The domestic stock market rallied today as treasury yields in the US continued its downward movement. The FIIs are returning to the Indian market, which is giving the required push to domestic investors, too.

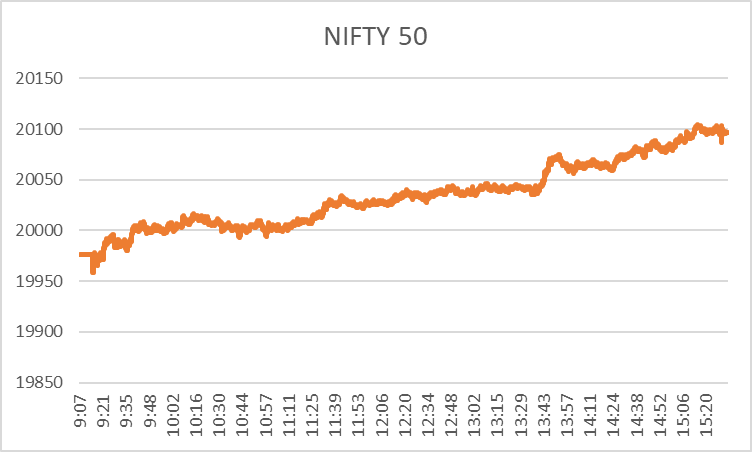

Today, Nifty 50 gained 1.04% and surpassed the 20000 mark. The broad market index peaked at 20104.65 and ended the day at 20096.60. Apart from mixed global cues, the banking sector pushed the market high today, IT and auto sectors also joined in.

Here are the top nifty gainers and losers today, which played a pivotal role in determining the course of the market today.

Top 5 Nifty Gainer Stocks Today

| Stocks | Previous day’s Closing Price | LTP | Change (%) |

| AXISBANK | 1,021.15 | 1,058.90 | 3.7 |

| HEROMOTOCO | 3,622.00 | 3,738.00 | 3.2 |

| M&M | 1,566.05 | 1,614.00 | 3.06 |

| WIPRO | 396.85 | 406.05 | 2.32 |

| HDFCBANK | 1,528.65 | 1,560.30 | 2.07 |

- Axis Bank: This private sector bank gained the highest amongst Nifty 50 stocks. It is a top nifty gainer with a rise of around 3.70%. The stock closed at 1058.90, up from its previous close of 1021.15. The overall surge in the banking sector pushed the stock upward, and the investors are waiting for institutional investors to meet, which will be rescheduled for December 4 and 5.

- Hero Moto Corp: The auto sector ended in green today, and this stock is the top Nifty gainer from the sector, rising 3.20% from yesterday’s closing price. The stability of oil prices is another reason behind the gain in auto sector stocks.

- M&M: Mahindra & Mahindra gained 3.06% today post rise in the auto sector. The positive sentiment in the domestic market also pushed the stock upward. It closed at 1614, up from its previous close at 1566.05. The company announced investors meet on 4 December, which is another factor working for the price gain.

- Wipro: With new launches like Continuous Compliance Solution and IT infrastructure for Stockholm Exergi AB, this IT stock gained 2.32% during today’s session. In addition, the stock price was influenced by the upswing in the IT sector to some extent.

- HDFC Bank: This stock went up 2.07% following the announcement of the upcoming investors meet and positive sentiments amongst investors especially in the banking sector today.

Top 5 Nifty Loser Stocks Today

| Stocks | Previous day’s Closing Price | LTP | Change (%) |

| ADANIENT | 2,423.50 | 2,394.00 | -1.22 |

| ONGC | 193.95 | 192 | -1.01 |

| DIVISLAB | 3,760.15 | 3,729.85 | -0.81 |

| NESTLEIND | 24,218.60 | 24,078.00 | -0.58 |

| EICHERMOT | 3,826.70 | 3,810.00 | -0.44 |

- Adani Enterprise: After giving solid profits to the investors yesterday, this Adani stock ended in the red today. The stock lost 1.22% today and closed at 2394, becoming the top Nifty loser. It seems the profit booking has begun for the Adani group stocks after yesterday’s massive rise.

- ONGC: Though oil prices are stable comparatively, however, as the OPEC meeting is around the corner, oil & gas companies are sceptical, and so are their investors. ONGC lost 1.01% during today’s market session as oil prices inched up in the global market yesterday.

- Divi’s Lab: This pharma stock lost 0.81% today due to the usual market movement. The stock closed at 3792.85 today, lower from yesterday’s 3760.15.

- Nestle India: The FMCG stock dipped 0.58% and closed at 24078. This is due to the slow FMCG sector today.

- Eicher Motor: Even though the auto sector rose today, this auto stock ended in red with a dip of 0.44%. This dip can be from increasing oil prices and the upcoming investors meeting on 4 December that the company announced today.

Wrapping up

The overall market poured gains today, except for the realty, media, and consumer durables sectors. The banking sector has been a clear winner today, and most of the nifty gainers are from the sector itself.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/