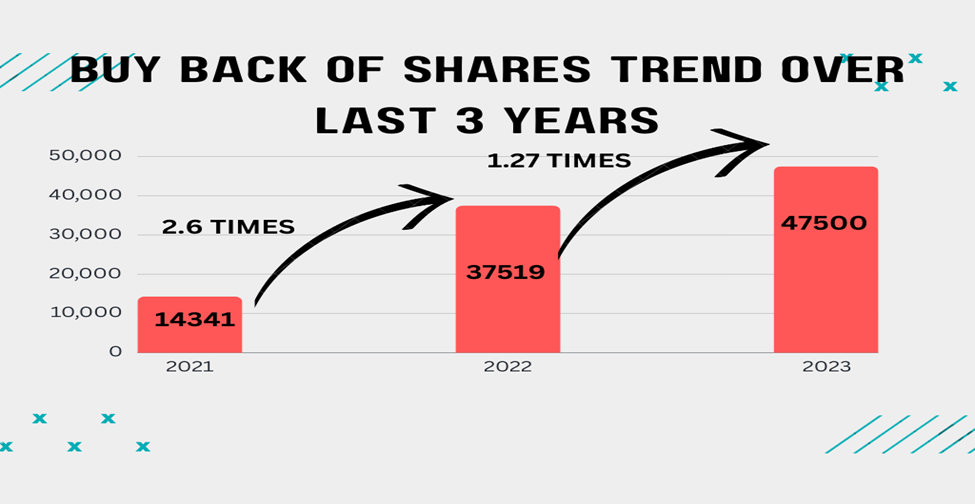

The climbing buyback tally over the previous few years has piqued the interest of all investors in learning more about what is buy back of shares. It is fascinating that this year’s combined issue price has increased nearly 1.27 times to Rs. 47,500.

Let’s take a look at the chart below:

The data speaks volumes about the transitional shift of interest of investors and companies in the buyback. Buy back of shares, in simple terms, is when a company repurchases or buys back its company’s share from the existing shareholders in the market.

This brings us to the next set of queries: what are the reasons for buy back of shares? What are the merits and demerits of buybacks? How do buybacks affect a company’s portfolio? And lastly, should you engage in buybacks or not?

So, if you, too picture yourself trapped in the mesh of such questions, don’t get bogged down. We are here to help. In this article, we have covered everything about buy back in detail, starting from what is buy back of shares to sharing the buy back of shares list to exploring its benefits and drawbacks. As a bonus tip, we will share 5 things about the back of shares that every investor must know.

Let’s get started.

What is Buy back of Shares?

A share buyback is a corporate action that involves a company buying back its shares from the market. The buyback price, which is the price at which the company repurchases its shares from existing shareholders, is generally higher than the current market price.

This reduces the number of outstanding shares and increases the ownership stake of the remaining shareholders. After we have answered, what is buyback of shares, let’s move towards, what is the purpose or the objective of the buyback.

Generally speaking, a company plans to buy back shares if it considers them undervalued. Therefore, it injects extra cash not immediately needed into its books to buy back its shares, increase its value, and establish a solid financial position.

Share prices rise in response to a drop in the quantity of shares available on the market, which also suggests promising future growth. We hope that now you must have well-understood the buy back of shares meaning.

Different Methods of Buyback of Shares

After understanding “what is buyback of shares,” it is essential to delve into different methods of buyback before making decisions about investing.

| Buy Back Method | Open Market Buyback | Fixed-Price Tender Offer | Dutch Auction Tender Offer | Direct Negotiation With Shareholders |

| Features | The company offers to buy a specific number of shares from its shareholders at a fixed price within a certain period. | This method is adaptable and convenient but susceptible to market conditions and fluctuations. | The company negotiates with one or more significant shareholders to buy their shares at a mutually agreed price. | This method is transparent and fair but can also be costly and time-consuming. |

| Flexibility and Risk | This method is efficient and adaptable but also complex and uncertain. | This method is quick and easy but can also be unfair and risky. | This method is quick and easy, but can also be unfair and risky. | This method is quick and easy, but an also be unfair and risky. |

Reason for Buy back of Shares

Picture this. You own some shares of a company. You bought those shares when the company was doing well, hoping to make some profit. But then, the company decides to buy back some of its shares from the market.

It is evident for you to wonder what buy back of shares means for you. And what was the reason for buy back of shares for the company? And, most importantly, how does it affect your interest as an investor?

Here are several reasons for buy back of shares.

- To enhance shareholder value: By buying back shares, a company can use its excess cash to increase the earnings per share (EPS) and the remaining shareholders’ return on equity (ROE). EPS is the net income divided by the number of shares, and ROE is the net income divided by the shareholders’ equity. By reducing the number of shares and increasing the net income, both EPS and ROE increase, making the shares more attractive and valuable to investors.

- To look more financially healthy: By buying back shares, a company can improve its financial ratios, such as EPS, P/E, ROE, and ROA, which can attract more investors to the company. P/E is the stock price divided by the EPS, and ROA is the net income divided by the total assets. By reducing the number of shares and increasing the EPS, the P/E ratio decreases, which can indicate that the stock is undervalued. By reducing the total assets and increasing the net income, the ROA increases, which can indicate that the company is more efficient and profitable.

