The domestic stock market today is in a dilemma. While the actual growth for the September quarter surpassed the previous expectations of RBI and grew 7.6%, the inflation also rose during November.

The CPI rose to 5.5% in November compared to 4.87% and 5.02% in October and September respectively. It has also exceeded the upper tolerance level of RBI, which was fixed at 4%.

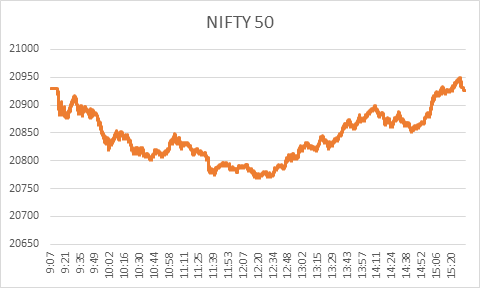

All these made the market flat today and Nifty 50 rose only 0.10% and closed at 20926.35.

Here are the top five nifty gainers and losers today.

Top 5 Gainer Stocks Today

| Stocks | Previous Day’s Closing Price | LTP | Change (%) |

| NTPC | 283.4 | 294.1 | 3.78 |

| ADANIPORTS | 1,041.95 | 1,074.00 | 3.08 |

| HEROMOTOCO | 3,747.15 | 3,855.00 | 2.88 |

| POWERGRID | 231.35 | 236.7 | 2.31 |

| EICHERMOT | 3,951.75 | 4,036.00 | 2.13 |

- NTPC: Today, the energy stocks were on the rise as the industrial production index rose. The top nifty gainer today is NTPC gaining 3.78% closing at 2694.10 up from its previous day’s close at 283.40.

- Adani Ports: This Adani Group surged 3.08% following its board meeting where approvals for issuance of non-convertible debentures, and non-cumulative redeemable preference shares had been granted.

- Hero Moto Corp: India’s favourite Hero Motors rose today by 2.88% following the surge in the automobile industry due to the positive Industrial growth in the previous quarter. The stock went up to 3855 from its previous price of 3747.15 yesterday.

- Power Grid: As the core sectors were positive today, due to the industrial production growth, this power company gained 2.31% and closed at 236.10.

- Eicher Motors: The positive sentiments around the auto sector today pushed this famous auto company by 2.13% on NSE. The stock went up to 4036 up from its previous close at 3951.75.

Top 5 Loser Stocks Today

| Stocks | Previous Day’s Closing Price | LTP | Change (%) |

| TCS | 3,672.10 | 3,597.00 | -2.05 |

| INFY | 1,476.05 | 1,449.95 | -1.77 |

| HDFCLIFE | 707.35 | 698 | -1.32 |

| AXISBANK | 1,131.00 | 1,116.90 | -1.25 |

| ULTRACEMCO | 9,863.50 | 9,748.90 | -1.16 |

- TCS: The IT sector was sluggish today following concerns about interest rates as inflation has gone up. The stock fell 2.05% and closed at 3597, down from its previous close at 3672.10.

- Infosys: Another IT stock to add to the list of nifty losers today as it lost 1.77%. The primary reason behind the fall is the same as TCS which is the rise in inflation, which worries the investors regarding further rate hikes.

- HDFC Life: The financial service sector was slow today, which dragged the insurance company by 1.32%. The stock closed at 698 in today’s session, down from its previous close at 707.35.

- Axis Bank: This private sector bank lost 1.25% following sluggishness in the market, especially in the financial and banking sectors.

- Ultratech Cement: The cement stockalso lost 1.16% today even though today the realty sector was high and ended in the green. The stock closed today at 9748.90 down from its yesterday’s close at 9863.50.

Wrapping up

Today the market was completely under the influence of macroeconomic data released yesterday by RBI. Though the broad market index didn’t move much, core sector stocks performed well while the IT sector and financial services dragged.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 1 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/