The Reserve Bank of India (RBI) plays a pivotal role in shaping the sector’s direction through its monetary policies. The RBI recently introduced new policies that have stirred the banking waters, presenting challenges and opportunities for financial institutions.

Let us explore these new rules in-depth and evaluate their potential ramifications.

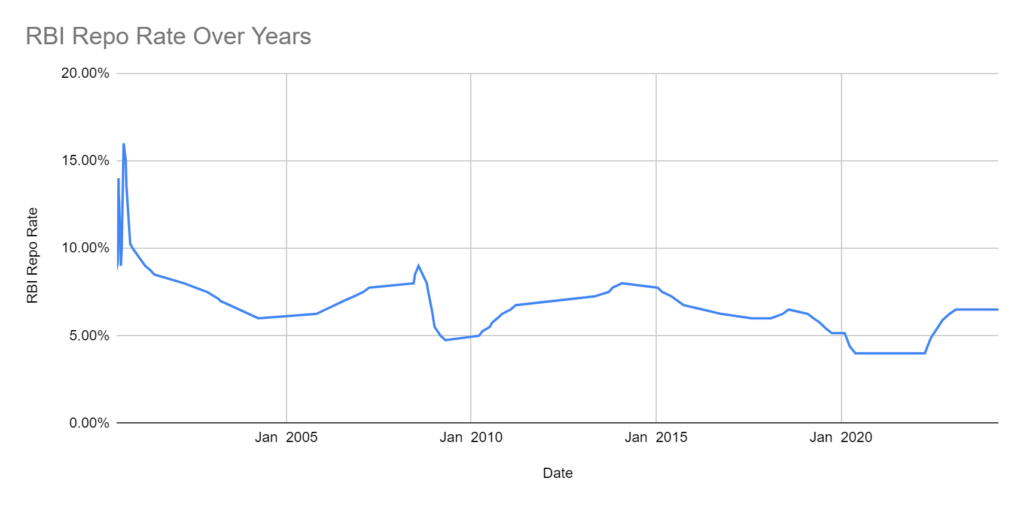

The Steady Hand of Repo Rates

Since February 2023, the RBI has maintained a steady repo rate of 6.5%, a decision that has been consistent for over a year. This unwavering stance indicates the central bank’s commitment to stabilizing the economy and controlling inflation within the 2-6% target range.

While this has provided a predictable environment for banks, it has also limited their ability to maneuver interest rates to attract borrowers or incentivize savers. This steady repo rate underscores the central bank’s dual objectives: gradually withdrawing monetary accommodation to ensure inflation aligns with the targeted trajectory while simultaneously nurturing the seeds of economic growth.

Navigating the Tightrope of Inflation

The RBI’s policies have been largely influenced by the inflationary trends. With headline inflation reaching a peak of 5.7% in December due to higher food prices, the central bank has been cautious. Although core inflation has seen a dip below 4% for the first time since the onset of the COVID-19 pandemic, the volatility of food inflation poses a significant risk to the anchoring of inflation expectations.

Revised Norms on Investment Portfolios

The RBI’s revised norms on investment portfolios, set to take effect in April 2024, have introduced tighter regulations on transfers, the inclusion of non-SLR securities, and the symmetric treatment of gains and losses. These revisions are expected to impact the classification principles and could lead to banks taking a more conservative approach to managing their investment portfolios.

Stricter Lending Norms

In addition to the challenges posed by the new RBI policies, banks are now grappling with stricter lending norms, particularly in project finance and unsecured personal loans. These measures aim to curb excessive risk-taking and foster a responsible lending culture.

Project Finance Under Scrutiny: The RBI has introduced new guidelines for project financing, emphasizing the need for due diligence and risk assessment. Banks must now set aside a higher provision for project loans, especially those prone to delays and cost overruns. Projects that fail to commence operations within the stipulated timelines could be classified as non-performing assets (NPAs), thereby increasing the financial burden on banks.

Unsecured Personal Loans Get a Closer Look: The central bank has raised the risk weights for unsecured personal loans from 100% to 125%. This increment means that banks must hold more capital against these loans, making them less attractive from a profitability standpoint. The move is expected to tighten consumer credit availability, potentially slowing the growth of personal loan portfolios.

These stringent lending norms are part of the RBI’s broader strategy to fortify the banking sector against systemic risks. While they may lead to an uptick in borrowing costs and a squeeze on credit expansion, they are also seen as crucial steps to ensure the long-term health and stability of the financial system. These policies make the loan lending process more difficult by raising the stakes for banks, which, on the other hand, mitigates the risk of another businessman disappearing with crores of loan money.

Prudential Framework for Income Recognition

The RBI has released a draft guideline titled “Prudential Framework for Income Recognition, Asset Classification, and Provisioning pertaining to Advances – Projects Under Implementation”. This document outlines a more stringent set of criteria for income recognition, which is expected to enhance the accuracy of financial reporting and asset quality assessment among banks. Following are the highlights of the draft:

- Prudential Framework: The RBI proposes a harmonized prudential framework for financing projects in various sectors, focusing on income recognition, asset classification, and provisioning for advances related to projects under implementation.

