Introduction

Talk about lubricants, and Castrol is one brand that immediately comes to mind. This 100-year-old brand is the market leader in its segment and continues to be a cash-generating machine. However, the share price of Castrol has delivered inferior returns for its shareholders in the last ten years.

Let us understand more about Castrol India

Castrol India Overview

Castrol India made its debut in the Indian market in 1910, with its first branch office located in Bombay. Castrol India Ltd is a subsidiary company of Castrol (a global leader in lubricants, part of BP group) that produces and distributes lubricant products, including premium lubricating oils and greases, antifreeze and coolant, engine oils, compressor oils, and more.

Castrol has leadership positions in most segments, including passenger car engine oils, 4-stroke motorcycle engines, and multi-grade diesel engines. Castrol offers a range of favored brands, including Castrol CRB, Castrol GTX, Castrol Activ, Castrol MAGNATEC, and Castrol VECTON. Millions of consumers and customers trust these brands throughout the country.

Additionally, the company operates in specialized markets such as High-performance Lubricants and metalworking fluids, which are used in various industries, including automotive manufacturing, mining, machinery, and wind energy.

Castrol has an extensive manufacturing and distribution network in India, with three manufacturing plants in Silvassa, Patalganga, and Paharpur and a distribution network of 420 distributors who serve customers through over 105,000 retail outlets. Castrol also serves its customers through exclusive outlets, including Castrol Bike Points, Castrol Pitstops, Castrol Rural Outlets, and Castrol Authorized Service Associates (CASAs).

Castrol India Company Journey

Castrol India has had a long and illustrious history. Here are some of the critical milestones in the company:

- 1910: C.C. Wakefield’s automobile lubricants were introduced in the Indian market

- 1919: C.C. Wakefield sets up a branch office in Bombay, its first overseas branch

- 1960: C.C. Wakefield changed its name to Castrol Ltd. The Indian branch’s name changes accordingly

- 1961: Manufacturing operations have commenced in India at a blending plant in Wadala, Mumbai.

- 1966: Burmah Oil acquires Castrol globally

- 1979: Indian branch incorporated with a new name, Indrol Lubricants & Specialties Pvt Ltd

- 1983: Indrol becomes a public limited company, with Castrol UK holding 40% equity

- 1990: Indrol Lubricants changes its name to Castrol India Ltd

- 2000: BP takes over Burmah Castrol. Castrol India becomes part of the BP Group

Castrol India Management Profile

Mr. R Gopalakrishnan has been the Chairman of Castrol India since 17 October 2000. He is also an Independent Director & Non-Executive Chairman of Castrol India. He has extensive corporate experience of nearly 55 years, of which 31 years were with Hindustan Lever Limited (HLL) / Unilever and 18 years were with Tata Group. He has a rich experience of over 34 years of serving across the boards of several companies. He studied physics at St. Xavier College, Kolkata, and did his engineering at the Indian Institute of Technology (IIT), Kharagpur. Later, he completed an Advanced Management Program at Harvard Business School, USA.

Mr. Sandeep Sangwan has been the Managing Director of Castrol India since January 2020. Before joining the Company, he worked with Gillette and P&G for over 20 years in India, the Middle East, China, and Europe, where he held several leadership roles in sales, marketing, and P&L delivery. He is an alumnus of the Indian Institute of Management (IIM), Lucknow, and Regional Engineering College (NIT), Kurukshetra.

Mr. Deepesh Baxi has been the Chief Financial Officer and Whole-time Director of Castrol India since 1st January 2021. Deepesh is also responsible for strengthening relationships with CIL’s investors, analysts, and bankers. Before this role, Deepesh worked as a Financial Controller for Castrol’s global business. Deepesh is a Chartered Accountant awarded CXO of the Year in January 2020 by the Institute of Chartered Accountants of India (ICAI). He is an alumnus of the Indian Institute of Management (IIM) Ahmedabad and holds a Certified Internal Auditor (CIA) certification from the Institute of Internal Auditors, USA.

Mr. Mayank Pandey has been the whole time Director of Castrol India since 09 August 2021. Mayank Pandey has over 20 years of industry experience, of which he has spent the last 14 years at BP, having joined Castrol in September 2007. Mayank heads the supply chain operations for India. He is responsible for developing and implementing a robust Supply Chain strategy to enable business growth for Castrol India and operate a safe, reliable, and efficient supply chain. Mayank has an MBA from the SP Jain Institute of Management and a Mechanical Engineer from the Harcourt Butler Technological Institute.

