Introduction

Did you know that Tata Chemicals is in almost every household in India? It’s true! In 1983, Tata Chemicals was the first company in India to introduce the iconic iodized-packaged salt brand Tata Salt. And since then, it has become a trusted household name nationwide. Over the years, Tata Chemicals has grown into a diversified chemical company with a presence in over 99 countries across six continents.

This article will dive deep into Tata Chemicals share price analysis and understand its prospects.

Tata Chemicals History

Tata Chemicals was initially set up as Okhamandal Salt Works in 1927 and later became part of Tata Group when JRD Tata took it over in 1939.

Initially started as the manufacturer of industrial salt and later diversified into manufacturing soda ash, sodium bicarbonate, and a range of science-based products. Tata Chemicals is the world’s third-largest producer of soda ash, sixth-largest producer of sodium bicarbonate, and a leader in crop protection and agri-input solutions.

Recently, Tata Chemicals expanded into health-based nutraceuticals, prebiotics under the brand Tata NQ, and the production and recycling of Li-ion batteries.

Tata Chemicals Business Overview

Tata Chemicals has divided its operations into two business segments- Basic Chemistry and Specialty Products.

The Basic Chemistry segment comprises inorganic chemicals like soda ash, sodium bicarbonate, and salt. It has manufacturing operations spread over four continents- North America, Europe, Africa (Kenya), and Asia.

While the Specialty Products segment comprises specialty silica, prebiotics, agri-inputs, and material sciences. Its listed subsidiary, Rallis India Limited, produces Agri inputs, including seeds for Indian and overseas farmers. In FY23, Tata Chemicals’ revenue from operations stood at ₹16,789 crores and EBITDA of ₹3,822 crores.

Tata Chemicals Management Profile

The leadership team of Tata Chemicals includes:

R Mukundan is the Managing Director and CEO of Tata Chemicals and joined Tata Administrative Services (TAS) in 1990 after completing his MBA from FMS, Delhi. Over 26 years, Mr Mukundan has served in the group’s hospitality, automotive, and chemical sectors.

Zarir Langrana is the Executive Director and currently heads the Global Chemicals Business of Tata Chemicals. Mr Langrana is an economics graduate from the University of Madras and did his management studies at XLRI-Jamshedpur. He was inducted into the Tata Group through the TAS.

Nandakumar S. Tirumalai is the Chief Financial Officer (CFO) of Tata Chemicals and joined Tata Group in 2012 as Head- Treasury and Investor Relations in Tata Power. Later, he moved to Titan Limited as Vice President- Corporate Finance in 2018. Before joining Tata Group, Mr Nandakumar worked with companies like ITC, Raymond, Reliance Securities, etc.

Rahul Pinjarkar is the Chief Human Resources Office at Tata Chemicals and has over 28 years of experience handling HR-related functions. Mr Pinjarkar joined Tata Group in 2018, leading the HR function at Trent Hypermarkets and moved to Tata Chemicals before joining the Tata Group. He worked with Novartis, Philips, and Saint Gobain Group.

