Introduction

In the wake of surging inflation, the Reserve Bank of India (RBI) has taken aggressive measures, leading to substantial interest rate hikes. This move has significantly impacted non-banking companies, as they now grapple with higher financial costs due to increased debt servicing. As Indian companies announce their Q1 earnings for FY24, the adverse effects of rising interest rates on corporate earnings have become a major concern.

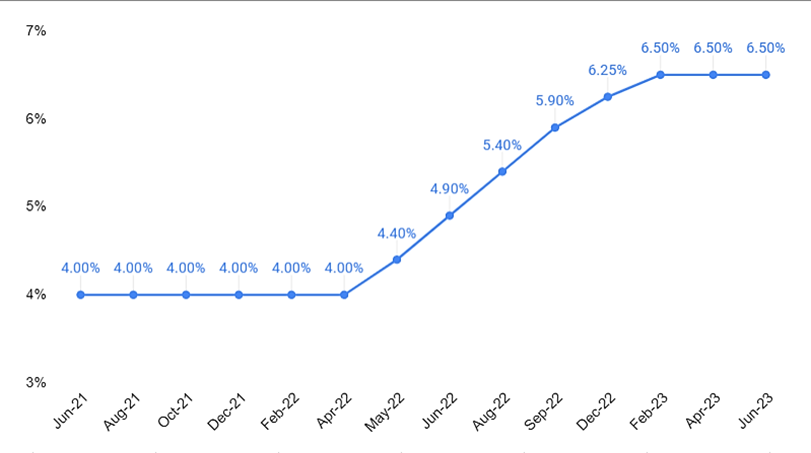

Interest Rate Hikes Impact Corporate Earnings: Since April 2022, the RBI has increased interest rates from 4% to 6.5% by February 2023. This spike has resulted in non-banking companies facing higher expenses in the form of interest payments on their loans and debts. Consequently, their earnings have been eroded, making it challenging to maintain profitability.

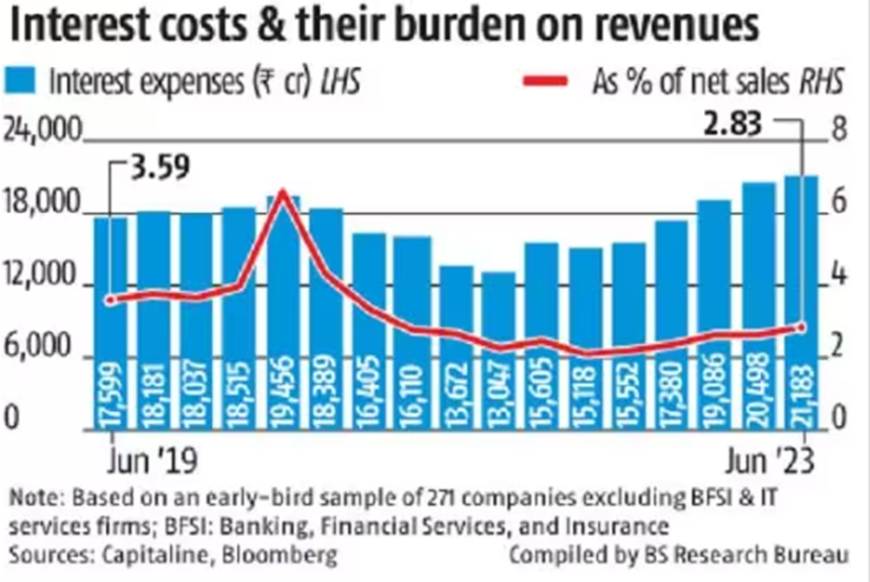

A Study on 271 Listed Companies: A recent study on 271 listed companies, excluding banking, financial, and IT sectors, shed light on the severity of the situation. The combined interest expenses for these companies surged by a staggering 36% compared to the same period last year. This surge is the most significant interest expense increase in the past three years. Additionally, the rise in interest burden has offset a substantial portion of the gains that resulted from the decline in commodity and energy prices during this period.

Interest Burden Lower Than Pre-Pandemic Levels: While the current interest burden is a cause for concern, it is noteworthy that it remains lower than pre-pandemic levels. Before the COVID-19 pandemic hit, interest expenses, as a percentage of sales, stood at 3.6% in 2019. This ratio declined in the early post-pandemic period due to lower interest rates and companies reducing their leverage. However, since the interest rate hike cycle began in April 2022, interest expenses as a percentage of sales have risen and now sit at 2.83% in the current quarter.

Key Takeaways

The data reveals a critical insight—despite cooling raw material and energy costs, rising interest expenses continue to trouble non-banking companies. While inflation remains a primary concern, there is hope that once it cools down below the RBI’s tolerance limit of 4%, and with a decline in rate hikes by the RBI, this trend could potentially reverse. Companies must remain vigilant and adapt to the challenging financial landscape to safeguard their earnings.

