Introduction

Britannia is a brand many generations of Indians have grown up with, with several cherished and loved brands in India and the world. It has also created a lot of shareholder wealth over the last two decades since it was listed.

In this article, we try and understand the strengths of Britannia Industries and its prospects in the future.

Britannia Industries Overview

Britannia Industries is one of India’s leading food companies with a 100-year legacy and annual revenues of over INR 16,000 Cr. Britannia is a part of the Wadia group (headed by Nusli Wadia), which comprises companies like Bombay Dyeing, Bombay Burmah Trading Corporation, National Peroxide, Go Air, etc.

Britannia is among the most trusted food brands manufacturing well-known brands like Good Day, Tiger, NutriChoice, Milk Bikis, and Marie Gold, which are household names in India.

Britannia Industries’ product portfolio includes Biscuits, Bread, Cakes, Rusk, and Dairy products, including Cheese, Beverages, Milk, and Yoghurt. It sells its products through more than 26.8 lakh direct outlets and 28k rural preferred dealers as of March 2023.

Britannia Industries Journey

- 1892: Britannia Industry was founded in 1892 by a group of British businessmen with an investment of INR 295. Initially, biscuits were manufactured in a small house in central Kolkata. Here are some of the critical milestones in the history of the company.

- 1918: The Company was incorporated on 21st March as a Public Limited Company under the Indian Companies Act, 1913

- 1954: The development of high-quality sliced and wrapped bread in India was pioneered by the company

- 1955: Britannia launched Bourbon biscuits

- 1963: Britannia cakes hit the market

- 1979: Effective 3rd October, the company’s name was changed from Britannia Biscuit Co. Ltd. to Britannia Industries Ltd.

- 1983: Sales cross INR 100 crores mark

- 1986: Good Day brand was launched

- 1989: Executive office of the company was shifted to Bangalore

- 1993: Little Hearts and 50-50 was launched

- 1997: Britannia Incorporates the ‘Eat Healthy. Think better’ corporate identity

- 2000: Britannia was voted in the top 300 small companies by Forbes Global

- 2004: Britannia was accorded the status of being a ‘Superbrand.’

- 2014: Tie up with Amazon for the launch of its latest product, Good Day Chunkies, a premium chocolate chip cookie

- 2016: R&D facility launched in Karnataka

- 2017: Entered into a joint venture agreement with Chipita S.A., a Greek company, to manufacture and sell ready-to-eat delicious croissants.

- 2018: The Company celebrates 100 years of incorporation

- 2021: Good Day re-launched, inspired by the smiles of India

- 2022: The Company entered into a joint venture with BEL for cheese.

Britannia has faced numerous challenges throughout its journey, demonstrating resilience and commitment to innovation and sustainability. The company continues to evolve and adapt to changing market conditions while focusing on delivering high-quality products to its customers.

Britannia Industries Management Profile

Mr. Nusli Wadia is a well-known Indian industrialist. He is the Chairman of Britannia Industries and also the Chairman of Wadia group companies. He is also a Director on the board of several Indian companies. He was appointed to the Prime Minister’s Council on Trade and Industry between the period of 1998 to 2004. He has a distinct presence in public affairs and has been actively associated with leading charitable and educational institutions.

Mr. Varun Berry is the MD & Vice Chairman of Britannia Industries. He joined the company as Vice President and Chief Operating Officer on 1st Feb 2013. He has an experience of over 27 years with premier companies like Hindustan Unilever and PepsiCo, both in India and overseas, and a successful track record in leading start-ups, turnarounds, joint ventures, and growth businesses.

Mr. Ranjeet Kohli is the Executive Director & CEO of Britannia Industries. He joined the company on 26th September 2022. He has served in numerous senior leadership roles during his 25+ years career in sectors like FMCG & Retail and joins Britannia from India’s largest Food Services Company, Jubilant FoodWorks. He has an excellent track record of building & scaling up high-performance businesses and has been successful in shaping & executing winning strategies.

Mr. Venkataraman N is the Executive Director & CFO of Britannia Industries. He has over 35 years of rich experience and has been associated with Britannia Industries Limited since April 2007. Before this, he was heading the Finance functions of the two-wheeler and commercial vehicle businesses of Eicher Motors Limited. He leads Finance, Business Commercial, IT, Legal, Secretarial, and Business Strategy functions in Britannia and is also responsible for the Company’s Cost efficiency and IT Transformation initiatives.