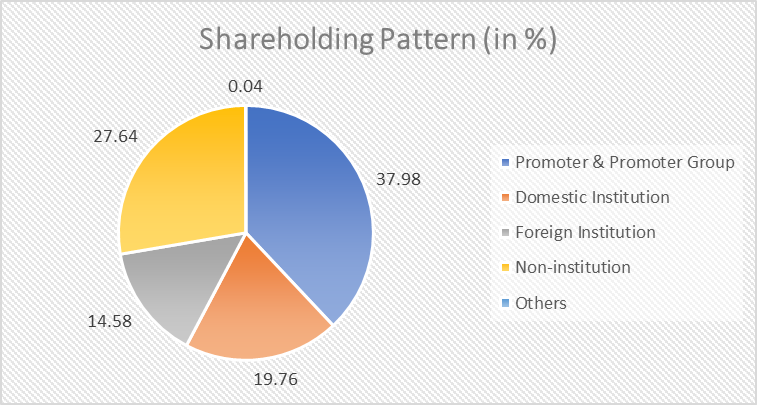

Tata Chemicals Shareholding Pattern

Tata Chemicals Financials

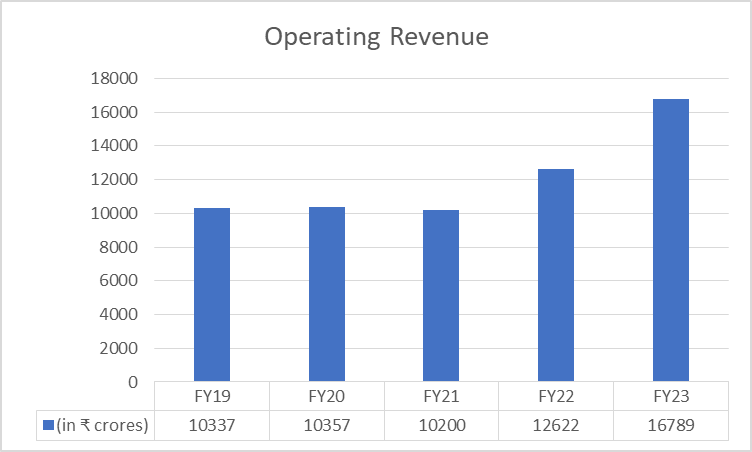

Revenue

In FY23, Tata Chemicals reported a 33% growth in revenue at ₹16,789 crores, compared to ₹12,622 crores.

Segment-wise Revenue

| FY21 (in ₹ crores) | FY22 (in ₹ crores) | FY23 (in ₹ crores) | |

| Basic Chemistry Product | 7609 | 9758 | 13597 |

| Speciality Products | 2580 | 2826 | 3198 |

Geographical Revenue Distribution

| FY21 (in ₹ crores) | FY22 (in ₹ crores) | FY23 (in ₹ crores) | |

| India | 4922.46 | 5927 | 7216 |

| Asia (other than India) | 321.89 | 402 | 902 |

| Europe | 1406.26 | 1898 | 2607 |

| Africa | 247.66 | 321 | 495 |

| America | 3287.65 | 4057 | 5534 |

| Others | 13.88 | 17 | 35 |

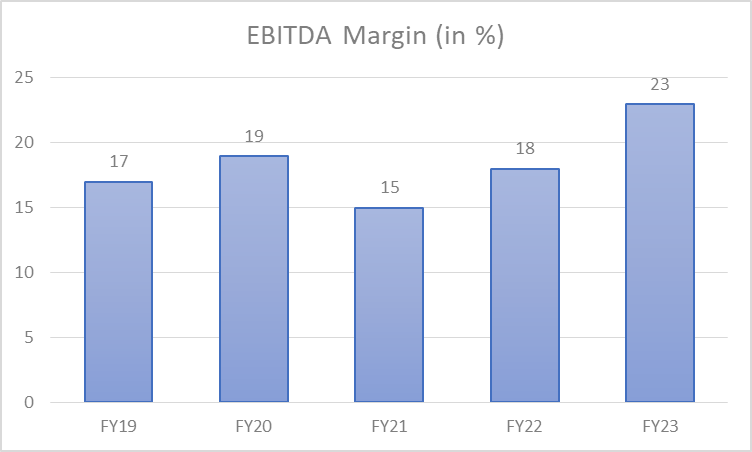

EBITDA

In FY23, Tata Chemicals reported 66% growth in EBITDA at ₹3,822 crores, compared to ₹2,305 crores in FY22.

