Introduction

In a surprising turn of events, Foxconn, renowned for its iPhone production, has decided to terminate its joint venture with Vedanta, effectively abandoning its plans to establish a semiconductor manufacturing plant in India. The project, which was initially intended for Maharashtra but later relocated to Gujarat, was hailed as a significant undertaking by the Indian government. However, less than a year after signing the Memorandum of Understanding (MoU), Foxconn’s unexpected withdrawal has raised questions about the future of India’s semiconductor industry.

Foxconn-Vedanta JV: A Promising Collaboration Cut Short

The partnership between Vedanta and Foxconn was greeted with enthusiasm when it was announced in September 2022. The signing ceremony, attended by high-profile dignitaries such as the Chief Minister of Gujarat and the IT Minister, showcased the government’s support for the project. However, the promising venture was short-lived, as Foxconn recently decided to withdraw from the Vedanta JV.

Reasons Behind Foxconn’s Departure

The precise motives for Foxconn’s withdrawal from the partnership remain undisclosed. It is worth noting that both Vedanta and Foxconn had limited experience in semiconductor manufacturing, making the Gujarat project their first foray into this specialized field. Foxconn, known for its expertise in iPhone production, aimed to diversify its business portfolio by venturing into the semiconductor industry. However, the exact factors that led to the partnership’s dissolution have not been revealed by the company.

Key Takeaway

India’s Semiconductor Ambitions in Jeopardy

The departure of Foxconn from the $19.5 billion joint venture with Vedanta has ignited concerns about India’s aspirations to become a prominent player in the semiconductor market. Semiconductor chips are vital components in electronic devices, and the ability to manufacture them domestically holds significant strategic advantages, especially when it comes to competing with global leaders like China. With Foxconn’s sudden exit, India’s semiconductor industry faces uncertainty regarding its growth and development trajectory.

Government’s Response and Investor Confidence

In response to Foxconn’s decision, Deputy IT Minister Chandrasekhar took to Twitter to reassure the public that India’s plans would not be affected. He emphasized that both Foxconn and Vedanta are esteemed investors in the country, and it is not the government’s responsibility to intervene in the affairs of private entities. While the government remains optimistic, the episode raises questions about the long-term implications for India’s semiconductor ambitions.

Conclusion

Foxconn’s sudden exit from the joint venture with Vedanta has made India’s chip-making plans uncertain. With the semiconductor industry playing a crucial role in today’s technology-driven world, the departure of a key player like Foxconn raises concerns about India’s ability to establish itself as a formidable competitor. As India recalibrates its strategy, it remains to be seen how the country will navigate the challenges ahead and forge a path towards realizing its semiconductor aspirations.

India Surpasses China as the Premier Destination for Emerging Market Debt Investment

Introduction

In a groundbreaking survey conducted by Invesco, India has emerged as the most attractive emerging market for investing in debt instruments, surpassing China. With fund managers overseeing a staggering $21 trillion in assets collectively, this shift in preference towards India can be attributed to the nation’s remarkable strides in achieving stability, favorable demographics, and the implementation of regulatory measures that have enhanced the investment landscape.

Unveiling the Survey Findings

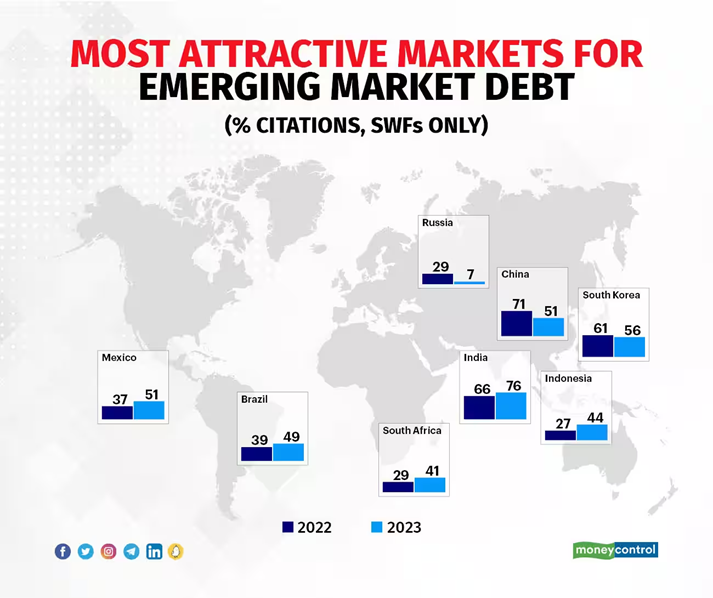

Invesco’s comprehensive survey gathered data from 85 sovereign wealth funds and 57 central banks, which manage approximately $21 trillion in assets together. The results of the survey revealed that, in 2023, India achieved an impressive ranking of 76% in terms of debt attractiveness, a significant increase from its previous rating of 66% in 2022.

Factors Behind India’s Rise:

The ascent of India as the premier choice for emerging market debt investment can be attributed to multiple factors. Firstly, the country has made substantial advancements in creating a favorable business environment and fostering a friendly atmosphere for investors. These factors have influenced sovereign wealth funds to favor India over China, recognizing the significant potential it offers.

Key Takeaway

Shifting Investment Preferences

With inflation levels persisting at elevated levels and interest rates witnessing an upward trend, sovereign wealth funds have begun exhibiting a preference for fixed-income and private debt investments. Emerging markets like India, which showcase robust demographics, political stability, and proactive reforms, have become highly appealing investment options, thus surpassing China.

Implications of the Influx of Funds

The inflow of sovereign wealth funds will play a crucial role in financing India’s current account deficit while bolstering domestic assets, including debt instruments. Additionally, this influx will contribute to strengthening currencies, further solidifying India’s position as an attractive investment destination.

Reducing Dependence on China

In a broader context, this preference for India can also be seen as a gradual shift away from reliance on China. Countries around the world are actively seeking alternatives to reduce their dependence and concentration on China, and India is poised to become the prime beneficiary of this global repositioning. Its rise as the leading destination for emerging market debt investment demonstrates the trust placed in India’s potential and the desire to diversify investment portfolios.

Conclusion

India’s ascent as the most attractive destination for emerging market debt investment represents a remarkable achievement. With its stability, favorable demographics, and proactive reforms, India has successfully outshined China in the eyes of sovereign wealth funds. As funds flow into the country, India’s economy stands to benefit immensely, while the shift away from China highlights the growing recognition of India’s potential as a global investment powerhouse.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.