Introduction

In a significant development, India’s banking system has encountered a liquidity deficit for the first time during the current financial year. The liquidity gauge now registers a deficit of Rs. 23,600 crores, marking a noteworthy shift in the country’s financial landscape. This turn of events can be attributed to the strategic actions of the Reserve Bank of India (RBI) and the consequential impact of tax outflows.

The Unfolding Scenario

Amidst the intricate fabric of India’s financial domain, the banking sector’s liquidity has assumed a pivotal role. At the outset of this month, the sector reveled in a surplus of Rs. 2.8 lakh crores. However, this surplus has gradually declined since, drawing attention to the fluid nature of financial liquidity.

A series of influential factors have played into this evolving narrative. The RBI’s decision to impose an Incremental Cash Reserve Ratio (CRR) of 10% on deposits made between May 19 and July 28 is a significant milestone in this journey. This move has directly led to a withdrawal of over Rs. 1.42 lakh crore from the system, contributing to the present liquidity deficit.

A Complex Web of Influences

The dwindling liquidity scenario finds its roots in a web of financial activities. One facet of this narrative is the impact of Goods and Services Tax (GST) outflows and various auctions. In light of a report by Kotak Mahindra Bank dated August 21, the week spanning from August 19 to 25 is expected to witness outflows worth Rs. 1.50 lakh crore due to GST payments. Additionally, auctions related to state loans, Treasury bills, and government securities are projected to bring outflows worth Rs. 63,430 crores.

Counterbalancing these outflows are inflows amounting to Rs. 1.23 lakh crore. These inflows are tied to coupon inflows, the redemption of Treasury Bills and state loans, and the government’s expenditure.

The Current Landscape

As of August 21, the banking system’s liquidity deficit is Rs. 23,600 crores ($2.84 billion). This statistic encapsulates the intricate interplay of various financial dynamics and regulatory measures that have shaped the present scenario.

Insights and Looking Ahead

Several key takeaways emerge from this unfolding narrative. The recent months have witnessed a surge in liquidity within the banking system, owing to the discontinuation of Rs. 2,000 notes, the transfer of RBI’s surplus to the government, increased government spending, and capital inflows. The RBI introduced the Incremental Cash Reserve Ratio as a regulatory measure to counterbalance this liquidity surge.

Looking forward, it’s crucial to consider the implications of foreign exchange interventions to manage the depreciation of the Indian Rupee. These interventions could add to the complexity of the liquidity equation. Notably, RBI Governor Shri Shaktikanta Das has provided assurance that the Incremental CRR requirement will be reviewed on September 8, 2023, or potentially even earlier, contingent upon the evolving situation.

In a landscape characterized by fluid financial dynamics, India’s banking system is navigating the complexities of liquidity with vigilance and strategic measures. The RBI’s oversight and regulatory actions are instrumental in shaping the trajectory of this narrative. As the financial realm continues to evolve, these decisive actions will play a pivotal role in determining the future course of India’s banking system liquidity.

FAQs

What exactly is liquidity deficit in the banking system?

Liquidity deficit in the banking system refers to a situation where the available funds or cash within the system falls short of the immediate financial demands. It indicates that the banks face a shortage of liquid assets to meet their obligations and fulfill customer demands.

How does the Incremental Cash Reserve Ratio (CRR) impact liquidity?

The Incremental Cash Reserve Ratio is a regulatory measure introduced by the Reserve Bank of India (RBI) to manage excess liquidity in the banking system. When RBI imposes an Incremental CRR, banks must hold a percentage of their deposits as cash reserves with the central bank. This action effectively reduces the funds available for lending and spending, thereby controlling liquidity.

What factors contribute to fluctuations in banking system liquidity?

Banking system liquidity is influenced by various factors, including government spending, capital inflows, currency interventions, tax outflows, and regulatory policies. These factors can lead to liquidity level shifts, affecting banks’ ability to meet their financial obligations and provide customer loans.

Outward Remittances under RBI’s LRS Witness 50% Surge, Reaching $9.1 Billion in Q1

Introduction

Financial transactions have gained extraordinary momentum in a world characterized by global connectivity and a progressively borderless landscape. The surge of India’s outward remittances under the liberalized remittance scheme (LRS) by 50% in the initial quarter of FY24 underscores the dynamics of this phenomenon. This rise can be attributed to several contributing factors, including adjustments in tax collection schedules and the resumption of regular international travel patterns.

The Momentum of Financial Movements

In an age of interconnectedness, financial movements have taken center stage. India’s outward remittances have observed a significant increase under the LRS scheme. This surge is a testament to the robust expansion experienced across various sectors due to alterations in tax collection practices and the gradual normalization of international travel.

