The first week of October witnessed an interesting development in the Indian equities market – Foreign Portfolio Investors, commonly known as FPIs, withdrew their investments. This abrupt change follows several months of consistent buying by FPIs, raising questions about the factors influencing this shift.

Exploring the Recent Trend

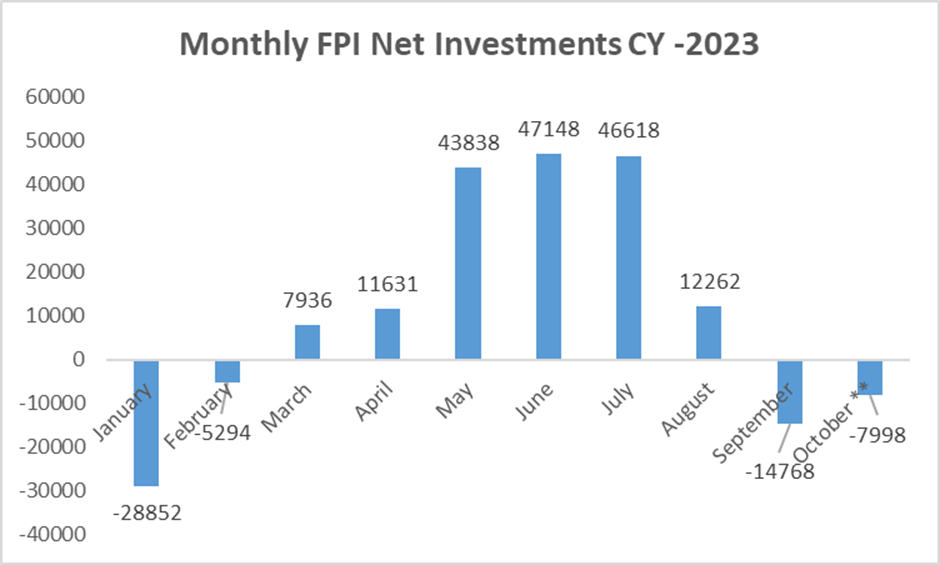

For the first two months of the calendar year, FPIs were net sellers. However, from March to August, they displayed unwavering interest in Indian equities, infusing a substantial sum of 1.74 lakh crore. It seemed like India had become an attractive investment destination for FPIs among emerging economies.

The Sudden Change

The turning point came in September and the first week of October when FPIs became net sellers again, pulling out a significant 14,768 crores and nearly 8,000 crores, respectively. This abrupt reversal in behavior sent shockwaves through the market.

Factors at Play

Multiple factors have contributed to this change in FPI sentiment. Firstly, the appreciation of the US dollar has affected their investment decisions. The steady rise in US bond yields has also been a significant influencer.

Notably, the 10-year US Treasury bond yield has recently surpassed 4.8%, marking the highest level in over 16 years. This figure is nearly 45% higher than the 25-year average yield of 3.3%. Such high yields have lured investors towards the safety of US bonds.

Key Takeaways

So, what does this mean for India’s financial landscape? The shift in FPI behavior has raised concerns about the Indian rupee’s depreciation. When US bond yields rise, FPIs tend to reallocate their investments away from Indian equities and into the more stable US bonds. This can subsequently exert downward pressure on the value of the Indian rupee.

The Domestic Cushion

Fortunately, the impact of FPIs selling off Indian equities has been somewhat offset by domestic institutional investors who have continued to buy Indian assets. This has provided a certain degree of stability in the market.

The Bigger Picture

To add to the complexity, other factors have come into play. Higher crude oil prices, persistent inflation, and elevated interest rates have made foreign investors cautious about their approach to the Indian market. These factors collectively influence their investment strategies.

Additionally, the ongoing conflict in Israel can potentially disrupt global trade and affect investor sentiments. Notably, Iran, as a major oil producer, could significantly impact crude oil prices in the near term. These global and domestic factors have made the Indian market dynamic and challenging.

In conclusion, India has experienced a significant shift in FPI behavior during September and October. The rise in US bond yields and other economic variables have prompted FPIs to reevaluate their investment portfolios. However, the resilience of domestic institutional investors has helped mitigate the impact to some extent.

FAQs

Why did FPIs turn into net sellers in October?

FPIs became net sellers due to the appreciation of the US dollar and the rise in US bond yields, which made US bonds more attractive investments.

Is India still an attractive destination for foreign investments?

Yes, India may still be attractive, but various global and domestic factors are currently at play, making the market more dynamic and challenging for investors to navigate.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/