Introduction

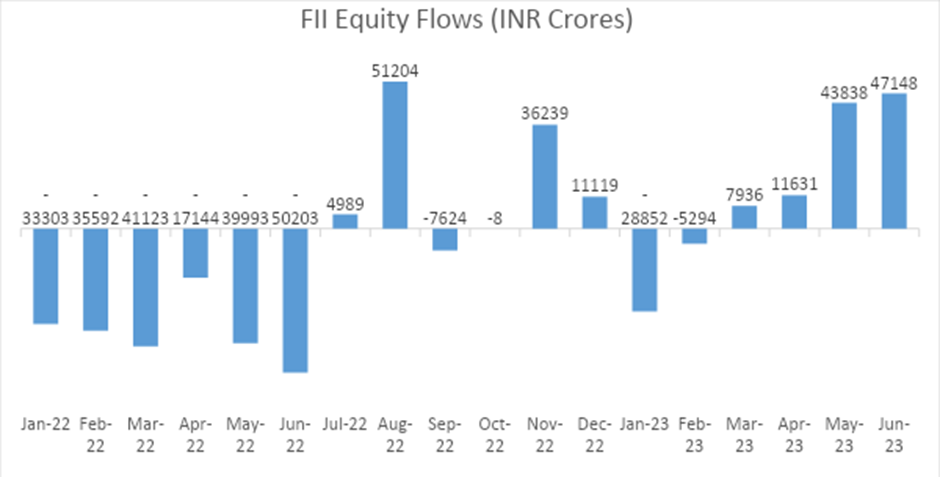

June has proven to be a momentous month for the Indian market, as foreign portfolio investors (FPIs) recorded their highest inflows in the past 10 months. FPIs have poured an astounding Rs 47,148 crore into Indian equities during June, significantly boosting our economy.

It marks the fourth consecutive month where FPIs have acted as net buyers in domestic stocks after witnessing outflows earlier this year. The continuous inflow of FPI investments has driven our markets to reach record highs.

In May, FPIs made investments totaling Rs 43,838 crore; in April, the figure stood at Rs 11,631 crore; in March, it reached Rs 7,936 crore. These substantial investment amounts flowing into our economy reflect a positive trend for our markets.

Key Takeaway

Macro Indicators and Market Performance: The sustained inflow of foreign portfolio investments is not surprising, considering the steady improvement in India’s macroeconomic indicators. The positive trajectory of our GDP growth and corporate earnings has the potential to enhance the market performance further. These factors have contributed to the increasing buying interest from FPIs, ultimately leading to the market hitting new record highs.

The Economic Outlook: India’s macroeconomic indicators have consistently improved, providing a favorable climate for foreign investments. This influx of FPIs is pivotal in strengthening our economy and instilling confidence in domestic and international investors. As we continue to witness a positive trend in FPI buying, it highlights the potential for sustained growth in our markets.

Conclusion

This influx of foreign investments reflects the confidence of international investors in India’s improving macroeconomic indicators and market potential. As the trend of FPI buying continues, we can anticipate further growth in our markets, leading to new milestones.

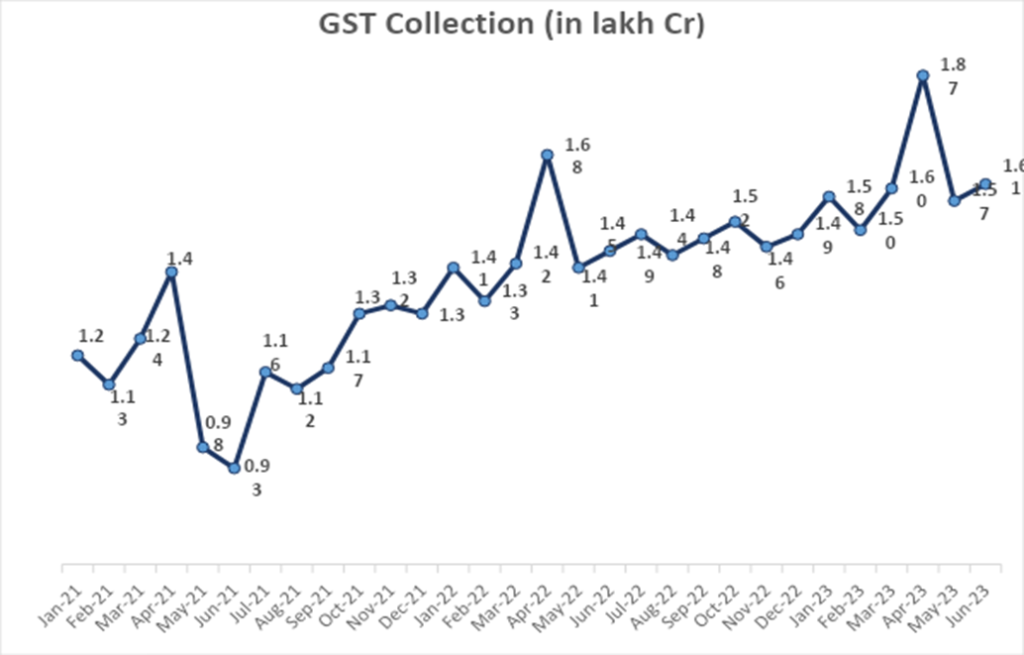

India’s GST Collections Witness Robust Growth, Cross Rs 1.60 Lakh Crore Mark

India’s Goods and Services Tax (GST) collections have soared, registering a remarkable 12 percent increase compared to the previous year. The collections for the current period have reached an impressive Rs 1.61 lakh crore, marking the fourth instance since 2017 that the overall GST collection has exceeded the Rs 1.60 lakh crore threshold.

Key Takeaway

Surging GST Collections: The surge in GST collections demonstrates a significant upturn in economic activity and a rise in consumption levels across the country. This remarkable growth is a testament to the resilience of the Indian economy, as it continues to thrive amidst global challenges and uncertainties.

Improving Economic Activity: The substantial increase in GST collections reflects the improving economic landscape of India. It indicates a boost in business transactions, increased consumer spending, and a revitalized market. This upward trend in GST collections paints a good picture of the nation’s overall economic health.

Rising Consumption Levels: The surge in GST collections is closely linked to the rising consumption levels in India. As more people engage in economic activities and spend on goods and services, the revenue generated through GST also witnesses a notable rise. This upward trajectory of collections further signifies consumers’ growing confidence and purchasing power.

Resilience in the Face of Challenges: Despite the prevailing challenges and uncertainties in the global scenario, the Indian economy has shown remarkable resilience. The consistent growth in GST collections is a testament to the stability and strength of the country’s economic foundation. It showcases the ability of the Indian market to adapt, evolve, and bounce back from adversities.

Conclusion

The impressive surge in GST collections indicates a thriving economy with improving economic activity and rising consumption levels. This achievement highlights the resilience and potential of the Indian market to overcome challenges and emerge stronger. The robust growth in GST collections is an encouraging sign for the future, as it signifies a positive trajectory for the Indian economy.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.