Introduction

Axis Bank, earlier known as UTI, was the first of the new private banks to have begun operations in 1994 after the Government of India allowed private banks to open shutters. The Bank has come a long way since then and has delivered excellent returns for its shareholders after Mr. Amitabh Chaudhary took over as the CEO of the bank in 2019.

This article tries to understand what led to the Axis Bank turnaround.

Axis Bank Overview

Axis Bank is the third largest private sector bank in India. The Bank offers financial services to customer segments covering Large and Mid-Corporates, MSME, Agriculture, and Retail Businesses.

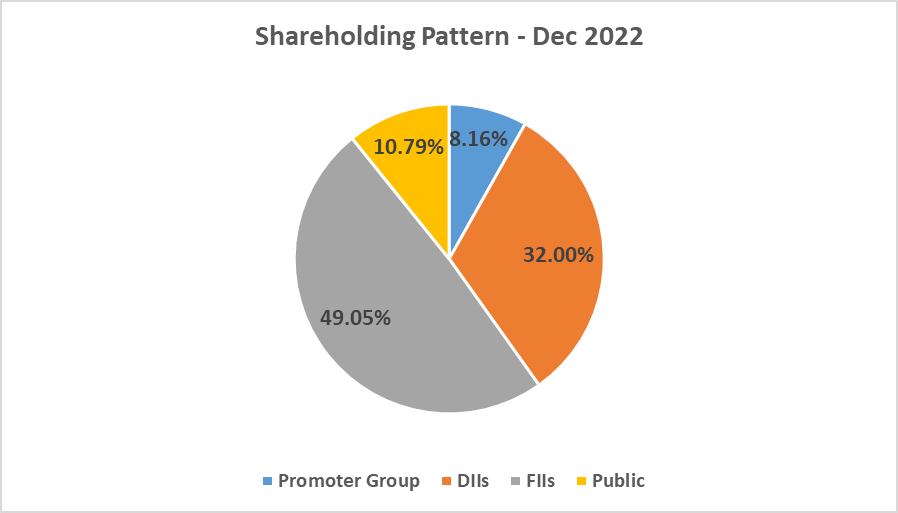

Axis Bank is one of the first new-generation private sector banks to have begun operations in 1994. The Bank was promoted in 1993, jointly by Specified Undertaking of Unit Trust of India (SUUTI) (then known as Unit Trust of India), Life Insurance Corporation of India (LIC), General Insurance Corporation of India (GIC), National Insurance Company Ltd. (NIC), The New India Assurance Company Ltd. (NIA), The Oriental Insurance Company Ltd. (OIC), and United India Insurance Company Ltd. (UIIC). The shareholding of Unit Trust of India was subsequently transferred to SUUTI, an entity established in 2003. GIC, NIC, NIA, OIC, and UIIC have been reclassified from the promoter category to the public category. As of March 31, 2023, SUUTI and LIC are the promoters of the Bank.

The Bank has a large footprint of 4,903 domestic branches (including extension counters) with 15,953 ATMs & cash recyclers spread across the country as of 31st March 2023. The Bank’s Overseas operations are spread over eight international offices with branches in Singapore, Dubai (at DIFC), and Gift City-IBU; representative offices in Dhaka, Dubai, Abu Dhabi, and Sharjah; and an overseas subsidiary in London, UK. The international offices focus on Corporate Lending, Coverage Business, Trade Finance, Syndication, Investment Banking, Liability Businesses, and Private Banking/Wealth Management offerings.

Axis Bank Company Journey

Axis Bank has a long and illustrious history that spans over a century. Here are some of the critical milestones in the company’s journey:

- 1993: UTI Bank is incorporated as a private sector bank in India. It begins its operations with a registered office in Ahmedabad, Gujarat.

