Introduction

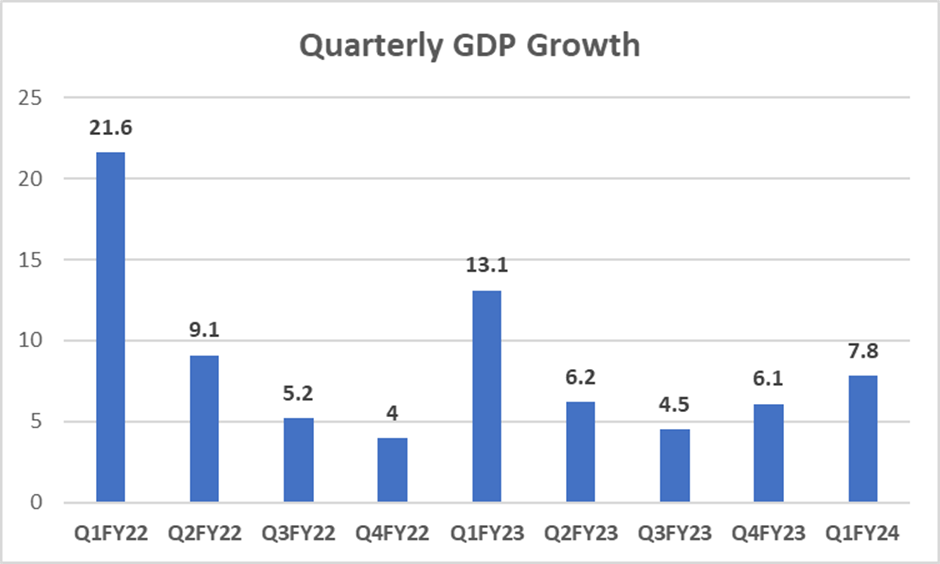

In a bustling world of economic updates, quarterly GDP numbers are the most anticipated event for analysts and investors alike. The first quarter of FY24 has just unfolded, and Indian GDP has painted an intriguing picture. A leap from 6.1% in the previous quarter to 7.8% is a testament to India’s resilience in global economic uncertainty.

The Surge in India’s Economic Growth

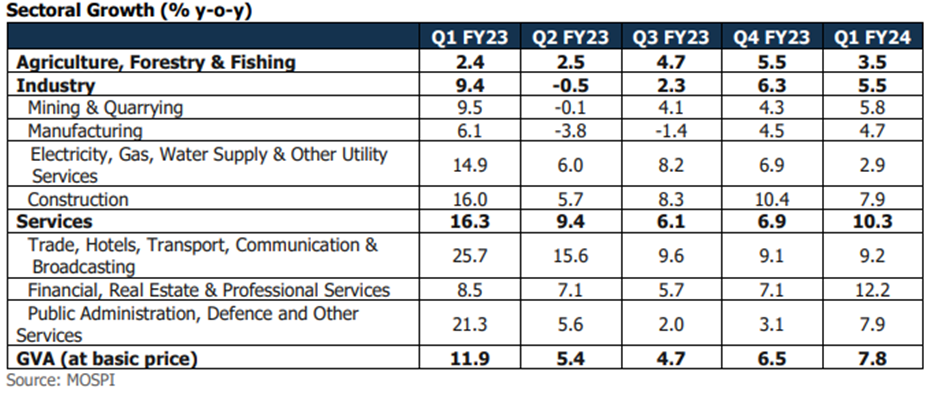

The most striking aspect of this quarter’s performance lies in the services sector, which experienced a remarkable surge in growth. It soared from 6.9% to 10.3%, reflecting a robust expansion across various sub-sectors. The services sector’s impressive growth is a driving force behind India’s overall economic progress.

Conversely, the manufacturing and mining sectors reported more modest growth figures, while the broader industrial sector managed a 5.5% growth rate, a slight dip from the preceding quarter’s 6.3%. This indicates a mixed bag of performance within the industrial landscape.

