Remember when Foreign Portfolio Investment (FPI) was pouring money into Indian stocks so enthusiastically? Well, January was a different story. Those same foreign investors, FPIs, have turned net sellers, offloading a massive ₹24,734 crore worth of stocks!

This January sell-off may come as a surprise, but it’s important to remember the bigger picture. For the entire calendar year 2023, FPIs were actually net buyers in India, pumping in a total of ₹1.71 lakh crore into equities and a whopping ₹2.37 lakh crore across all asset classes (including debt, hybrid instruments, and debt-VRR).

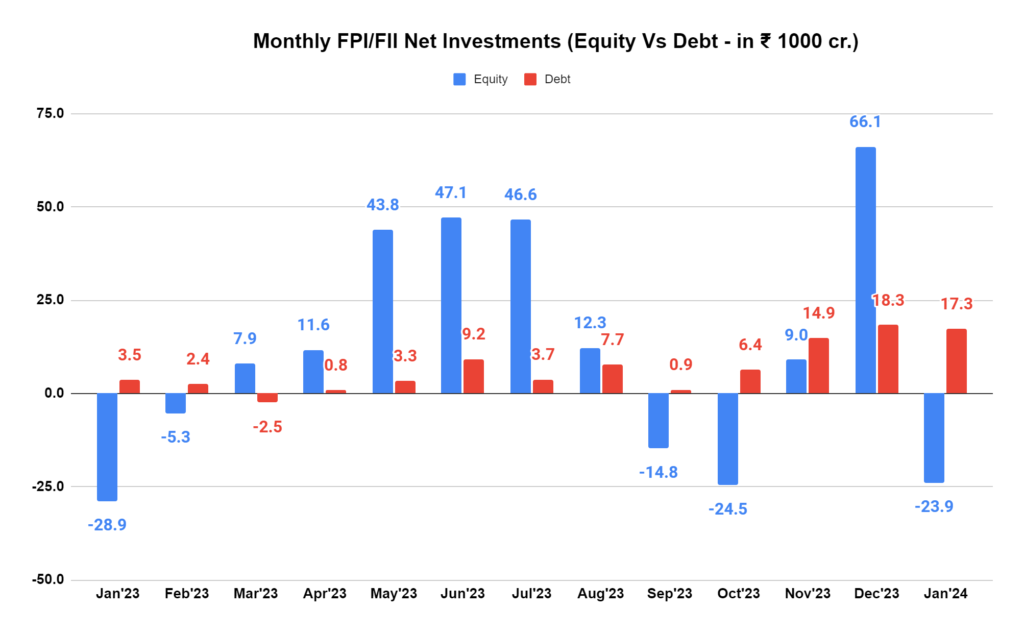

In fact, 2023 saw only four months – January, February, September, and October – with net FPI outflows from equities. The remaining months, like May, June, and July, each witnessed inflows exceeding ₹43,800 crore!

Here’s What Really Happened

One big reason for their sudden change of heart was rising US bond yields. Imagine you have two options for your money: invest in a risky venture like Indian stocks, or lend it to the US government for a guaranteed return. That return is called a bond yield. Now, picture that US bond yield rising from 3.9% to 4.18%. Suddenly, the safe option looks a lot more attractive, right?

That’s precisely what happened in January. FPIs, always chasing the best returns, saw the allure of those rising US yields and decided to pull their money out of Indian stocks. Simply put, it attracted them with the promise of safety and stability.

The Fed Pivot and the False Alarm:

Remember that “Fed pivot” everyone was talking about in December? It was the belief that the US Federal Reserve would start cutting interest rates soon, causing bond yields to fall. This triggered a rally in global markets, including India, as investors rushed to buy riskier assets like stocks.

But January brought a harsh reality check. The Fed’s decision changed, and the talk of rate cuts faded. Fueled by inflation concerns and economic data, bond yields started to climb back up. This reversed the tide for FPIs, pushing them back towards the safety of US bonds and away from Indian equities.

The Message in Numbers

So, what does the jump from 3.8% to 4.18% tell us? It’s a signal that investors are less optimistic about the near future. They see a higher risk of inflation and slower economic growth, making them prioritize security over potential gains. This sentiment, reflected in rising US bond yields, triggered FPI outflows from emerging markets like India.

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

The Road Ahead

The January outflow shows the delicate relationship between global cues and investor sentiment. While it’s a cause for concern, it’s important to remember that the long-term trend for FPIs in India remains positive. The 2023 data clearly highlights their overall bullish stance on the Indian market.

However, the US bond yield story will be one to watch closely in the coming months. If they continue to rise, it could further pressure FPI inflows and Indian equities. But suppose the Fed changes its approach and hints at an earlier pivot. In that case, we might see investors returning to emerging markets’ riskier but potentially rewarding waters.

In conclusion, the big takeaway is that FPI flows can be tricky friends. Depending on the global mood, they can shower you with love one month and leave you cold the next. So, watch these foreign investors because their decisions can make or break the Indian stock market.

While January’s reversal is noteworthy, it’s crucial not to lose sight of the more significant trend of FPI interest in the Indian market.

Read More: Grey Market Premium

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 8

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/