- 1994: UTI Bank opens its first branch in Ahmedabad

- 1998: The Company went public. The public issue was subscribed by 1.2 times with over 1 lakh retail investors

- 2003: Crossed the one-million mark in debit card issuance

- 2004: Offered customers access to 7000 ATMs across the country, the largest to be offered by an Indian Bank, through bilateral agreements and multi-lateral consortiums for shared ATMs

- 2005: UTI Bank enlisted on the London Stock Exchange and raised USD 239.30 million through Global Depository Receipts (GDRs)

- 2007: UTI changes its name to Axis Bank, launches its new logo and a national ad campaign

- 2010: Axis Bank acquired the Investment Banking and Equity Capital market business of Enam Securities

- 2011: Launched retail broking business and online trading platform – Axis Direct

- 2013: Launched overseas subsidiary Axis Bank UK Limited to commence banking operations in the United Kingdom

- 2015: Introduced Burgundy – Wealth Management Services

- 2018: Opened IFSC Banking Unit at Gift City Multi-Services SEZ in Gandhinagar, Gujarat

- 2019: Amitabh Chaudhary takes over as MD & CEO from 1st Jan 2019

- 2023: Axis Bank completes acquisition of Citibank India’s consumer businesses in India

Axis Bank Management Profile

Mr Amitabh Chaudhary is the Managing Director and CEO of Axis Bank. Before joining the Bank, Amitabh had a long and successful stint of nine years at HDFC Life. Under his leadership, HDFC Life emerged as the finest, most technology-savvy brand in the insurance space, and today, it is one of India’s largest private life insurers. Amitabh is also currently the Chair of the FICCI Committee on Banking.

Mr Rajiv Anand is the bank’s Deputy Managing Director, leading some of the most critical functions, including Wholesale Banking and Digital Banking, along with support functions like Marketing and Corporate Communications. Rajiv has had an illustrious career spanning more than 30 years and has focused on various facets of the financial services industry. He is widely recognized for his strengths in capital markets and for successfully building new businesses to scale.

Mr Ganesh Sankaran has been the Group Executive – the Wholesale Banking Coverage Group at Axis Bank since March 2019. He has nearly 25 years of experience across coverage, credit, and risk functions. He has handled verticals like Corporate Credit, Financial Institutions, Business Banking, Mortgages, Commercial Transportation, Equipment Finance & Rural Lending. Before joining Axis Bank, he was an Executive Director at Federal Bank. His responsibilities included creating a robust business architecture across the Wholesale Bank, Micro/Rural Bank, and Business Banking.

Mr Neeraj Gambhir has been the Group Executive – Treasury, Markets & Wholesale Banking Products of Axis Bank since May 2020. He has over 25 years of experience in the financial services industry with expertise in Fixed Income, Foreign Exchange, Capital Markets, Structured Finance, Derivatives Risk Management, and Investment Banking areas. Previously, he was the MD and Head of Fixed Income for Nomura Holding Inc. India, where he set up and grew their Fixed Income franchise in the country. Before that, he was the Managing Director of Lehman Brothers India and a Senior General Manager and Global Head of Structured Finance & Balance Sheet Management at ICICI Bank.

Axis Bank Shareholding Pattern

Axis Bank Company Analysis

Axis Bank is a financial conglomerate. Through its various subsidiaries, it has a presence in asset management, broking & investment banking, special situations funding, structured financing & home loans.

Key Subsidiaries of Axis Bank are:

- Axis Finance

- Axis AMC

- Axis Capital

- Axis Securities

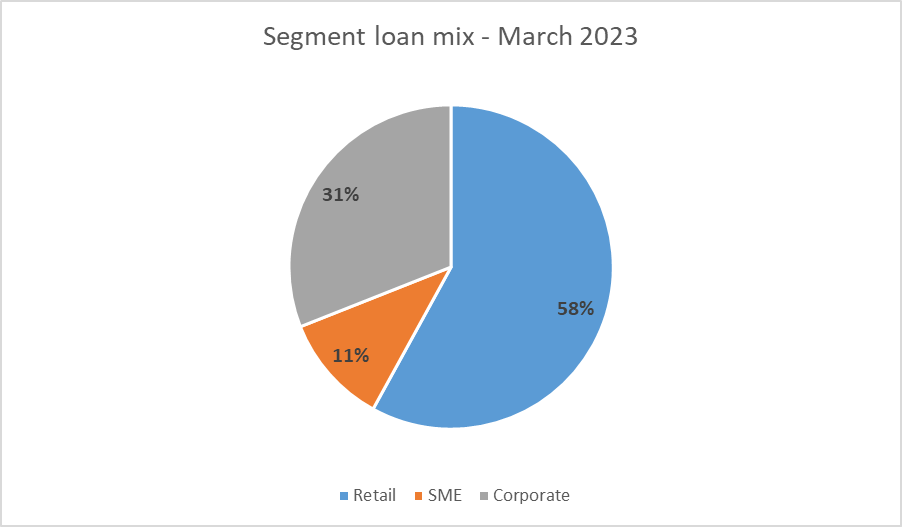

Within the bank, the loan mix is dominated by the retail book, which has led to significant improvement in the NPA ratio for the bank. As of FY23, the retail loan book is more than 50% of the total advances.

