Introduction

In a groundbreaking move, the Securities and Exchange Board of India (SEBI) has declared its plans to shift all scrips to a T+1 settlement cycle, effective October 2023.

This decision positions India as a trailblazer, becoming the first major market after China to implement the T+1 settlement cycle, even before other major global markets such as the US, UK, and Japan. This move marks a significant step towards streamlining trade-related settlements and enhancing market efficiency.

| Sr. No | Country | Settlement Cycle |

| 1 | China | T+1 |

| 2 | India | |

| 3 | US | T+2 |

| 4 | UK | |

| 5 | Japan | |

| 6 | Switzerland | |

| 7 | Canada | |

| 8 | South Korea | |

| 9 | Brazil | |

| 10 | South Africa |

What is the T+1 settlement?

Under the T+1 settlement cycle, all transactions will be completed within 24 hours from the execution of the trade. For instance, if an investor purchases shares on a Wednesday, they will have the shares credited to their demat account by Thursday. This swift settlement process is expected to improve liquidity and reduce the time to access funds after a trade.

SEBI chairperson, Madhabi Buch, has also unveiled plans for an instant settlement process known as the T+0 trading cycle. In this system, buying or selling shares will be processed and completed immediately, eliminating any waiting period for investors.

Why do we need T+1 settlement?

The shift to an instant settlement process has several advantages for market participants. Notably, it is expected to boost trading volumes in the cash segment, as investments can be quickly transferred across stocks without delays. This, in turn, mitigates the risks of defaults or fraudulent activities.

For investors, the benefits are far-reaching

- Immediate Access to Funds: With instant settlement, investors gain immediate access to their funds after a trade, enhancing the fluidity of their portfolios.

- Seizing Short-term Opportunities: Instant settlement enables investors to capitalize on short-term trading opportunities by reinvesting the proceeds from a sale promptly, eliminating counterparty default risks.

SEBI’s proactive stance in transforming the Indian financial landscape and fostering a conducive ecosystem for investors is commendable. Over the years, the regulatory body has introduced numerous measures to bolster transparency, uphold market integrity, and safeguard investor interests.

Initially piloted with 256 listed stocks, the T+1 settlement cycle will now encompass all scrips, including shares, ETFs, REITs, Infrastructure Investment Trusts (InvITs), Sovereign Gold Bonds, government bonds, and corporate bonds. This move is expected to further enhance the efficiency and reliability of the Indian capital market.

As the October deadline approaches, market participants eagerly await the implementation of the T+1 settlement cycle, heralding a new era of seamless and rapid transactions in India’s financial markets. With SEBI’s continued efforts to explore instant settlement, the Indian capital market is poised to witness transformative changes that will benefit all stakeholders.

India’s Resilient Economy: IMF Raises GDP Growth Forecast to 6.1% for FY24

Introduction

In a recent report, the International Monetary Fund (IMF) has projected India to be the fastest growing major economy, as it revised the country’s GDP growth forecast upwards for the fiscal year 2023-24. Despite global headwinds and challenges, India is set to outpace its neighbors and retain its position as the world’s fastest-growing major economy.

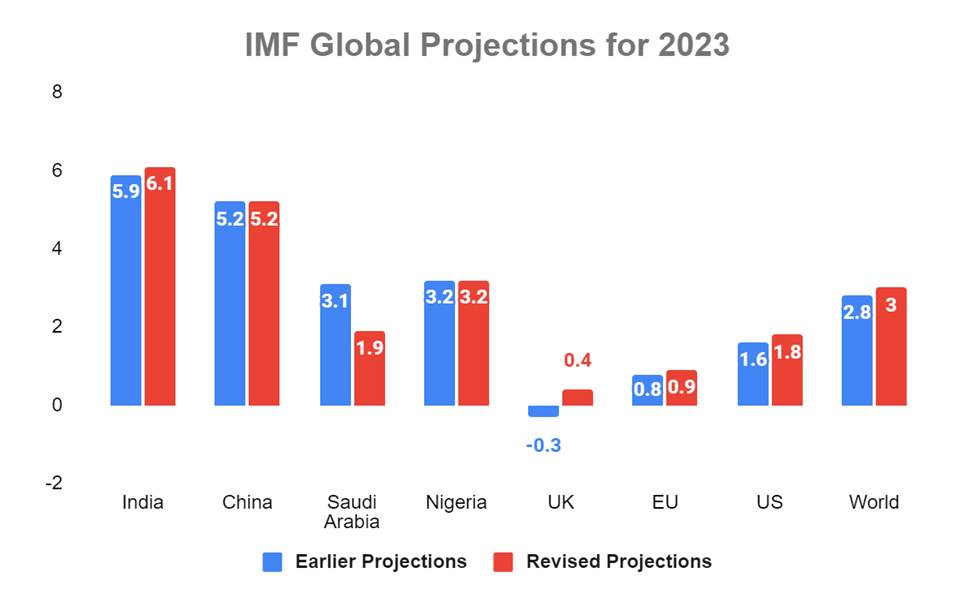

IMF’s Positive Outlook: The IMF’s latest report highlights India’s economic strength and resilience amidst the ongoing global uncertainties. The growth forecast for India has been revised to 6.1 percent, up from the previous estimate of 5.9 percent, for the fiscal year 2023-24. It is noteworthy that the IMF uses a fiscal year basis for India’s GDP growth projections while employing the calendar year for other economies.

