Bank of Baroda’s history is steeped in excellence as one of India’s foremost public sector banks. With a robust legacy, it holds a formidable position in the banking industry, delivering diverse banking products and services to individuals, corporations, and governments globally.

Bank of Baroda History

Bank of Baroda has evolved significantly from its inception to become India’s third-largest public sector bank (PSU).

1908

- Maharaja Sayajirao Gaekwad III, the Maharaja of Baroda, founded the Bank of Baroda on 20 July 1908.

- The first branch was set up at Mandvi, Baroda (now known as Vadodara).

1918 – 1949

- Over the years, branches were set up at key locations like Bombay (now Mumbai), Calcutta (now Kolkata), Delhi, and more.

- 1953: The bank established its first overseas branches in Mobasa (Kenya) and Kampala (Uganda).

- 1957: It set up operations in the United Kingdom (UK).

- 1964: It became the first bank to start mobile operations.

- 1969: The bank was nationalized. “The Bank of Baroda Ltd” became “Bank of Baroda”.

- 1985: The bank began to computerize and mechanize its operations. It also introduced BOBCARD.

- 1996: It became one of the first nationalized banks to tap into the capital market via the public issue of equity shares.

2007 – 2008

- The bank has completed 100 years since its inception.

- It set up India’s first Gen-Next branch dedicated to the youth.

- The bank established a joint venture for mutual funds, “Baroda Pioneer Asset Management Company Ltd.” with Pioneer Investments of Italy.

- Bank of Baroda introduced state-of-the-art banking technology solutions with “BarodaNext”.

- There was 100% implementation of core banking solutions.

- 2019: The country witnessed the first-ever tripartite amalgamation of Bank of Baroda, Vijaya Bank, and Dena Bank.

- 2020: The bank introduced a transformation project, “BOB NOWW,” to build a futuristic bank.

- 2021: The bank launched BoB World, an end-to-end video KYC-based online account opening process, and a website centralization project

- 2022: It won the ‘Best Technology Bank’ by the Indian Banks’ Association (IBA) two times in a row. The Great Place To Work Institute certified it as a Great Place To Work.

- 2023

- Bank of Baroda emerged as the Overall Top Performing Bank in the EASE 4.0 Reforms Index FY2021-22.

- Fabulous Employers Pvt Ltd certified it as a Great Place to Work.

- It received the Best AI and ML Bank among large banks at the IBA.

- It was felicitated at The Economic Times “Best BFSI Brands 2023”.

The bank is revamping its business model by including Environmental, Social, and Governance (ESG) elements. This will help reduce the bank’s carbon footprint and improve its ESG ratings.

Bank of Baroda Business Overview

Bank of Baroda is amongst the leading public sector banks in India. Post the merger of Bank of Baroda with Vijaya Bank and Dena Bank in 2019, it became India’s third-largest public sector bank.

The bank offers a wide range of solutions and services. These include personal banking, corporate banking, international banking, small and medium enterprise (SME) banking, rural banking, non-resident Indian (NRI) banking, and treasury services.

Bank of Baroda Management Profile

Dr. Hasmukh Adhia

He is the Non-Executive Chairman of the Bank of Baroda. Dr. Adhia holds a Post-Graduate degree in Accountancy. Additionally, he is a Gold medalist from the Indian Institute of Management (IIM), Bangalore. He has held important positions in the Government of India. He has also served on the Board of Directors of various institutions/companies.

Shri Debadatta Chand

He is the Managing Director and CEO of Bank of Baroda. He has over 29 years of experience in the banking and financial services industry. Shri Debadatta Chand holds a B. Tech. Degree, an MBA degree, a CAIIB qualification, and a PG Diploma in Equity Research. He is also a certified Portfolio Manager.

Shri Ajay K Khurana

Shri Khurana is an Executive Director at Bank of Baroda. He holds a Post-Graduate degree in Business Management and a CAIIB qualification. He has over 17 years experience in various capacities.

Shri Joydeep Dutta Roy

He is an Executive Director at the Bank of Baroda. Joydeep Dutta Roy has over 25 years of banking experience. He holds an Honours degree in Economics from Delhi University. He is also a law graduate with an MBA from the Narsee Monjee Institute of Management Studies, Mumbai.

