JP Power Share Price: Key Insights About This Small-Cap Stock

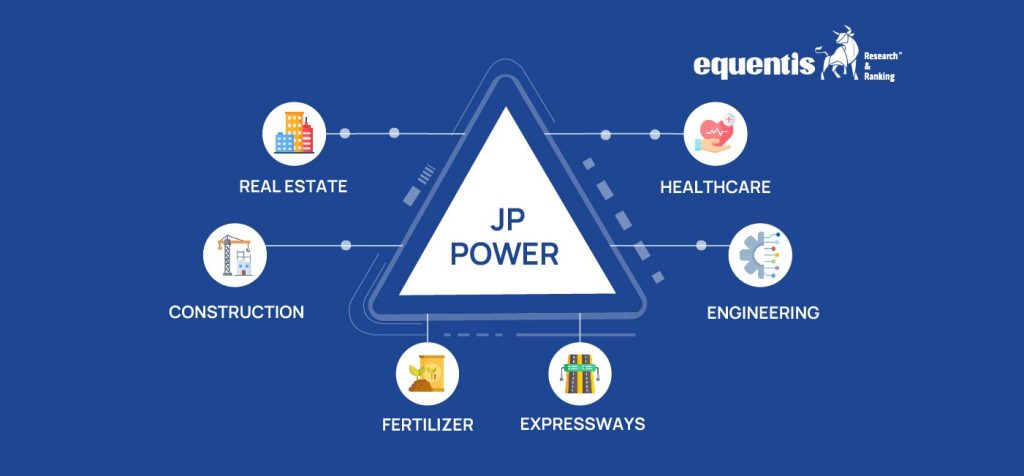

Jaiprakash Power Ventures Ltd, additionally referred to as JP Power Ventures, is part of the Jaypee Group. Following several years of repeated losses, the company has returned to profitability, with strong earnings growth. JP Power share price has also shed the image of being a penny stock, and investors are showing more interest in the company. In this article, we will do a fundamental analysis of JP Power’s share price and evaluate its long-term growth prospects.