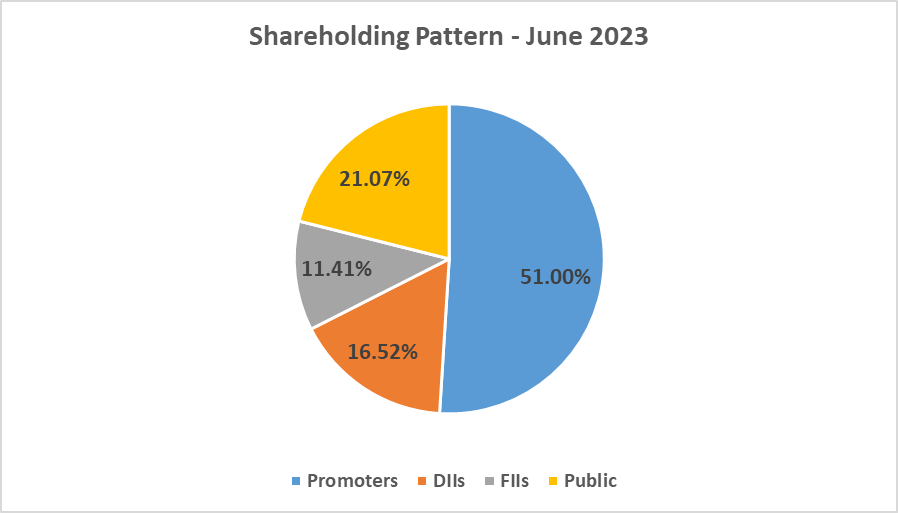

Castrol India Shareholding Pattern

Castrol India Company Analysis

India’s lubricant market operates in three broad segments: Automotive, Industrial, and Marine. All three segments include players from National Oil Companies, international oil majors, and several local companies.

Castrol India Limited operates across all three segments and holds a leading position in retail automotive, with a notable presence in specialized industrial fluids.

Castrol India is keen to support the transition to electric vehicles (EVs) within the automotive lubricant segment. It is working with its industry partners to bring forth the next generation of technologies while diversifying its traditional lubricants business.

The sales of electric vehicles (EVs) in India currently account for less than 1% of total new car sales (Source: SIAM). Considering that the penetration of cars in India is still low and is poised to grow further, the Company foresees continued demand for internal combustion engines (ICE) vehicles till 2040, alongside EV market growth.

Castrol India Fundamentals

The core business of Castrol India is to manufacture and distribute automotive and industrial lubricants in the market. Castrol India benefits from its parent company, Castrol Worldwide, which operates in more than 120 countries, providing access to global technology innovations and management expertise. Additionally, Castrol India is a reliable supplier to OEMs such as Maruti Suzuki, Tata Motors, Mahindra, JCB, Audi, and Bosch.

Castrol is exploring opportunities to provide solutions and services to complement its core lubricants business. So, Castrol India made some strategic decisions to grow its business, like entering into partnerships with auto companies to add incremental volume growth, expanding its presence in service and maintenance space, increasing Castrol Auto service (CAS) outlets to over 300 across about 100 cities in India, and have 5,000 Castrol bike point across India.

Castrol and Mahindra Insurance Brokers recently announced an alliance for Castrol auto service workshops. The offer will allow Castrol Auto Service (CAS) workshops to distribute eligible vehicle insurance policies, and suitable CAS workshops will be able to register as cashless claim sites with leading insurance companies.

Castrol India is also expanding its portfolio into the Auto care segment with various products. Their new range of products includes Castrol chain cleaner, Castrol chain lube, Castrol 3-in-1 shiner, Castrol 1-Step Polishing Compound, and Castrol Anti-Rust Lubricant Spray.

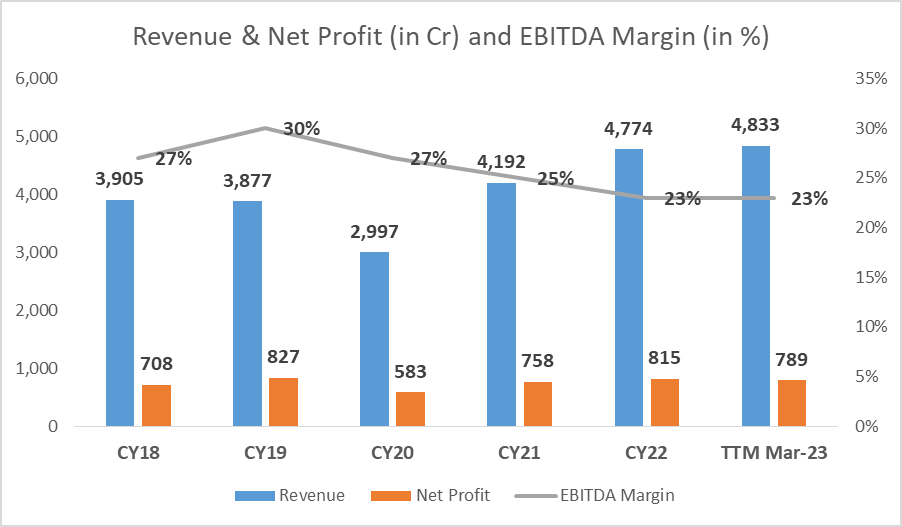

Revenue and Profitability

Castrol has struggled to deliver revenue and profit growth over the last decade. For the first quarter (Q1) ended 31 March 2023, the Company registered Revenue from Operations of INR 1,294 Cr., marking a growth of 5% compared to INR 1,236 Cr in 1Q 2022 (corresponding quarter in the previous year) and an increase of 10% from INR 1,176 Cr in 4Q 2022 (last quarter).

