In a surprising turn of events, a group called Hamas, backed by Iran, launched an unexpected attack on Israel. This attack resulted in the loss of more than 1,000 lives in Israel over the weekend.

This unfortunate incident has increased tensions in the Middle East and caused oil prices to rise. The impact of these events is being felt worldwide, affecting stock markets and causing people to turn to gold as a safe investment.

Rising Oil Prices and Inflation Concerns

With the rise in oil prices, concerns about inflation have surfaced. If tensions in the Middle East continue to escalate, it could strengthen the belief that the Federal Reserve will retain interest rates higher for an extended period.

Impact on India: This, in turn, may hurt India’s currency, the rupee, and may lead to foreign investors pulling their money out of Indian stocks. Many anxiously await how various asset classes will react to these events.

While there is no immediate need to panic, experts closely watch the situation as it develops. Any further escalation of the conflict could significantly affect Indian stocks due to increased oil prices, a more volatile rupee, and higher bond yields.

Market fallout: Israel’s TA-35 index plunges

To put things into perspective, Israel’s TA-35 Index, which tracks the performance of 35 leading companies on the Tel Aviv Stock Exchange, saw a steep 6.47% drop in its value.

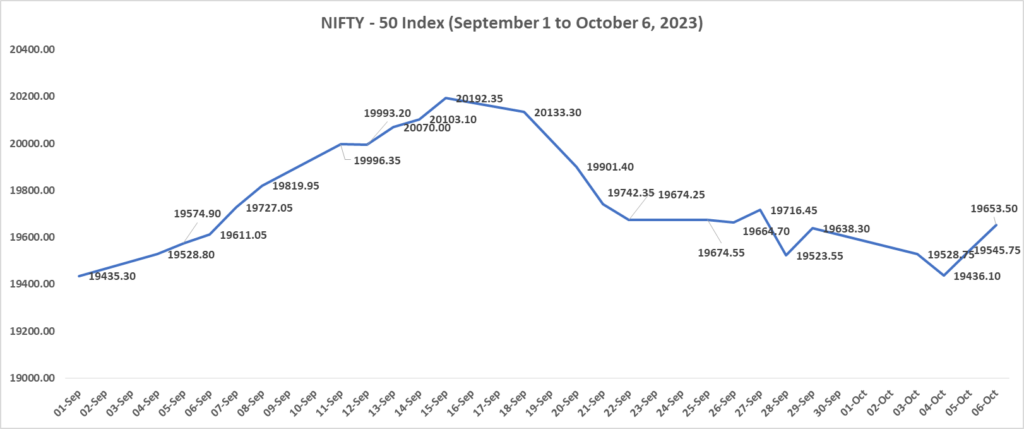

Impact on India: In India, the Nifty and Sensex, which are key benchmarks, traded around 3% lower than their record highs in mid-September. Even small and mid-cap indices in India were down by 2-3.5% due to selling by foreign institutional investors.

Expert insights

Samir Arora, founder and fund manager of Helios Capital Management, suggests waiting and assessing the situation for a few days before making any hasty decisions is essential. Unlike a similar situation in Ukraine last year, he’s not taking immediate action now.

Crude oil prices had recently fallen 9% from their yearly high, but the ongoing conflict raises concerns. Experts are even considering the possibility of a state actor being involved in the coordinated attacks on Israel.

Shiv Sehgal, President and Head of Nuvama Capital Markets, predicts that Indian markets may initially drop in response to events in Asia but could recover later. Volatility is expected to increase due to the impact on commodities like metals and oil.

An oil price rally may be driven by hedge funds covering their significant short positions. The West Texas Intermediate (WTI) futures trading market indicates that many investors are betting against oil. However, a rally may occur if the conflict continues as these investors cover their positions.

Deven Choksey, managing director of KR Choksey Shares and Securities, believes that OPEC nations will try to keep the oil price increase within a specific range to maintain their understanding with the US. However, a short-term increase of 10-12% in oil prices may occur due to the initial shock of the attack.

Foreign Investment Shift

If the conflict intensifies, there could be a shift in investor behavior. Foreign investors may sell riskier assets in emerging markets and seek safer havens like the US dollar and gold. This shift could lead to a weaker rupee and higher outflows of dollars, making Indian exports more expensive.

Foreign Portfolio Investors (FPIs)

Foreign portfolio investors (FPIs) had been actively investing in Indian shares, but last month, they started booking profits due to rising bond yields in the US. When US bond yields rise, FPIs move their money from riskier emerging markets to safer US treasuries.

The Road Ahead

The impact of the Israel-Hamas conflict on Indian stocks is uncertain, and the situation is evolving. Investors are closely monitoring the events and their potential consequences on various financial assets, and it remains to be seen how the global and Indian markets will react in the coming days. However, keep an eye out for updates.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How does the Israel-Hamas conflict affect the Indian Stock Market?

The Israel-Hamas conflict can affect the Indian stock market in a few ways. It can make oil prices go up, and that’s not good for India since we import a lot of oil. It can increase prices for things we buy, and the bank might raise interest rates. Also, foreign investors may take their money out of Indian stocks, making things shaky. Experts are keeping a close eye on this situation.

What happened to Indian stock prices because of the Israel-Hamas conflict?

The Israel-Hamas conflict made Indian stock prices drop a bit. Nifty and Sensex were not as high as in September.

How can the Israel-Hamas conflict affect investments from other countries in India?

The conflict can influence foreign investors. They could sell their investments in India and put their money in safer assets like the US dollar or gold. But it is too soon to do anything. Chances are the stock market will get back in shape sooner or later, and so will the foreign investments.

How useful was this post?

Click on a star to rate it!

Average rating 4.1 / 5. Vote count: 12

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.