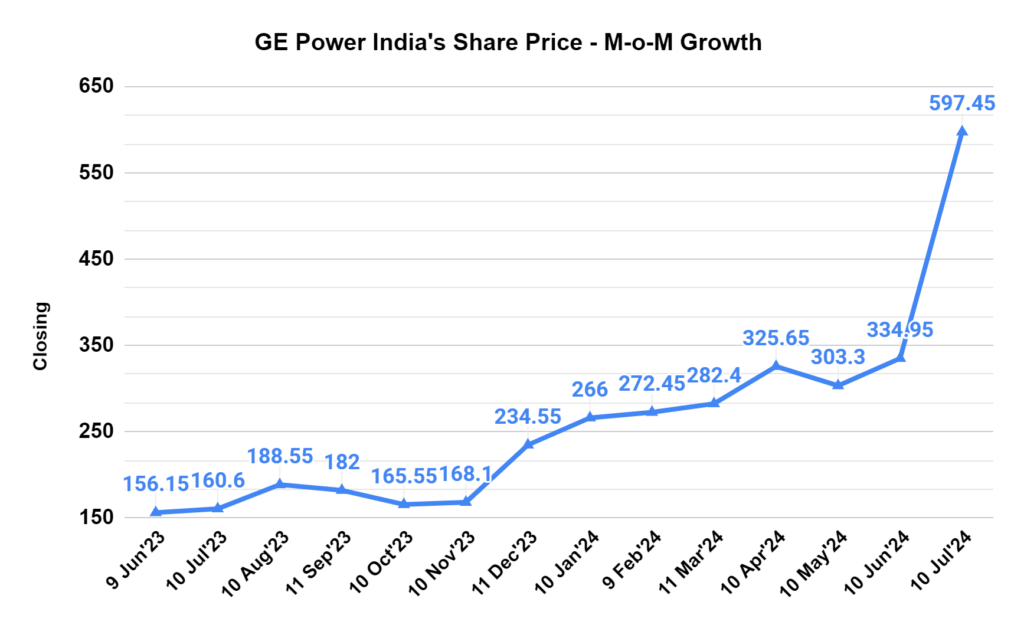

Remember all those headlines from last year about GE Power’s financial worries? Well, the narrative seems to be undergoing a dramatic rewrite. The company’s share price has defied expectations, soaring about 66% [Source: NSE] in the past month, with around half the gains in the past five sessions. This rally has investors wondering if GE Power has finally turned a corner. But what’s fueling this sudden surge?

Let’s explore the details behind GE Power’s recent success and whether this momentum can be sustained in the long run.

Top 6 Reasons Behind the Surge in GE Power India’s Price

1. Order Influx Boosting Confidence

GE Power India has been on a roll lately, securing numerous orders that have significantly boosted investor confidence. This month alone, they secured contracts from Mangalore Refinery and Petrochemicals (Rs 7.67 crore) and NTPC (Rs 1.87 crore) for supplying turbines and spares [Source: Moneycontrol].

In June, NTPC GE Power Services (NGSL) issued a significant Letter of Intent (LoI) for a Rs 243.46 crore project involving steam turbine renovation, further strengthening their position. Their ability to secure diverse orders across the power plant lifecycle showcases their expertise and is a crucial driver of the recent surge.

2. Financial Turnaround Fuels Optimism

GE Power India’s financial performance has shown encouraging signs. They reported a consolidated net profit of Rs 25.94 crore in Q4 FY24, a stark contrast to the net loss of Rs 129.7 crore in the same quarter of the previous year. Revenue from operations also saw a healthy 13.43% year-on-year growth.

This positive financial turnaround suggests the company might be emerging from financial difficulty, adding to the overall optimism surrounding its future.

ALSO READ: What is a Bracket order? How to place bracket orders?

3. Focus on Modernization Projects Expands Market Reach

GE Power India’s recent order wins go beyond new projects. The LoI from NTPC GE Power Services highlights their focus on modernization projects, a crucial aspect of India’s aging power infrastructure. This focus on extending the lifespan and improving the efficiency of existing plants allows them to tap into a wider market segment, further contributing to their growth.

4. Expertise Across Power Plant Lifecycle

These recent developments underscore GE Power India’s expertise across the entire power plant lifecycle. From designing and manufacturing new equipment to constructing, servicing, and modernizing existing plants, they offer a comprehensive suite of solutions. This broad range of capabilities positions them as a strong contender within the industry and is a critical factor in attracting new orders and investors.

5. Potential Market Tailwinds Create Anticipation

The Indian government’s continued focus on infrastructure development, particularly in the power sector, creates a favorable tailwind for GE Power India. Investors anticipate increased investments in power generation and transmission will increase demand for GE Power’s products and services. This potential for future growth adds to the overall optimism surrounding the company’s share price.

6. Year-Long Growth Trajectory Fuels Investor Excitement

GE Power India’s recent surge isn’t happening in isolation. The company’s share price has steadily climbed for the past year, with gains exceeding 260%. So far, in 2024, the stock has risen over 153%.

This sustained growth trend paints a clearer picture of a potential turnaround story for GE Power India. Investors are taking notice of this long-term trend, and the recent order wins and improving financials are fueling their excitement about the company’s prospects. The combination of short-term positive developments and a year-long growth trajectory creates a wave of optimism surrounding GE Power India.

A Word of Caution

While the recent developments are undeniably positive, caution is necessary. The stock’s relative strength index (RSI) currently sits at 83.4 [Source: CNBC]. This metric indicates that the stock trades in the “overbought” zone. In simpler terms, this suggests that the stock’s price may have risen too quickly in a short period and could be due for a correction in the near future. This doesn’t necessarily mean a freefall but rather a potential short-term pullback where the stock price might experience some downward movement.

Investors should be aware of this potential volatility and conduct thorough research before making investment decisions. The recent positive developments are encouraging signs for GE Power India’s future, but a balanced approach that considers both the upside and potential downside is crucial.

Wrapping up

GE Power India’s recent share price surge, fueled by a string of orders, improving financials, and a focus on modernization projects, may seem promising. The impressive year-long growth trajectory further adds to the optimism surrounding the company. However, caution is necessary due to the stock’s overbought status, suggesting potential short-term volatility.

Whether GE Power India can sustain its growth momentum depends on several factors, including successfully executing existing projects, securing further orders, and maintaining its improving financial health. Only time will tell if this recent surge marks a true turnaround for the company. As always, thorough research is essential before making any investment decisions.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.4 / 5. Vote count: 5

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.