Shri Lalit Tyagi

Shru Tyagi is an Executive Director at the Bank of Baroda. He has over 26 years of experience in various spectrums of banking. He is also a law graduate with an MBA from the Narsee Monjee Institute of Management Studies, Mumbai.

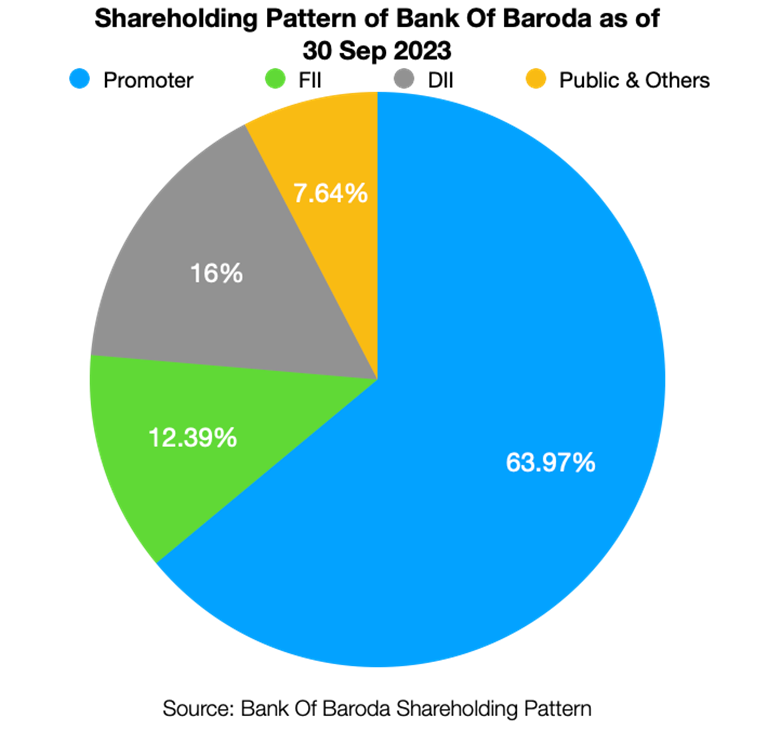

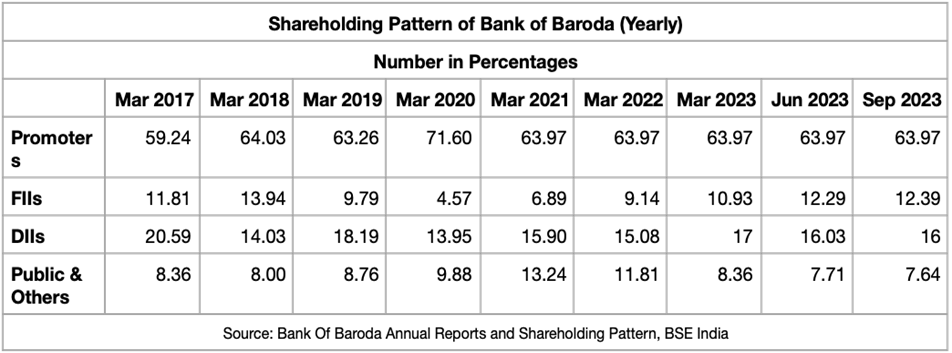

Bank of Baroda Shareholding Pattern

Let us have a detailed look into the shareholding pattern of the Bank of Baroda.

- For the quarter ended June 2023, the bank’s total promoters’ stake remained unchanged at 63.97%.

- The FII holdings increased from 4.57% in March 2020 to 12.29% in June 2023.

- Furthermore, DIIs have increased their share in this stock from 13.95% in March 2020 to 17% in June 2023.

- Though the public holding stood at 9.88% in March 2020 and 13.24% in March 2021, it decreased to 7.71% in June 2023.