The Liberalized Remittance Scheme (LRS) at a Glance

The LRS allows resident individuals to send up to $250,000 annually for approved transactions like education, medical treatment, employment, emigration, travel, and investment. This framework offers flexibility and opportunity for Indians looking to engage in global financial activities.

Unveiling the Surge: Q1 FY24 Statistics

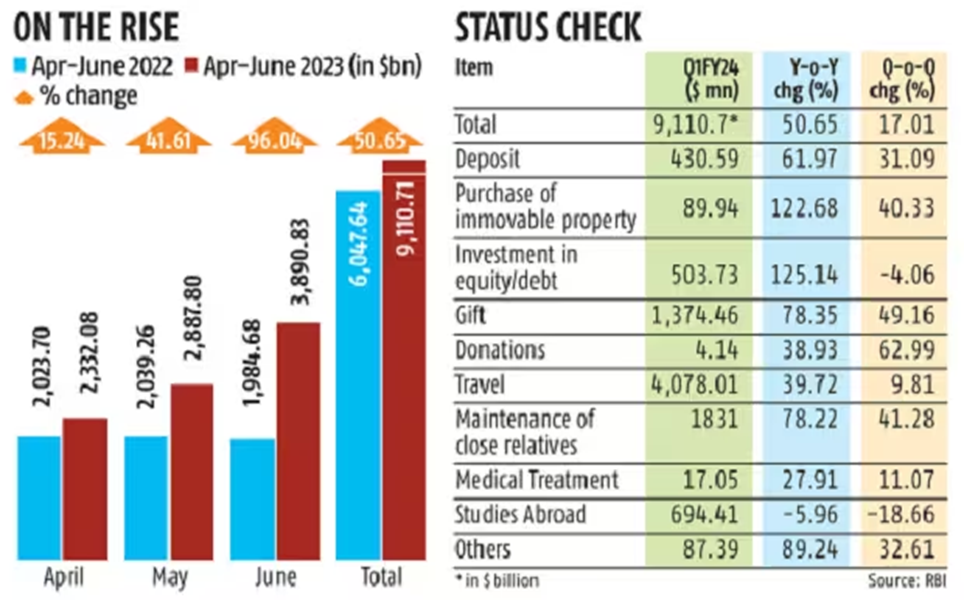

The first quarter of FY24 witnessed an impressive surge in outward remittances under the LRS scheme. The figures rose by a notable 50.64%, reaching a staggering $9.1 billion compared to the $6.05 billion recorded during the same period in the previous year.

When examining this increase on a year-on-year basis, substantial growth was observed in equity and debt investments, property acquisitions, and other avenues, all of which saw triple-digit expansion. These developments have greatly contributed to the surge in remittances.

Comprehensive Breakdown of Factors

The components contributing to this surge are diverse. Alongside the positive increases in equity, debt investments, and property acquisitions, other factors on the list include deposits, international travel, and medical expenses. However, it’s important to note that one negative aspect is associated with expenditures for education abroad.

Unpacking the Reasons

This remittance surge can be primarily attributed to the strategic timing of tax collection changes. The postponement of tax collected at source (TCS) on LRS regulations until October 1 has incentivized individuals to capitalize on the current regulations.

During the Union Budget FY23, the government proposed a substantial increase in TCS on foreign remittances from 5% to 20% for amounts exceeding Rs 7 lakh, excluding education and medical purposes. With the new regulation slated to effect on October 1, individuals are leveraging the existing rules to their advantage.

Prospective Impact

While the impending impact of the 20% TCS is expected to be significant, its exact consequences will only be fully understood once it is implemented. The economic landscape will likely experience shifts, and the response of individuals and sectors will provide insight into the overall implications.

The surge of outward remittances under RBI’s LRS in Q1 FY24, reaching $9.1 billion, reflects the changing dynamics of global financial movements. The combination of adjustments in tax regulations and the re-establishment of international travel patterns has contributed to this remarkable growth. As India continues to engage in a borderless world, the remittance landscape is poised for continued evolution.

FAQs

What is the liberalized remittance scheme (LRS)?

The LRS framework permits Indian residents to send up to $250,000 annually for specific transactions, including education, medical treatment, travel, and investments.

What factors contributed to the surge in outward remittances?

The remittance surge can be attributed to changes in tax collection schedules and the resumption of international travel.

What were the major areas of growth in remittances?

Equity and debt investments, property acquisitions, and other avenues experienced substantial growth, driving outward remittances.

How did the government’s proposal regarding TCS impact remittances?

The government’s proposal to increase TCS on foreign remittances to 20% incentivized individuals to use the existing regulations before the new rule takes effect.

What can we expect in terms of the impact of the increased TCS?

The full impact of the 20% TCS will become clearer after its implementation, as it will likely lead to economic shifts and changes in individual behaviors.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.