Segment-wise Profit Before Interest Cost

| FY21 (in ₹ crores) | FY22 (in ₹ crores) | FY23 (in ₹ crores) | |

| Basic Chemistry Product | 728.50 | 1486 | 3028 |

| Speciality Products | 209.33 | 168 | 91 |

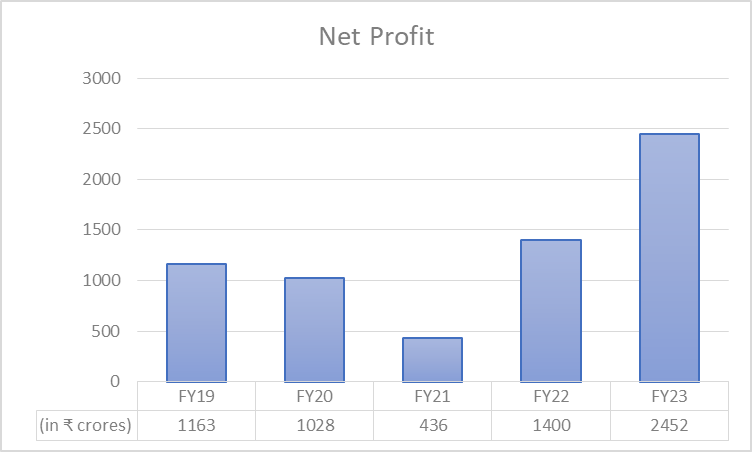

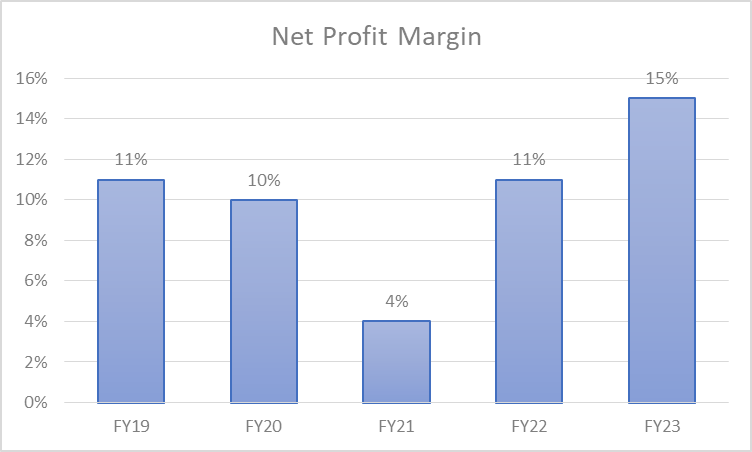

Net Profit

Tata Chemicals’ net profit in FY23 was ₹2,452 crores, up 75% from ₹1,400 crores in FY22.

Tata Chemicals Key Financial Metrics

Current Ratio: In FY23, Tata Chemicals’ current ratio decreased marginally to 2mes from 2.52 times.

Debt-to-equity Ratio: Tata Chemicals adjusted net debt to equity is 0.22 times in FY23, compared to 0.26 in FY22. The company has a gross debt of ₹6,296 crores in long and short-term borrowings. In FY23, the company repaid more debt than it had earlier guided and intends to repay USD 200-250 million in debt in FY24.

Return on Capital Employed (ROCE): During FY23, ROCE improved to 8.07% from 6.56% in FY22.

Tata Chemicals Share Price Analysis

Tata Chemicals launched its IPO on 21st September 1993 at an issue price of ₹18 per share and got a good response from investors. IPO was oversubscribed by five times. As of 24th June 2023, Tata Chemicals share price has grown at a CAGR of 23% in the last 10 years.

And the company has been consistently paying dividends to its shareholders. In the last three years, Tata Chemicals has paid ₹10 in 2021, ₹12.50 in 2022, and ₹17.50 in 2023 as dividends to shareholders.

Tata Chemicals share price has increased from around ₹160 level on 1st January 2013 to ₹980 as of 24th June 2023. It reached an all-time high level of ₹1,214 on 10th October 2022. As of 24th June 2023, the Tata Chemicals market cap is ₹24,968 crores.

Tata Chemicals Company Analysis

Basic Chemistry Business

The basic chemistry business at Tata Chemicals generates the majority of the company’s revenue. In FY23, the segment generated over 80% of the total revenue for the company. It consists of Soda Ash, Salt, and Sodium Bicarbonate.

Soda Ash

Tata Chemicals is the world’s third-largest producer of Soda Ash, with an installed annual capacity of 4.36 million MT. The overall long-term global demand for Soda Ash is expected to grow at a CAGR of ~3% and ~6% in India.

Soda Ash is a key raw material in glass and lithium carbonate manufacturing. While it has been traditionally used in various applications, the increasing global demand for solar glass and lithium carbonate, particularly for manufacturing electric vehicle (EV) batteries, is expected to drive the growth in Soda Ash demand.

The current global capacity for Soda Ash is 65 million MT, which will not be adequate to service the growing demand driven by new applications. As per estimates, an additional 16 million MT capacity is needed by 2030 to service the ever increasing demand for soda ash.

Tata Chemicals intends to double its soda ash capacity in a phased manner. During FY24, the company plans to add 1.85 lakh MT of capacity between FY24 and FY27, Tata Chemicals has planned ~30% incremental capacity addition.