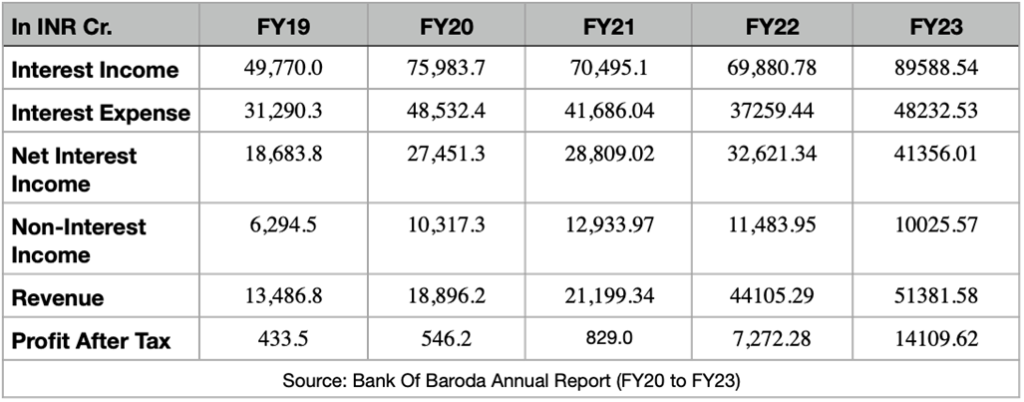

Bank of Baroda Financials

1. Core Operating Profit and Net Profit

The bank has reported an operating income of ₹51,381.58 crore during FY2022-23, compared to ₹44,105.29 crore during FY2021-2022. The bank has posted a net profit of ₹14,109.62 crore (nearly double) for FY2022-23, as against a net profit of ₹7,272.28 crore for FY2021-22.

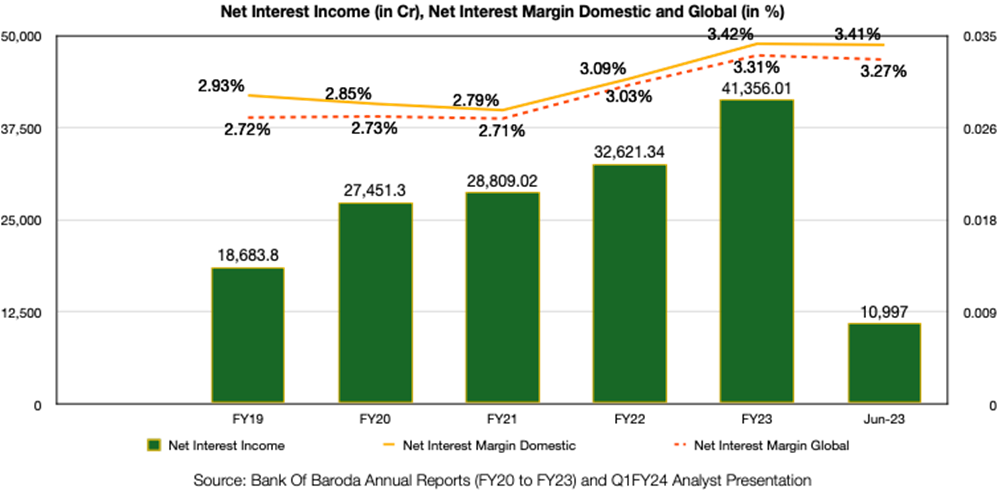

2. Net Interest Income and Net Interest Margin

Net Interest Income (NII) is the difference between the interest earned on a bank’s assets (like loans and investments) and the interest paid on its liabilities (like deposits and borrowings).

Net Interest Margin (NIM) is calculated by dividing the NII by the average interest-earning assets.

The bank’s Net Interest Income increased to ₹41,356 crore in FY2022-23 from ₹32,621 crore in FY2021-22, registering a growth of 26.8% YoY. The NII for the quarter of 30 June 2023, at ₹10,997 crore, grew by 24.4% YoY. NIM global and NIM domestic improved to 3.31% and 3.42% in FY2022-23 as against 3.03% and 3.09%, respectively, in FY2021-22.

