Introduction

MRF recently reached a significant milestone in the Indian stock market. The share price surpassed the distinctive ₹1 lakh mark, making it the first Indian company to achieve this considerable feat.

MRF share price has increased by a CAGR of 22% in the last ten years, from ₹12,933 on 21st June 2013 to ₹1,00,081 on 15th June 2023.

Let’s check out what contributed to the phenomenal rise of the company and its future growth potential.

MRF Company Journey

- 1946: The journey to becoming India’s most preferred tyre company is unusual. Madras Rubber Factory, or MRF, started as a toy balloon manufacturing unit in 1946 by K.M. Mammen Mappillai in Madras and was primarily involved in manufacturing latex cast toys, gloves, and contraceptives.

- 1952: However, in 1952, they ventured into manufacturing tread rubber and soon became the leader in the space with a market share of 50%.

- 1961: With successful technical collaboration with the Mansfield Tire & Rubber Company in the US, it launched its first tyre in 1961.

- 2000: It became a big player in India’s four- and two-wheeler tyre manufacturing and started exporting tyres.

- 2011: The company also participated in rallies and motorsports to showcase its tyres’ sturdiness and stability. By 2011, it had a sales turnover of $2 billion.

- 2013: The company’s Aero Muscle tyres became the only tyre manufactured by an Indian company to be selected by the Indian Air Force for their Sukhoi 30 MKI jets.

MRF Company Analysis

The company has ventured into various business activities, including manufacturing toys, tyres, sports goods, wall paints and coats, and other tyre-related services. Because it primarily manufactures tyres, tubes, flaps, and tread rubber, it does not divide its income into various segments and has only one operating segment.

However, it has classified its business into three categories based on products:

- Automobile Tyres

- Automobile Tubes

- Others

MRF Management Profile

- The Mammen family members run the company, and Mr. K.M Mammen serves as Chairman and Managing Director. He is the third generation of the Mammen family to take over the reins of the business.

- Mr. Arun Mammen is the Vice Chairman and Managing Director.

- Mr. Rahul Mammen Mappillai is the Managing Director, and Mr. Varun Mammen is Whole Time Director.

- Mr. Madhu P Nainan is the Vice President of Finance

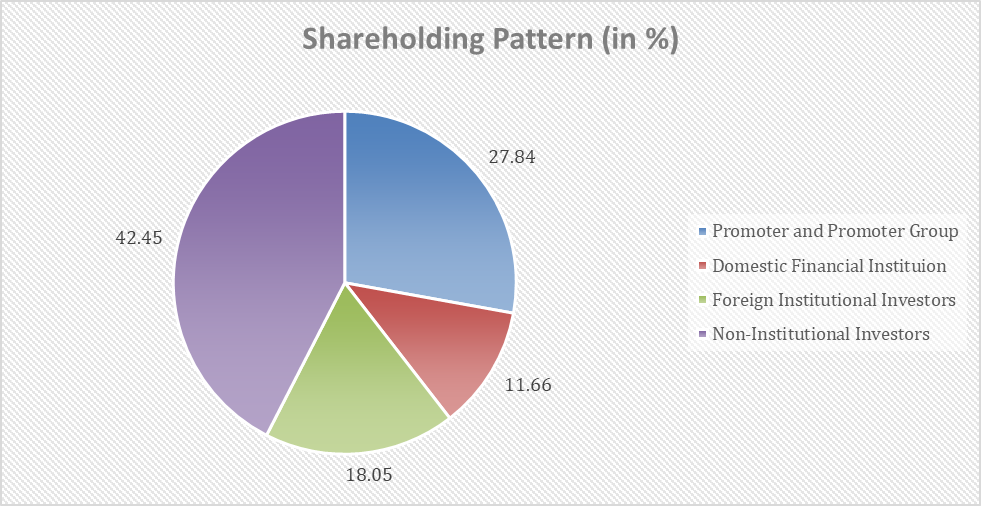

MRF Shareholding Pattern

MRF Financials

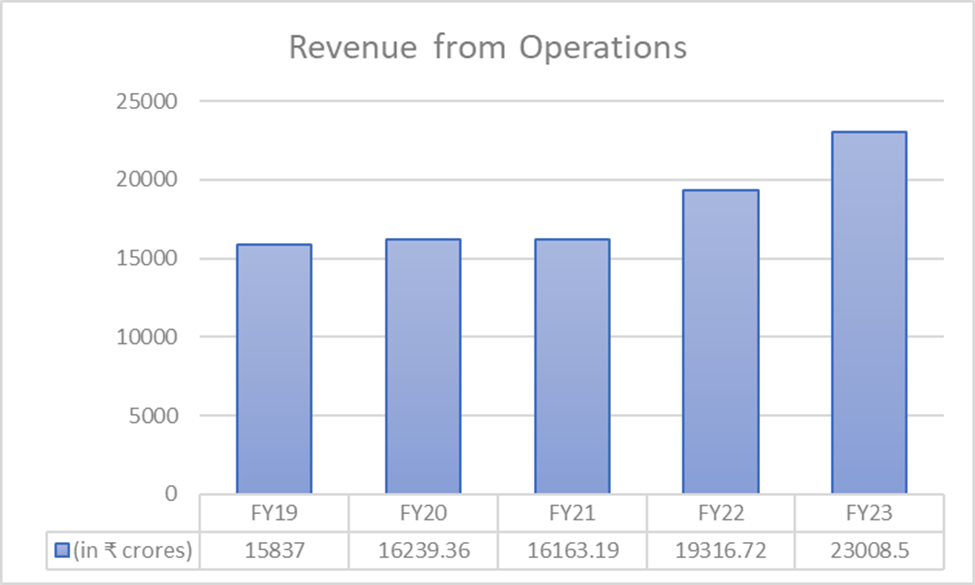

Revenue

In FY23, MRF reported a 19.1% growth in revenue from operations at ₹23,008.5 crores from ₹19,316.72 crores in FY22.