Sales growth CAGR for CY18 to CY22 has been a modest 5.15%. Profit before Tax for 1Q 2023 stood at INR 288 Cr, a drop of 7% compared to INR 311 Cr in 1Q 2022 and 16% higher than INR 248 Cr in 4Q 2022. Net PAT growth CAGR for CY18 to CY22 has been a mere 3.58%, even less than the sales growth.

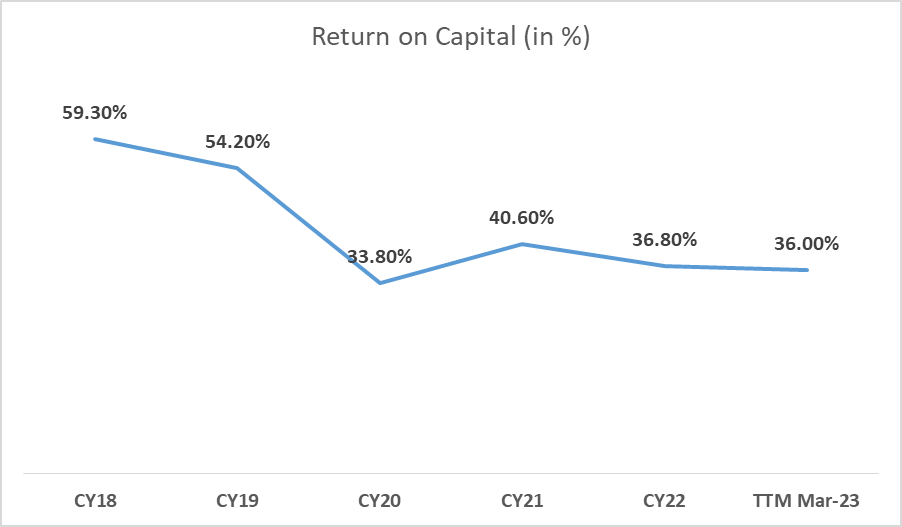

Return on Capital Employed:

While the growth has been modest, the company delivers 35%+ ROCE yearly. Although the ROCE has reduced from 50%+ odd levels in CY18 to 37% in CY22 due to the reduction in margins, it remains pretty high.

The company is cash-rich and consistently delivers high operating cash flow. That is why it has very low borrowing and, hence meager debt-to-equity ratio. It uses its cash reserves to pay handsome dividends to shareholders.

Castrol India Share Price History

While Castrol India is highly profitable, cash flow generating, and pays enormous dividends, the stock price performance has been dismal over the last ten years.

10-year share price CAGR has been -1%. The stock was trading around INR 160 per share on 30th July 2013 and trades at around INR 145 as of 27th July 2023. One of the reasons for the dismal performance of the stock price can be attributed to the low growth in revenue and profitability of the business.

Castrol India Strengths & Risks

Castrol has always enjoyed its brand legacy, and it will be able to secure its profitability with a better product mix, cost control, and the launch of advanced products with better realization in the future. Some of the positive triggers for the stock going forward are:

Lubricant demand is expected to grow at low to low-single digits in the next couple of years, led by higher demand from the personal mobility space and a revival in demand from CVs on account of overall recovery in the Indian economy.

Castrol India is expanding into new areas, such as Castrol Auto Services, and forming partnerships, like the one with Jio-BP (which may necessitate additional investment). These strategic moves are expected to help the company gain market share.

Strong demand from personal mobility and a potential revival in the CV and industrial segments would help boost Castrol’s lubricant sales volumes. At the same time, margins are expected to remain healthy, led by better realizations and operating leverage.

Electrification trend: EVs also require transmission fluids, greases, and coolants, and Castrol could cater to the EV segment and explore new business opportunities while strengthening its existing business in ICE.

Key risks:

- Lower-than-expected lubricant volume in case of economic slowdown.

- Possibility of impact on margins in case of a sharp rise in crude oil prices.

- Long-term sales may reduce as the share of Electric Vehicles starts increasing.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Is Castrol India good to buy for the long term?

Castrol India’s share price has not done well in the past due to the absence of growth in the business, both at the revenue and profit level. One must ensure there is visibility of growth before investing in Castrol. Additionally, entry valuation must be at a reasonable margin of safety to provide a cushion against future risks.

What is the face value of Castrol India Share?

The face value of Castrol India is INR 5 per share.

What is the Market cap of Castrol India?

The market cap of Castrol India is INR 12,868 crores as of 18th July 2023.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3.7 / 5. Vote count: 17

No votes so far! Be the first to rate this post.