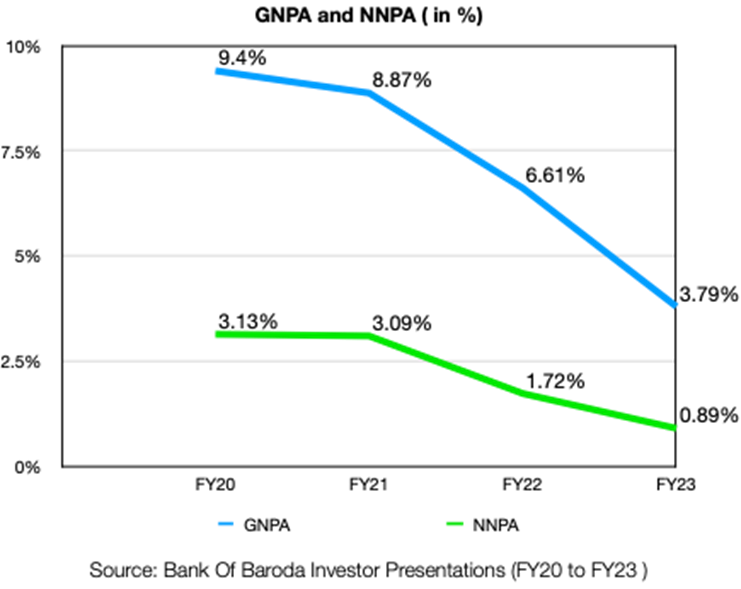

3. Asset Quality (GNPA & NNPA)

NPA refers to Non-Performing Assets. It is a loan or an advance where the borrower has not paid the interest or principal amount for a specified period, generally 90 days or more.

Gross NPA is the total value of a bank’s NPAs. Net NPA is the value of NPA after reducing the provisions made by the bank to cover the potential losses arising from the NPAs.

FY2022-23 saw a significant improvement in the bank’s asset quality. Higher recoveries and upgradations drove the improvement. In FY2022-23, the Gross NPA (GNPA) ratio declined by 282 bps to 3.79% in FY2022-23 and Net NPAs dropped to an 11-year low of 0.89%.

Fresh slippages were lower during the year, which led to a fall in the slippage ratio to 1.07%, with credit costs coming in at a record low of 0.53%.

The Provision Coverage Ratio (PCR), including Technical Written Off (TWO) accounts, could help the bank prepare to cover future losses. It has risen to 92.43%, indicating a significant protection level. The bank has constructed efficient collection machinery using advanced analytical tools to detect potential weaknesses and early warning signs.

The BOB balance sheet indicates the provisions for NPA have declined to ₹4,351 crore in FY2022-23 from ₹14,640 crore in FY2021-22. The bank launched the One-Time Settlement (OTS) schemes “Rin Mukti Yojana” and “Vasooli Sankalp” to address a large number of small NPA accounts.

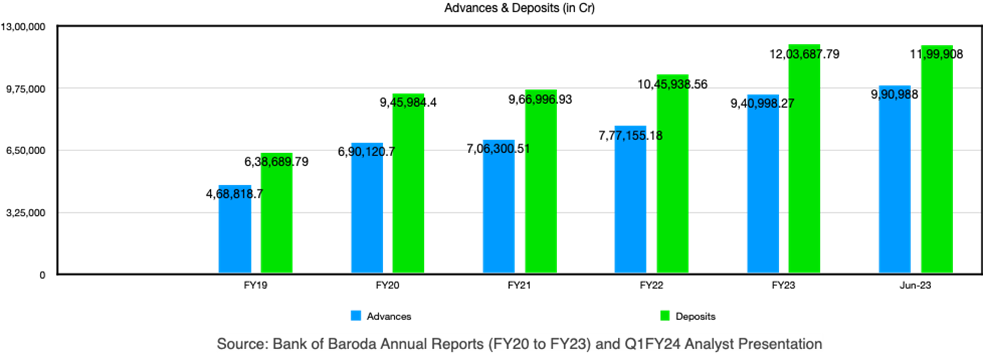

4. Advances and Deposits

An advance is a loan or credit offered by banks to their customers. Banks offer various advances such as business, personal, home, education, vehicle, and credit card loans. Advances as of 30 June 2023 were ₹9,90,988 crore as against ₹8,39,785 crore on 30 June 2022, an increase of 18% YoY.

Deposits are a critical source of funding for banks, and they use these funds to provide loans and advances to customers. As of 30 June 2023, deposits were ₹11,99,908 crore as against ₹10,32,714 crore on 30 June 2022, an increase of 16.2% YoY. The total deposits rose to ₹12,03,688 crore during FY2022-23 from ₹10,45,939 crore during FY2021-22, registering a 15.1% YoY growth.

