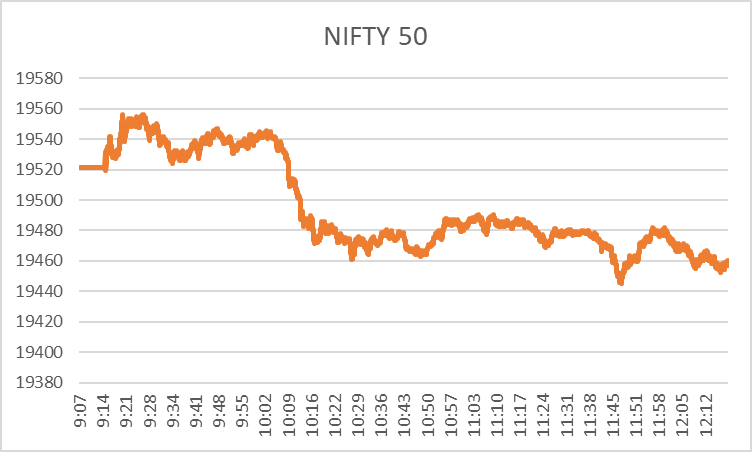

The first market session of the fourth week of October started negatively despite the festive rush. The broad market index Nifty 50 has plunged by 0.43% since the beginning of the share market today.

Increasing conflict between Middle countries and rising crude prices are still pivotal in dragging down global and domestic markets. All the sectors are in red in the share market today, with the most selling in the following three sectors.

NSE Sectors in the Red

Metals, media, and realty sectors are the main pulling force behind the market today, but PSU banks and oil & gas sectors are not behind. All these sectoral indices have dropped more than 1% until around 12 p.m.

NSE Media Sector Today

The media sector has tanked by 3.08% if we consider the Nifty Media Index, which tracks the industry.

- Network 18 Media & Investments Ltd. has tanked 5.92% until now. The massive fall can be attributed to the falling market and negative sentiments. However, it is about to release its quarterly results in the next two days, which can hurt its prices as investors are also worried about the market and the company’s performance.

- Hathway Cable & Datacom Ltd. comes next, which has dragged the sector down by another 5.41% fall. While the negative sentiments in the share market today have been primarily dragging this share too, its below-average performance in the second quarter can be a reason for the selling pressure it is witnessing.

NSE Metal Sector Today

The next sector witnessing the bloodbath is the metal sector, and its index – Nifty Metal has plunged by 1.90% until 12.08 a.m.

- Hindustan Copper Ltd. has been dragged by 5.19%, which is a complete effect of negative market sentiment and the prices of oil rising.

- Welspun Corp Ltd. has fallen by 4.87% until now. The company received a significant contract from exporting LSAW pipes and Bends the previous week, but the destination was Middle Eastern countries. This seems to be working negatively for the country mainly.

NSE Realty Sector Today

The sectoral index for the realty sector – Nifty Realty has fallen by 2.01% until now. Again, the negative market sentiment is in the play.

- Macrotech Developers Ltd., commonly known as Lodha, has tanked by 3.87% already until now. However, its quarterly results are due this weekend, but the market situation is affecting the most to pull the stock down.

- Swan Energy Ltd. has also fallen by 2.50%, and like most of the stocks above, it has fallen due to the negative sentiments prevailing in the market.

This festive demand and vibes could not help the markets from falling today like the previous few market sessions. The rising crude prices in the global market, inflicted by the Middle East conflict, have also taken over all the festive gains and plans.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/