Introduction

Drones are gaining importance in various sectors like defense, security, agriculture, and industrial inspection. They provide real-time information and reduce human intervention. Due to their efficiency and safety, there is a high demand for drones in the market.

IdeaForge is a leading drone manufacturer that produces advanced UAV solutions for various applications. Their products provide surveillance, reconnaissance, and data collection capabilities in diverse environments.

The initial public offering (IPO) was in late June 2023, at a range of ₹638 to ₹672. Investors responded enthusiastically to the public offering, leading to a substantial listing premium on BSE and NSE in July 2023. This article will examine how ideaForge has fared after its IPO.

Brief Overview of ideaForge

ideaForge Technology Limited (“ideaForge”) was incorporated on February 8, 2007. ideaForge is the pioneer and the pre-eminent market leader in the Indian unmanned aircraft systems (“UAS”) market, with a market share of approximately 50% in FY2022.

It had the largest operational deployment of indigenous UAVs across India, with an ideaForge-manufactured drone taking off every five minutes on average for surveillance and mapping as of FY2023.

Business Overview of ideaForge

The company has ranked 7th globally in the dual-use category (civil and defense) drone manufacturers as of December 2022. During the Q2FY24 ideaForge has bagged new orders worth INR 169 cr. In addition to being among the 1st few players in India to enter the UAV market, ideaForge also has the distinction of being the 1st company to indigenously develop and manufacture vertical take-off and landing (“VTOL”) UAVs in India in 2009.

The company possesses an in-house product development center that enables it to internally handle the design, development, engineering, and manufacturing of its UAVs, emphasizing performance, reliability, and autonomy.

Upon listing, ideaForge IPO was priced at ₹1,305 on BSE and ₹1,300 on NSE. The IPO successfully attracted investor attention across categories. From auctions to qualified consumer institutions (QIBs), it was subscribed 106.05 times ~ 94% due to strong interest rates. But what happened to the company after listing?

Financials of ideaForge

ideaForge Technology announced its Unaudited Financial Results for the Quarter ended 30th September 2023. The details are mentioned in the table below.

Key Financial Highlights table

| Particulars (INR Mn) | Q2 FY24 | Q2 FY23 | Q1 FY24 | H1 FY24 | H1 FY23 | H1 Y-o-Y |

| Revenues | 237.3 | 402.8 | 970.7 | 1208.0 | 1395.5 | -13.4% |

| Gross Profit | 100.0 | 276.1 | 539.2 | 639.2 | 1,014.0 | -37.0% |

| Gross Profit (%) | 42.1% | 68.6% | 55.5% | 52.9% | 72.7% | |

| EBITDA | 70.4 | 98.2 | 320.3 | 390.8 | 659.5 | -40.7% |

| EBITDA Margins (%) | 29.7% | 24.4% | 33.0% | 32.4% | 47.3% | |

| Profit After Tax | 8.9 | 39.7 | 188.6 | 197.6 | 452.1 | -56.3% |

| PAT Margins (%) | 3.8% | 9.8% | 19.4% | 16.4% | 32.4% |

During the Q2FY24 IdeaForge has bagged new orders worth INR 169 Cr.

- The revenue contribution from Civil business increased in Q2 FY24

- ideaForge drones completed a cumulative of 400K+ flights on the field

- Product demonstrations to the end customers, along with VARs in the United States

- Dun & Bradstreet Business Excellence Award 2023, and SIDM Champion Award for

‘Technology and Product Innovation’ - ConnectXchange initiative for MHA and MOD to increase product adoption

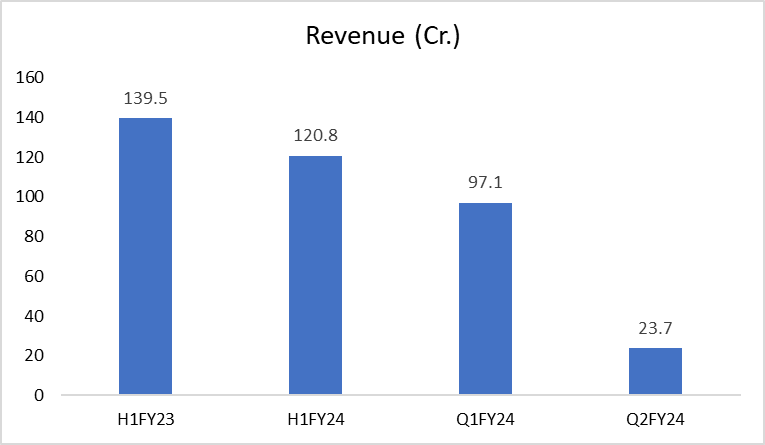

Revenue

The consolidated revenue from operations for the quarter of September 2023 stood at INR 23.7 crores, a decrease of 41% on a year-on-year basis. For H1 ’24, the revenue from operations was at INR 120.8 crores, decreasing 13.4% on a year-on-year basis. According to the results, the revenue contribution from civil business increased in Q2 FY24. During the quarter under review, the company earned 69% of its revenue from defence contracts, while the remaining 31% came from civil business.

