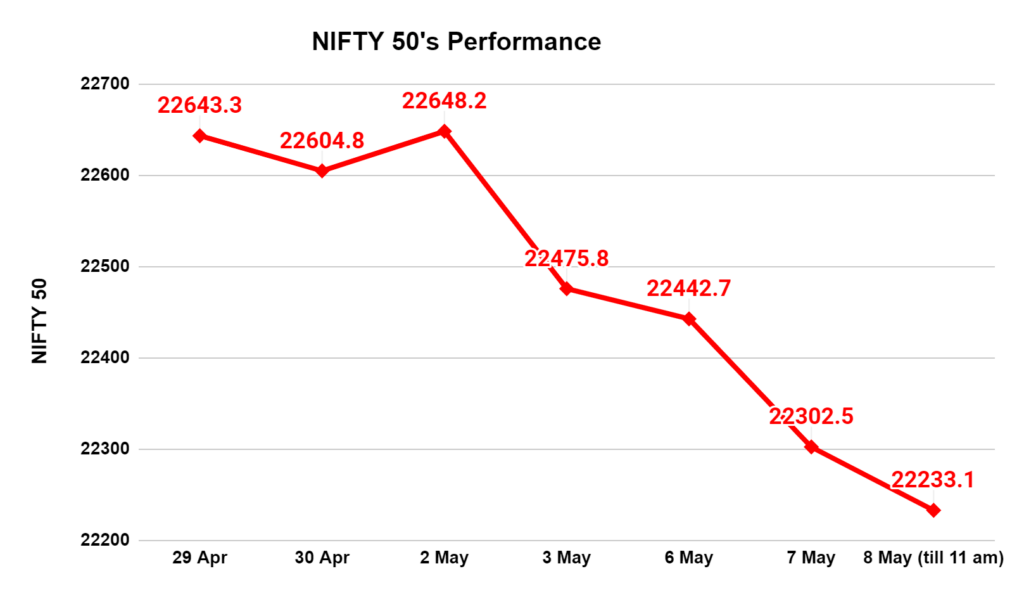

The Indian stock market has experienced a rough ride lately. Remember those record highs we were celebrating just a while back? Well, recently, things have gotten a bit more interesting – and perhaps a touch concerning. The once-vibrant party atmosphere has been replaced by a nervous murmur, with the market shedding a whopping ₹11 lakh crore in just three days.

So, what’s causing this sudden shift? Let’s look into the six main reasons behind the market’s recent tremors:

1. Election Jitters: The Uncertainty Factor

India’s ongoing Lok Sabha elections have greatly shadowed the stock market. The initial phases saw a lower voter turnout than anticipated, raising questions about the potential outcome. The stock market, which previously factored in a smooth victory for the ruling party, is now uncertain. This voter behavior has made investors nervous, leading some to pull back and causing a shift from a bullish to a more cautious approach.

2. Valuation Worries: Are We Overheated?

The stock market has been rising for a while, pushing the Sensex and Nifty to near-record highs. But all that sunshine might have brought some scorching temperatures – in the form of high valuations. Some analysts are concerned that the market might be overvalued based on price-to-earnings (PE) and price-to-book ratios.

This means that stock prices might be inflated compared to the companies’ earnings or underlying value. If this is true, a correction could be in the cards, leading to a drop in stock prices.

3. Foreign Investors Hitting the Brakes: FIIs on the Move

Foreign Institutional Investors (FIIs) are a major force in the Indian stock market. Lately, they’ve been net sellers, pulling out a significant amount of money (over Rs 5,500 crore in the first few days of May) from Indian stocks. Why the change of heart? A few things might be at play. Rising bond yields in the US are making those investments more attractive compared to Indian stocks. Additionally, the timeline for interest rate cuts in India might have been pushed back, further impacting their investment decisions.

4. Earnings Season: Reality Check?

The recently concluded March quarter earnings season might not have delivered the fireworks investors were hoping for. While the overall performance of Indian companies met expectations, there weren’t many positive surprises. Some companies are even disappointed with adverse earnings reports. Sectors like consumption and outsourcing haven’t grown much, while financials are the only bright spot. This lack of strong earnings growth and high market valuations create a sense of unease among investors.

5. Sectoral Shakeup: Not All Stocks Are Created Equal

While consumer companies offered a glimmer of hope with slight gains, the broader market witnessed a bloodbath. Financials and autos led the losses, dragging down sentiment and pushing the volatility index to a 15-month high. Reflecting this, the Nifty 50 and Sensex dipped by 0.62% and 0.52% respectively. Almost all major sectors bled red, with Nifty Realty taking the biggest hit at 3.49%. Banking woes continued as Bank Nifty declined for a second day, closing 609 points lower at 48,285. This highlights the uneven market correction, where some sectors offered temporary refuge while others faced a brutal reality check.

6. Global Cues: A Bumpy Ride Elsewhere

The Indian market isn’t operating in a vacuum. Global cues are also playing a role. While the US market has been upward, Asian markets are experiencing some uncertainty. This mixed picture creates a sense of caution for investors in India, contributing to the current volatility. The ongoing trade tensions between the US and China, further amplified by recent actions against Huawei, add to the global market jitters.

What does the future hold?

How the Indian stock market will behave remains uncertain. The upcoming election results on June 4th may likely be a significant turning point. However, analysts believe the market may still be due for a correction to address the overvaluation of stocks. It’s important to remember that volatility is expected in the stock market. As an investor, staying informed, researching, and maintaining a long-term perspective can help you navigate these challenging times.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.4 / 5. Vote count: 9

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/