Introduction

A thought-provoking research paper published by the Reserve Bank of India (RBI) recently highlighted India’s remarkable potential to become a developed nation. The criteria for categorizing a country as “developed” vary among institutions such as the World Bank and the International Monetary Fund (IMF), with per capita income playing a significant role.

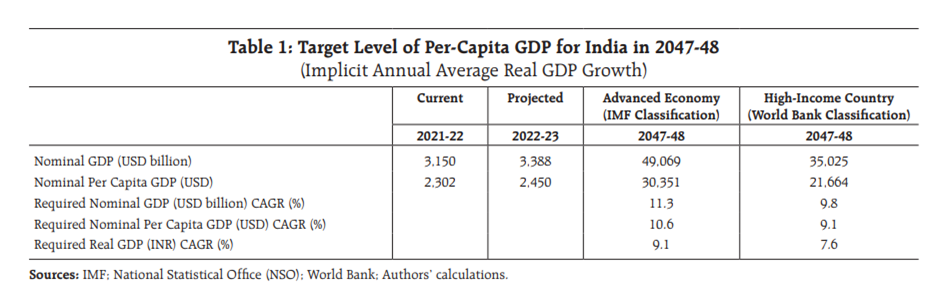

World Bank’s Benchmark: According to the World Bank, India must surpass a per capita nominal GDP of US$ 21,664 to be classified as a high-income country by 2047. To accomplish this goal, India must maintain a consistent compound annual growth rate (CAGR) of 7.6 percent in real GDP from 2023-24 to 2047-48.

IMF’s Advanced Economy Classification: On the other hand, the IMF sets a higher bar for attaining an advanced economy (AE) status, requiring a per capita nominal GDP exceeding US$ 30,351 by 2047. To meet this objective, India would need to achieve a more ambitious real GDP CAGR of 9.1 percent during the same period.

Growth Rates as Indicators: These growth rates signify the pace of economic expansion required for India to realize different levels of economic development by 2047.

Rebalancing India’s Economic Structure: The research paper underlines the need for India to rebalance its economic structure by strengthening its industrial sector. The industrial sector not only offers employment opportunities but also possesses strong backward and forward linkages. A robust industrial sector would enable India to meet the growing demands of its ever-expanding population domestically.

Key Takeaway

The nation must strive for higher annual growth rates to bridge the gap between India and other major economies. This becomes imperative for India rather than being a mere choice. The key challenge lies in ensuring access to quality education, healthcare, and infrastructure for its people.

India can emerge as a global economic leader by investing in the youth and unlocking their potential. However, not providing these essentials could transform the much-celebrated demographic dividend into a liability.

India’s ascent towards high-income status by 2047 is an ambitious yet attainable goal. RBI’s research paper emphasizes the importance of sustained economic growth and the need to bolster the industrial sector.

India has the potential to transform its economy and become a prominent player on the global stage if it addresses the challenges and invests in key areas. The journey to becoming a developed nation would require concerted efforts and a focus on empowering its youth and securing a prosperous future for India and its citizens.

India and UAE Forge Groundbreaking Trade Agreements to Foster Bilateral Relations

Introduction

In a significant move to strengthen their bilateral relations, India and the United Arab Emirates (UAE) have recently signed two groundbreaking Memoranda of Understanding (MOUs) for bilateral trade. These agreements mark a significant milestone in their relationship, as they introduce innovative measures to simplify financial interactions and promote the use of local currencies for cross-border transactions. This blog post will delve into the key highlights and implications of these MOUs, shedding light on their benefits to both nations.

- Promoting Local Currency Use for Cross-Border Transactions: The first MOU focuses on establishing a framework to encourage local currencies, such as the Indian Rupee (INR) and the Emirati Dirham (AED), for conducting cross-border trade. This initiative enables exporters and importers to invoice and settle transactions in their respective domestic currencies. This measure aims to streamline international trade and enhance economic cooperation between India and the UAE by optimizing settlement and transaction costs.

- Linking Fast Payment Systems: The second MOU aims to connect the Fast Payment Systems (FPS) of both countries, namely India’s Unified Payments Interface (UPI) and the UAE’s Instant Payment Platform (IPP). This integration facilitates swift, secure, and cost-effective cross-border fund transfers. Furthermore, it enables mutual acceptance of domestic cards and enhances financial messaging between India and the UAE. This seamless financial infrastructure will play a pivotal role in fostering smoother trade interactions.

Key Takeaways

Expanding Trade Relations: India and the UAE have already achieved a significant trade volume of $85 billion and are rapidly approaching the remarkable milestone of $100 billion. The signing of these MOUs further solidifies the economic engagement between the two nations. Notably, the UAE is home to approximately 3.5 million Indian expatriates, constituting about 30% of the country’s population. This substantial expatriate community will contribute to increased investments and remittances, enhancing the economic collaboration between the two sides.

Reduced Reliance on the US Dollar: Using local currencies for bilateral trade will streamline transactions and decrease reliance on the US dollar. This shift is particularly advantageous for India, as it is the UAE’s fourth-largest importer of crude oil. By allowing payments for oil imports to be conducted in Indian Rupees instead of dollars, India stands to benefit significantly from this agreement.

Strengthening Economic Engagement: In conclusion, these MOUs between India and the UAE represent a remarkable milestone in their cooperation. The agreements will strengthen economic engagement, foster seamless cross-border transactions, and promote greater financial cooperation.

Furthermore, they will pave the way for the internationalization of the Indian Rupee, offering new avenues for trade and investment between the two nations. This progressive step solidifies India-UAE ties and sets the stage for a prosperous future of collaboration and growth.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.