In this dynamic world of finance, investors often face challenges when choosing between Bajaj Finserv and Bajaj Finance. These NBFC giants have excelled in creating shareholder value over the past decade and continue to be Dalal Street’s favorite stocks.

Let us understand more about Bajaj Finserv the company.

Bajaj Finserv Overview

Bajaj Finserv was spun off from Bajaj Auto Limited in April 2007 to focus solely on the group’s financial services businesses, unlock value in high-growth business areas such as Auto, Insurance, Finance, and Wind Power, and strengthen their competencies.

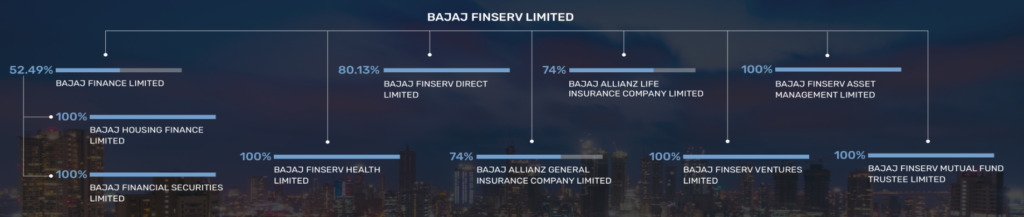

The company operates as a group holding company and operates through multiple subsidiaries. It has a 52.4% stake in Bajaj Finance Ltd., 74% each in Bajaj Allianz Life Insurance and Bajaj Allianz General Insurance, and 80.13% in Bajaj Finserv Direct.

The wholly-owned subsidiaries include Bajaj Finserv Health Ltd., Bajaj Finserv Ventures Ltd., Bajaj Finserv Asset Management Ltd., and Bajaj Finserv Mutual Fund Trustees Ltd.

Bajaj Auto Limited was renamed Bajaj Finance Limited in September 2010. Read Bajaj Finance Share Price Analysis here.

Bajaj Finserv Company Analysis

The company operates through various subsidiaries, offering a comprehensive suite of financial solutions to cater to the diverse needs of individuals and SME customers throughout their life cycles. The company has divided its business into Products & Solutions and Platforms.

Products & Solutions

Bajaj Finance: It’s the lending arm of the company involved in consumer lending, personal loans, SME loans, rural lending, commercial lending, and loan against securities.

Bajaj Allianz Life Insurance Limited: It’s the life insurance division of Bajaj Finserv, with a strong presence in individual and group life insurance verticals.

Bajaj Allianz General Insurance Limited: It’s the general insurance division of the company offering insurance solutions for cars, two-wheelers, travel, health, home, etc., across both retail and commercial customers.

Platforms

Bajaj Finserv Direct Limited: It is like a marketplace platform where Bajaj Finserv Direct has partnered with respected names in the financial industry to provide financial product categories spanning secured and unsecured debt, insurance, investments, credit cards, etc.

Bajaj Finserv Health Limited: It is the group’s personalized healthcare platform providing access to services like health insurance, doctor teleconsultation, discounts on lab tests, free preventive health checkups, and others.

Bajaj Financial Securities Limited is a registered stockbroker and depository participant with SEBI who offers investment products and services to retail and HNI clients, including margin trade financing.

Bajaj Finserv has categorized its income sources into the following segments:

- Life Insurance

- General Insurance

- Windmill

- Retail Financing

- Investments and Others

Bajaj Finserv Management Profile

Bajaj Finserv is led by Chairman and Managing Director Sanjiv Bajaj, and under his leadership, the company has emerged as a leading financial services provider. Sanjiv is a Harvard Business School, USA, alumnus and member of various prestigious industry bodies.

Mr. S. Sreenivasan is the President (Finance) and Chief Financial Officer (CFO) at Bajaj Finserv Limited. He is a member of the senior executive management team, which oversees long-term strategic and annual operating plans, annual operations, and corporate governance of the group. A qualified Chartered Accountant and CFA, Mr. Sreenivasan has played an instrumental role in the turnaround of the group’s insurance businesses.

Mr. V. Rajagopalan is the President of Legal & Taxation at Bajaj Finserv. He oversees the group’s new business initiative related to acquisition structuring, treasury, regulatory, and legal matters at the corporate level.

