Introduction

Recently, the Indian government has taken a significant step by imposing a substantial 40% export duty on onions. This strategic move has been made with a distinct purpose, and its implications generate substantial interest. The export duty enactment is set to remain in effect until December, and the motivations behind this decision are rooted in economic stability and food security.

The core objective behind this measure is to counteract the recent notable surge in onion prices that has captured the nation’s attention. This proactive approach underscores the government’s commitment to managing economic dynamics efficiently. Notably, this marks the inaugural instance of implementing an export duty on onions.

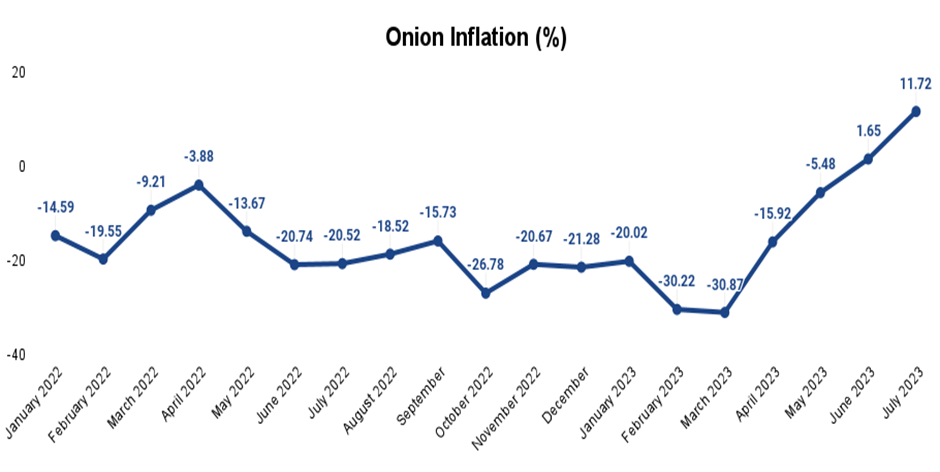

After consistently recording negative values since September 2021, the price inflation for onions experienced an unprecedented spike, reaching an astonishing 11.72% in July this year. This rapid escalation from June’s 1.65% and the steep fall of -20.5% observed in July 2022 raises eyebrows across the economic landscape.

A combination of factors has contributed to this price surge, including the disruptive impact of unseasonal rainfall in Maharashtra and Karnataka during April. These unexpected showers elevated moisture levels within stored Rabi crop onions, causing their shelf life to dwindle. As a result, concerns about potential supply constraints have gained momentum, triggering alarms about potential shortages as early as September.

