Introduction

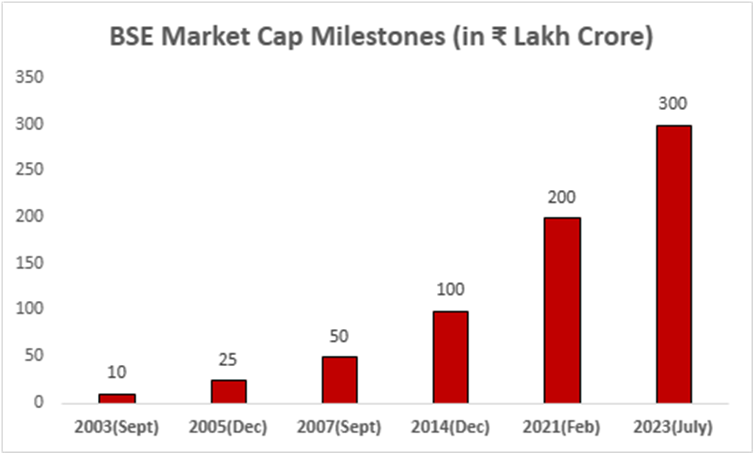

In a momentous achievement, the Bombay Stock Exchange (BSE) has witnessed an unprecedented surge in market capitalization, crossing the monumental milestone of Rs 300 lakh crore. This remarkable feat reflects India’s strong macroeconomic fundamentals, robust corporate earnings, and positive investor sentiment. With this accomplishment, India now stands as the world’s fourth-largest market by value, trailing only the United States, China, and Japan.

India’s Market Cap Journey

India’s combined market capitalization soared to an impressive Rs 300 lakh crore, achieving this milestone in a span of just two years and six months since February 2021. In contrast, the market cap took over six years to grow from Rs 100 lakh crore to Rs 200 lakh crore. This accelerated growth demonstrates the country’s resilience and potential for long-term economic expansion.

Global Ranking and Factors at Play: With a market value of nearly $3.6 trillion, India secures the fourth position worldwide, trailing behind economic giants like the United States, China, and Japan. It is important to note that Hong Kong, which appears as a contender for the fourth spot, owes its market cap largely to listed Chinese companies.

Key Takeaway

Investor Sentiment and Foreign Portfolio Inflows: Indian equities have remained a favored destination for domestic and foreign investors despite facing certain challenges. The country’s strong macroeconomic fundamentals and impressive corporate earnings have consistently attracted investors. Consequently, Foreign Portfolio Investors (FPIs) injected significant capital, with an inflow of $13.65 billion during the June quarter. This marks the highest investment made by FPIs since December 2020, showcasing their renewed confidence in the Indian market.

India’s Resilience as the Fastest-Growing Economy: India continues to be the fastest-growing major economy among its global peers. This achievement can be attributed to the country’s stable economic framework, favorable investment climate, and entrepreneurial spirit. These factors contribute to India’s overall appeal as a promising market for investors seeking long-term growth prospects.

Future Factors Shaping Market Trends: Several significant factors will influence market trends as we progress into the year’s second half. The monsoon season and its impact on inflation, state elections, and upcoming corporate financial results will all play a crucial role in shaping the direction of the market. Investors will closely monitor these developments to make informed decisions and capitalize on potential opportunities.

Conclusion:

BSE market capitalization crossing the landmark figure of Rs 300 lakh crore represents a remarkable achievement for the Indian economy. With strong macroeconomic fundamentals, robust corporate earnings, and positive investor sentiment, India has firmly established itself as an attractive investment destination.

As the country continues to thrive and navigate through upcoming challenges, it is poised to maintain its position as one of the fastest-growing major economies, making it an exciting prospect for domestic and international investors alike.

India’s Services Sector Shows Resilient Growth for 23rd Straight Month!

Introduction

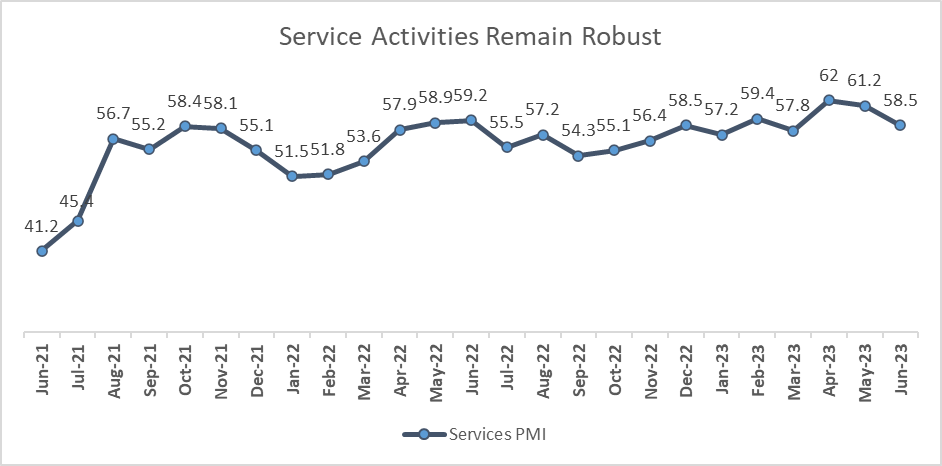

India’s services sector has continued its expansion streak for the 23rd consecutive month. However, according to the latest report from the S&P Global India Services PMI Business Activity Index, growth eased to a three-month low in June. Despite the slight moderation, the sector exhibited robust demand, with new business volumes rising at an accelerated pace. This blog post analyzes the recent data, highlighting the positive trends and the overall resilience of India’s services industry.

Services PMI and Composite PMI: The S&P Global India Services PMI Business Activity Index fell from 61.2 in May to 58.5 in June, signaling a slight slowdown in growth. Similarly, the manufacturing PMI also dipped to 58.7 in June from 57.8 in May. Consequently, the composite PMI reading, which considers the weighted average of manufacturing and service sector PMIs, declined to 59.4 in June from 61.6 in May.

Although these figures represent a decrease from the previous month, they still indicate a sharp pace of growth. Notably, a reading above 50 in PMI terms signifies expansion, and India has consistently maintained a score above this threshold for an impressive 23-month period.

Positive Demand Trends and Job Creation: Service providers in India continued to observe positive demand trends in June, leading to a stronger increase in new business volumes. This surge in demand has also resulted in additional job creation within the services sector. In fact, business optimism reached its highest level this year, indicating a favorable outlook for the industry’s future prospects. However, the global economic slowdown slightly impacted export growth, which fell to a three-month low.

Key Takeaway

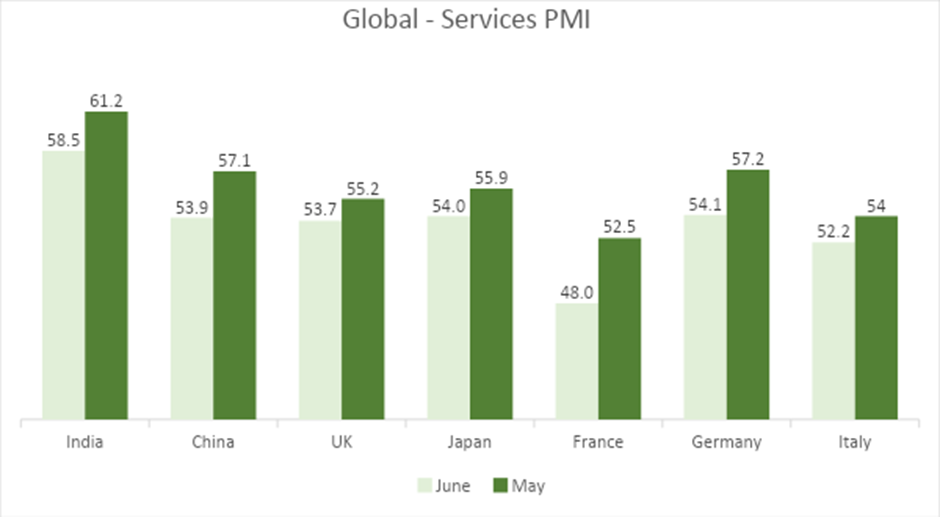

Analyzing the Numbers: Despite the easing of growth, the services sector in India remains resilient. The Services PMI of 58.5 still reflects strong demand and a faster growth pace of new business volume. Furthermore, this moderation aligns with trends seen among global peers. With a services PMI reading of 58.5, India continues to maintain the highest score among major advanced and emerging economies. Thus, even though there was a slight slowdown, the overall picture suggests positive growth and a resilient performance by India’s services industry.

Conclusion

India’s services sector, a key driver of the country’s economy, has extended its expansion phase for an impressive 23rd consecutive month. Although the growth rate eased to a three-month low in June, the sector demonstrated its resilience by maintaining strong demand and experiencing accelerated growth in new business volumes.

The moderation observed is in line with global trends, and India’s services PMI remains the highest among major advanced and emerging economies. It indicates a positive outlook for the industry’s future reinforcing its importance in driving India’s economic growth.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.