Introduction

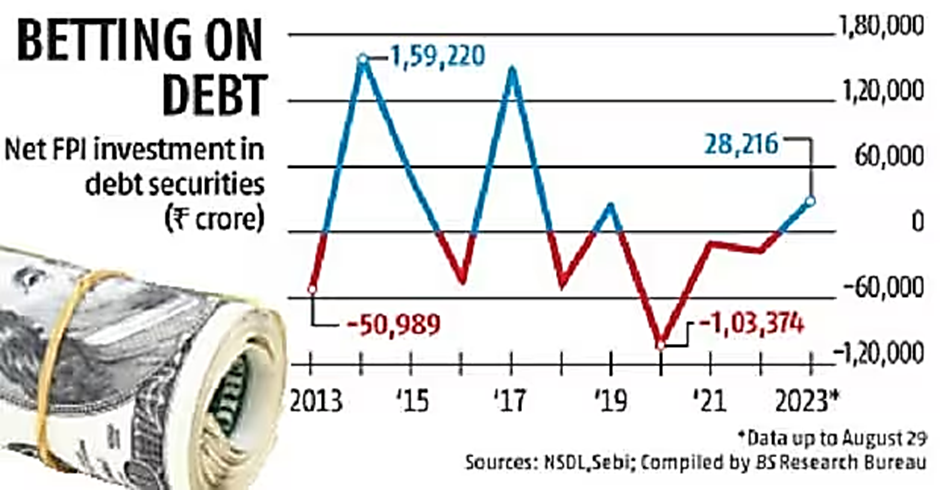

In the world of finance, numbers often tell a compelling story. The recent surge in Foreign Portfolio Investment (FPI) inflows into the Indian debt market, reaching a six-year high of Rs 28,216 crore, is not just about numbers but a significant milestone and a shift in investor sentiment.

This blog post will delve into the details of this remarkable development and its implications for India’s financial landscape.

Understanding the Surge in FPI Inflows

The Long-Awaited Surge

The last time FPIs were net purchasers in the Indian debt market in 2019, when they invested over Rs 24,000 crore worth of bonds. The recent surge, exceeding this figure, signifies a return of investor confidence in India’s debt market.

A June to Remember

June witnessed a massive surge in FPI inflows, with a staggering Rs 10,235 crore pumped into the market. This sudden influx of funds is a testament to the attractiveness of India’s debt market.

A Glimpse into the Future

India’s Global Bond Index Inclusion

JP Morgan said India’s sovereign bonds will be included in two of three global indexes by mid-2024. This development is expected to trigger inflows worth approximately $40 billion. It clearly indicates the growing recognition of India’s financial strength on the global stage.

Diversification Amid Uncertainty

In a world fraught with economic uncertainty, investors are increasingly seeking diversification. India’s stable macroeconomic fundamentals make it an attractive destination for FPIs looking to diversify their portfolios. The optimism surrounding India’s inclusion in global bond indexes has further fueled this trend.

Key Takeaways

A Sweet Spot for Investment

As FPIs look to expand their exposure in Asia and other emerging markets, India finds itself in a favorable position. The nation’s robust macroeconomic fundamentals and growth prospects make it a preferred choice for foreign investors.

Optimism Despite Challenges

FPIs remain optimistic about India’s growth prospects despite the currency risk and current rupee depreciation. This optimism is rooted in India’s resilience and potential to weather economic challenges.

The surge in FPI inflows into the Indian debt market is not just a financial statistic; it reflects India’s growing prominence in the global financial landscape. With the inclusion of global bond indexes on the horizon and strong fundamentals to back it up, India is set to attract even more foreign investment in the coming years.

FAQs

What is FPI?

Foreign Portfolio Investment (FPI) refers to investments made by foreign entities in a country’s financial assets, including stocks and bonds.

Why are FPI inflows into the Indian debt market significant?

The surge in FPI inflows reflects increased investor confidence in India’s financial stability and growth prospects.

What is the significance of India’s inclusion in global bond indexes?

Inclusion in global bond indexes attracts significant foreign investments, boosting India’s economic growth and stability.

Are there any risks associated with investing in the Indian debt market?

Yes, there are currency risks and fluctuations in the value of the rupee that can affect returns on investments in the Indian debt market.

US GDP Downward Revision: What’s Behind It?