Agriculture’s Slower Pace

On a different note, the agriculture sector had a less enthusiastic run in Q1 FY24, expanding at a slower pace of 3.5%. This subdued performance can be attributed to a weak monsoon and various weather-related disruptions that affected crop yields during the quarter.

Key Takeaways

In the broader context, India’s economic performance remains robust, even amidst a volatile global economic backdrop. This resilience can be attributed to a combination of factors, including urban discretionary spending and government investments, which have acted as protective buffers, insulating the economy from the negative impacts of declining international demand.

However, it’s essential to note that the Reserve Bank of India (RBI) had initially projected an 8% GDP growth rate for this quarter. This projection has been revised downwards due to a resurgence in inflation and the delayed effects of interest rate hikes. The central bank’s cautious outlook underscores the importance of closely monitoring economic indicators and reacting swiftly to emerging challenges.

India’s Continuing Growth Story

Despite the slight revision in Gross Domestic Product growth projections, India retains its coveted status as the world’s fastest-growing major economy. The first quarter of FY24 reflects the nation’s adaptability and resilience, which continue to propel it forward on the global economic stage.

FAQs

1. What are GDP numbers, and why are they essential?

Gross Domestic Product numbers measure a country’s economic performance. They are crucial because they provide insights into the nation’s financial health and growth prospects, influencing investment decisions and government policies.

2. Why did India’s GDP grow faster in the first quarter of FY24?

India’s GDP growth in the first quarter of FY24 accelerated due to robust service sector performance and increased investments, providing a much-needed boost to economic expansion.

3. What challenges did the agriculture sector face in Q1 FY24?

The agriculture sector faced challenges such as a weak monsoon and weather-related disruptions, which led to slower growth in the first quarter of FY24.

4. Why did the RBI revise its GDP growth projection?

The Reserve Bank of India (RBI) adjusted its GDP growth projection due to rising inflation and the delayed impacts of interest rate increases, highlighting the need for cautious economic management.

5. Is India’s economic growth sustainable in the long term?

India’s ability to adapt and its resilience in the face of global economic uncertainties suggest that its growth story remains promising in the long term, albeit with occasional fluctuations.

UPI Transactions for August Surpass 10 Billion, Signaling India’s Digital Payment Revolution

In recent years, India has witnessed a remarkable transformation in financial transactions. The advent of the Unified Payment Interface in 2016 marked the beginning of a digital payment revolution that has not only changed the country’s financial landscape but has also gained international recognition.

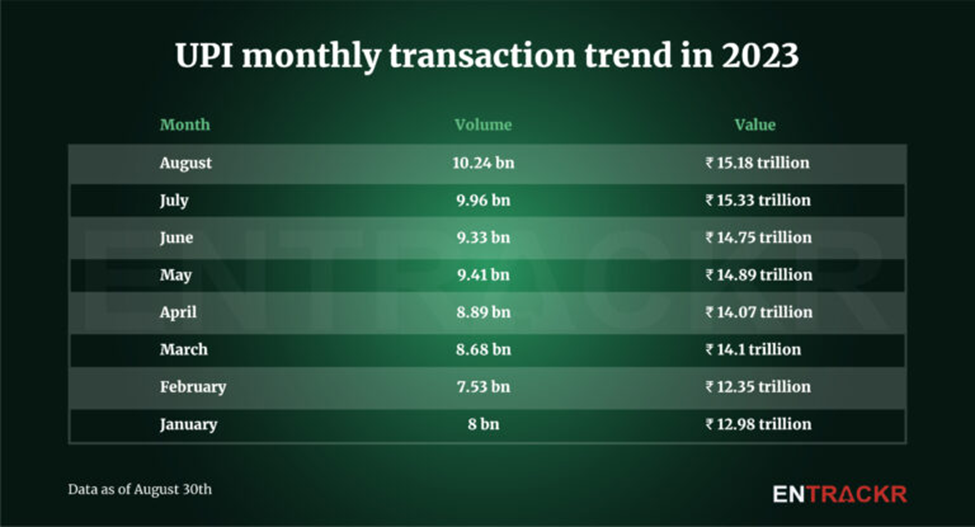

In a surprising turn of events, UPI transactions for August have crossed the 10 billion mark for the first time, underscoring this innovative payment system’s immense growth and adoption.