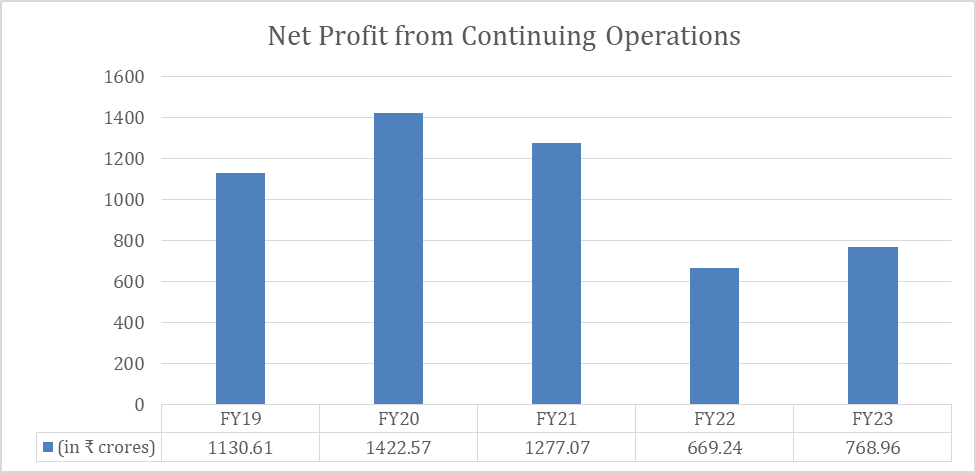

Net Profits

In FY23, MRF posted a 26% growth in net profits from continuing operations at ₹816.23 crores compared to ₹647.34 crores in FY22.

Key Financial Ratios

- Operating Margin: MRF’s operating margin for FY23 stands at 4.82%, compared to 4.27% in FY22.

- Net Profit Margin: In FY23, MRF’s net profit margin was at 3.58%, compared to 3.35% in FY22.

- Current Ratio: MRF’s current ratio for FY23 stands at 1.22 times, down from 1.45 times in FY22.

- Debt-to-equity Ratio: MRF has negligible debt on its book at 0.07 times in FY23, compared to 0.08 times in FY22.

MRF Share Price History

The company became public limited in April 1993, and each share traded for around ₹11 then. today, in less than 25 years, MRF share price hit the ₹50,000 mark on 26th April 2016. And it took another seven years to double its share price.

Over 10 years, MRF share price has given a CAGR return of 23%, rising from ₹12,700 on 1st January 2013 to ₹1,00,020 on 12th June 2023. The company has a consistent track record of paying dividends, and in the last three years, it has paid ₹1,000 in 2020, ₹1,470 in 2021, and ₹1,500 in 2022. As of 12th June 2020, it had a market cap of around ₹42,437 crores.

Factors Contributing to Becoming India’s First ₹1 lakh Stock

It was not by chance or coincidence that the company became India’s first ₹1 lakh stock. There are numerous factors at work.

A Big No to Stock Split

The management took a strategic decision not to split the share. Unlike many businesses that opt for stock splits as their share prices skyrocket, MRF took a different path to maintain accessibility for retail investors and uphold liquidity in the stock. This move allowed the company to keep speculators and traders away from the stock and attract only long-term investors.

Low Outstanding Shares

There are only 42.4 lakh shares in circulation, which is too less compared to other companies with similar market caps. Indian Railway Finance Corporation (IRFC) has a comparable market cap of ₹43,322 crores as of June 19, 2023, but its shares are trading at ₹33.10 per share as it has issued a total of 1306.8 crore shares.

HDFC Bank, the most valuable bank in the Indian stock market, has a market cap of ₹8.99 lakh crores and has 558.9 crore shares in circulation. If we adjust the share price of HDFC Bank with 42.4 lakh shares, the price of each share would be around ₹21 lahks.

So, MRF may be the priciest share in the Indian stock market but not the most valuable share.

MRF Share Price Target Growth Potential

So, will MRF maintain its momentum and add the next lakh to its share price?

It’s difficult to predict. The positive thing about MRF is that it has maintained its leadership position in the domestic tyre industry despite new players in the market. Its revenue market share stood at 25% in FY22, indicating the same. A strong brand image combined with a diversified product portfolio and wide distribution network favors MRF.

Company Key Risks

Factors like raw material price volatility, the cyclicality of the automotive industry, strong ESG concerns, and competition from global and domestic players are the company’s key risks. One of the biggest concerns is low operating and net profit margins in the lower single digit.

However, the next price increase in share price could depend on how margins expand due to the recent CAPEX for capacity addition.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considerea d as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Will MRF split its share?

The management is strongly against the split of shares. It has strategically decided to keep the share price high to keep speculators and traders away and reduce price volatility.

How has MRF share price performed in the last 10 years?

As of 19th June 2023, MRF share price in the last 10 years has given a CAGR return of 23%.

When was MRF established?

Madras Rubber Factory was established in 1946 in Madras as a toy balloon manufacturing unit by K.M. Mammen Mappillai. It was primarily involved in manufacturing latex-cast toys, gloves, and contraceptives.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 18

No votes so far! Be the first to rate this post.