- Applicability: The directions apply to commercial banks, NBFCs, primary cooperative banks, and all-India financial institutions. NBFCs following IndAS are also guided by specific directions.

- Provisioning Norms: The draft outlines general and specific provisioning requirements for standard assets, DCCO deferred accounts, and non-performing assets during different project phases.

Digital Lending Transparency: With the burgeoning growth of digital lending platforms, the RBI has sought public feedback on the Draft Circular on “Digital Lending – Transparency in Aggregation of Loan Products from Multiple Lenders”. This initiative aims to foster a more transparent digital lending ecosystem, thereby protecting the interests of borrowers and investors alike. Following are the key highlights of the guidelines:

- Customer Centricity: Emphasizes the importance of customer-focused services and complete transparency in the credit intermediation process.

- Lender Identity Disclosure: Requires lending service providers (LSPs) to disclose the identity of potential lenders upfront to borrowers, enabling informed decision-making.

- Regulatory Framework: Introduces a regulatory framework for loan product aggregation by LSPs, ensuring adherence to the guidelines.

- Effective Date: Per the circular, the instructions will apply to digital lending operations from 2024.

- Fair Lending Practices: Effective April 1, 2024, the RBI has instituted revised fair lending practices. These practices are designed to curb the exploitation of penal charges on loan defaults, which some banks and non-banking financial companies (NBFCs) previously leveraged as a revenue-generating mechanism.

Need For These RBI Policies

The Reserve Bank of India’s (RBI) stringent policies, particularly those related to bad debt, respond to the growing concern over non-performing assets (NPAs) in the banking sector. The requirement for these policies can be attributed to several factors:

- Early Recognition of Financial Stress: The RBI has emphasized the importance of early recognition and reporting of defaults. This proactive approach allows banks to manage potential NPAs before they escalate.

- Expected Credit Loss (ECL) Provisions: The new rules require banks to make provisions based on ECLs, which are more stringent and require higher provisions for bad loans than previous rules. This ensures that banks are better prepared to absorb potential losses from NPAs.

- Alignment with International Standards: The RBI’s framework aligns with international banking supervision guidelines, promoting transparency and consistency in treating bad loans. In 2023, India reached Rs 2.09 lakh crore in bad loans, a huge amount of money higher than the entire GDPs of small countries like the Maldives, Bhutan, and several nations in the Pacific Islands like Tonga and Micronesia.

- Disincentives for Delays: The RBI has introduced disincentives for delays in implementing resolution plans, encouraging banks to address bad debts promptly.

- Withdrawal of Asset Classification Dispensations: The RBI has withdrawn asset classification dispensations, which means that restructured assets will no longer enjoy the benefits of being classified as standard assets. This will lead to a more accurate reflection of a bank’s financial health.

- Mandatory Inter-Creditor Agreements: All lenders must sign inter-creditor agreements, ensuring collective action and decision-making in resolving stressed assets.

These measures are designed to strengthen the banking sector’s ability to manage risks associated with bad debts and to ensure that banks maintain adequate capital buffers to withstand financial shocks. By enforcing these policies, the RBI aims to enhance the overall stability and resilience of the Indian banking system.

Impact of RBI Policies on Banks

The new RBI lending norms are expected to have varying impacts on different banks, depending on their exposure to unsecured loans and infrastructure financing. Here’s a summary of the potential effects:

- Public Sector Banks: Public sector banks will likely face a larger impact due to their higher exposure to infrastructure loans. They may see an increase in provisioning requirements, affecting their profitability and possibly leading to more selective credit distribution or increased lending rates.

- Private Lenders: Private banks, which tend to finance operational assets rather than funding projects under construction, might be less affected by the new norms for infrastructure lending. However, they will still need to adapt to the increased risk weights for unsecured personal loans.

- Non-Banking Financial Companies (NBFCs): NBFCs that have pivoted to unsecured lending categories such as personal and credit card loans may also experience challenges due to the higher risk weights. The net interest margins for such loans are declining because of steep competition, and the new norms could exacerbate this trend.

- Banks with High Unsecured Retail Credit: Banks with a significant portion of their portfolio in unsecured retail credit will need to absorb higher risk weights on their capital, which could lead to asset quality volatility.

- Concerns Over Project Viability: The new stringent rules for project finance, particularly in the infrastructure sector, have raised concerns among banks and NBFCs. Higher provisioning during construction phases and the classification of delayed projects as non-performing assets may hinder project viability and impede India’s capital expenditure momentum.

- Impact on Liquidity in Currency Markets: The new guidelines on hedging foreign exchange risk are anticipated to reduce speculative activity and the number of players in the currency exchanges. This could lead to a drying up of liquidity in the exchange currency pairs.

