Despite some financial ministry hesitating, the IMF believes that India’s inclusion in global indices would promote fiscal discipline and boost investor confidence. With India’s robust external position and ongoing economic reforms, the country is poised to navigate external vulnerabilities and attract more foreign investments in the medium term.

Breaking News: Government Sets Ambitious Target of Constructing 13,800 Km of Roads by FY24

In a groundbreaking move to bolster road infrastructure, the government has announced a substantial revision to its highway construction target, setting an ambitious goal for the fiscal year FY24.

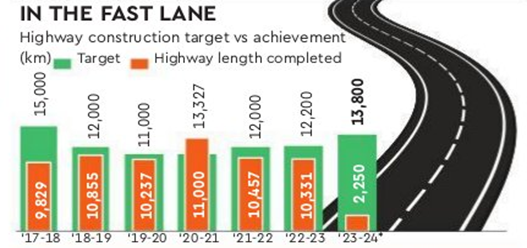

The initial target for road construction in FY24 was set at 12,500 km, but the government has now raised the bar, aiming to construct an impressive 13,800 km of roads. This bold objective seeks to outperform the government’s best-performing year, FY21, during which they completed 13,327 km of roads. The momentum has already begun, with 2,250 km of roads completed during the fiscal year’s first quarter, backed by a substantial investment of 99,273 crore.

It’s important to highlight that achieving road construction targets has been historically challenging for the government. Over the past six years, they have only succeeded in meeting their set goal once, making this new objective even more ambitious and closely watched.

Key Takeaways

Capital Expenditure Target: The government has earmarked Rs 2.58 lakh crores for capital expenditure throughout the year to utilize 90% of this fund by December. This significant investment will be a driving force behind accelerated road construction.

310 Highway Projects in the Pipeline: In their quest to achieve the revised target, the government plans to complete 310 highway projects during FY24.

Record-Breaking Toll Collections: New roadways have contributed to a remarkable 41% increase in toll collections, amounting to a staggering Rs. 48,028 crore. This surge in toll revenue showcases the potential economic benefits of investing in infrastructure.

The ambitious target of constructing 13,800 km of roads represents a crucial step towards infrastructure development, fostering economic growth, and bolstering nationwide connectivity. Improved road networks will facilitate smoother transportation and aid in the overall development of industries and regions.

Challenges that the government must address: There are some potential challenges that the government must address. Adverse weather conditions, clearance delays, and rising input costs may pose hurdles and potentially slow down the progress of some road projects. The government must remain vigilant and implement strategies to mitigate these obstacles.

As the government embarks on this ambitious journey to reshape India’s road infrastructure, all eyes will be on its progress. If successful, this feat will undoubtedly be a significant milestone in the country’s development and a testament to the power of vision and perseverance in nation-building.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3 / 5. Vote count: 1

No votes so far! Be the first to rate this post.