Introduction

In a groundbreaking moment this Monday, the benchmark Nifty soared past the 20,000 mark for the first time. This remarkable milestone has set the financial world abuzz with excitement. Simultaneously, the BSE Sensex had an outstanding day, concluding at 67,127.08, marking a record high and crossing the 67,000 threshold for the first time. These are undoubtedly thrilling times for the Indian stock market!

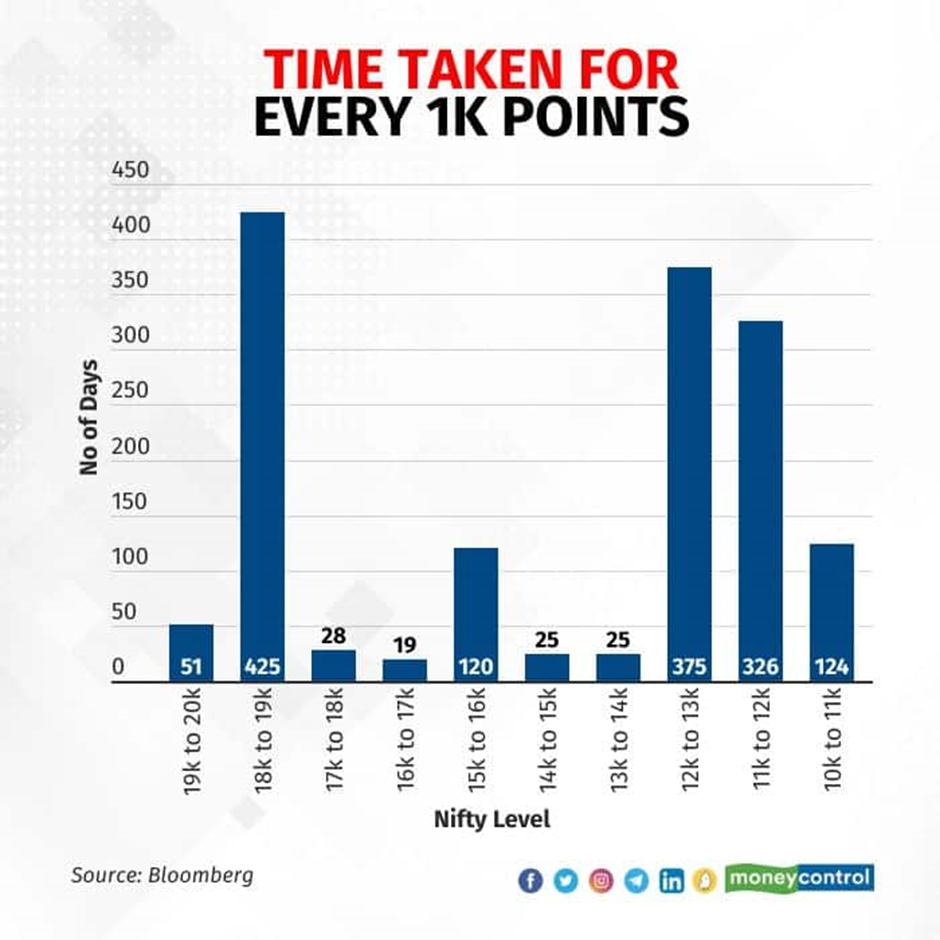

Here’s an intriguing tidbit for you: It took the index just 51 trading sessions to leap from 19,000 to the 20,000 level while reaching 19,000 from 18,000 required 425 sessions.

What’s genuinely captivating is that the Indian markets are on fire despite global concerns of a recession, crude oil prices surging past $90 per barrel, a strengthening US dollar, rising bond yields, and debates about overvaluation in the markets. So, what’s behind this impressive rally? Let’s dive into the factors propelling this surge.

1. G20 Optimism: The G20 Delhi Declaration and India’s diplomatic successes have injected abundant positive energy into the market. The inclusion of the African Union in the G20 and the proposed India-Middle East-Europe Corridor are perceived as significant economic and market stimulants. We will delve deeper into G20 developments in this week’s episode of “The Third Umpire.” These encouraging signals are providing a substantial boost to the stock market.

2. Positive Domestic Cues:

Despite numerous challenges, the Indian economy is displaying remarkable resilience. The recent rally can be attributed to favorable domestic factors such as robust GDP figures for Q1FY24, substantial GST collections, and a promising Purchasing Managers’ Index (PMI) for August. Investors are also placing their bets on India’s long-term growth story.