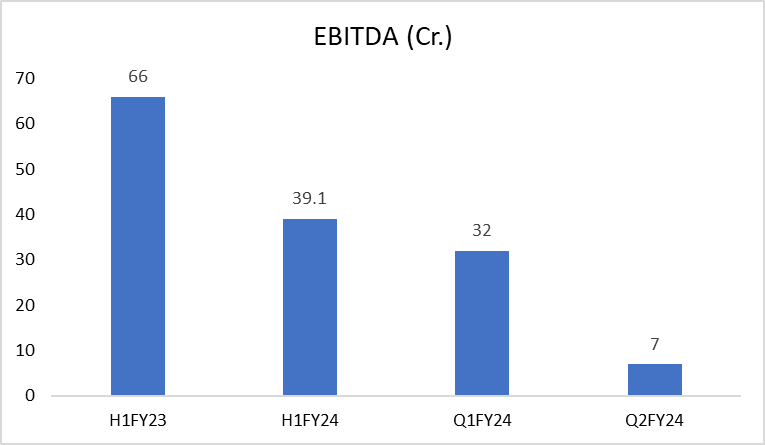

EBITDA

The company’s earnings before interest, tax, depreciation, and amortization (EBITDA) stood at Rs 7 crore in Q2 FY24 against Rs 9.82 crore in Q2 FY23. For H1 ’24, EBITDA was 39.1 crores at 32.4%.

Net Profit

According to the latest corporate filing, ideaForge’s profit after tax (PAT) tanked more than 78% year-on-year (YoY) to INR 0.89 crores in Q2FY24 due to a sharp decline in revenue. The firm had posted a PAT of Rs 3.97 crore in the year-ago period.

Future Ahead for ideaForge

During one of the interviews, the CEO of ideaForge, Ankit Mehta stated this quarter was the performance phase for the company. Highlighting the importance of vertically integrated operations and indigenization efforts, highlighting their role in ensuring the quality and reliability of delivered mission-critical UAVs. The order book has improved on the back of new orders received in Q2 FY24

1-Year Performance

The stock was listed with a bumper opening at 1,305 on BSE and ₹1,300 on NSE. In January 2024, it is listed at around ₹758. ideaForge share price has failed to provide positive returns to investors since its listing despite a stellar debut in the market.

In conclusion, IdeaForge’s post-IPO journey has been a roller coaster marked by challenges and achievements. Investors and analysts are watching its performance closely as the company prepares to announce its Q3 results. Despite recent challenges, ideaForge remains a strong contender in the drone market.

The probable factors that are affecting the ideaForge share price growth are as follows:

Valuation of Stock:

Some investors expressed concerns about the company’s shrinking order book when it listed for the IPO. The company explained that this was due to major contract delays in executing major contracts and completing contracts. Despite the improvements, analysts remain optimistic long-term, crediting the company’s strong products and brand recognition.

Many Offering:

ideaForge serves a varied customer base, with a primary focus on the defense and civil sectors. Drones are essential in defense, providing crucial surveillance capabilities and improving security and reconnaissance efforts. In the civil sector, these drones are utilized for surveillance and mapping, presenting innovative solutions across various industries.

Overcoming obstacles and securing self-reliance:

The drone sector is experiencing significant growth and rapid transformation, albeit at an early stage of development. Unlike many industries with occasional dramatic technological shifts, drone technology undergoes continuous evolution, demanding ongoing innovation. Remarkably, ideaForge distinguishes itself by reducing reliance on imported components. Recent apprehensions regarding potential restrictions on component supplies from China have spurred the company to ensure that imports account for only 15-20% of its revenues.

Know more about

International growth and financial prospects:

Although the company’s export revenue is currently in the single digits, ideaForge is committed to its global expansion strategy. The company has strategically broadened its presence through a network of reseller partners. Without immediate plans for capital investment, ideaForge is maximizing its existing capacity to manufacture quadcopters and switch drones efficiently. The focus is on enhancing the value of its product offerings through planned initiatives.

Read More: Grey Market Premium

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What led to Idea Forge's share price decline post-IPO?

The decline is attributed to concerns about high valuation and weak performance in the first and second quarters of FY24.

Why did Idea Forge's order book shrink despite operating in the defense sector?

The company clarified that the drop in the order book was due to the fulfillment of large contracts and delays in closing certain deals. They expect the numbers to change in the next quarter, and the analysts are closely monitoring the Q3 results.

What factors contribute to analysts' optimism about Idea Forge's future potential?

Analysts cite a healthy order book, modest earnings multiple, and the company's strong product line and brand recognition as reasons for optimism.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 4

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/