It will be the fifth and last full union budget for the Narendra Modi-led central government before the 2024 general elections. So, hopes are running high, and the market is also expected to turn volatile around the high-decibel union budget.

So, if you want to invest in sectors that get maximum attention in the union budget and make some quick profit. then, you should read this blog – how markets perform immediately post budget, before making any decision.

Union Budget 2023

On 1st February 2023, Finance Minister Nirmala Sitharaman will present the fifth union budget of the second tenure of the Modi government in parliament.

The union budget combines revenue and capital, and the finance minister outlays the projected receivables and expenditures for the upcoming financial year. The primary objectives of the union budget are to ensure the efficient allocation of resources, stimulate the growth of the economy’s income and wealth disparities between the rich and poor, keep a check on inflation, and rationalize tax structures.

Not only does the union budget set the direction of the Indian economy, but it also has a political impact and is an opportunity for the government to portray its long-term vision for India and how people like to see the government, whether it is pro-socialist, or capitalist.

Impact of Union Budget on the Stock Market

Another segment where the impact of the union budget is the highest on the stock market. In the run-up to the budget to post the budget presentation, the market scrutinizes every move and government announcement, trying to figure out the best stock to play with to generate quick profits.

We thought we’d take a different route and understand how the stock market performed around the union budget.

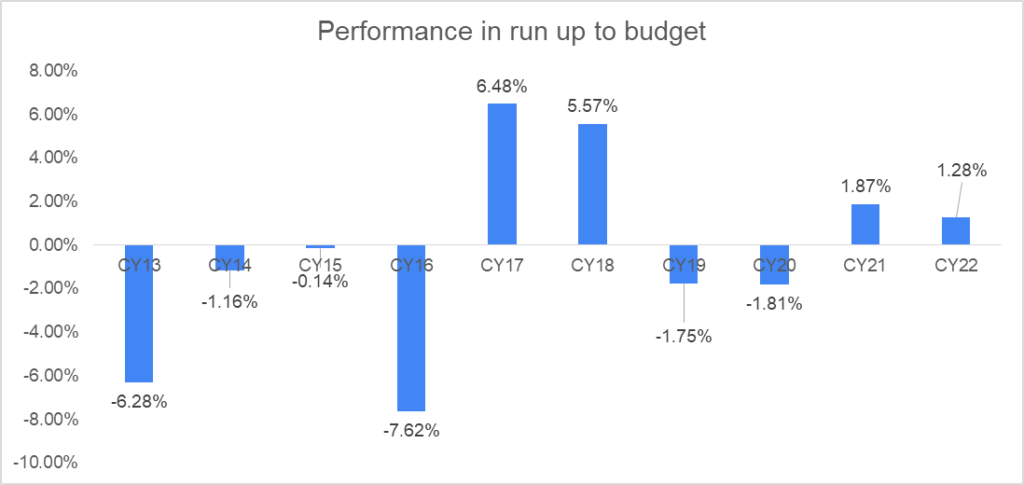

Last 10 years’ pre-budget impact on the stock market

Since 2016, the union budget has been brought forward by one month and is tabled in the parliament on 1st February every year.

In the run-up to the budget, the market is mostly impacted by global macros and the release of Q3 corporate earnings, which sets the mood for the market. If we look at the one-month pre-budget return of Nifty 50 over the 10 years, there is no consistent trend or pattern. In fact, the monthly return of Nifty 50 before the budget presentation has been mixed in the last five years.

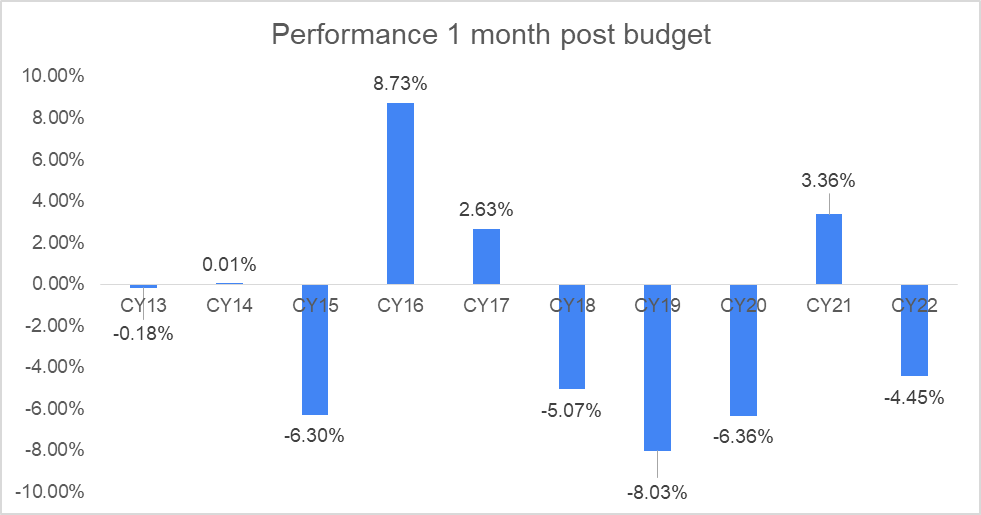

Last 10 years, how markets perform immediately post budget

In the last 10 years, Nifty 50 fell six times every month after the budget presentation. And, in the last five years, the index posted gains only once in 2021 of 3.36%. Again, there has been no consistent trend, and the global macros and liquidity position influence the market.