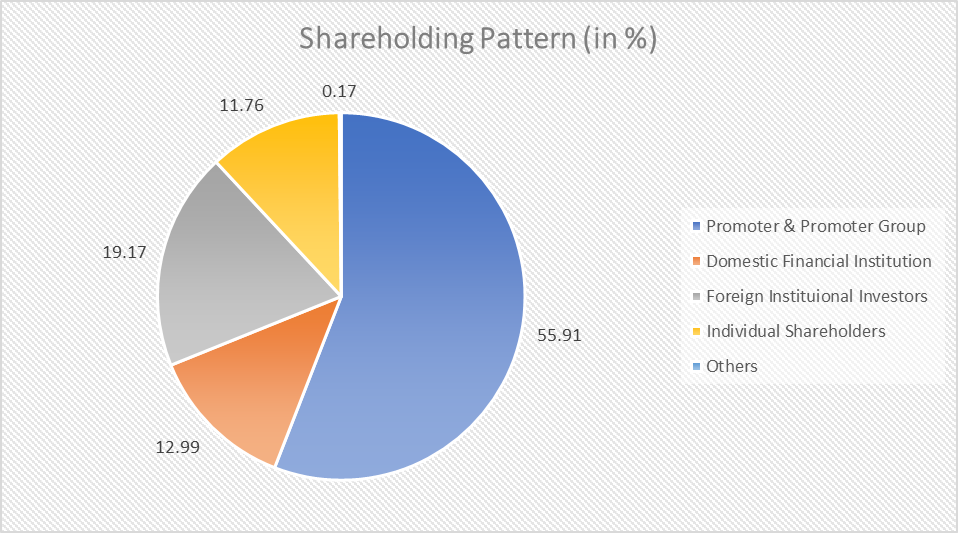

Bajaj Finserv Shareholding Pattern

Bajaj Finserv Financials

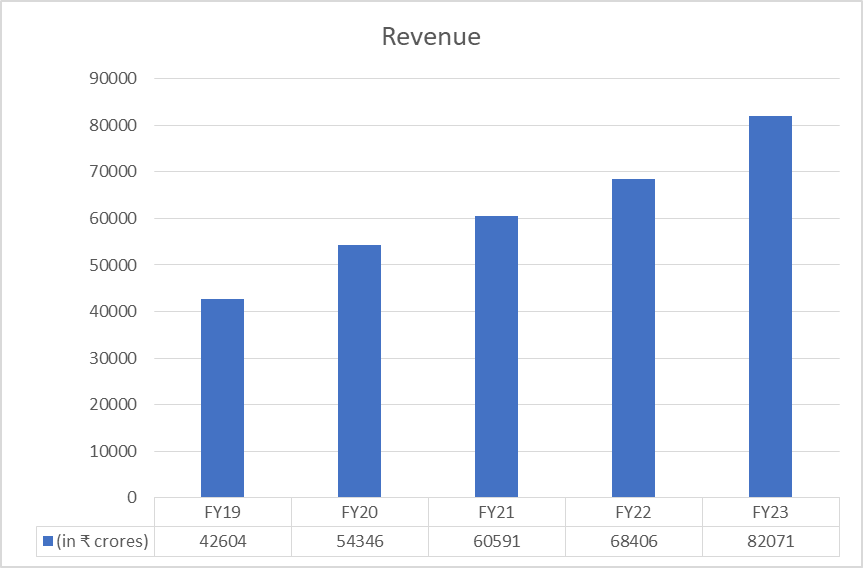

Revenue

In FY23, Bajaj Finserv reported total revenue from operations at ₹82,071 crores, a growth of 20% compared to the previous fiscal year at ₹68,406 crores.

