Introduction

In the wake of the current fiscal year, India’s government finds itself grappling with a widening fiscal deficit, reaching 25.3% of the annual target. A fiscal deficit signifies the disparity between total government expenditures and revenues, implying that the government is spending more than it earns. This news-driven blog will delve into the reasons behind the surge in the fiscal deficit and analyze its potential impact on the economy.

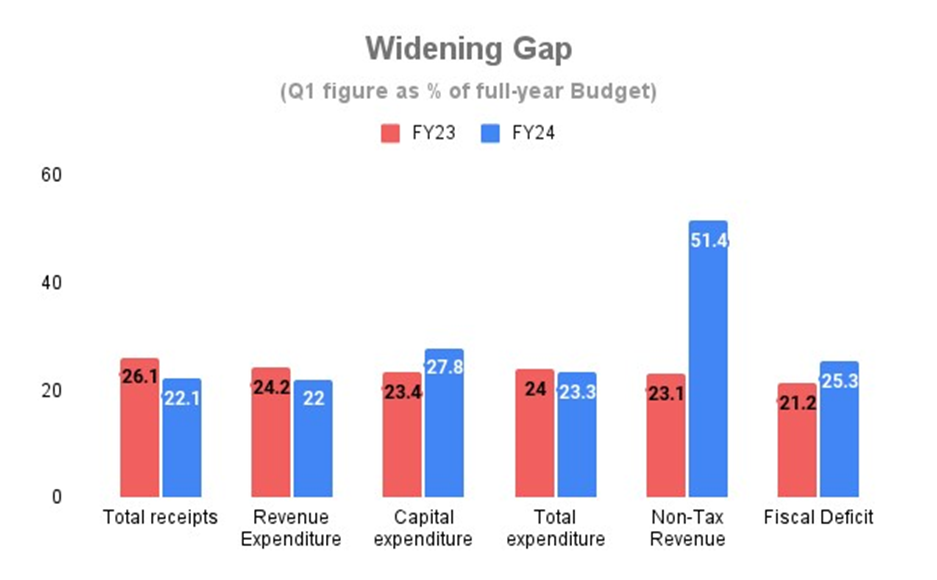

Q1 FY23 Deficit Numbers: The fiscal deficit for the first quarter of the current fiscal year stood at a considerable Rs 4.5 lakh crore, accounting for 25.3% of the budgeted estimate. This figure represented a notable increase compared to last year’s corresponding period when the deficit was 21.2% of the budget estimates. The escalation in the deficit raises concerns and calls for an examination of contributing factors.

Key Takeaways

Contributing Factors: The surge in the fiscal deficit can be attributed to several key factors. First and foremost, total receipts and revenue expenditure declined during the same period. However, the primary driver of the higher deficit was the substantial increase in capital expenditure, which surged to 2.78 trillion in Q1 FY23, compared to 1.75 trillion in the previous year. Moreover, an interesting aspect of the data was the non-tax revenue, which received a significant boost due to a massive dividend from the Reserve Bank of India (RBI) amounting to Rs 87,000 crore.

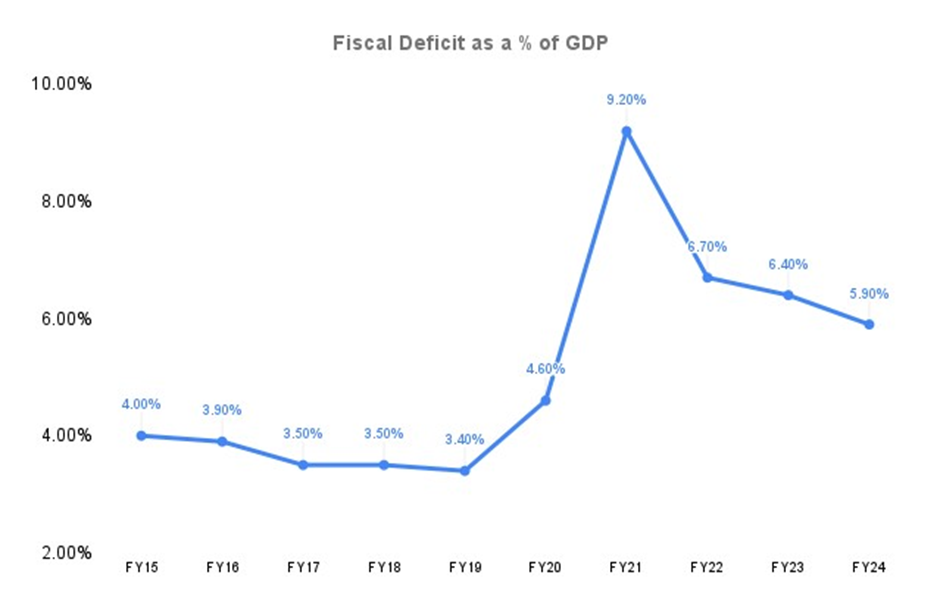

Government’s Fiscal Consolidation Plan: Recognizing the severity of the situation, the government has outlined a plan to mitigate the fiscal deficit. They aim to reduce the deficit to 5.9% of the Gross Domestic Product (GDP) by the end of FY24. This targeted fiscal consolidation plan has been welcomed by economic experts, as it sets a clear path for stabilizing the economy.

RBI’s Support and Buffer: The government received a helping hand from the RBI in the form of a dividend surplus transfer to address the higher-than-expected deficit. The higher dividend amount from the RBI is expected to offset the excess spending on capital projects, helping to manage the fiscal imbalance effectively.

