The rally in the domestic stock market continued which started yesterday with the Fed’s signal towards rate cuts, and IPI going up in India. A sharp fall in the bond yields added to the gains of the domestic market as FIIs returned especially in the IT and financial services segment.

“Market is likely to consolidate after the run-up in the first half of this month. Positive news flows and buy-on dips can keep the market resilient. The strongest tailwind for the market now is the sharp dip in the US bond yield (the 10-year is around 3.95 per cent) triggering large capital flows to emerging markets like India. Since large cap financials and IT are reasonably valued and have been FII’s favourite sectors, these segments will continue to do well.” – VK Vijaykumar of Geojit Financial.

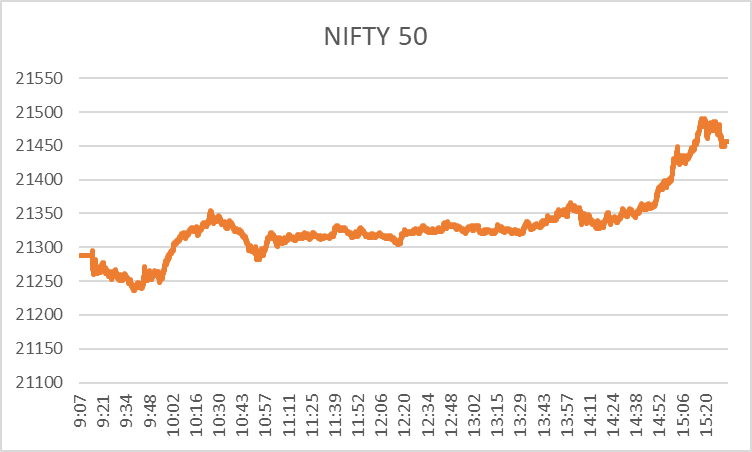

The Nifty 50 went up 1.29% and closed at 21456.65 up from the previous day’s close at 21182.70. Today the equity benchmark index touched 21492.30.

Here are the top nifty gainers and losers today.

Top 5 Gainer Stocks Today

| Stocks | Previous Day’s Closing Price | LTP | Change (%) |

| HCLTECH | 1,414.60 | 1,493.65 | 5.59 |

| TCS | 3,667.25 | 3,871.00 | 5.56 |

| INFY | 1,501.45 | 1,576.55 | 5 |

| SBIN | 623.65 | 648.3 | 3.95 |

| TATASTEEL | 132 | 136.55 | 3.45 |

- HCL Technologies: The gaining streak continues and today this IT stock gained 5.59% following the FIIs pouring money into the IT stocks as the bond yields dipped. In addition to that, the new business coming in from the Department of Transport and Planning, Victoria, playing its card in pushing the stock upward.

- TCS: Tata Consultancy Services gained 5.56% today due to the positive market and IT sector soaring high. The stock closed at 3871 up from its yesterday’s close at 3667.25.

- Infosys: This IT stock went up 5% from its previous closing price of 1501.45 to 1576.55 today following the upswing in the market and investments coming in the way of the IT sector from foreign investors.

- SBIN: If there are two sectors that FIIs love, those are IT and Financial Services. So, this top nifty gainer is from the latter. The PSU bank gained 3.95% following the inflow of investments from abroad as well as domestic investors. The public sector bank also acquired 6.35% stakes in Canpac Trends Pvt. Ltd.

- Tata Steel: This steel company went up 3.45% as the metal sector soared high due to the positive sentiments in the economy and the high industrial growth report published earlier this week.

Top 5 Loser Stocks Today

| Stocks | Previous Day’s Closing Price | LTP | Change (%) |

| HDFCLIFE | 684.55 | 672 | -1.83 |

| NESTLEIND | 24,793.30 | 24,412.00 | -1.54 |

| BHARTIARTL | 1,005.20 | 994.25 | -1.09 |

| SBILIFE | 1,469.85 | 1,454.60 | -1.04 |

| BAJAJ-AUTO | 6,334.85 | 6,275.95 | -0.93 |

- HDFC Life: While financial services are on the rise, this insurance company lost for the third consecutive session. Today, it dipped from its previous day’s close at 684.55 to 672, which is a drop of 1.83% and become the top nifty loser today.

- Nestle India: Another day of dip, the stock lost another 1.54% today after yesterday’s fall. The stock closed at 24412 down from its previous day’s close at 24793.30. The stock has been adversely performing as the FMCG sector as a whole has been sluggish for the previous few market sessions.

- Bharti Airtel: This telecommunication stock lost 1.09% as the media and communication sector dipped today a bit. The stock closed at 994.25 while yesterday the closing price was at 1005.20. Today, this telecommunication stock is the third top nifty loser.

- SBI Life: The insurance sector is a bit slow, as it seems as if another insurance stock dipped today. The stock lost 1.04% and closed at 1454.60 while yesterday it closed at 1469.85.

- Bajaj Auto: As the auto sector was flat today, this auto stock dipped 0.93%. The stock closed at 6275.95 today while it closed at 6334.85 yesterday.

Wrapping up

While there were few sectors such as FMCG, auto and others were sluggish sectors like metal, IT, financial services, banking sector, and oil & gas make the market soar high.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 2.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/