Introduction

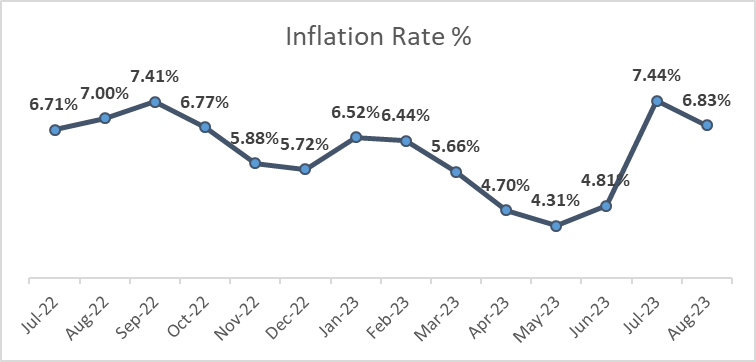

The Consumer Price Index (CPI) has been making headlines for its surprising fluctuations in recent economic news. In July, the CPI, which serves as a crucial measure of retail inflation in the country, shocked experts by surging to an unexpected high of 7.44%. This marked a 15-month peak and raised eyebrows across the financial world.

However, August brought relief as the retail inflation rate eased slightly, dropping to 6.83% from the previous month’s 7.44% and falling below market predictions of 7%.

Despite this improvement, it’s important to note that the inflation rate of 6.83% remains above the upper tolerance limit set by the Reserve Bank of India (RBI), marking the second consecutive month where it exceeds this threshold.

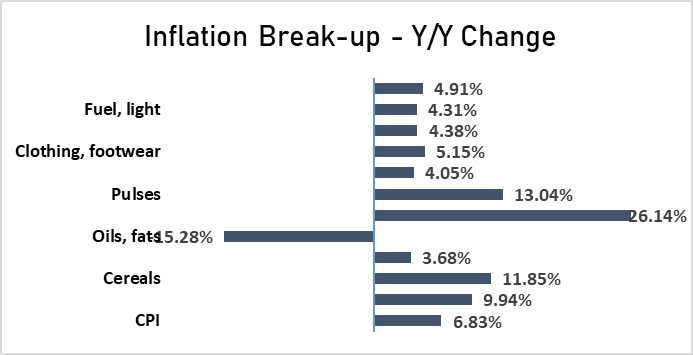

The Factors Behind Inflation: Taking a closer look at the driving forces behind this inflation rollercoaster, it becomes evident that certain factors played pivotal roles. Notably, vegetable inflation soared to 26.1% year-on-year, contributing significantly to the overall consumer price basket. Cereals and pulses were also major contributors to the inflationary pressures.

Positive Signs and Concerns: On a more positive note, core inflation, which excludes food and oil, showed signs of easing, falling to 4.9%, which is a welcome change. However, despite these glimpses of improvement, several upside risks continue to loom over the inflation landscape.

Key Takeaways

- Uncertainty in Food Inflation: The outlook for food inflation remains uncertain due to an uneven monsoon, which can significantly impact agricultural production and food prices.

- Crude Oil Prices: Crude oil prices have been hovering above $90 per barrel, posing a substantial risk to inflation as they impact fuel and transportation costs.

- RBI’s Revised Inflation Target: The Reserve Bank of India (RBI) itself anticipates more upward pressure on inflation in the future. In fact, they have recently revised their inflation target for the current financial year, increasing it to 5.4% from the previous 5.1%.

While August brought some relief from lower CPI inflation, the economic landscape remains uncertain. Inflation still hovers above the RBI’s upper tolerance limit, and various factors, including food inflation and volatile crude oil prices, continue to pose risks. As the financial world keeps a watchful eye on these developments, it’s clear that inflation remains a persistent concern in the nation’s economic agenda.

FAQs

What is CPI Inflation?

CPI Inflation, or Consumer Price Index Inflation, is a measure that tracks the average change in prices paid by consumers for a basket of goods and services over time. It is a critical indicator of retail inflation and reflects the cost of living for the average citizen.

Why did CPI Inflation surge in July but ease in August?

In July, CPI Inflation surged due to rising vegetable prices and other inflationary pressures. However, it eased slightly in August as some of these pressures subsided. This could be attributed to seasonal factors and improved supply conditions.

What are the implications of CPI Inflation exceeding RBI’s tolerance limit?

When CPI Inflation surpasses the Reserve Bank of India’s upper tolerance limit, it can lead to concerns about the economy’s overall health. It may prompt the RBI to consider tightening monetary policy to control inflation, which can impact interest rates and borrowing costs for individuals and businesses.

July’s Industrial Production Index (IIP) Report Reveals Promising Economic Trends

Introduction: The Industrial Production Index (IIP) is a critical economic indicator that monitors manufacturing activity across diverse sectors of the economy. It is a barometer of overall economic health and activity levels, providing valuable insights into the nation’s industrial performance.