Mr. Amit Doshi is the CMO of Britannia Industries. He joined the company on 17th Jan 2022. He is a marketing and sales leader with 19 years of diverse business & capability building experience in key innovation, brand marketing, digital, sales, and customer development roles. In his previous assignment, he was Director, Marketing and part of the Indian and Asia-Pacific Marketing leadership team at Lenovo.

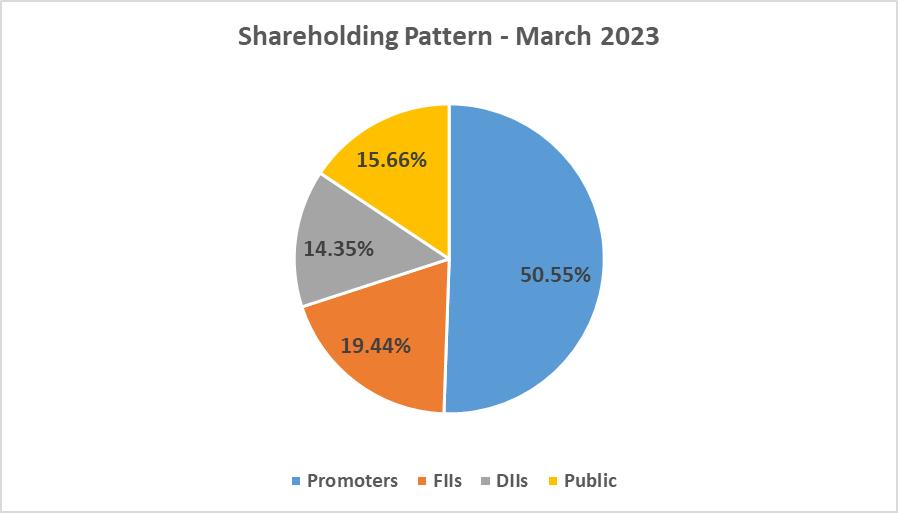

Britannia Industries Shareholding Pattern

Britannia Industries Company Analysis

Various business segments of Britannia Industries are as follows:

1. Biscuits – Good Day, Marie Gold, Milk Bikis, 50-50, Jim Jam, etc.

2. Dairy – Britannia Cheese slice, Britannia WINKIN Cow thick shakes, Britannia Come Alive Paneer, etc.

3. Snacking – Britannia Treat Croissant, Britannia Time Pass Chips, Britannia Treat Cream Wafer, etc.

4. Cakes – Britannia Muffils cakes, Britannia Cake Roll YO!, Britannia Cake Tiffin fun, etc.

5. Rusk – Toastea

6. Bread – Sandwich White bread, Fruit bread, 100% Whole Wheat Sandwich bread, etc.

Under Varun Berry’s leadership, Britannia has consolidated its position in the core biscuits segment, while its non-biscuits execution has been sub-par. Over the last decade, despite multiple initiatives, the company has yet to be able to diversify from Biscuits. Share of non-biscuits hovers at 22-25%. Further to its aspiration to become a ‘Total Foods Company,’ Britannia aims “to move from the side of the plate to the middle”. Post Covid-19, the share of biscuits has seen expansion.

The company will focus on clocking equal revenue contributions from its biscuits and non-biscuits segments for the next decade (per an interaction between Britannia Management & CNBC – TV18). It has set a target of expanding non-biscuits’ contribution to ~35% in the next three years, to 40-45% in five years, and to ~50% in the coming ten years, with expected growth acceleration in the non-biscuits segment.

For the growth of their other business segment, Britannia took some significant steps, like

- Entering into a joint venture with an international company like Chipita S.A. to boost the croissants segment

- Partnering with BEL to boost Dairy products like cheese.

- Britannia is also spending money on innovation and new product launches, including a new variety of cakes and dairy products.