Sodium Bicarbonate

Sodium Bicarbonate is mostly used in the food, feed, and pharmaceutical sectors, and its demand is expected to grow at a CAGR of ~3% globally and ~7% in India over the next five years. Its sustainable new applications include Industrial Flue Gas Treatment to reduce emissions and applications in poultry and cattle feed to increase productivity and reduce methane emissions in cattle.

Tata Chemicals’ carbon capture unit can produce 99.99% pure carbon dioxide enabling it to create high-grade carbon-neutral Sodium Bicarbonate. The company plans to increase its bicarbonate capacity by 2.5X in 5 to 7 years.

Salt

Tata Chemicals is the largest producer of vacuum-evaporated iodized salt in India. Apart from manufacturing edible-grade salt, Tata Chemicals also produces salt for industrial purposes used in manufacturing synthetic Soda Ash, Caustic Soda, and Chlorine Derivatives.

In between FY24 and FY27, Tata Chemicals plans to increase its capacity by five times.

Specialty Products

The specialty products business includes Specialty Silica, Prebiotics, and Agrochemicals & Seeds.

Specialty Silica

Tata Chemicals has extended its expertise in basic chemistry to manufacture specialty silica products used as an ingredient and intermediate in industrial, food, pharmaceuticals, and personal care applications.

HSD, or High-dispersible Silica, is used in automotive tyres for green labelling. Its use in tyres improves safety and performance, increasing fuel efficiency by 7%. Tata Chemicals is investing in sustainable green chemistry and focusing on becoming a world leader in producing HDS from renewable feedstock and rice husk.

Fermentation

Tata Chemicals is investing in tomorrow’s technologies aligned with sustainable green chemistry. Its fermentation platform has the potential to produce industrial materials and nutraceutical products. Its current product, fructooligosaccharide, is used in prebiotics and alternative sweeteners.

Agrochemicals & Seeds

Tata Chemical’s listed subsidiary Rallis India is engaged in producing agrochemicals, specialty crop nutrition, and seeds domestic and export markets.

Tata Chemicals Share Price Growth Potential

The strong demand for the Soda Ash segment in the domestic and international markets helped Tata Chemicals to report better earnings during FY23 across all segments.

EBITDA margin expanded by 500 bps to 23% during FY23, led by good growth in the basic chemicals segments. A tight soda ash supply scenario on the back of strong demand from emerging industries and geographies, China’s reopening is likely to support the continuance of upbeat financial performance in Tata Chemicals. The strong positive in the specialty products segments also drives the company’s operational performance.

Focus on R&D and Development of New Product Portfolio

In FY23, Tata Chemicals and Rallis India filed 14 new patent applications and have been granted 133 patents to date. In the last fiscal year, it also won the CII India’s Top 50 Innovative Company Award and Top Innovative Company (Large) in Manufacturing. Some of the next focus areas in innovations for Tata Chemicals are:

- Tata Chemicals is building next-generation silica for applications in paints, silicones, and application-specific silica products in the speciality materials segment.

- Focusing on developing sodium-based energy storage solutions for next-generation EV batteries.

- Developing high-energy solutions from energy-rich biomass/ agri-waste.

- In the FOS & Nutrition segment, the company is building an encapsulation technology platform to enhance thermo-stability and increase the shelf-life of minerals and bio-actives.

- Development of efficient solvent recovery and recycling of reagents across all projects and development of safer formulations developments.

Key Risks for Tata Chemicals Share Price

However, global demand for soda ash is likely to remain stable in the medium to long term, but a global recession could disrupt supply-demand dynamics. Furthermore, as China reopens and grows its economy, increased supply may have an impact on international prices for soda ash and Tata Chemicals’ profitability.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

How has Tata Chemicals share price performed in the last 5 and 10 years?

As of 24th June 2023, Tata Chemicals share price has given an impressive CAGR return of 25% and 23% in the last 10 years and 5 years, respectively.

When was Tata Chemicals established?

Tata Chemicals was founded in 1927 as Okhamandal Salt Works and later became a part of the Tata Group when JRD Tata purchased it in 1939.

What does Tata Chemicals manufacture?

Tata Chemicals produces Soda Ash and Sodium Bicarbonate, primarily used in making soaps, detergents, glass, solar glass, etc. Its other specialty products segment includes specialty silica, prebiotics, agri-inputs, and material sciences. Tata Chemicals is the brand owner of iconic Tata Salt.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.6 / 5. Vote count: 17

No votes so far! Be the first to rate this post.