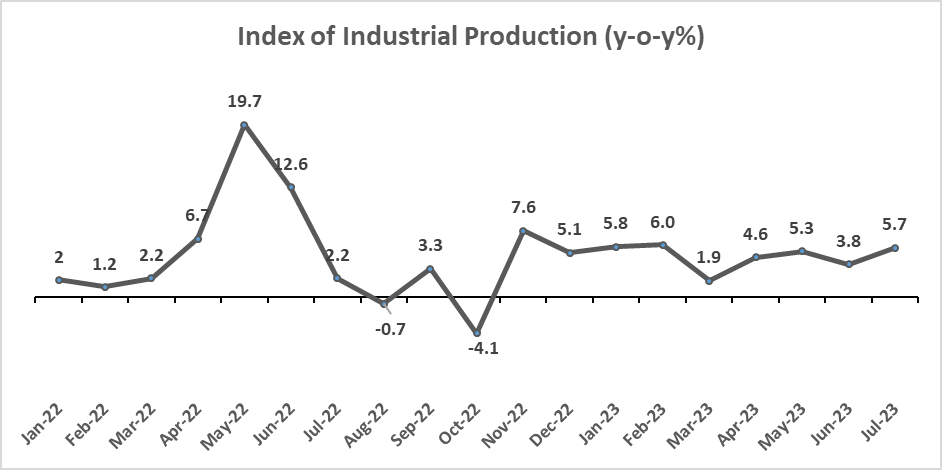

July’s IIP Report Highlights: In July, the IIP offered an optimistic outlook, reporting a growth rate of 5.7%. This notable improvement marked a significant bounce-back from June’s three-month low of 3.8%. Let’s delve into the details of this growth to gain a deeper understanding of the factors at play.

Sectoral Analysis: Breaking down the growth, you can see that the mining and electricity sectors substantially contributed substantially to the overall expansion.

| Component-wise breakup of all IIP Growth (y-o-y%) | |||||||

| Sector | Jan-23 | Feb-23 | Mar-23 | Apr-23 | May-23 | Jun-23 | Jul-23 |

| Mining | 9 | 4.8 | 6.8 | 5.1 | 6.4 | 7.6 | 10.7 |

| Manufacturing | 4.5 | 5.9 | 1.5 | 5.5 | 5.8 | 3.1 | 4.6 |

| Electricity | 12.7 | 8.2 | -1.6 | -1.1 | 0.9 | 4.2 | 8 |

| Use-based Classification | |||||||

| Primary Goods | 9.8 | 7 | 3.3 | 1.9 | 3.6 | 5.3 | 7.6 |

| Capital Goods | 10.5 | 11 | 10 | 4.4 | 8.1 | 2 | 4.6 |

| Intermediate Goods | 1.4 | 1 | 1.8 | 1.7 | 3 | 4.6 | 1.9 |

| Infrastructure/Construction goods | 11.3 | 9 | 7.2 | 13.4 | 11.3 | 12.9 | 11.4 |

| Consumer durables | -8.2 | -4.1 | -8 | -2.3 | 1.2 | -6.7 | -2.7 |

| Consumer non-durables | 6.5 | 12.5 | -1.9 | 11.4 | 8.4 | 0.3 | 7.4 |

| Industrial Output | 5.8 | 6 | 1.9 | 4.6 | 5.3 | 3.8 | 5.7 |

This robust performance in mining and electricity generation signals positive economic momentum. Equally promising is the resurgence in manufacturing, indicating a broader-based recovery.

Key Takeaways

Infrastructure and Construction: The infrastructure and construction goods segment continued its impressive run, posting an impressive 11.4% growth in July. Remarkably, this segment has maintained double-digit growth for four consecutive months. This sustained success can be attributed to the Central government’s substantial investments in infrastructure projects and increasing capacity utilization levels.

Consumer Goods Segment: Taking a closer look at the consumer goods segment, the picture is somewhat mixed. On one hand, the production of consumer durables continued to decline, presenting a challenging scenario. However, there was a silver lining as non-durable production witnessed a resurgence. This uptick suggests that certain pockets of positive consumer sentiment are emerging.

The July IIP report paints an encouraging picture of India’s industrial landscape. The bounce-back in manufacturing and robust mining, electricity, and infrastructure performance underscores the nation’s resilience and growth potential. While challenges persist in the consumer durables sector, the revival of non-durables production indicates a gradual recovery in specific consumer markets. Monitoring these trends and adapting economic policies will be crucial as we progress to ensure sustained growth and prosperity.

FAQs

What is the Industrial Production Index (IIP)?

The Industrial Production Index (IIP) is an economic indicator that tracks manufacturing activity across various sectors of the economy, offering insights into the overall economic health and activity levels.

Why is the July IIP growth significant?

July’s IIP growth of 5.7% is noteworthy as it marks a substantial rebound from June’s low of 3.8%, indicating positive momentum in the industrial sector.

What factors are driving the robust performance of infrastructure and construction goods?