Britannia Industries Fundamental Analysis

Revenue and Profitability

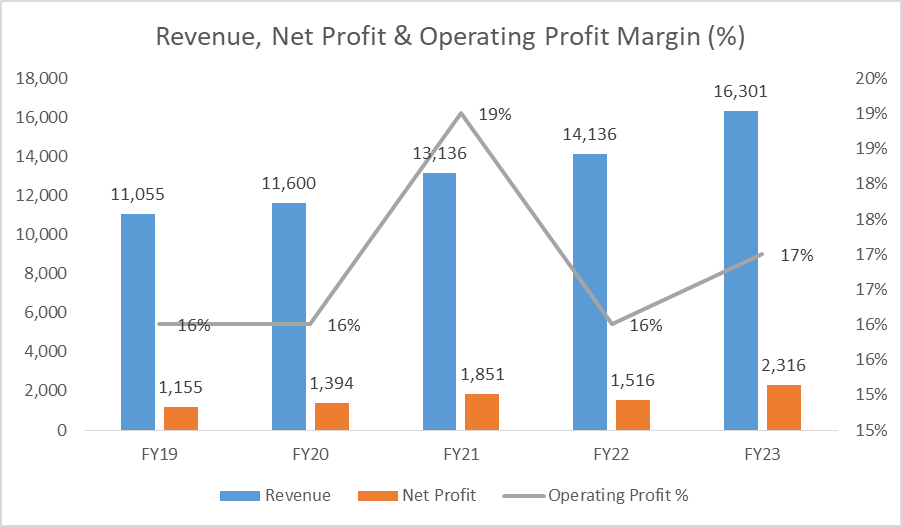

- The Company reported consolidated revenue from operations at INR 16,301 Cr in FY23, up 15.3% Y-o-Y compared to INR 14,136 Cr in FY22.

- It reported consolidated profit after tax (PAT) of INR 2,316 Cr for FY23, a 53% rise Y-o-Y.

- Operating margins have stayed in the 16%-17% range for the last five years except for FY21, when it reached 19%, driven by higher home consumption of packaged food during the pandemic.

Return on Capital Employed

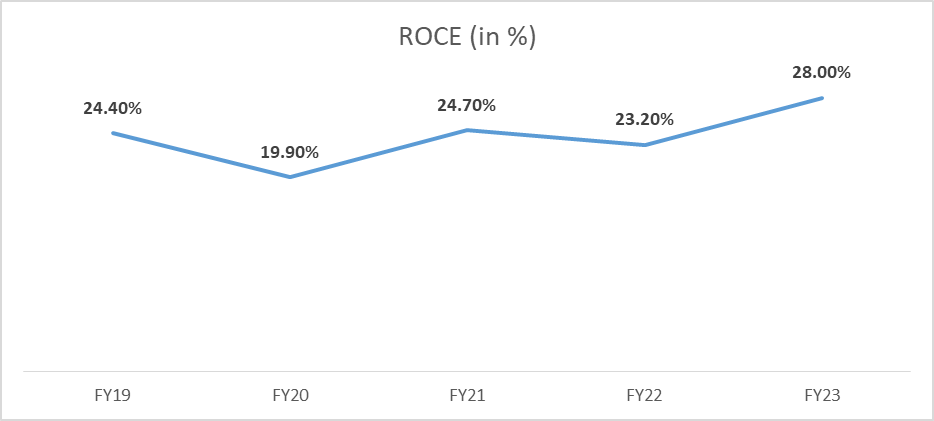

- Britannia Industries has been able to post consistent ROCE numbers on the back of its market leadership and ability to pass on price hikes to customers.

- The company delivered 28% ROCE in FY23 against 23.2% in FY22. The company saw margins improving significantly in Q3 and Q4 of FY23, which led to higher PAT and return ratios.