Axis Bank completed the acquisition of Citibank India’s Consumer Business, comprising loans, credit cards, wealth management, and retail banking operations. This strategic acquisition strengthens Axis Bank’s position among large private lenders in India and will help accelerate its premium market share growth. The acquisition was carried out in a record time of seven months post-receipt of CCI approval.

With the acquisition of Citibank India Consumer Business, Axis Bank added over 2.4 million new customers and ~3200 employees to the Axis family.

Axis Bank Financials

Core Operating Profit and Net Profit

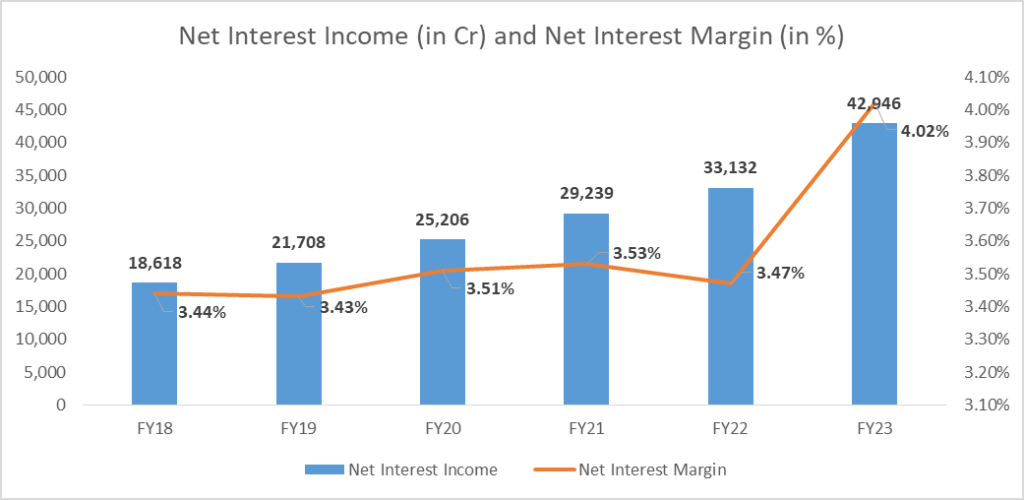

Net Interest Income for FY23 grew 30% YOY to INR 42,946 Cr from INR 33,132 Cr in FY22. Core operating profit in FY23 grew 40% YOY to INR 32,291 Cr from INR 23,094 Cr in FY22.

Net Profit for FY23 (excluding exceptional items) grew 68% to INR 21,933 Cr from INR 13,025 Cr in FY22. Reported net profit for FY23 de-grew by 26% YOY to INR 9,580 crores due to the write-off of the acquisition cost of Citi’s India consumer business along with expenses related to one-time policy harmonization, banker fees, stamp duties, and taxes. * Excluding trading profit and exchange gain/loss on capital repatriated from overseas branches.

| Financial Performance (in Cr) | Q4FY23 | Q4FY22 | %Growth | FY23 | FY22 | %Growth |

| Net Interest Income | 11,742 | 8,819 | 33% | 42,946 | 33,132 | 30% |

| Other Income | 4,895 | 4,224 | 16% | 16,501 | 15,221 | 8% |

| Operating Revenue | 16,637 | 13,042 | 28% | 59,447 | 48353 | 23% |

| Core Operating Revenue(*) | 16,554 | 12,812 | 29% | 59,689 | 46705 | 28% |

| Operating Expenses | 7,470 | 6,576 | 14% | 27,398 | 23,611 | 16% |

| Operating Profit | 9,168 | 6,466 | 42% | 32,048 | 24,742 | 30% |

| Core Operating Profit(*) | 9,084 | 6,235 | 46% | 32,291 | 23,094 | 40% |

| Net Profit | -5,728 | 4,118 | – | 9,580 | 13,025 | -26% |

Net Interest Income & Net Interest Margin

Net Interest Income (NII) is the difference between the interest earned on a bank’s assets (such as loans and investments) and the interest paid on its liabilities (such as deposits and borrowings).