The strong growth in the infrastructure and construction goods segment can be attributed to the Central government’s investments in infrastructure projects and increasing capacity utilization levels, boosting this sector’s performance.

Automotive Stocks in India Experience Volatility Amidst Speculations of Diesel Vehicle Tax Hike

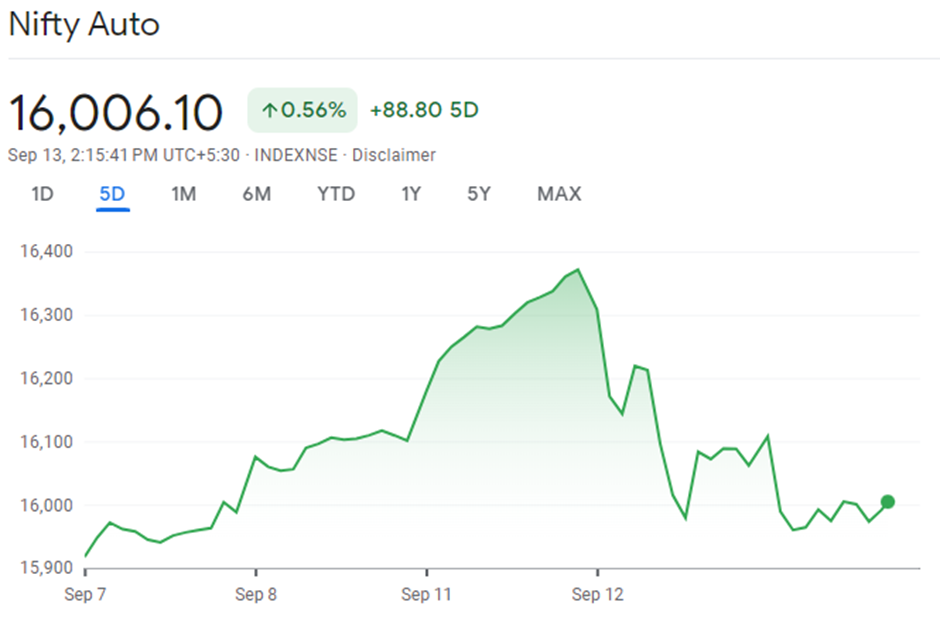

In the past 48 hours, the Indian automotive stocks have been on a rollercoaster ride, all thanks to an announcement by Nitin Gadkari, the Transport Minister, which left the industry and investors in suspense.

Speculations ran high as he hinted at the possibility of recommending a 10% GST increase on diesel-powered vehicles, proposing it as a “pollution tax.”

The rationale behind this proposed pollution tax is straightforward: the government aims to encourage consumers to shift away from traditional petrol and diesel vehicles and embrace cleaner, more sustainable fuel alternatives. However, Minister Gadkari later clarified his statement by asserting that no such proposal is currently under active consideration by the government. Still, he emphasized the urgency of actively adopting cleaner and greener fuels.

Key Takeaways

- Current Taxation Levels: As it stands, the government already levies a 28% tax on diesel vehicles, coupled with additional cess based on engine capacity, driving the total tax rate to nearly 50%. Any further increase in taxation for diesel vehicles is likely to substantially impact sales, given the already high tax burden on this segment.

- Impact on Auto Stocks: The uncertainty surrounding the potential tax hike has triggered fluctuations in the automotive stock market. Investors closely monitor the situation, as any increase in taxes could lead to decreased consumer demand and, subsequently, negatively affect the automotive sector’s performance.

- Long-Term Environmental Goals: While the 10% pollution tax is not currently on the government’s agenda, it aligns with broader environmental objectives. India is committed to reducing greenhouse gas emissions and has set ambitious targets, including achieving net-zero emissions by 2070. Such measures, if implemented, could play a crucial role in reducing the country’s carbon footprint and promoting sustainable transportation options.

In conclusion, the automotive industry in India finds itself at a crossroads as the government contemplates measures to promote cleaner and more sustainable transportation. The uncertainty surrounding the potential tax increase on diesel vehicles has led to fluctuations in stock prices, highlighting the industry’s sensitivity to policy changes. As the nation strives towards its environmental goals, it remains to be seen how these developments will shape the future of the Indian automotive sector.

FAQs

Is the 10% pollution tax on diesel vehicles already in effect?

No, the 10% pollution tax on diesel vehicles is not currently in effect. While it was mentioned as a possibility by Transport Minister Nitin Gadkari, there is no active consideration of this proposal by the government.

How will the potential tax increase impact consumers?

If the tax on diesel vehicles is raised further, it could lead to higher prices for diesel cars and potentially reduce consumer demand. This would result in increased costs for those considering diesel vehicles.

What are India’s long-term environmental goals regarding emissions?

India has set ambitious goals to reduce greenhouse gas emissions, committed to achieving net-zero emissions by 2070. The potential pollution tax aligns with these broader environmental objectives aimed at curbing pollution and promoting cleaner transportation alternatives.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.