The bank’s net advance increased to ₹9,40,998 crore during FY2022-23 from ₹7,77,155 crore during FY2021-22, registering a growth of 21.1%.

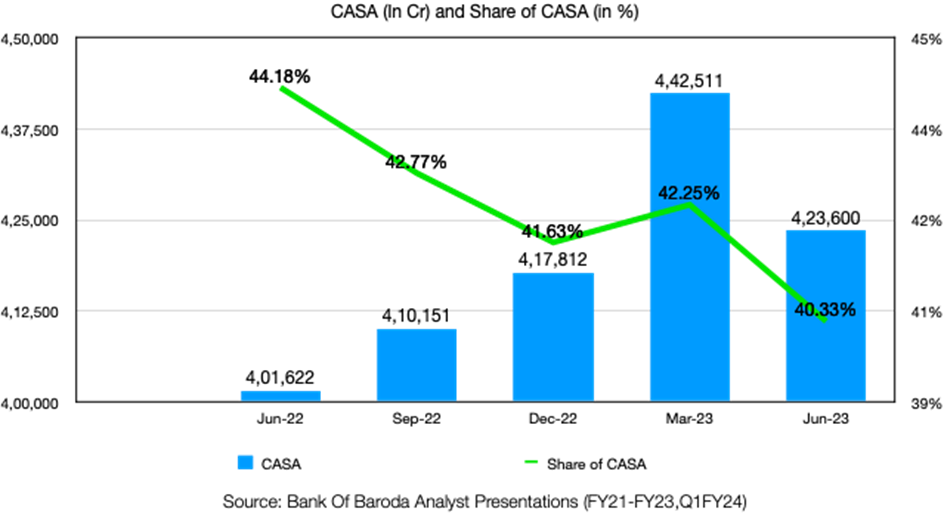

The bank’s CASA (Current Account & Savings Account) deposits ratio is 40.33% as of Q1 FY2023-24 and has reduced slightly from 44.18% in Q1 FY2022-23.

The bank has continued to focus on CASA deposits, with current deposits growing at 9.2% and saving deposits at 7.6%. The CASA ratio stood at 42.25% on 31 March 2023. It will help minimize the overall cost of deposits and manage liquidity.

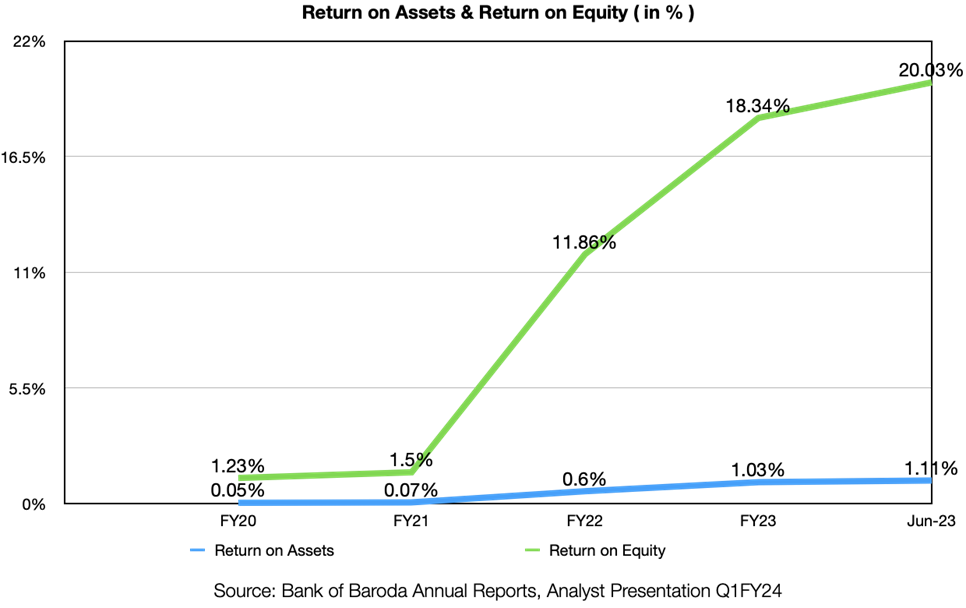

5. Return Ratios (ROA and ROE)

The bank’s Return on Assets (ROA) for FY2022-23 improved by 43 bps to 1.03% in FY2022-23 from 0.6% in FY2021-22. It further increased to 1.11% in Q1 FY2023-24.