The RBI’s efforts to curb inflation through interest rate hikes have substantially impacted non-banking companies. As corporate earnings are announced for Q1 FY24, it is evident that rising interest rates remain a major challenge for businesses. Balancing the effects of inflation with interest rate policies will be crucial for companies navigating this volatile economic climate. As India’s economy evolves, companies must stay resilient and proactive to maintain financial stability.

US Economy Shows Resilience as Second-Quarter GDP Beats Expectations

Introduction

In our previous discussion, we highlighted the Federal Reserve’s efforts to manage inflation and avoid a sharp economic downturn while aiming for a ‘soft landing’ for the U.S. economy. With the recent release of the second-quarter GDP data, the economy appears to be more robust than anticipated.

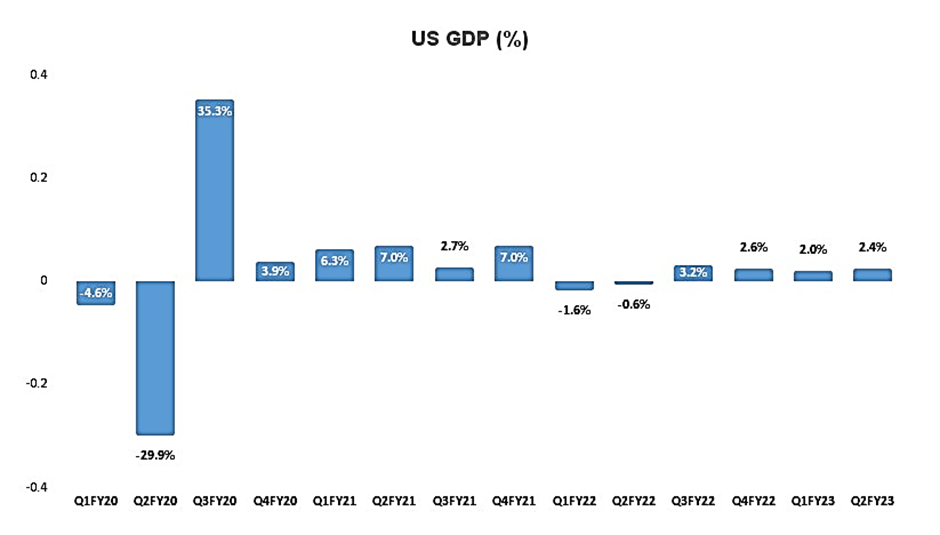

Strong Second-Quarter GDP Growth: The U.S. economy exhibited an impressive performance in the second quarter, with GDP growth reaching 2.4% – surpassing both economists’ predictions and the 2% growth rate recorded in the first quarter. This unexpected acceleration suggests that the nation’s economic health remains resilient, despite the Federal Reserve’s aggressive rate hikes.

Drivers of Growth: The rise in GDP can be attributed to several key factors contributing to economic expansion. Notably, there was an increase in consumer spending, non-residential fixed investment, and state and local government spending. While consumer spending in the second quarter grew slightly slower at 1.6% compared to the first quarter, it remained robust. The growth was fueled by spending on services, including vacations, restaurant meals, and entertainment events like concerts featuring artists such as Taylor Swift.

| Categories | Q22023 | Q12023 | Q42022 | Q32022 | Q22022 | Q12022 |

| Real GDP | 2.40% | 2.00% | 2.60% | 3.20% | -0.60% | -1.60% |

| Personal consumption | 1.60% | 4.20% | 1.00% | 2.30% | 2.00% | 1.30% |

| Non – Residential investment | 7.70% | 0.60% | 4.00% | 6.20% | 0.1% | 7.9% |

| Residential investment | -4.20% | -4.00% | -25.10% | -27.10% | -17.80% | -3.10% |

| Exports | 10.80% | 7.80% | -3.70% | 14.60% | 13.80% | -4.60% |

| Imports | -7.80% | 2.00% | -5.50% | -7.30% | 2.20% | 18.40% |

| Government spending | 2.60% | 5.00% | 3.80% | 3.70% | -1.60% | -2.30% |

Positive Indicators: Overall, the latest GDP data reaffirms that the U.S. economy is currently in good shape. Low unemployment rates and continued strong job creation further bolster this positive outlook. (Chart: U.S. Economic Indicators)

Uncertain Short-Term Economic Outlook: Despite the encouraging signs, concerns about the sustainability of this growth persist. The short-term economic outlook remains uncertain due to several factors, including tighter monetary policy and challenges in the global economy, which may impact future GDP growth. While the Federal Reserve no longer predicts a recession in 2023, they are cautiously anticipating a noticeable slowdown in growth later this year.

The U.S. economy has demonstrated its resilience with a strong showing in the second quarter, outperforming expectations and maintaining a solid foundation. However, the short-term outlook’s uncertainties should not be ignored, as risks from tighter monetary policies and global economic challenges loom. As we move forward, monitoring these factors will be crucial in understanding the future trajectory of the U.S. economy.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.