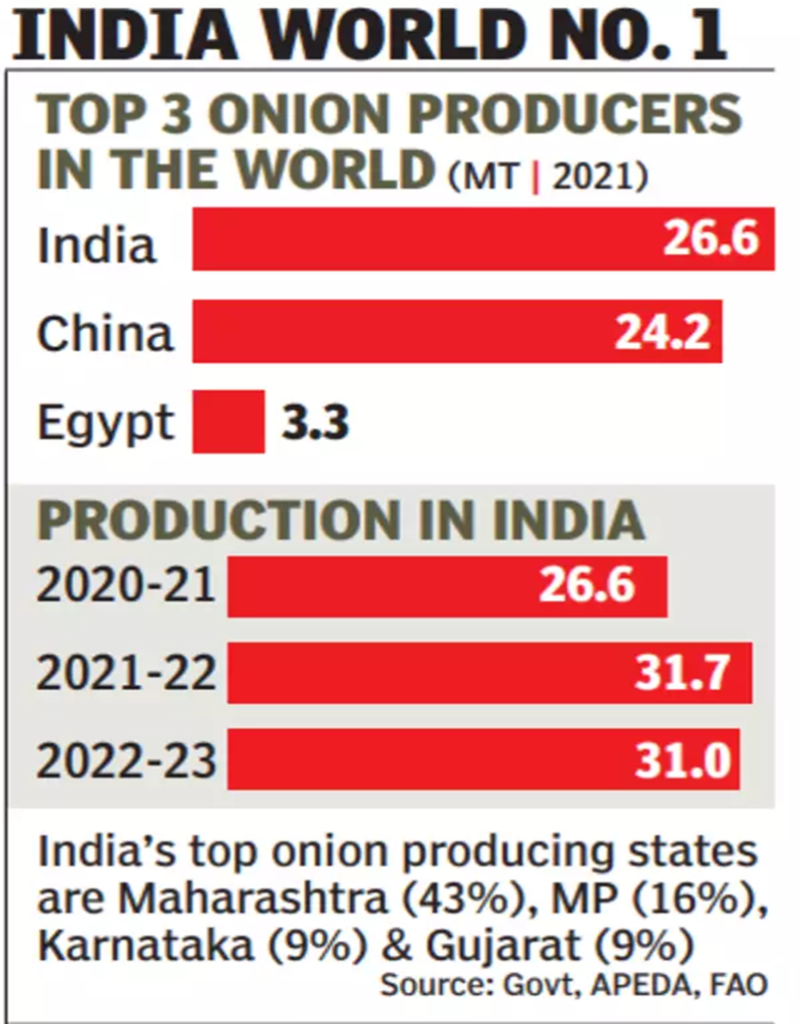

Interestingly, India, a global leader in onion production, contributed a staggering 31 million tonnes during the 2022-2023 timeframe. However, forecasts regarding onion prices shortly are far from reassuring.

An authoritative report from Crisil, a reputable rating agency, forecasts retail onion prices to hover between ₹60-70 per kilo in the coming month. Adding to the urgency, noted agricultural economist Ashok Gulati has publicly proposed that onion prices could surge to a remarkable ₹100 per kilo by September’s end.

Key Takeaways

Taking a broader view, it’s crucial to note that this move by the Indian government isn’t an isolated occurrence on the global stage. Other nations have taken comparable steps to safeguard their domestic interests during food-related instability. An illustrative example lies in the aftermath of the intensified Russia-Ukraine conflict, wherein multiple countries prioritized their populations and imposed limitations on crucial commodity exports.

In the words of Union Consumer Affairs Secretary Rohit Kumar Singh, the imposition of export duty on onions is a well-calibrated maneuver designed to enhance domestic availability and regulate prices. This assertion underscores the government’s commitment to maintaining market equilibrium and ensuring consumer satisfaction.

In conclusion, India’s imposition of a significant export duty on onions explicitly responds to the recent surge in onion prices. By striving to restore stability to the market, this strategic maneuver aims to establish a robust foundation for the impending festive season.

FAQs

How does the government justify the imposition of export duty on onions?

According to Union Consumer Affairs Secretary Rohit Kumar Singh, the export duty imposition is a strategic decision to boost domestic onion availability and regulate prices. The government aims to strike a balance between market dynamics and consumer interests.

How does this move compare to global trends?

This move by the Indian government isn’t unique on the global stage. Other countries have also taken protective measures, restricting the export of critical commodities to prioritize their citizens’ needs during instability, such as geopolitical conflicts.

What are the projected onion prices in the near future?

According to a report by Crisil, a respected rating agency, retail onion prices are anticipated to range between ₹60-70 per kilo in the coming month. Experts even suggest that prices might surge to ₹100 per kilo by the end of September.

Indian Offshore Funds Gain Traction: A Boost to India’s Equity Market

Introduction

In recent times, the Indian equity market has been making waves, with market indices like Nifty and Sensex soaring to new heights. This upward momentum can be attributed mainly to the influx of foreign investment into Indian equities. The surge in interest from foreign investors has not only elevated the market indices but has also led to substantial growth in India-focused offshore funds. This article delves into the remarkable growth of Indian offshore funds, analyzing their impact on the market and exploring the factors driving this surge.

Understanding Indian Offshore Funds

Indian offshore funds are investment vehicles not based in India but primarily in the Indian equity markets. These funds allow investors to participate in the growth potential of the Indian economy without being subject to the same regulatory framework as domestic investors.