Net Interest Margin (NIM) is calculated by dividing the NII by the average interest-earning assets. NIM continues to witness up-tick led by structural drivers like

- Improvement in balance sheet mix

- Reducing the share of low-yielding RIDF (Rural Infrastructure Development Fund) bonds

- Improvement in CASA% (Current Account and Savings Account)

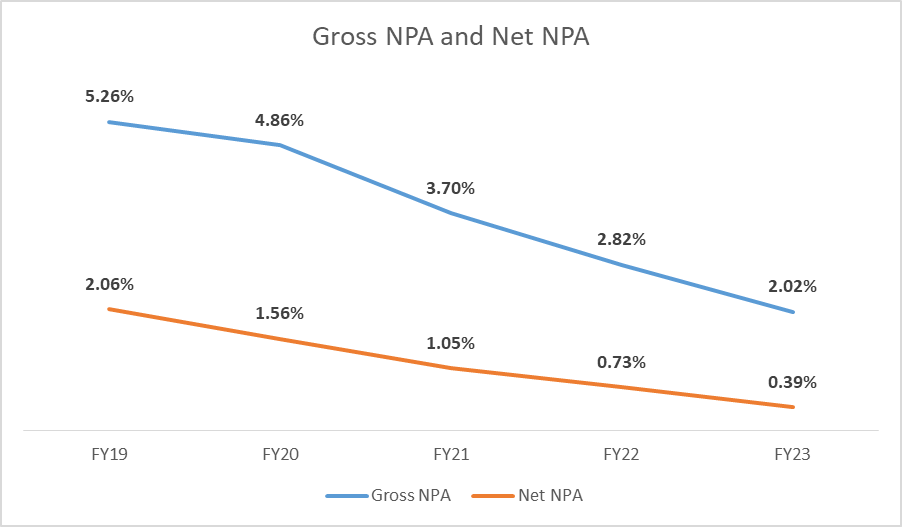

- Asset Quality: NPA stands for Non-Performing Asset. It refers to a loan or an advance where the borrower has not paid the interest or the principal amount for a specified period, usually for 90 days or more.

Gross NPA refers to the total value of a bank’s non-performing assets. Net NPA, on the other hand, is the value of NPA after reducing the provisions made by the bank to cover the losses that may arise from such non-performing assets.

As of 31st March 2023, the Bank’s reported Gross NPA and Net NPA levels were 2.02% and 0.39%, respectively, as against 2.82% and 0.73% in FY22. The chart below shows that asset quality has improved significantly over the last five years due to a higher share of loan mix from retail books.

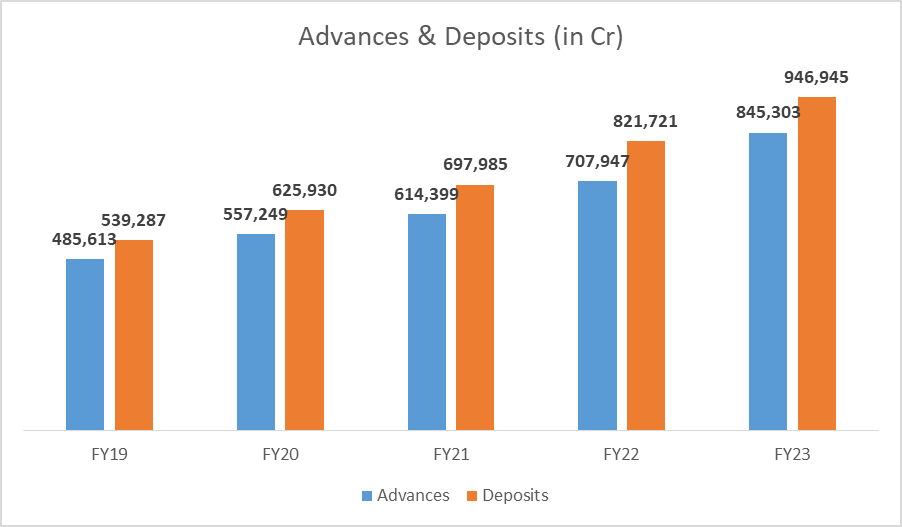

Advances & Deposits

An advance refers to a loan or credit extended by a bank to its customers. Banks offer various advances such as personal, business, home, education, vehicle, and credit card loans.