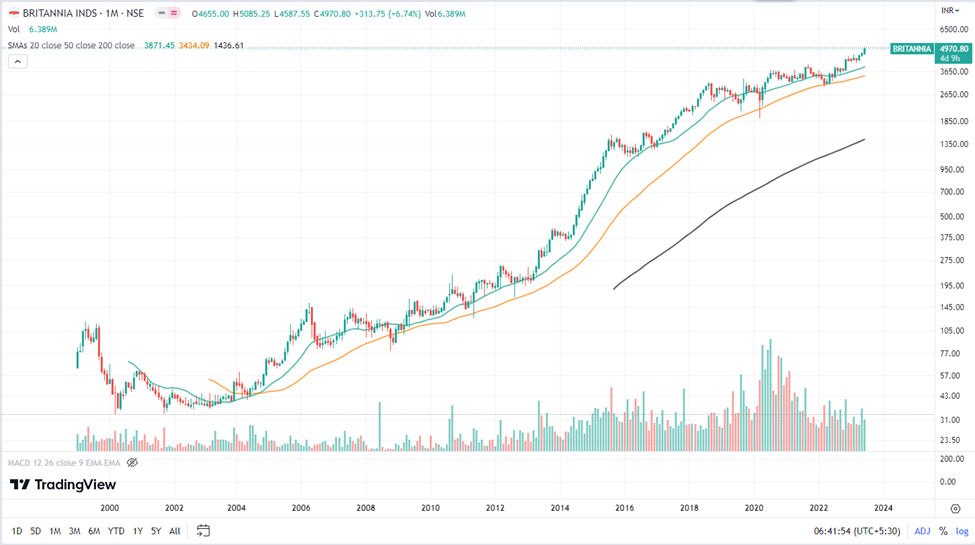

Britannia Industries Share Price History

Britannia Industries is a stock that hasn’t disappointed investors. The company continues to deliver exceptional performance yearly, reflecting Britannia’s share performance. Britannia has delivered a 10-year CAGR of 31% from INR 280 on 25th June 2013 to currently trading at INR 3,438 per share on 25h June 2023.

The stock price was around INR 63 per share in 1999 (accounting for stock splits and bonus shares), and since then, the company has multiplied investor wealth by a whopping 54x times. The business has built strong moats around its brands, distribution, and marketing, which may be challenging to beat.

Britannia Industries Share Price Target Growth Potential

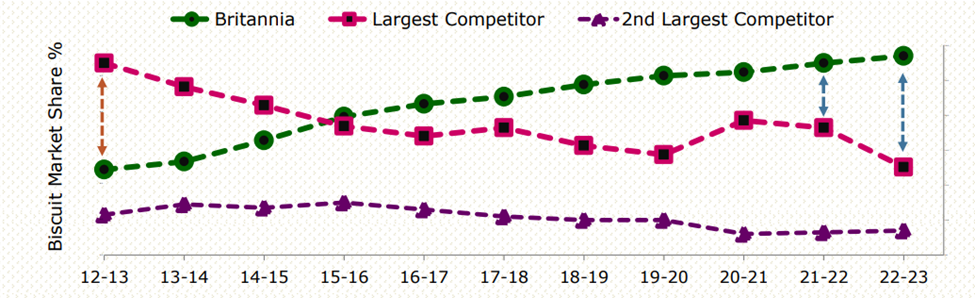

Biscuits market share continues to rise:

As seen in the chart below, Britannia Industries has consistently increased its market share and the gap between the largest and the 2nd largest player. It is well-positioned to continue its leadership march in the Biscuits category. Britannia follows a price-straddle approach, which hooks a consumer to the portfolio. This is unlike peer Parle — a strong mass-end player — which has yet to see success in the premium portfolio. On the other hand, ITC is looking to scale its business at the premium end with focused interventions.

Adjacencies provide new levers of growth:

The company has been charting its business diversification for a long time, albeit dragging its feet on the execution front (non-biscuits share remains at 22-25% of sales). Factors such as robust opportunity in core biscuits, Britannia’s limited domain knowledge in adjacencies, and negative margin mix have hurt its diversification agenda. Britannia is looking to secure partnerships with domain experts, like its tie-up in the croissants/cheese space. Management aspires to achieve 35% revenue from non-biscuits in three years, expanding it to 40% in five years and 50% in ten.

Heightened capex plan till FY25

The company plans a capex of INR 500-600 crore in FY2024 towards investment in enhancing dairy capacity, a new facility in Bihar, and investments in an existing facility in Ranjangaon. Capex will moderate from FY26 onwards.

Key risks:

Key risks include:

- Sustained inflation in key wheat flour

- A surge in competitive intensity (spike at the premium end),

- Company’s inability to execute in adjacencies, and

- Sustained rural slowdown

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considerea d as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What is the face value of Britannia’s share?

The face value of Britannia’s share is INR 1 per share.

What is the Market Cap of Britannia Industries?

The market cap of Britannia Industries is INR 1.19 trillion.

Is Britannia good to buy for the long term?

Britannia Industries is a market leader in the biscuits segment. It has been trying to diversify beyond biscuits into snacks, dairy products, bread, cakes, etc., expanding its distribution footprint consistently. The company has very aggressive growth plans, which could help it grow. However, you must be cautious and do your due diligence before you decide to invest in Britannia Industries.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3.4 / 5. Vote count: 9

No votes so far! Be the first to rate this post.