Introduction

The Indian equity market is set for a noteworthy change as LTI Mindtree, a prominent player in the IT services sector, gears up to enter the prestigious NIFTY 50 index. This development comes as a consequence of the merger between HDFC and HDFC Bank, leading to the exit of HDFC shares from the index. The adjustment is scheduled to take place on July 12 and will be effective from July 13.

The Importance of NIFTY 50: Benchmark indices such as NIFTY 50 and Sensex 30 hold immense significance for investors, serving as reliable indicators of market sentiment. The NIFTY 50 provides a comprehensive overview of the Indian equity market’s performance by tracking the movement of the 50 largest and most actively traded stocks across diverse sectors. Consequently, any alterations in the composition of these indices carry considerable weight.

Changes in NIFTY 50 Composition: As HDFC makes its exit from the NIFTY 50, LTI Mindtree will step in to replace it. Simultaneously, Jindal Steel and Power will take LTI Mindtree’s place in the NIFTY Next 50. This reshuffling will also affect several other stocks across different indices as HDFC relinquishes its position.

Key Takeaway

Implications of LTI Mindtree’s Entry: The inclusion of LTI Mindtree in the NIFTY 50 index has significant implications for the company. One of the key advantages is the attraction of investments from passive funds such as index funds and exchange-traded funds (ETFs) that closely track the index. Moreover, companies enjoy enhanced visibility and the potential for market capitalization growth as a result of being part of a benchmark index.

Estimating Inflows and Outflows: Nuvama Institutional Equities, a renowned financial analysis firm, forecasts that LTI Mindtree’s inclusion in the NIFTY index will result in a net inflow of approximately $125-130 million. Passive inflows, estimated at around $172 million, are expected to flow into the company due to this development.

However, adjustments in the NIFTY Next 50 may cause outflows of approximately $50 million for LTI Mindtree. Consequently, taking into account both inflows and outflows, Nuvama Institutional Equities projects a net inflow ranging from $125 million to $130 million for LTI Mindtree.

Conclusion

LTI Mindtree’s entrance into the illustrious NIFTY 50 index highlights its growing prominence in the Indian equity market. As the company prepares for increased visibility and potential market capitalization growth, investors and analysts eagerly anticipate the adjustment in the index composition, scheduled to take place on July 12. The estimated inflows and outflows stemming from LTI Mindtree’s inclusion in the NIFTY 50 suggest a positive outlook for the company’s future prospects.

India’s Commercial Export Share Doubles, Powered by Robust Service Industry

Introduction

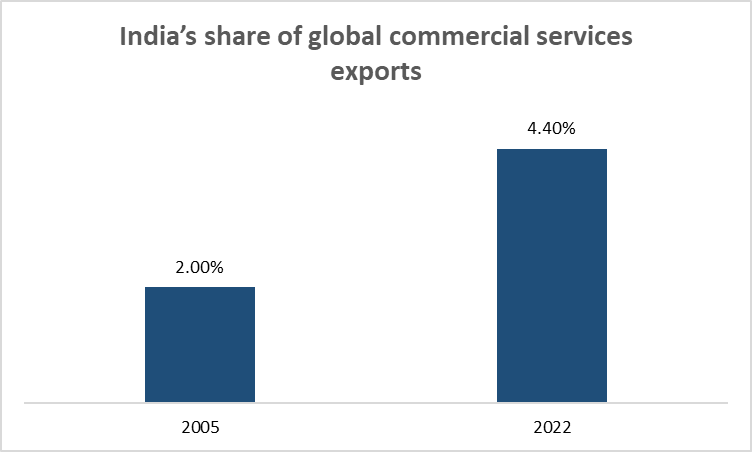

India has emerged as a global force in commercial services exports, making remarkable strides over the past decade. According to a recent report by the World Bank and World Trade Organization (WTO), India’s share of global commercial exports has doubled, reaching an impressive 4.4% in 2022, up from a modest 2% share in 2005.

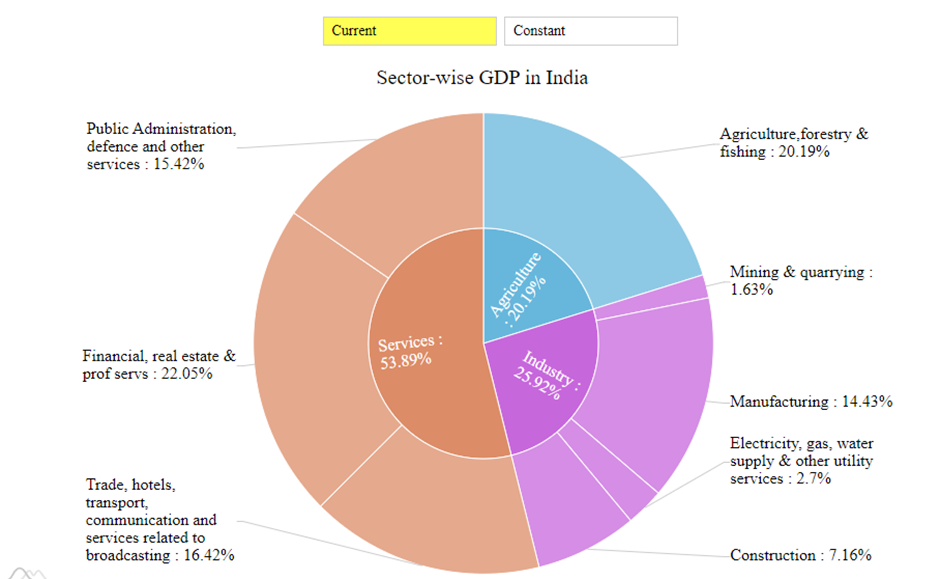

This surge in export contributions can be attributed to India’s thriving service industry, which has become the fastest-growing sector in the country and now accounts for over 50% of India’s GDP.

Impressive Trade Performance: The World Bank and WTO report highlights four developing economies that have stood out in terms of their outstanding trade performance in services: China, Hong Kong, Singapore, and India. These nations have experienced significant growth in their service exports, bolstering their overall economic growth and global market presence.

Booming Service Industry: India’s success in commercial service exports is largely attributed to its flourishing service industry. Despite a global economic slowdown, the sector has remained resilient, with services exports consistently displaying strength.

In May, while goods exports fell by 10.3% year-on-year, India’s services exports grew by a notable 7.7%, defying the prevailing global downturn. India has achieved this growth without relying on vast subsidies or tariff protection.

Key Takeaway

The Need for Upskilling and Development: As India continues its ascent in the global commercial export market, investing in upskilling and reskilling the workforce is crucial. To maintain competitiveness and capitalize on opportunities, India must prioritize the development of domestic service sectors, particularly in research and development (R&D). This strategic investment will ensure that the country keeps pace with rapid technological advancements, moves up the value chain, and sustains its upward trajectory.

Conclusion:

India’s exponential growth in global commercial services exports is a testament to its robust service industry and entrepreneurial spirit. Doubling its share from 2% to 4.4% within a decade demonstrates the country’s remarkable progress on the global stage.

However, to secure its position as a leader in the international export market, India must prioritize upskilling, reskilling, and investing in R&D to stay ahead of evolving technologies and remain competitive in the ever-changing landscape of global trade. By doing so, India can continue to unlock new opportunities, drive economic growth, and elevate its standing as a global economic powerhouse.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.