Deposits are a critical source of funding for banks, and they use these funds to provide loans and advances to customers. The Bank’s advances grew 19% YOY and 11% QOQ to INR 845,303 Cr on 31st March 2023. Retail loans grew 22% YOY and 14% QOQ to INR 487,571 Cr and accounted for 58% of the net advances of the Bank.

One of the reasons for the superior performance of the Bank has been the growth in the retail loan book. The share of CASA (Current Account & Savings Account) deposits in total deposits stood at 47%, up 215 bps YOY and 261 bps QOQ.

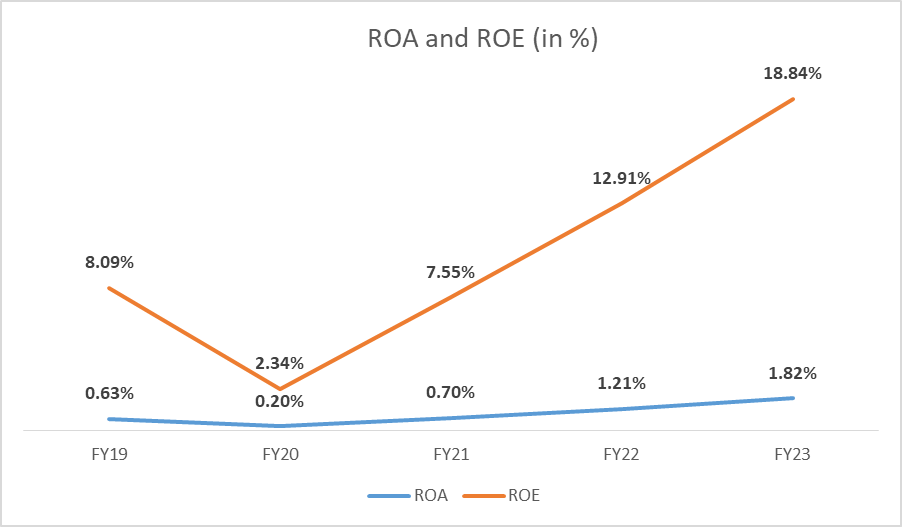

Improving Return ratios (ROA & ROE)

Axis Bank has been improving its RoA (A higher RoA suggests that a bank is more efficient in generating profits from its assets) & ROE (the higher the ROE, the more efficient a company’s management is at generating income and growth from its equity financing) over the last few years as seen in the chart below.

ROA is inching towards 2% from a low of 0.04% in FY18, and ROE is approaching 20% from a low of 0.53% in FY18. This shows the extent of turnaround the bank has seen in the last six years.

Payments & Digital

Axis Bank issued 42 lakhs new credit cards in FY23. The Bank has been one of the highest credit card issuers in the country over the last three quarters and has gained a total CIF market share of 17% in the previous six months.

Axis Bank Share Price history

Axis Bank’s share price has delivered a CAGR of 14% over the last ten years (from INR 229 on 20th June 2013 to INR 975 on 20th June 2023). However, the bank has delivered 33% CAGR over the last three years (From 20th June 2020 to 20th June 2023), and it remains one of the top picks in the banking space for the majority of the brokerage houses, given its superior financial performance, top-management stability/credibility, and strong capital/ provision buffers.

Axis Bank Strategy

The bank has already witnessed improvement in RoA and RoE and continues to work towards sustaining the momentum in the future. The management is confident about its business growth, reaping benefits from the acquired company, and focusing on the core business segments.

The bank has strengthened its retail segment with an aggressive focus on customer acquisition and improved granularity. CITI business integration may boost its business momentum and help capture market share in the retail segment.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What is the 52 Week High and Low of Axis Bank?

Axis Bank had a 52 Week high of INR 989.7 per share while the 52-week low was INR 618.3 per share as of 21st June 2023.

What is the face value of the share of Axis Bank Ltd.?

Axis Bank’s face value is INR 2 per share.

Is Axis Bank good for the long term?

Axis Bank has improved on all business parameters, including profitability, NPAs, retail loan book mix, and return ratios, and is well-positioned to deliver good returns over the long term. That being said, investors must be cautious about their entry valuation, thoroughly study, and keep a decent margin of safety before investing.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 15

No votes so far! Be the first to rate this post.