The bank’s Return on Equity (ROE) increased by 648 bps to 18.34% in FY2022-23. Q1 FY2023-24 saw an increase in ROE to 20.03%.

The book value per share increased to ₹148.80 in FY2022-23 from ₹118.97 in FY2021-22. The earnings per share (EPS) increased to ₹27.28 in FY2022-23 from ₹14.06 in FY2021-22.

6. Dividend payouts

Bank of Baroda paid a dividend of 275% for the year ended March 2023. The dividend payout per share of the bank was ₹5.5. In July 2022, the bank paid a dividend of ₹2.85 per share. In 2015, after the stock split, the bank distributed a dividend of ₹3.20 per share.

Bank of Baroda Share Price History

The bank’s stock price has been volatile since being listed on the National Stock Exchange in 1991. The stock began trading at a low price and rose to a high of ₹202 in October 2010. However, the stock price took a hit because of the global financial crisis in 2009. As time passed, most public sector banks’ stock prices fell further as their NPAs increased.

Furthermore, the bank opted for a stock split in 2014 — the face value of the share was split from ₹10 to ₹2, which helped increase the overall liquidity for the bank. However, the bank’s stocks have rallied after the successful merger in 2019 with Vijaya Bank and Dena Bank.

The bank’s share price is trading from ₹200 to ₹213. This is due to an increase in Bank of Baroda’s profit (net) this quarter, a significant reduction in NPAs, and an increase in revenue. As of 14 September 2023, the bank’s 52-week high is ₹213.20.

Bank of Baroda SWOT

Strengths for Bank of Baroda

- Wide network: Bank of Baroda has 8,205 domestic branches (2,867 in rural India), 93 overseas branches across 17 countries, and 9,764 ATMs.

- Humongous product portfolio: The bank has a wide range of banking products and services to cater to its diverse customer base. The bank has leveraged technology to cross-sell and create opportunities to generate revenue.

- Large customer base: Bank of Baroda has a vast customer base of 15.3 crore. The bank’s Bob World app has around 3 crore activated users.

- Bank size and government ownership: The Government of India owns most of the equity stake in BoB (63.97% as of 30 June 2023). As of 31 March 2023, BoB became the second-largest PSB in India in terms of advances, with a 7% market share and a 6.7% share in the total deposits.

- Strong capital position: As of 31 March 2023, the bank has a robust capital adequacy ratio (CAR) of 16.24%.

- Strong solvency profile: With the enhanced capital position and the diminishing net non-performing advances (NNPA) level, the bank’s solvency level stands at 10.5% as of 31 March 2023, in contrast to 19.1% as of 31 March 2022. There is an expectation that the bank’s solvency profile will improve in the coming years.

- Strong earnings: The bank’s earnings have improved greatly due to the astute management and control of its assets, liabilities, and expenses. There has been an improvement in the core operating profitability (before divestments and trading income) to 2.05% of average total assets (ATA) in Q1 FY2023-24 (1.97% in FY2022-23, 1.70% in FY2021-22).

Key Risks

- International market presence: The bank is in 17 countries; however, the primary focus is on the Indian market. To increase profitability, the bank needs to increase its international presence.

- Brand image: Government banks spend less on their brand image, which can hamper their brand value. The bank must focus on its brand image and be at par with its competitors.

- Competition: The banking industry comprises domestic (private banks, NBFCs) and foreign competitors. This can also affect the bank’s lending business and other revenue streams.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What is the face value of Bank of Baroda’s share?

The face value of Bank of Baroda’s share price is ₹2 per share.

What is the 52-week high and low of Bank of Baroda?

As of 8 September 2023, the 52-week high of Bank of Baroda is ₹210.80, and the 52-week low of Bank of Baroda is ₹124.

Who is the promoter of the Bank of Baroda?

Bank of Baroda is a state-owned bank, and the Government of India holds 63.97% of the total paid-up equity of the bank.

How useful was this post?

Click on a star to rate it!

Average rating 3.4 / 5. Vote count: 17

No votes so far! Be the first to rate this post.