Segment-wise Revenue Breakup

| FY21 (in ₹ crores) | FY22 (in ₹ crores) | FY23 (in ₹ crores) | |

| Life Insurance | 12024.84 | 16127.05 | 19461.43 |

| General Insurance | 12624.38 | 13788.07 | 15486.93 |

| Windmill | 23.94 | 29.38 | 23.16 |

| Retail Financing | 26683.05 | 31640.41 | 41405.69 |

| Investments and Others | 480.19 | 995.53 | 1704.11 |

Segment-wise Profit Before Tax Breakup

| FY21 (in ₹ crores) | FY22 (in ₹ crores) | FY23 (in ₹ crores) | |

| Life Insurance | 1383.22 | 42.90 | -190.51 |

| General Insurance | 2392.32 | 1735.31 | 1403.12 |

| Windmill | 4.91 | 6.32 | 10.49 |

| Retail Financing | 6386.64 | 10000.15 | 16168.79 |

| Investments and Others | -304.75 | -514.10 | -580.76 |

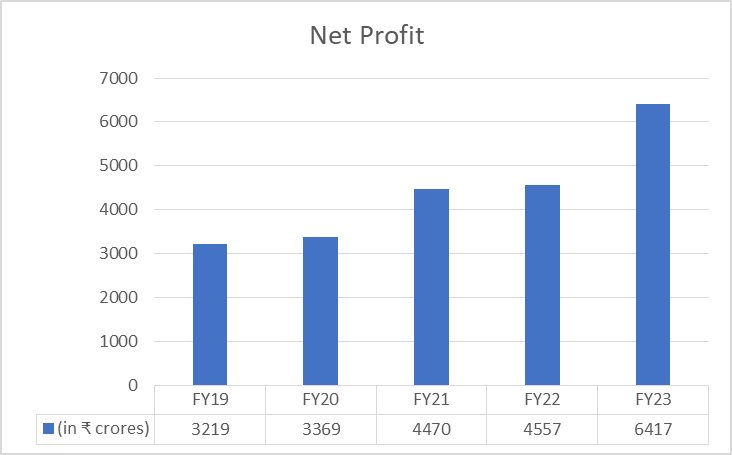

Net Profit

In FY23, Bajaj Finserv posted a net profit of ₹6,417 crores, up 41% compared to the previous fiscal at ₹4,557 crores.

Subsidiaries’ Contribution to Net Profit

| FY21 | FY22 | FY23 | |

| Bajaj Finance | 52% | 81% | 94% |

| BAGIC | 31% | 22% | 13% |

| BALIC | 21% | 5% | 2% |

| Others | -4% | -8% | -9% |

In FY23, Bajaj Finance contributed 94% to Bajaj Finserv’s consolidated profit. Bajaj Allianz General Insurance accounted for 19% of the profit, Bajaj Allianz Life Insurance contributed 2%, while other businesses reported losses, resulting in a negative contribution of 9%.

Bajaj Finserv Subsidiaries’ Operational Performance

Bajaj Finance Limited

Bajaj Finance boasts an impressive customer franchise of 6.91 crores, with a cross-sell customer base of 4.06 crores. The company strategically targets mass affluent and above clients. Additionally, Bajaj Finance places great importance on cross-selling, leveraging its existing customer base to drive additional product offerings and enhance customer relationships.

As of 31st March 2023, the company lending AUM mix for Urban: Rural: SME: Commercial: Mortgage stood at 32%: 10%: 14%: 13%: 31%.

Financial Performance Highlights of FY23 over FY22

- The lending book size grew by 27% to ₹2,42,269 crores from ₹1,91,423 crores.

- Total income during the period went up by 31% to ₹41,406 crores from ₹31,648 crores.

- And, profit after tax (PAT) went up by 64% to ₹11,508 crores from ₹7,028 crores

- Net NPA stood at 0.34% as of 31st March 2023 as against 0.68% the previous year

The Capital Adequacy Ratio (CAR) remained strong at 24.97% as of 31st March 2023, against the minimum regulatory requirement of 15%.

Bajaj Allianz General Insurance

The company offers a diverse portfolio of insurance products in retail and corporate markets. It focuses on retail segments that target mass, mass affluent, and HNIs, while commercial segments primarily target SMEs and MSMEs.

In FY23, the company recorded a 12% growth in gross written premium at ₹15,487 crore compared to ₹13,788 crore in FY22. The profit after tax (PAT) increased marginally by 1% at ₹1,348 crores.

The solvency ratio of Bajaj Allianz General Insurance is 391% as of 31st March 2023, indicating a financially strong position of the company.

Bajaj Allianz Life Insurance

In FY23, the company recorded a 21% growth in gross premium written at ₹19,462 crores compared to ₹16,127 crores. The profit after tax (PAT) increased by 20% year-on-year to ₹390 crores from ₹324 crores in FY22.

As of 31st March 2023, the company’s solvency ratio stands at 591%

Bajaj Finserv Share Price History

Bajaj Finserv is the biggest wealth creator in the Indian stock market. Bajaj Finserv share price has grown at a CAGR of 37% in the last ten years.

