Introduction

In a groundbreaking merger between two powerhouses of the Indian banking system, HDFC Bank and HDFC Ltd, HDFC has achieved the prestigious position of being the 7th largest global lender. This remarkable feat places HDFC ahead of numerous iconic super banks, solidifying its influence in the global financial landscape.

Mega Merger Approaches:

Approved in April and successfully implemented on July 1st, 2023, the mega $40 billion merger between HDFC Bank and HDFC Ltd has set a new benchmark in India’s corporate history. This historic transaction is regarded as the largest in India Inc.’s annals, signifying this significant development’s magnitude.

HDFC’s Rise in Global Rankings: Following the reverse merger, HDFC Bank has absorbed its parent entity, HDFC Ltd, and will continue to operate under the name HDFC Bank. As a result, HDFC’s market capitalization has soared to approximately $151 billion or Rs 12.38 lakh crores, propelling it to the position of the 7th largest lender worldwide. Surpassing renowned institutions such as Morgan Stanley, Goldman Sachs, and Bank of China, HDFC Bank now stands as a formidable force in the global banking arena.

World’s Largest Banks by Market Cap

| Sr. No | Name of the Bank | Market Cap ($Bn) |

| 1 | JPMorgan Chase | 438 |

| 2 | Bank of America | 232 |

| 3 | ICBC | 224 |

| 4 | Agricultural Bank of China | 171 |

| 5 | Wells Fargo | 163 |

| 6 | HSBC | 160 |

| 7 | HDFC Bank | 151 |

| 8 | Morgan Stanley | 143 |

| 9 | China Construction Bank | 141 |

| 10 | Bank of China | 138 |

| 11 | Royal Bank of Canada | 136 |

| 12 | Toronto Dominion Bank | 118 |

| 13 | Commonwealth Bank | 115 |

| 14 | CM Bank | 112 |

| 15 | Goldman Sachs | 108 |

Key Takeaways

- Unprecedented Transaction: The $40 billion merger marks a watershed moment in the history of India Inc., making it the most significant transaction ever conducted in the country.

- Expanding Customer Base and Network: HDFC Bank will now serve an impressive 120 million customers while expanding its branch network to 8,300 locations. With over 1.77 lakh employees, the bank is poised for further growth and enhanced services.

- Market Influence: The combined shares of the HDFC twins hold substantial weightage, nearly 14%, on the indices, showcasing their significant impact on the market.

- Resilience amidst Global Turmoil: The merger of HDFC Limited with HDFC Bank assumes even greater significance considering the economic challenges faced by global banks like Silicon Valley Bank, Signature Bank, First Republic, and Credit Suisse. It underscores the importance of regulatory policies and emphasizes the strength and recovery of Indian banks.

- Elevating the Indian Banking Sector: The successful merger showcases the competitiveness and strength of Indian banks in the international arena, bolstering the reputation of the Indian banking sector as a whole.

HDFC’s rise as the 7th largest global lender after the merger of HDFC Bank and HDFC Ltd is a historic achievement. With its increased market capitalization, expanded customer base, and formidable presence in the global financial landscape, HDFC Bank demonstrates the resilience and competitiveness of Indian banks. This milestone serves as a testament to the robustness of the Indian banking system and reinforces the reputation of Indian banks on the international stage.

India’s Exports Witness Steepest Decline in Three Years: A Reflection on Trade Performance

Introduction:

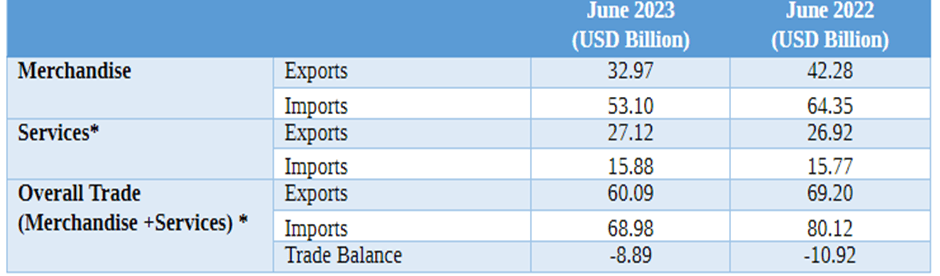

India’s Exports performance faced significant challenges in the month of June, resulting in a noteworthy decrease in both goods and services sectors. The combined exports of merchandise and services experienced a sharp decline of approximately 13% compared to the previous year, indicating the most substantial fall in the past three years. While merchandise exports contracted by 22% year-on-year, reaching $32.97 billion, services exports witnessed a slight increase of 0.7% to reach $27.12 billion.

India’s Exports in the Goods Sector: Merchandise exports, in particular, encountered a significant setback, with a decline of 22% compared to the previous year. This drop marked the most substantial contraction in the past three years, bringing the total value of merchandise exports to $32.97 billion. The decline in India’s exports can be attributed to several factors, including the economic slowdown in major economies due to the Russia-Ukraine conflict, escalating energy and commodity costs, inflationary pressures, and monetary tightening in significant global markets.

India’s Exports in the Services Sector: Despite the challenging conditions faced by the goods sector, India’s services exports experienced a marginal increase of 0.7%, reaching a value of $27.12 billion. This positive trend demonstrates the resilience and strength of India’s services industry. The slight rise in services exports for the month of June provides a ray of hope amid the overall decline in trade performance.

Trade Imbalances: In June, merchandise imports declined by approximately 17%, resulting in a trade deficit above $20 billion. However, it is worth noting that the trade deficit decreased sequentially. On the services front, the trade surplus narrowed to $11.2 billion in June, marking the lowest recorded surplus in 2023 so far. The trade surplus generated by services exports plays a crucial role in safeguarding against external risks and contributing to the overall balance of trade.

Future Outlook and Key Takeaways

- While short-term challenges persist, focusing on the long-term prospects and initiatives that can positively impact India’s exports is important.

- Programs such as the Production-Linked Incentive (PLI) scheme and the Make in India campaign, along with the robustness of India’s services industry and the shifting demand from China, are expected to enhance India’s export performance in the long run.

- Additionally, the World Trade Organization predicts a growth of 1.7% in world merchandise trade volume in 2023 and a further rebound of 3.2% in 2024, indicating a positive outlook for trade in the coming years.

India’s Exports faced significant challenges in June, experiencing the sharpest decline in three years. While the goods sector suffered a substantial contraction, the services sector managed to exhibit resilience with a slight increase. The long-term potential of India’s export industry, government initiatives, and global trade projections indicate a promising outlook for the future. India is poised to rebound and thrive in the global trade landscape by navigating through short-term headwinds and capitalizing on strengths.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3 / 5. Vote count: 2

No votes so far! Be the first to rate this post.