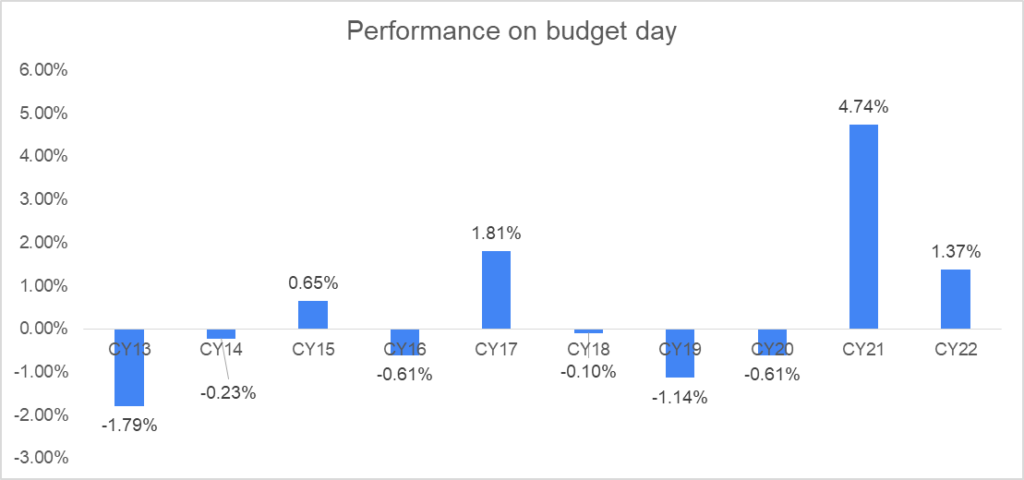

Nifty50 performance on the Budget day

The Nifty 50 has given a lower close 6 times on the budget day itself in the last 10 years. On Budget 2021 and budget 2022 days, the market closed with gains of 4.74% and 1.37%, respectively. Due to higher speculation in the market, the volatility in the market around the budget days increases as traders take new positions based on the budget presentation and settle the old trades.

However, there have been sector-specific actions on the budget days, like post budget 2022, pharma, metal, and capital goods stocks recorded gains. And cuts in custom duty helped export and textile stocks to surge higher.

It is difficult to make new trades and investments based on the budget announcement as the budget momentum in the market fizzle out after a few days of the pre-budget presentation hat Impacts the Stock Market on the Budget Days Most?

The market follows the budget speech closely, but the focus is on how the finance minister announces its investments, outlay, and the country’s fiscal deficit position. It impacts the money supply and liquidity in the market.

A fiscal deficit is the excess of the total government spending over the total tax and non-tax receipts. The government must row from the market to address the shortfall in a set fiscal deficit situation.

In case of a large fiscal deficit or the government increases the fiscal deficit target for the next financial year, it expects a shortfall in revenue collection, which can lead to higher interest rates, impacting the economic growth cycle and stoking inflation. While a fiscal deficit within the comfortable limit is always good for the economy as the government can spend more and drive economic activity and growth.

Also, another thing that market participants look at is the change in tax structures. A likely change in short-term and long-term capital gains tax and security transaction tax can impact the market significantly. Because a small change in tax structure can sway the profitability metrics for large investors and institutions.

Should You Invest in Budget Day?

Past data shows how markets perform immediately post-budget is unpredictable and uncertain. The budget should not influence your investing decisions if you are a long-term investor.

In the budget, there is no significant shift in policy matters. Therefore the underlying fundamentals remain the same. The best way to play the union budget is by keeping an eye on the market movements in the coming days, studying how the budget will affect your investment portfolio, and then making appropriate investment decisions.

However, when investing, ignoring the budget noise and looking at the long-term horizon always helps. For instance, on 28th Jan 2013, Nifty50 was trading at the 6075 level, and it grew three times in the next 10 years to reach the 18,000+ levels. Nifty50 has given multiple opportunities to invest at lower valuations to create wealth during this period.

FAQs

When is the union budget presented in the parliament?

The union budget of India is presented on 1st February every year and is tabled in Lok Sabha by the Finance Minister.

How do markets perform immediately post-budget?

The union budget announcement significantly impacts the stock market. Over the years, we have seen significant market volatility on budget days. Factors like changes in income tax slabs, capital gains tax, and fiscal deficit have a huge impact on the stock market as they affect the money supply in the system.

How does a budget help an economy?

A budget helps to provide a direction to the economy, where the government will focus and spend money in the upcoming years to drive economic growth and maintain the economy’s financial stability.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 6

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/