The Evolution of UPI

When the Unified Payment Interface was first introduced, it primarily served as a platform for peer-to-peer money transfers. However, the landscape of digital payments in India saw a significant shift, driven by factors like demonetization and the COVID-19 pandemic. This shift accelerated the digitization of payments, leading UPI to achieve several significant milestones.

Unified Payment Interface boasts over 330 million unique users and is supported by approximately 70 million merchants who have deployed more than 256 million QR codes nationwide. This widespread acceptance and usage highlight the convenience and accessibility of UPI for both individuals and businesses.

The Milestone Achievement

The National Payments Corporation of India (NPCI) recently released data that showcased a monumental achievement for UPI. UPI recorded a staggering 10 billion transactions in August, amounting to Rs 15.18 lakh crore. This achievement is particularly noteworthy as UPI had come incredibly close to the 10 billion mark just the previous month, in July, with 9.96 billion transactions.

Leading the Way: UPI Applications

Examining the applications facilitating UPI payments, Phonepe, with a 47% market share, emerges as the leader. Google Pay and Paytm follow closely, with 35% and 13% market shares, respectively. This competitive landscape demonstrates the diversity of options available to users, contributing to the widespread adoption of UPI.

The Remarkable Journey

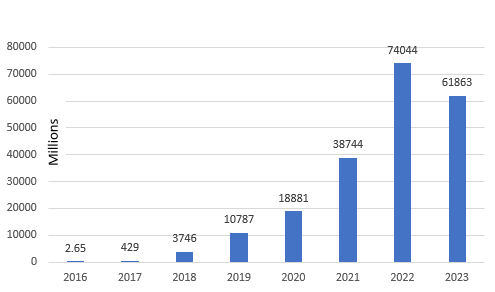

The journey of UPI from its modest beginnings in 2016 to its current status as a digital payment giant is nothing short of remarkable. In its inaugural year, UPI recorded a mere 2.65 million transactions. Fast forward to 2023, and it has processed over 61,000 million transactions in just the first 7 months of the year. This exponential growth showcases users’ and businesses’ trust and confidence in UPI as a secure and efficient payment method.

UPI JOURNEY

A Global Vision

Beyond its domestic success, the Indian government has been actively working to expand the reach of UPI to other countries. The goal is to enable seamless cross-border transactions, reducing the cost of fund transfers and remittance payments. This international outreach is a testament to India’s commitment to advancing digital payment solutions globally.

Key Takeaways

The Future of Digital Payments

As UPI transactions continue to surge, it is evident that India is well on its way to becoming a cashless and digitally-driven economy. The convenience, security, and accessibility offered by UPI have played a pivotal role in shaping this transition. With ongoing innovations and a growing user base, UPI is poised to further revolutionize financial transactions in India and beyond.

In conclusion, the remarkable milestone of UPI transactions crossing the 10 billion mark in August reaffirms its status as a game-changer in digital payments. This achievement reflects the rapid growth of UPI and the evolving preferences of consumers and businesses in India. As we move forward, UPI is set to play a central role in India’s journey towards a more cashless and digitally empowered future.

FAQs

1. What is UPI, and how does it work?

Unified Payment Interface (UPI) is a digital payment system that allows users to send and receive money using their smartphones. It links a bank account to a mobile app, enabling seamless transactions.

2. What contributed to the rapid growth of UPI in India?

Factors like demonetization and the COVID-19 pandemic accelerated the adoption of digital payments, including UPI, by emphasizing the importance of contactless transactions.

3. Which UPI application is the most popular in India?

Phonepe leads the market with a 47% share, followed by Google Pay and Paytm.

4. How does UPI benefit businesses and merchants?

UPI offers businesses a convenient and secure way to receive customer payments, reducing the reliance on cash transactions and enhancing financial inclusion.

5. What are the future prospects for UPI?

UPI is expected to continue growing in popularity, both in India and internationally, as governments and businesses recognize the benefits of digital payment systems.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.