- To prevent hostile takeovers: A company can reduce the number of shares available to a potential acquirer and raise the cost of the takeover by buying back shares. A hostile takeover occurs when another company or a group of investors attempts to acquire a controlling stake in the company without the board of directors’ approval.

By repurchasing its stock, the company can increase its ownership stake and make it more difficult for the acquirer to gain control. The company can also use the buyback as a defensive strategy by offering the shareholders a higher price than the acquirer, discouraging them from selling their shares.

- To reward employees and management. The company can raise the market price of its shares and increase the value and rewards for holders of the stock by buying back its shares. Through the issuance of stock options and awards using the repurchased shares, the company can also use the buyback to prevent diluting its current shareholders.

Advantages of Buy Back of Shares

1. Earnings Per Share (EPS) Improvement: Reduces the number of outstanding shares, leading to an increase in earnings per share, which can be attractive to investors.

2. Signal of Undervaluation: A buyback can signal the market that the company believes its stock is undervalued, boosting investor confidence.

3. Tax-Efficient Capital Return: Buybacks can be a tax-efficient way to return capital to shareholders compared to dividends, as capital gains tax rates may be lower.

4. Enhanced Shareholder Value: By reducing the share count, a buyback can enhance shareholder value, making the remaining shares more valuable.

5. Employee Stock Options Impact: Buybacks can offset the dilution effect of employee stock options, benefiting existing shareholders.

6. Flexible Capital Allocation: Provides flexibility in capital allocation, allowing the company to allocate excess cash in a way that maximizes shareholder value.

Disadvantages of Buy Back of Shares

1. Market Timing Risks: The timing of the buyback can be crucial, and if done at high market prices, it may not generate the desired value for shareholders.

2. Financial Strain: Funding share buybacks may strain the company’s finances, especially if done with debt, potentially affecting its financial stability.

3. Reduced Financial Flexibility: Using cash for buybacks reduces the company’s cash reserves, limiting its flexibility for future investments or unforeseen challenges.

4. Ownership Concentration: Buybacks may concentrate ownership among a smaller group of shareholders, potentially reducing market liquidity.

5. Short-Term Focus Criticism: Critics argue that buybacks may encourage a short-term focus on stock prices rather than long-term value creation.

6. Missed Investment Opportunities: If funds are used for buybacks instead of strategic investments, the company may miss growth opportunities.

Upcoming Buy Back of Shares List

Now that you’ve thoroughly reviewed the concept of “what is buy back of shares,” take a look at this upcoming Buy Back of shares list-

| Company Name | Record Date | Buyback Type | Buyback Price in Rs. (per share) | Current Market Price in Rs. | Issue Size (Amount in Cr) |

| SIS Ltd | 12th Dec 23 | Tender Offer | 550 | 475.20 | 90 |

| Rajoo Engineers Ltd | Tender Offer | 210 | 194.80 | 19.79 | |

| Elegant Marbles and Grani Industries | Tender Offer | 385 | 340.65 | 26.83 | |

| Somany Ceramics Ltd | 15th Dec 23 | Tender Offer | 850 | 749.75 | 125 |

Some Big Buy back of Shares List 2023 that made news headlines include

- Tata Consultancy Services (TCS) announced its buyback of shares worth an issue price of 17000 crores at a premium of 15%.

- Larsen and Toubro Limited (L & T) announced its buyback with an issue price worth Rs. 10,000 crores at a discount of 2.49%

- Piramal Enterprises announced its buyback with an issue price worth Rs. 1750 crores at a premium of 37%.

- Wipro announced its buyback with an issue price worth Rs. 12000 crores at a premium of 5.86%.

The Bottom Line

We have discussed what is buyback of shares is, why companies do it, and how it affects shareholders and the company in this article. Reasons for buy back of shares include increasing the value of their remaining shares, improving their financial ratios, rewarding loyal investors, or preventing hostile takeovers.

However, the benefits of stock buybacks are diluted by potential drawbacks. such as decreasing cash reserves, increasing debt, and signaling a lack of growth opportunities.

Therefore, before participating in the buyback offer, shareholders should carefully weigh the pros and cons of the offer and the offer price. A share buyback is not always a good sign for the company or the shareholders, and it should be weighed against the company’s overall performance and strategy.

FAQ

1. What are the regulatory requirements for a buyback of shares?Some of the key requirements you must know as you learn “what is buy back of shares” are:

The company should have the authority to buy back its shares in its articles of association. It should obtain the approval of the board of directors or the shareholders, as applicable.

The company should not buy back more than 25% of its paid-up capital and free reserves in a financial year.

The company should disclose the details of the buyback offer to the stock exchanges, SEBI, and the public through a public announcement and offer document. The company should complete the buyback within one year from the date of passing the board or shareholders resolution, as applicable.

2. How can shareholders participate in a buyback offer?

Shareholders can participate in a buyback offer by bidding their shares or selling them in the open market, depending on the method chosen by the company.

3. How does a buyback of shares affect the financial health of a company?

Buyback improves the earnings per Share (EPS), Return on Equity (ROE), and Cash flow per share when the number of shares in the market gets reduced. But, it also harms the cash reserves, debt, and liquidity of the company.

How useful was this post?

Click on a star to rate it!

Average rating 1 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/