It launched its IPO on May 5th, 2008, raising approximately ₹1650 crores, and the price of each share was set at ₹705.

Since its listing, Bajaj Finserv has issued 1:1 bonus shares once and has done a stock split in the ratio 5:1 on 13th September 2022. In the last three years, Bajaj Finserv has paid ₹3 in 2021 and ₹4 in 2022 as dividends of pre-split shares. In 2023, the company announced a dividend of ₹0.80 per share.

On 1st July 2013, Bajaj Finserv share price was ₹58.65 and touched an all-time high level of ₹1,844 on 1st September 2022. (Bajaj Finserv is trading at split-adjusted value). As of 14th June 2023, Bajaj Finserv’s market capitalization is at ₹2,35,594 crores.

Bajaj Finserv Fundamental Analysis

Strong Performance in Lending Business

In FY23, Bajaj Finance continued its strong performance, driving up revenue and profits for the parent company. During the year, Bajaj Finance’s assets under management (AUM) grew by 25% to ₹2,47,379 crores and contributed over 90% to Bajaj Finserv’s profits.

Another encouraging development is the increase in the deposit book, which now stands at 44,666 crores, representing a 45% increase year on year. As of 31st March 2023, the company’s deposit book contributes 21% to consolidated borrowings, compared to 19% at the end of FY22. It will lower the company’s credit costs, increasing profitability.

Mixed Performances in Insurance Businesses

In FY23, the insurance arms of the Bajaj Finserv group showed positive business trends across different insurance segments. The general insurance business’s gross direct premium income (GDPI) was 12% compared to 20.2% for private sector players and 16.3% for the industry. Bajaj Allianz General Insurance also had a combined operating ratio (COR) of 100.5% in FY23, indicating that underwriting was not profitable.

Bajaj Allianz Life Insurance did well in the life insurance industry, achieving a growth rate of 41% in FY23. This outpaced the growth of private players (24%) and the industry (19%). The company grew second fastest in Individual Rated New Business (IRNB) among the top 10 private players. Additionally, in Q4FY23, Bajaj Allianz Life Insurance witnessed a 26% increase in renewals, supported by initiatives to improve persistence.

Bajaj Finserv Plans

Launch of Mutual Fund Business

Supported by its strong lending and insurance businesses, Bajaj Finserv is now venturing into the world of mutual funds. The company plans to launch mutual funds in the second quarter of FY24. Although the space is crowded, and top players like HDFCMF, SBIMF, and ICICI Prudential AMC dominate it, Bajaj Finserv’s superior cross-sell capability can help strengthen its position initially.

The company announced in a press release its plans to introduce a wide range of investment products spanning fixed-income, hybrid, and equity categories, catering to the varying needs of investors.

It has submitted seven schemes to SEBI for approval, encompassing liquid funds, money market funds, overnight funds, arbitrage funds, large and mid-cap funds, balanced advantage funds, and flexi-cap funds. Notably, the company aims to target the institutional segment and company treasuries, with a specific emphasis on short-term fixed-income categories.

Capitalizing on India’s Growing Economy

With the economy expanding rapidly compared to other developed global economies, Bajaj Finance’s strong presence in consumer lending and the retail segment will help it cover a wider customer base and capitalize on the increasing customer spending trends in India.

Furthermore, Bajaj Finance’s robust multichannel distribution network, combined with its digital-first approach and utilization of advanced technology and data analytics, can help it make the most of the opportunities in the market.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What’s the difference between Bajaj Finance and Bajaj Finserv?

Bajaj Finance operates as a subsidiary of Bajaj Finserv. On the other hand, Bajaj Finserv Limited is a holding company that operates through its various subsidiaries, including Bajaj Finance, Bajaj Allianz General Insurance, Bajaj Allianz Life Insurance, etc. Its primary role is to oversee and manage the group’s overall financial services business and provide strategic direction, governance, and coordination among its subsidiary companies.

How has Bajaj Finserv share price performed in the last 10 years?

As of 14th June 2023, Bajaj Finserv share price has given a CAGR return of 37% in the last 10 years.

When was Bajaj Finserv established?

Bajaj Finserv was demerged from Bajaj Auto Finance in April 2007 to oversee the group’s financial services businesses.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.4 / 5. Vote count: 9

No votes so far! Be the first to rate this post.