Introduction

The Indian economy has shown remarkable resilience despite facing global headwinds. However, there are two crucial challenges to address: the ongoing recovery of the rural economy and the hesitancy among Indian companies to invest in capital expenditure. A recent report by ETIG sheds light on the encouraging trend of increased capital expenditure among India Inc. However, it’s yet to demonstrate a fully broad-based capex cycle recovery due to prevailing economic uncertainties.

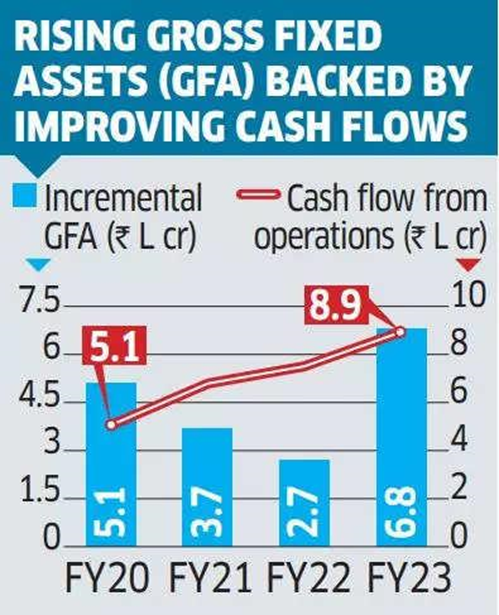

Encouraging Signs of Growth: The latest ETIG report analyzed a sample of 373 companies from the S&P BSE 500 index and revealed that 3 out of 4 companies reported a year-on-year improvement in Gross Fixed Assets (GFA). In the fiscal year 2022-23, the total GFA for the sample increased by ₹6.8 lakh crore, showing a significant 16% growth to reach ₹48.9 lakh crore. Compared to the preceding year’s increase of ₹2.7 lakh crore, this surge indicates a positive shift in corporate capex spending.

Key Takeaways

Factors Driving Increased Capex: One of the primary reasons behind this rise in capital expenditure is the improvement in cash flows and strengthened balance sheets of Indian companies. The burden of investment, primarily on the government, is now showing signs of being shared by the private sector. These indicators, combined with the Indian government’s infrastructure push in highways, railways, and defense spending, paint an optimistic picture for the economy.

Moreover, the Production Linked Incentive (PLI) scheme and the government’s focus on energy transition have fueled domestic manufacturing, contributing to capital expenditure growth. Additionally, the China+1 strategy provides fertile ground for the revival of the capex cycle.

Road Ahead: While the data presents positive signs for India Inc.’s capex spending, it’s crucial to acknowledge that the recovery is not entirely broad-based due to ongoing economic uncertainties. However, with strong bank and corporate balance sheets and the government’s infrastructure investments, the potential for a comprehensive recovery in India’s capital expenditure seems promising.

India’s corporate sector is gradually increasing its capex thanks to increased cash flows, improved balance sheets, and government initiatives. While challenges persist, the country’s potential for a robust and comprehensive recovery in capex spending is evident. As economic uncertainties subside, India Inc. stands poised to embark on a more significant capex cycle, further strengthening the nation’s economy.

Revival on the Horizon: Jet Airways Receives Renewed AOC from DCGA!

Introduction

In an unexpected twist, Jet Airways, the beleaguered and defunct airline, has been granted the Indian air operator’s permit, signaling its potential return to the skies!

The Current Story

Having operated for a successful 25-year run, Jet Airways ceased operations in April 2019, grappling with severe financial challenges, mounting losses, debts, and unpaid dues.

Subsequently, the National Company Law Tribunal (NCLT) placed the airline under the insolvency resolution process. In 2021, the Jalan-Kalrock consortium emerged as the winning bidder with the ambitious mission of resurrecting the airline. The consortium committed 1375 crores for this purpose, with 900 crores allocated for capital infusion and the remaining 475 crores to settle creditors’ claims. However, as of now, no repayments have been made.

Renewal of Jet Airways’ Air Operator Certificate by DCGA: The turning point in this saga revolves around the renewal of Jet Airways’ Air Operator Certificate (AOC) by the Directorate General of Civil Aviation (DGCA), India’s aviation regulatory body. An AOC is a crucial license issued by the DGCA, permitting an airline to operate commercial flights.

Key Takeaways

With the renewal of the AOC, the path is now paved for the grounded airline to revive its passenger services in India. Furthermore, this development reflects the Indian Aviation Regulator’s confidence in Jet Airways’ revival prospects. It’s worth noting that Jet Airways’ potential resurrection sets a historical precedent in Indian aviation, as no airline has ever been successfully revived after an extended grounding period.

Looking Ahead: Despite the upcoming final rounds of hearings on August 7, the significant achievement of securing the AOC undoubtedly augurs well for Jet Airways and the entire Indian Aviation Sector.

As aviation enthusiasts and stakeholders eagerly await Jet Airways’ potential comeback, the renewal of their AOC signifies a glimmer of hope amidst the turbulence the airline industry has faced, paving the way for potential success in the skies.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.