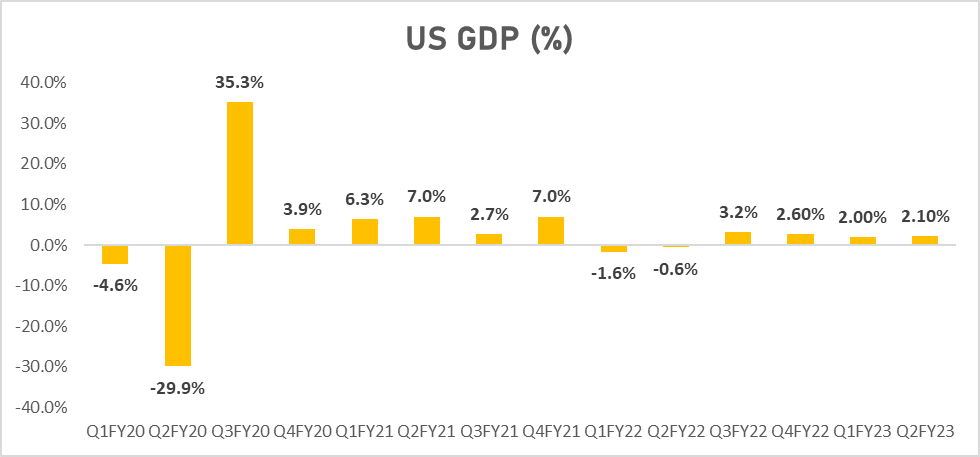

The latest US Gross Domestic Product (GDP) report has sent ripples through the economic landscape, revealing a downward revision to 2.1% for the year’s second quarter. This figure falls slightly below the initial estimate of 2.4% growth. Interestingly, though this revision is a downgrade, it still outperforms the revised 2% growth observed in the first quarter.

Factors Behind the Downward Revision

The revision for the second quarter primarily stems from adjustments in two critical areas: private inventory investment and non-residential fixed investment. These sectors experienced downturns that contributed to the overall GDP adjustment. Additionally, a drop in exports offset the gains in consumer spending, further impacting the GDP figures.

| Categories | Q22023 – Revised | Q22023 |

| Real GDP | 2.10% | 2.40% |

| Personal consumption | 1.70% | 1.60% |

| Non – Residential investment | 6.10% | 7.70% |

| Residential investment | -3.60% | -4.20% |

| Exports | -10.60% | -10.80% |

| Imports | -7% | -7.80% |

| Government spending | 3.30% | 2.60% |

Mixed Signals in the Economy

While some sectors of the US economy continue to show signs of growth, there’s a cloud of uncertainty looming over the sustainability of this progress. The US economy seems to be in decent shape in certain aspects, but questions arise about its long-term stability.

| Categories | Q22023 | Q12023 | Q42022 | Q32022 | Q22022 | Q12022 |

| Real GDP | 2.10% | 2.00% | 2.60% | 3.20% | -0.60% | -1.60% |

| Personal consumption | 1.70% | 4.20% | 1.00% | 2.30% | 2.00% | 1.30% |

| Non – Residential investment | 6.10% | 0.60% | 4.00% | 6.20% | 0.1% | 7.9% |

| Residential investment | -3.60% | -4.00% | -25.10% | -27.10% | -17.80% | -3.10% |

| Exports | -10.60% | 7.80% | -3.70% | 14.60% | 13.80% | -4.60% |

| Imports | -7.00% | 2.00% | -5.50% | -7.30% | 2.20% | 18.40% |

| Government spending | 3.30% | 5.00% | 3.80% | 3.70% | -1.60% | -2.30% |

Key Takeaways

As we look ahead, the immediate future of the US economy remains unclear. The Federal Reserve has taken proactive measures to curb inflation by raising interest rates multiple times. While this move aims to control inflation, it introduces certain risks to the US economy due to tighter monetary policies.

Global Economic Challenges

Moreover, global economic challenges pose a threat to potential future GDP growth. The world economy’s interconnected nature means that overseas issues can reverberate to the United States, impacting its economic performance.

Powell’s Perspective

The announcement of the lower GDP figure followed a speech by Jerome Powell, the Chair of the Federal Reserve, during the Jackson Hole symposium on August 25th. Powell highlighted that while US inflation has decreased from its peak, it still remains at elevated levels. He also hinted that interest rates might remain heightened for an extended period.

In conclusion, the US economy finds itself navigating through complex waters. The downward revision of the GDP figures indicates that challenges persist, despite some positive economic indicators. With inflation concerns and global economic uncertainties, the path forward remains uncertain.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan