Introduction

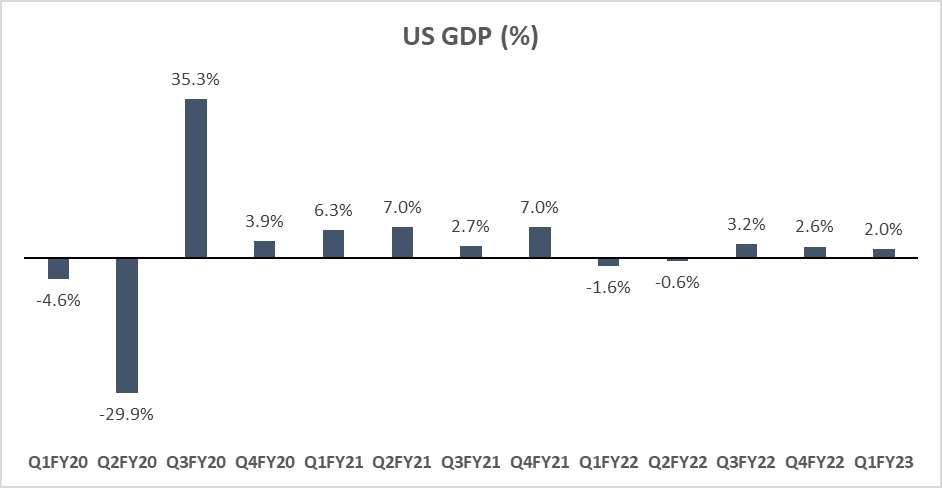

In the first quarter of 2023, the United States Gross Domestic Product (GDP) experienced a slight increase, signaling modest growth for the economy. According to the “third” estimate, the US GDP grew at an annual rate of 2.0 percent, showing a positive adjustment from the previous estimate.

This figure represents a positive adjustment of 0.7 percentage points from the “second” estimate, primarily due to upward revisions in exports and consumer spending. This growth can be attributed to various factors, including increased consumer spending, higher exports, and increased government expenditure. To provide some context, it’s worth noting that the real US GDP had also increased by 2.6 percent in the fourth quarter of 2022.

However, there are concerns about the sustainability of this growth, given certain challenges and uncertainties on the horizon.

Consumer Spending and Exports Drive Growth: One of the key contributors to the US GDP growth in Q1 2023 was the surge in consumer spending. It indicates that individuals are willing to spend more on goods and services, which boosts economic activity. Additionally, the U.S. witnessed a rise in exports, indicating that the country was successful in selling more goods and services to other nations. These factors played a significant role in propelling economic expansion during the quarter.

Government Expenditure and Business Investments Support Growth: Both state and local government spending, as well as federal government spending, witnessed an increase in the first quarter. This reflects higher levels of expenditure at these levels, which further stimulated economic growth. Furthermore, non-residential fixed investment, including spending on structures and equipment by businesses, also showed growth, indicating that businesses were confident about investing in their operations.

| Categories | Q1FY23 | Q42022 | Q32022 | Q22022 | Q12022 |

| Real GDP | 2.0% | 2.6% | 3.2% | -0.6% | -1.6% |

| Personal consumption | 4.2% | 1.0% | 2.3% | 2.0% | 1.3% |

| Non – Residential investment | 0.6% | 4.0% | 6.2% | 0.1% | 7.9% |

| Residential investment | -4.0% | -25.1% | -27.1% | -16.2% | -3.1% |

| Exports | 7.8% | -3.7% | 14.6% | 13.8% | -4.6% |

| Imports | 2.0% | -5.5% | -7.3% | 2.2% | 18.4% |

| Government spending | 5.0% | 3.8% | 3.7% | -1.6% | -2.3% |

Concerns over Inventory Investment and Residential Fixed Investment: While there were positive aspects to the US GDP growth, declines in two areas partially offset this progress. Private inventory investment, representing the change in the value of goods held in inventories by businesses, experienced a decrease.

It suggests that businesses may have been cautious in stockpiling goods, which could have implications for future production and sales. Additionally, residential fixed investment, encompassing housing construction and renovations, also declined, signaling potential weaknesses in the real estate sector.

Our Analysis

Uncertain Short-term Outlook: The short-term outlook for the economy remains uncertain. The Federal Reserve has implemented multiple interest rate hikes to curb inflation, which could have an impact on borrowing costs and consumer spending.

Moreover, the U.S. economy faces risks stemming from tighter monetary policy and challenges in the global economy, such as trade disputes and geopolitical tensions. These factors could potentially dampen future US GDP growth and introduce a degree of uncertainty into the economic landscape.

Gross NPAs Hit 10-Year Low of 3.9% in March 2023

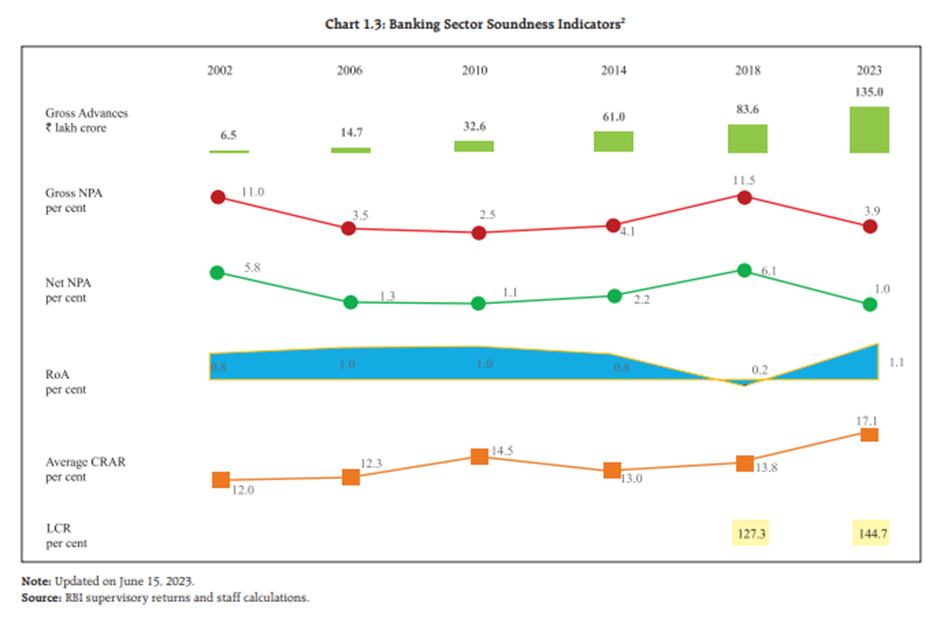

Non-Performing Assets (NPAs) have long been a concerning issue plaguing the Indian banking system. However, there have been notable improvements in bank asset quality over the years. In the recently released Financial Stability Report (FSR) by the RBI, it was revealed that the gross non-performing assets ratio for Indian banks continued its downward trend, reaching a ten-year low of 3.9% as of March 2023.

Furthermore, the RBI predicted that the Gross NPAs are expected to improve further to 3.6% in the baseline scenario. This positive trend in asset quality has had a significant impact on the market rally that India is currently experiencing.

The Journey from Crisis to Stability

If we take a look at the chart displayed, it illustrates how the asset quality of Indian banks began to deteriorate in the early part of the last decade. The situation reached its peak in March 2018 when the Gross NPAs accounted for 11.5% of gross advances. However, since then, there has been a consistent and steady improvement in bank asset quality.

Notable Improvements Across Sectors:

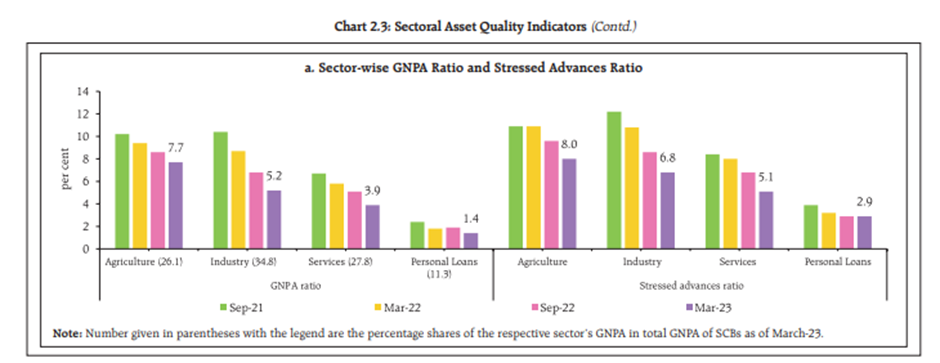

The positive developments extend beyond the overall asset quality of Indian banks. Various sectors such as agriculture, industry, services, and personal loans have also witnessed a decline in their Gross Non-Performing Assets (GNPA) ratios.

This indicates that the improvements in asset quality are widespread and not limited to specific sectors.

Our Analysis

Implications for the Market: The recent rally in the market can be largely attributed to the improving asset quality of Indian banks. As the banks’ non-performing assets continue to decrease, it instills confidence in investors, leading to increased investment and economic growth. This positive momentum has the potential to further strengthen the overall financial stability of the country.

Factors Contributing to Stability: Several factors have collectively positioned Indian banks to sustain the upturn in the credit cycle since early 2022. Robust earnings, adequate capital, liquidity buffers, and improving asset quality are some of the key elements that have contributed to the stability of India’s banking system. These factors have instilled confidence in both domestic and international investors, showcasing the resilience of the Indian banking sector.

Watchfulness in the Face of Global Tensions: While the Indian banking system has made significant strides toward stability, the RBI Governor has emphasized the need for vigilance. In light of the tensions present in the global banking system, financial sector regulators and regulated entities in India remain committed to maintaining stability.

This proactive approach ensures that any potential risks are addressed promptly, safeguarding the progress made so far. As the Indian banking sector continues its path to stability, it paves the way for further economic growth and prosperity.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.