This surplus transfer is also anticipated to provide a buffer to handle any potential reductions in revenue or unforeseen budgetary overshoots. Despite the challenges posed by the widening fiscal deficit in Q1 FY23, the Indian government’s proactive approach to fiscal consolidation offers hope for economic stability.

The focus on curtailing the deficit and the supportive RBI dividend transfer are encouraging signs that suggest the government is taking decisive steps to steer the economy in the right direction. As the fiscal year progresses, diligent management of finances will be crucial to achieving the desired fiscal targets and fostering sustainable economic growth.

Core Sector Output Surges to a 5-Month High: A Positive Sign for India’s Economy

Introduction

Welcome to our latest economic update! It’s that time of the month when we eagerly await the release of crucial economic data. India’s core sector output reached a five-month high today.

The Core Sector in India: A Vital Economic Indicator: The Core Sector in India serves as a vital barometer for economic health. Comprising eight fundamental industrial sectors, this index provides valuable insights into the overall functioning of the broader economy. By tracking the production levels of these sectors, we can gauge how well they are performing and understand their impact on the economy as a whole.

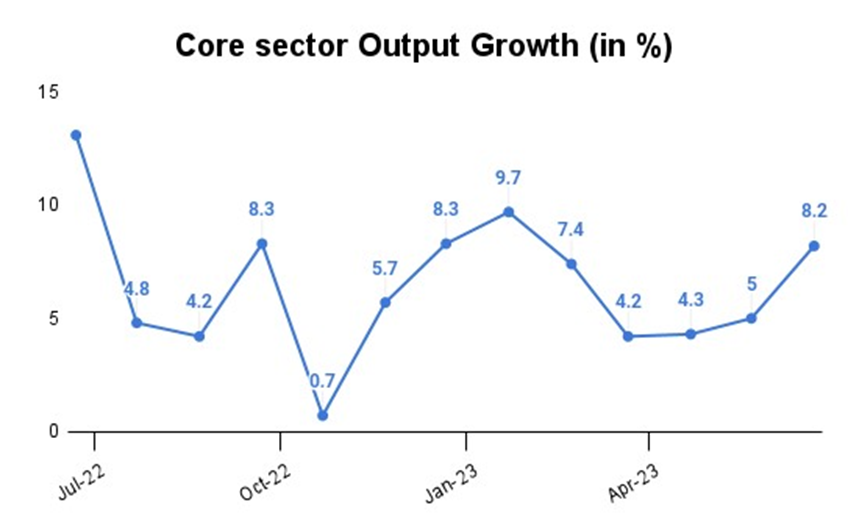

Surging Growth in June: In the month of June, the core sector experienced a significant upswing, as illustrated by the chart below. The growth rate soared to 8.2%, marking the highest level recorded in the past five months. This is a welcome development following growth rates of 5% in May and 4.3% in April.

Broad-Based Growth Across Sectors: What makes this surge even more encouraging is the broad-based nature of the growth. Seven of the eight core sectors exhibited positive growth trends on a year-on-year basis. The only exception was a marginal decline in crude oil production. The robust performance of these core sectors reflects the resilience of India’s economy, especially amidst persistent global challenges.

| Sector | Coal | Crude Oil | Natural Gas | Refinery products | Fertilisers | Steel | Cement | Electricity | Overall Index |

| Jun-23 | 162.4 | 76.4 | 73.4 | 136.2 | 130.8 | 192.9 | 194 | 203.4 | 155.7 |

| May-23 | 167.6 | 78.8 | 73.3 | 141.1 | 138.2 | 190.7 | 190.8 | 201.6 | 157.1 |

| Jun-22 | 148 | 76.9 | 70.9 | 130.3 | 126.4 | 158.2 | 177.4 | 196.9 | 143.9 |

| M/M | -3% | -3% | 0% | -3% | -5% | 1% | 2% | 1% | -1% |

| Y/Y | 9.73% | -0.65% | 3.53% | 4.53% | 3.48% | 21.93% | 9.36% | 3.30% | 8.20% |

Key Takeaways

Significance of Core Sectors: To comprehend the importance of these core sectors, imagine them as vital organs sustaining an economy’s overall well-being. They play a crucial role in producing essential goods and key inputs that other industries heavily rely on to function and expand. Thus, when these sectors thrive, it indicates a healthy and flourishing economy.

Global Challenges and Potential Headwinds: Despite the impressive performance of India’s core sector output, it’s essential to acknowledge the potential headwinds ahead. The global economy is currently facing the threat of a slowdown, which could have ramifications on both global and domestic demand. While the current growth in core sectors is a positive sign, it’s crucial to remain vigilant in facing external uncertainties.

Long-Term Optimism: Looking ahead, there is reason for optimism in the long term. The Indian Government’s aggressive capital expenditure investments are expected to significantly boost the core sectors’ growth. These investments are likely to contribute to the country’s overall economic outlook by stimulating the expansion of these vital industries.

In conclusion, the latest data on core sector output shows a remarkable rebound, reaching a five-month high in June. This growth signals positive momentum for India’s economy, despite global challenges. With the government’s strategic investments on the horizon, there is hope for sustained growth in the long term. However, vigilance is necessary to navigate potential headwinds and maintain the upward trajectory of the core sectors, ensuring the prosperity of the nation’s economy.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.