- The Impact on Bank Nifty and Stock Performance: The anticipation of RBI’s policy announcements has had a noticeable impact on the banking index, with Bank Nifty gaining nearly 300 points on the day of the announcement. Stocks of major banks like SBI and HDFC Bank saw gains of up to 2%, reflecting investor confidence in the stability of the banking sector’s outlook.

Impact on Investors and Account Holders

The implications of the RBI’s new regulations for investors are multifaceted and far-reaching:

Enhanced Stability in Investment Portfolios and Interest on Your Loans:

The RBI’s revisions, implemented in April 2024, are poised to introduce a more disciplined approach to asset classification. This includes establishing more rigorous transfer regulations and the symmetric treatment of gains and losses, thereby contributing to greater stability in investment portfolios.

If the RBI later decreases the repo rate to 5.5%, the banks may decrease your interest rate to 8.5%. On the flip side, if the repo rate increases, so does the interest rate of your loan, which can be difficult to pay off for many people. This can be seen as a trend with our global peers, who have increased their repo rates due to inflation causing a housing crisis in many countries, a prime example being the United Kingdom.

| Repo Rate In G20 Countries | ||

| Country | Last | Unit |

| Japan | 0.1 | % |

| Switzerland | 1.5 | % |

| Singapore | 3.42 | % |

| China | 3.45 | % |

| South Korea | 3.5 | % |

| Australia | 4.35 | % |

| Euro Area | 4.5 | % |

| Canada | 5 | % |

| United Kingdom | 5.25 | % |

| United States | 5.5 | % |

| Saudi Arabia | 6 | % |

| Indonesia | 6.25 | % |

| India | 6.5 | % |

| South Africa | 8.25 | % |

| Brazil | 10.5 | % |

| Mexico | 11 | % |

| Russia | 16 | % |

| Argentina | 50 | % |

| Turkey | 50 | % |

Safeguarding Against Unfair Practices: Investors stand to benefit from the prohibition of penal charges on loan defaults. This measure is anticipated to eliminate unfair financial penalties and promote a more equitable banking environment.

Greater Transparency in Digital Lending: The push for increased transparency in digital lending is expected to empower investors with better information, leading to more informed decision-making processes.

Conclusion

The new RBI policies present a complex scenario for banks. On one hand, they must navigate the challenges of a static repo rate and increased capital requirements. On the other, they have the opportunity to capitalize on the stability these policies bring to the market. As banks adjust to these changes, they will need to find innovative ways to maintain profitability while adhering to the stricter regulatory framework set by the RBI.

Indian banks face a cautious road ahead as they balance the dual objectives of growth and stability in a rapidly changing economic environment.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What is the RBI’s policy repo rate as of 2024?

As of 2024, the RBI has maintained the policy repo rate at a steady 6.50 percent.

How does the repo rate affect my loan interest rates?

The repo rate influences the interest rates on loans provided by banks. If the RBI increases the repo rate, banks may raise the interest rates on loans, making them more expensive for borrowers. Conversely, banks may lower the interest rates if the RBI decreases the repo rate, making loans cheaper.

How have RBI’s new policies affected Indian banks?

The RBI’s new policies have introduced a mix of challenges and opportunities. The steady repo rate at 6.5% since February 2023 has provided a stable environment but limited banks’ ability to adjust interest rates. Stricter norms on lending, particularly for project finance and unsecured personal loans, aim to curb excessive risk-taking and encourage responsible lending.

What are the new guidelines on income recognition and asset classification?

The RBI has released draft guidelines titled “Prudential Framework for Income Recognition, Asset Classification, and Provisioning pertaining to Advances – Projects Under Implementation,” which propose a harmonized framework for financing projects, focusing on accurate financial reporting and asset quality assessment.

What changes have been made to digital lending practices?

The RBI seeks feedback on the Draft Circular on “Digital Lending – Transparency in Aggregation of Loan Products from Multiple Lenders,” which aims to increase transparency and protect borrowers by requiring lending service providers to disclose potential lenders’ identities upfront.

What are the revised norms on investment portfolios?

Set to take effect from April 2024, the revised norms include tighter regulations on transfers, the inclusion of non-SLR securities, and symmetric treatment of gains and losses. This could lead to a more conservative approach by banks in managing their investment portfolios.

Why are stricter lending norms being implemented?

Stricter lending norms are being implemented to fortify the banking sector against systemic risks, ensure long-term health and stability, and prevent the risk of significant loan defaults. They include higher provisions for project loans and increased risk weights for unsecured personal loans.

Why are these RBI policies required?

These norms are required to address the concern over NPAs in the banking sector. They include early recognition of financial stress, ECL provisions, alignment with international standards, disincentives for delays in resolution plans, withdrawal of asset classification dispensations, and mandatory inter-creditor agreements.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/