The Indian stock market has been unstoppable in 2023, with the SENSEX taking just about six months to leap from 65,000 to 70,000 points. The spotlight may be on the top gainers such as UltraTech Cement Company, Tata Motors, Power Grid, and others. Still, amid these stalwarts, some low-cost, high-risk “penny stocks” have delivered astronomical returns, too. Skyrocketing by over 1,000% in some cases, these names prove that penny stocks must not be underestimated.

What Makes Penny Stocks Popular?

Penny stocks usually hold the promise of exponential returns. With minimal investment, even a tiny percentage gain can translate into profits, making them attractive for investors with risk tolerance seeking high-growth opportunities. Besides, some penny stocks are truly hidden gems with untapped market potential.

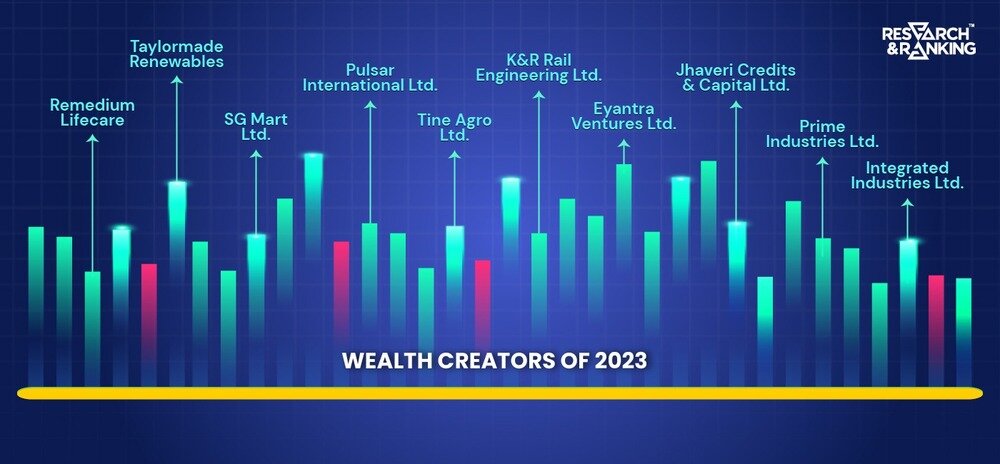

10 Penny Stocks with Windfall Profits

2023 has been a success story for some such players. Here’s a look at the big gainers in the small-cap category. [Source: NSE]

Remedium Lifecare Ltd (2,120%+)

In a world increasingly focused on sustainability, Remedium Lifecare has struck a chord. This atmospheric water-generating machine manufacturer has seen each share rise from ₹25.13 to ₹558, alongside impressive revenue and profit growth. Debt reduction adds to its appeal, making it a penny stock with a promising future.

Taylormade Renewables (1,800%+)

Stock success is tailormade for the company, focussing on renewable and solar energy equipment. Its share price rose from ₹38.25 to ₹726 per share. With sustainability and renewable energy gaining momentum, this penny stock has attracted investors seeking sustainable returns.

ALSO READ: HOW TO MAKE PASSIVE INCOME?

SG Mart Ltd (1,725%+)

SG Mart, another renewable energy player operating various solar and wind energy projects, has seen its stock soar to ₹7,681 from an initial value of ₹420 per share despite mixed financial results. While the company faces some challenges, its foray into B2B building materials and optimism about the real estate sector have kept investors hopeful.

Pulsar International Ltd (1,720%+)

After years of losses, this industrial and consumer goods company has finally turned a corner. Its share price rose to ₹70 per share from ₹3.82 a piece. With a turnaround in FY23 and continued revenue growth, Pulsar International is a penny stock that has started to shine.

Tine Agro Ltd (1,120%+)

Though its revenue declined slightly in FY23, Tine Agro’s focus on sustainable agriculture and debt reduction has resonated with investors. A recent stake acquisition by a prominent equity firm further adds to its potential, as its share price rose from ₹10 to ₹123 as 2023 began.

K&R Rail Engineering (1,055%+)

For this leading railway construction company, the price per share rose from ₹63 to ₹728. As its stock chugged along on the tracks of consistent revenue and profit growth, major project wins like the world’s longest cable car project in Nepal cemented its position as a penny stock with a strong foundation.

The top 10 gainers among many penny stocks defied expectations in 2023. However, investing in these volatile instruments comes with inherent risks despite their potential for explosive returns. Investors must thoroughly research and adopt a cautious approach to prevent these from turning penny dreadful!

Eyantra Ventures Ltd (2,230%+)

All that glitters is stocks for the jewelry trading and diamond-polishing company that saw its stock price rise from ₹17.6 to ₹410 a share. With a lean operation and a strategic acquisition, Eyantra is a diamond in the rough that has truly shone.

Jhaveri Credits & Capital Ltd (2,650%+)

The commodities broker consistently increased its revenue and saw a shift towards profitability, with stock value going from ₹10.33 to a whopping ₹284. The remarkable surge can be linked to improved earnings, with revenue for the six months ending September 2023 reaching ₹11.82 crores.

Prime Industries Ltd (3,000%+)

The second-highest gainer’s stock has seen a continuous upward trend, with its revenue escalating from ₹1.7 crore in FY22 to ₹6.83 crore in FY23.

Integrated Industries Ltd (6,000%+)

The food company may have seen bad days for years, but 2023 saw its share price skyrocket from a humble ₹7.23 to a jaw-dropping ₹441. Revenue and profits started flowing in the year’s second half, and a strategic acquisition further boosted investor confidence.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.2 / 5. Vote count: 5

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/