Record-Breaking Inflows in Q2 2023

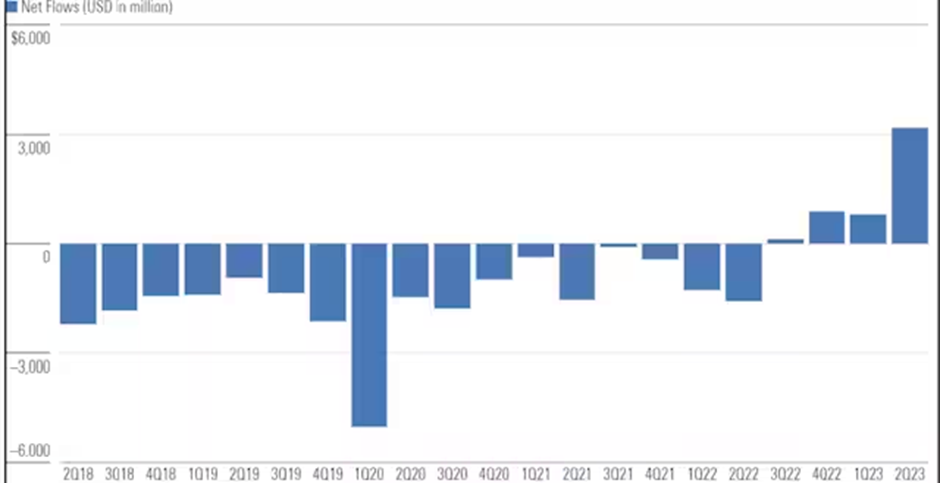

In the second quarter of 2023, India-focused offshore funds experienced an unprecedented surge in net inflows, reaching a staggering $2.42 billion. This marked the highest net inflow since March 2015, indicating a significant shift in investor sentiment towards the Indian market.

When considering Exchange-Traded Funds (ETFs) along with these offshore funds, the total net inflow surged to an impressive $3.2 billion. This figure starkly contrasts the $803 million recorded in the preceding March quarter. The remarkable increase in net inflows demonstrates a noteworthy change in investors’ perception of the Indian equity market.

Reversal of Fortune

The surge in net inflows seen in Q2 2023 is particularly noteworthy due to its contrast with the trend observed in previous quarters. Before the September 2022 quarter, India-focused offshore funds had encountered 17 consecutive quarters of net outflows.

This prolonged period of outflows indicated a lack of investor confidence in the Indian market. However, the sudden influx of funds in Q2 2023 suggests a notable reversal of this trend. It signifies a renewed confidence in the Indian economy and its growth prospects.

Driving Factors

Several factors have contributed to the resurgence of interest in India-focused offshore funds:

1. Economic Resilience

India’s ability to weather global economic uncertainties and maintain a steady growth trajectory has caught the attention of international investors. The nation’s resilience in the face of challenges has boosted investor confidence.

2. Policy Reforms

Reforms initiated by the Indian government to liberalize the economy, ease regulatory norms, and attract foreign investment have played a pivotal role in enticing offshore investors. These reforms create a more favorable environment for doing business in India.

3. Growth Potential

India’s status as one of the world’s fastest-growing major economies presents lucrative investment opportunities. Investors are drawn to the potential for high returns fueled by the country’s burgeoning consumer base and expanding industries.

The significant increase in net inflows to India-focused offshore funds in Q2 2023 showcases a noteworthy shift in investor sentiment towards the Indian equity market. This surge not only indicates renewed investor confidence but also highlights the potential of India’s growth story.

As the nation continues to implement pro-business reforms and exhibit economic resilience, it remains poised to attract further foreign investment and drive the growth of its equity market.

Key Takeaways

In a noteworthy development, foreign investors actively engage with the Indian equity markets through significant investment avenues, primarily India-focused offshore funds and ETFs. These channels have become prominent for channeling foreign capital into the Indian financial landscape.

The recent surge in net inflows and the growing momentum of the Indian markets have led to a remarkable increase in the asset base of these investment vehicles. Impressively, the combined assets of India-focused offshore funds and ETFs have surged by nearly 20%, soaring from $42.4 billion in March to a substantial $50.6 billion.

This impressive growth is particularly notable amidst a global economic slowdown and uncertain environment. Compared to other economies, the Indian economy has showcased remarkable resilience, further adding to its appeal for foreign investors seeking favorable investment prospects.

FAQs

What are India-focused offshore funds?

India-focused offshore funds are investment vehicles that primarily invest in the Indian equity markets but are not based within India.

Why did India-focused offshore funds experience net outflows previously?

Before Q2 2023, these funds faced 17 consecutive quarters of net outflows due to investor skepticism and market uncertainties.

What factors have contributed to the surge in net inflows?

Factors such as India’s economic resilience, policy reforms, and the nation’s growth potential have enticed foreign investors, leading to a surge in net inflows.

How do India-focused offshore funds benefit investors?

These funds allow international investors to participate in India’s economic growth and potential for high returns.

Read more: How Long-term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.