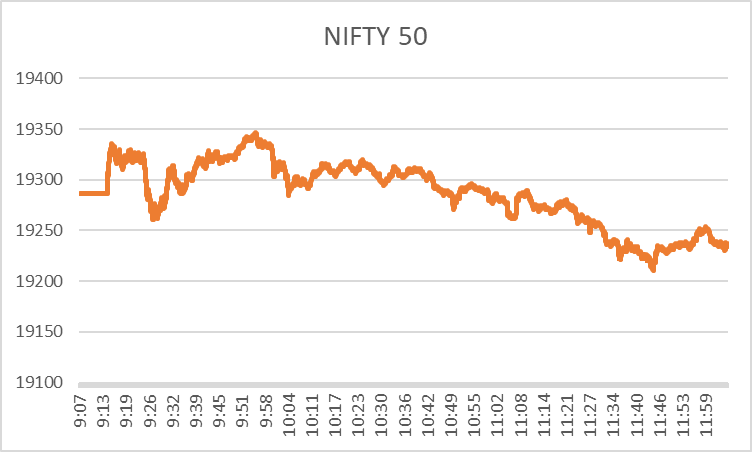

After a bloodbath during Monday’s market session, today, the Nifty 50 opened at 19286.45, slightly above the previous close of 19281.75. However, at 11.17 a.m., the broad market index was again red, shedding 0.04%.

The market’s selling pressure is super high as domestic investors are worried about the Middle East conflict and crude price volatility, while foreign investors are flying away as the US Bond yields rise. The share market today is being driven primarily by metals and PSU Banks and dragged down mainly by the media and healthcare sector.

NSE Trending Sectors in the Green

NSE Metal Sector Today

Though the market is sluggish, metal stocks are gaining today. The Nifty Metal Index has gained 1.08%, and the leading constituent stocks that have pulled it upward include –

- Jindal Steel & Power Ltd. has gained 2.52% until 11.28 a.m. following the release of its credit rating. The company’s ratings have been upgraded, and now it is an ‘AA’ rated company with a stable outlook. Another reason can be increased demand/ sales due to festive vibes.

- National Aluminium Company Ltd. has gained 2.23% as of 11.36 a.m., purely due to the upswing in the sector.

NSE PSU Bank Sector Today

PSU Banks are also in the green today after a few sessions of sluggishness. The Nifty PSU Bank Index has gained 0.77% until now, primarily led by –

- IOB, or Indian Overseas Bank, has gained 2.69%, again due to overall market movement.

- UCO Bank has gone up by 2.52% compared to the previous day’s closing price of 35.75 on the positive cues in the domestic market.

Sectors in the Red

NSE Media Sector Today

In the share market today, the sectors witnessing the maximum selling pressure, including Media and the Nifty Media index, have plunged by 0.83%.

- TV18 has been pulling the sector downward the most. Despite its promising quarterly results, the stock has fallen by around 2.22% until 11:50 a.m. The company’s consolidated revenue has increased by 22% on a YoY basis, but investors seem to be sceptical about this media stock and, thus, the selling pressure.

- Zee Entertainment also fell by 1.70%, pulling down the media sector in the share market today. This fall can be attributed to negative sentiments prevailing in the market.

NSE IT Sector Today

Information Technology, or the IT sector, is the next, falling by 0.64% if you consider the Nifty IT Index. IT giants like TCS and Infosys are the biggest losers in this sector.

- Infosys lost 1.02% until now, primarily due to unfavorable global cues. Moreover, the company has announced an investor conference too.

- TCS is the next, which has lost around 0.19% until now, dragging the overall sector downward.

At around 12 p.m., the fall in the share market today has furthered. Nifty 50 fell below the 19300 mark and is currently around 19234.70. In the first two hours of the market session today, the overall market was quite volatile. As different factors come together, the volatility appears to be significantly high.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/