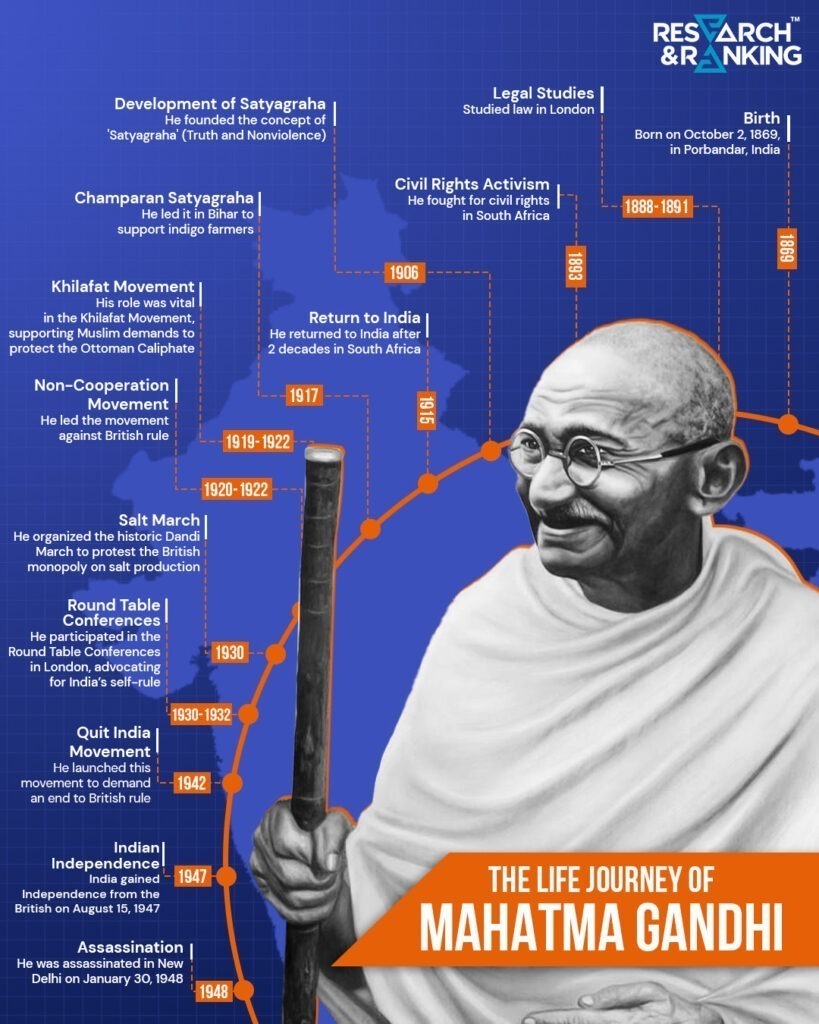

Mahatma Gandhi, the revered father of the nation, left behind a legacy of not only non-violent resistance but also invaluable lessons in personal finance.

In this article, we’ll delve into the financial wisdom imparted by Gandhiji and how we can apply it to lead a prosperous life.

Avoiding Impulsive Investments

Gandhiji’s famous words, “The world has enough for every man’s need, but not everyone’s greed,” hold true in personal finance. It’s easy to be enticed by promises of quick riches, but these often lead to financial ruin.

Instead, take the time to research and choose investments wisely. Look for stable opportunities with proven track records rather than being swayed by the allure of overnight success.

The Power of Discipline and Budgeting

Gandhiji was a paragon of discipline, a virtue of immense relevance in managing our finances. Creating and adhering to a budget is paramount. It ensures that we live within our means and channel resources effectively.

By tracking income and expenses meticulously, you gain a clear understanding of where your money goes. This empowers you to make informed decisions about saving and investing, ultimately leading to financial stability and growth.

Small Steps, Big Returns

Following in Gandhiji’s footsteps, start with modest investments. Even dedicating a nominal amount each month, like ₹ 1000 or ₹ 500, lays the foundation for substantial growth in the future. This approach allows you to learn the ropes of investing without taking undue risks.

Over time, as your confidence and knowledge grow, you can gradually increase your investment portfolio. Remember, it’s not the initial amount but the consistency and discipline you contribute.

Weathering Financial Adversities

Mahatma Gandhi faced monumental challenges, yet his unwavering faith and resilience saw him through. Similarly, in finance, setbacks are inevitable. Market fluctuations, unexpected expenses, and economic downturns are all part of the journey.

Patience and dedication are vital during these times. Resist the urge to make impulsive decisions based on short-term market movements. Instead, stay committed to your long-term financial goals, knowing that perseverance will ultimately lead to success.

Perseverance: The Key to Financial Success

Mahatma Gandhi’s perseverance was instrumental in securing India’s freedom. Likewise, unwavering determination in pursuing financial goals can surmount seemingly insurmountable obstacles. Setting realistic, achievable objectives and working steadily towards them is important. Remember, financial success is a marathon, not a sprint. Stay focused, stay committed, and you’ll see the fruits of your labor over time.

Define Your Financial Journey

Mahatma Gandhi had a crystal-clear vision for India’s freedom struggle. Similarly, a well-defined goal and a clear roadmap to attain it are imperative in finance. Start by asking yourself what you’re saving or investing for. Is it a comfortable retirement, a down payment on a home, or your child’s education?

Knowing why you’re allocating your resources and having a specific target in mind provides the necessary impetus to stay disciplined and focused.

Build your well-diversified portfolio

Create wealth now!

Build your well-diversified portfolio

Create wealth now!

Timely Financial Choices

Mahatma Gandhiji’s adage, “The future depends on what you do today,” rings true for financial decisions. Procrastination in critical financial choices, like starting a SIP or obtaining life insurance, can have far-reaching consequences. Take action now for a secure tomorrow.

Understand that every financial decision you make today sets the stage for your future financial well-being. Whether building an emergency fund or starting a long-term investment, the sooner you begin, the more you’ll reap the benefits.

Though rooted in a different context, Mahatma Gandhi’s principles offer timeless and practical financial guidance. With steadfast goals and adherence to these principles, managing finances becomes more attainable.

FAQs

Can following Gandhian financial principles really make a difference?

Absolutely. Gandhian principles emphasize discipline, patience, and long-term thinking, which are fundamental to achieving financial stability and success. They provide a solid foundation for making informed financial decisions.

How can I start with small investments?

Begin by allocating a small portion of your income towards investments. Even a modest sum, consistently invested over time, can yield significant returns. Consider options like mutual funds, which allow you to start with a minimal investment.

How can I define clear financial goals?

Start by identifying your objectives, whether saving for a home, retirement, or education. Then, outline the steps needed to achieve each goal. Be specific about the amount you aim to accumulate and your working timeline. Regularly revisit and adjust your goals as needed to stay on track.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/