3. FII/FII Trend:

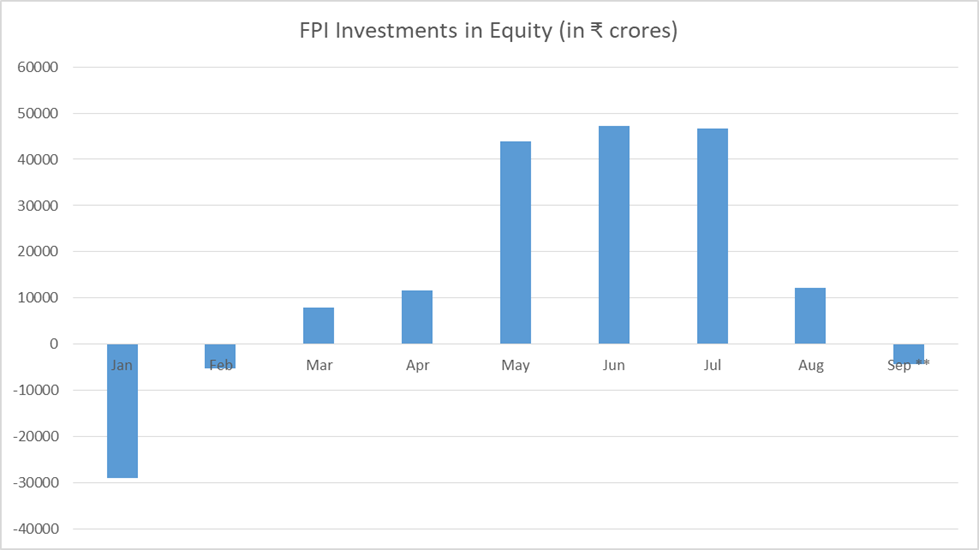

Foreign portfolio investors (FPIs) experienced a somewhat turbulent start in 2023, initially being net sellers in January and February, withdrawing nearly ₹34,000 crore. However, they swiftly changed course and became net buyers. September has seen a mixed bag of FPI activity, with funds being withdrawn in the first ten days of the month. Zooming out to the broader picture since last year, foreign institutional investors (FIIs) have reentered the Indian equities game.

Data constitutes trades conducted by FPIs on and up to 11th Sep 2023.

4. Growing Domestic Participation:

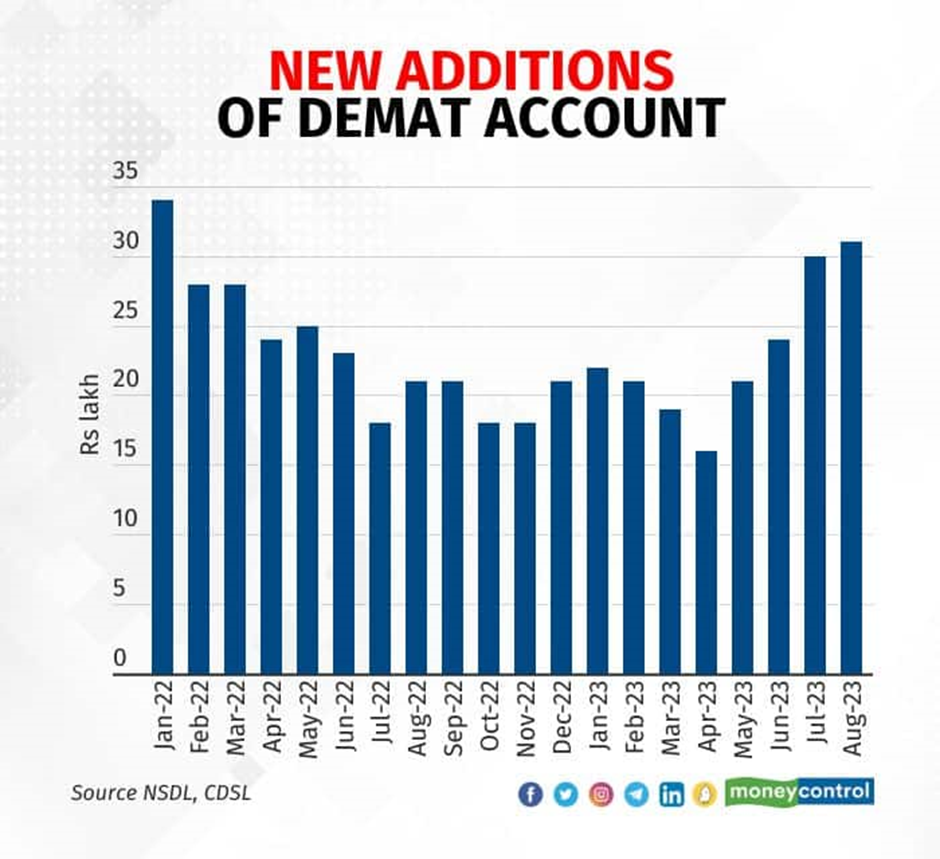

As discussed yesterday, the increasing number of Demat accounts in the country indicates growing optimism, confidence in India’s economic future, and greater awareness of equities as an asset class. Interestingly, in recent days, domestic institutional investors (DIIs) have been injecting capital into the markets.

Key Takeaways:

All of these factors are propelling the Indian benchmark indices to unprecedented heights. As the market continues its surge, it signifies more than just numbers; it’s a testament to India’s economic vigor and unwavering commitment to progress. With each milestone achieved, the Indian stock market presents investors with untapped potential and unparalleled opportunities. It’s an exhilarating time to be a part of India’s remarkable growth story.

FAQs

Is the Indian stock market’s recent success sustainable amid global economic uncertainties?

While global uncertainties persist, India’s strong domestic indicators, growing investor confidence, and positive economic cues suggest resilience. The market’s sustainability will depend on various factors, including global developments and government policies.

What role are foreign investors playing in this market rally?

Foreign institutional investors (FIIs) have been a key driver of this rally, reentering the Indian equities game. Their participation, while fluctuating, indicates confidence in India’s growth prospects. Monitoring their activity remains crucial.

How can individual investors capitalize on this stock market surge?

Individual investors should conduct thorough research, diversify their portfolios, and consider long-term investment strategies. Staying informed about market trends, both domestically and globally, is essential for making informed investment decisions in these exciting times.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.