Global Economic Projections: The upward revision in India’s growth forecast aligns with the IMF’s updated view on the global economy. The global growth rate is now projected to be 3 percent in 2023, slightly higher than the 2.8 percent forecast made in April. However, the IMF has also cautioned that persistent challenges could impact the medium-term outlook.

Key Takeaways

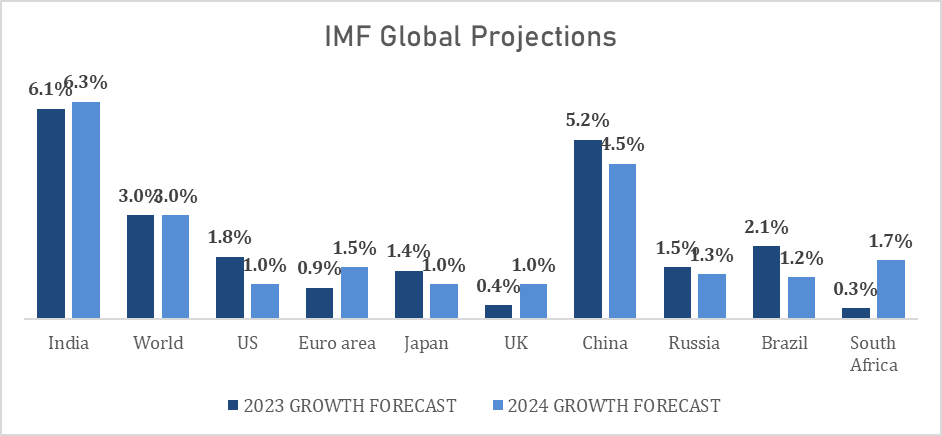

India Outpacing China: Comparing India’s growth trajectory to that of its neighbor China, India’s economy is anticipated to outpace China’s. In 2023, India is expected to grow at 6.1 percent, while China’s growth rate is projected to be 5.2 percent. Looking further ahead, India’s growth rate for 2024 is estimated at 6.1 percent, compared to China’s 4.5 percent.

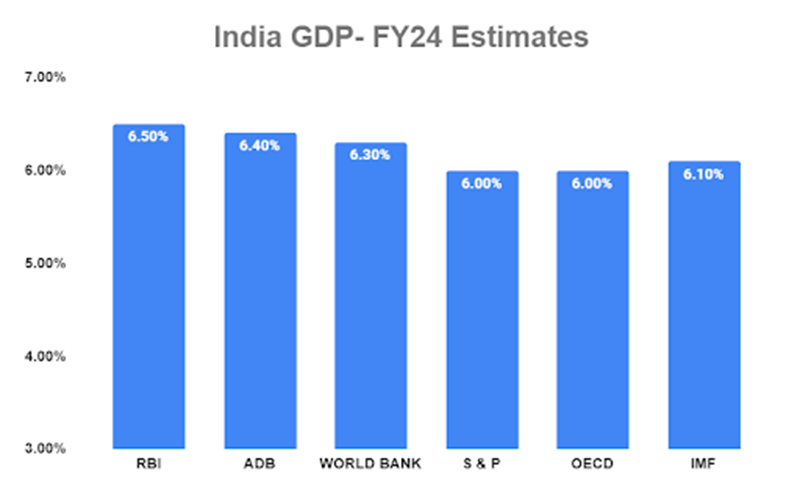

Other Projections: Various rating agencies have expressed positive sentiments regarding India’s economic prospects. Most of them predict India’s economy to grow between 6 percent and 6.5 percent in the fiscal year 2023-24. The Organization for Economic Co-operation and Development (OECD) revised its forecast to 6 percent, aligning with the higher end of this range. Meanwhile, the Reserve Bank of India (RBI) holds even more optimistic expectations, anticipating a growth rate of 6.5 percent during the same financial year.

India’s Economic Resilience: Despite uncertainties in the global economic landscape, India’s projected growth numbers are commendable. The country’s resilience shines through, positioning it as the fastest-growing major economy worldwide. The current projections indicate that India is on track to maintain its status as an economic powerhouse, even amidst the challenges presented by the global economy.

The IMF’s upward revision of India’s GDP growth forecast to 6.1 percent for the fiscal year 2023-24 demonstrates the country’s robust economic resilience. Amidst global uncertainties, India’s growth trajectory continues to surpass that of its neighboring economies, reaffirming its position as the fastest-growing major economy in the world. While challenges persist, India’s economic outlook remains positive and promising.

Whether a SEBI registered advisory will successfully implement such a scheme remains to be seen. In the meantime, it’s important to remember that thorough due diligence is crucial before choosing a stock market investments advisory.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.