Did you know Colgate originally sold soap and perfume before adding toothpaste to their product portfolio? The company’s roots date well before India’s first war of Independence in 1857.

Colgate is more than a company in India; it’s an emotion. The brand has extremely high recall across all age groups and has become synonymous with toothpaste. It’s one of those few companies that have stood the test of time and have grown by leaps and bounds.

In this article, we will understand more about Colgate and Colgate share price. Let’s dive in.

Brief Overview of Colgate

Colgate-Palmolive, as the company is known, was set up by William Colgate in 1806 in New York City. The company was initially called William Colgate & Company and was a soap and candle company.

The company developed and marketed more products over the years, but it is best known for its toothpaste, which it introduced in 1873. Initially, the company sold toothpaste in a jar, and in 1896, it introduced the collapsible tube to sell toothpaste called Colgate Ribbon Dental Cream.

Since then, Colgate has continued introducing a new range of toothpaste, establishing itself as a leading global oral care company serving hundreds of millions of consumers worldwide. In 1928, Palmolive-Peet bought Colgate to create the Colgate-Palmolive-Peet Company, and later, in 1953, Peet was dropped from the title and continued to be known as Colgate-Palmolive Company.

India Entry

Colgate started its operation in India in 1937 with the launch of dental cream. Over the years, it launched its other product range, including shampoo and cold cream, but continued to be known as an oral care company.

Currently, all oral care products are marketed under the Colgate brand, and all other non-oral personal care products, such as hand wash and shaving cream, are marketed under the Palmolive brand.

Business Overview of Colgate-Palmolive

Colgate Palmolive India is a subsidiary of Colgate-Palmolive, a global FMCG company that produces and distributes household, personal care, healthcare, and veterinary products.

In India, Colgate-Palmolive operates only in one segment- Oral, Personal, and Home Care. The oral segment includes toothpaste, toothbrush, mouthwash, toothpowder, and oil-pulling products. In the personal and home care segment, it includes soaps, shampoos, handwash, shower gels, conditioners, shaving products, dishwashing products, house cleaning, etc.

The company has a strong distribution network with a presence in more than 5 lakh villages across India and has three manufacturing units in Goa, Himachal Pradesh, and Gujarat.

Leadership Team

- Ms. Prabha Narasimhan is the Managing Director and CEO of Colgate-Palmolive India and joined the company in 2022 from Hindustan Unilever Limited, where she led the home care category. She has over 25 years of experience in customer development, consumer marketing, and innovation across geographies and multiple categories in the FMCG segment. Ms. Prabha has graduated from IIM-B and Melbourne Business School.

- Mr. M.S. Jacob has been the Whole-time Director and Chief Financial Officer since 2016. He joined Colgate in 1995 and served through multiple leadership roles in Finance across the Southeast Divisions of the company as well as the Asia Pacific Divisions. Mr. Jacob holds a B.Com degree from Mumbai University and is a qualified chartered accountant.

- Mr. Gunjit Jain is the Executive Vice President of Marketing and has been with the company since 2008. He has held roles and responsibilities across customer development, marketing, innovation, strategy, and leadership functions. Mr. Jain holds an MBA from IIFT, Delhi, and a B.Tech from Vellore Institute of Technology.

- Mr. Balaji Sreenivasan has been the Executive Vice President of Human Resources since November 2020 and joined the company in 2005. He has served through multiple leadership roles in the Human Resources function at Colgate’s subsidiaries in India, Turkey, Central Asia, North Africa, Middle Eastern countries, and the Asia Pacific region.

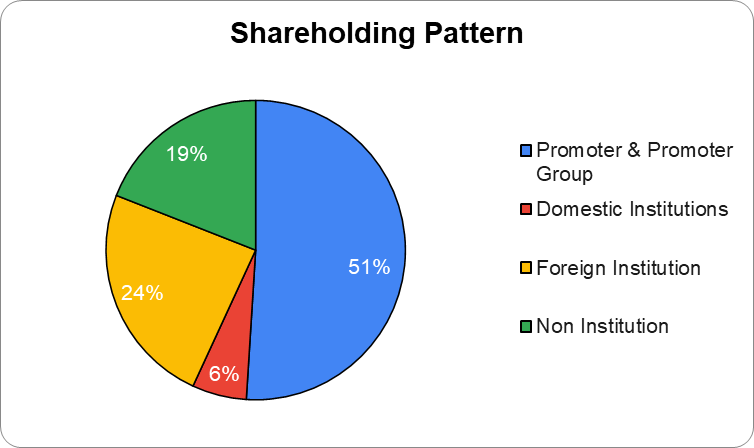

Shareholding Pattern

Financials

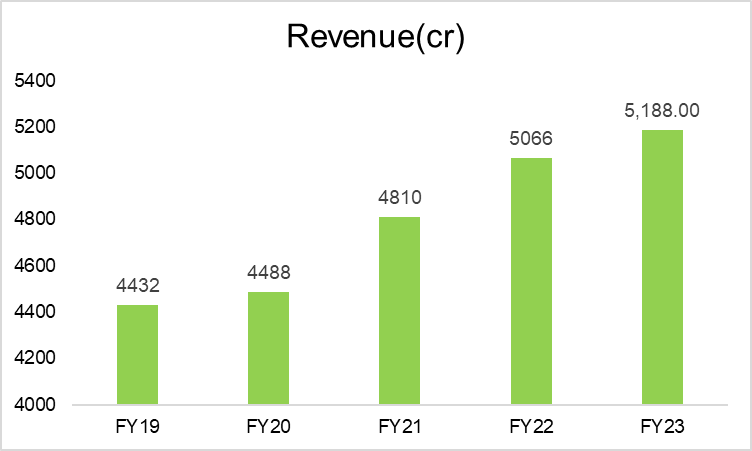

Revenue

In FY23, Colgate-Palmolive reported a 2.4% increase in revenue to ₹5,188 crore compared to ₹5,066 crore in FY22. And, in Q1FY24, the net sales of the company increased by 10.8% over the same quarter last year to ₹1,314.7 crore from ₹1,186.6 crores in Q1FY23.

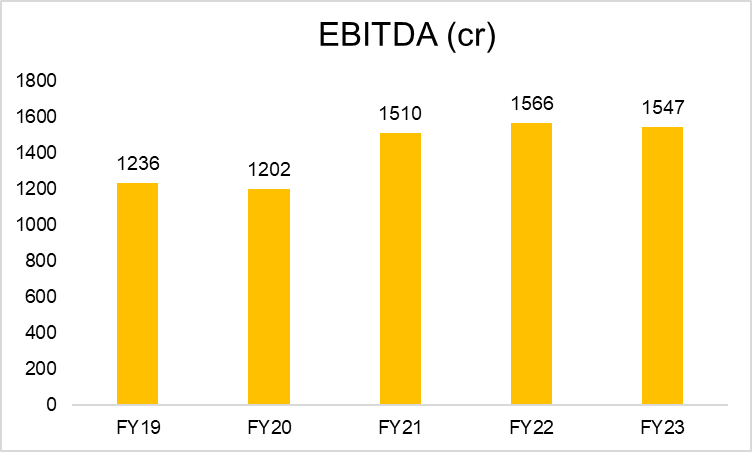

EBITDA

In FY23, the company reported a marginal dip of 1.2% annually in EBITDA to ₹1,547 crores from ₹1,566 crores in FY22.

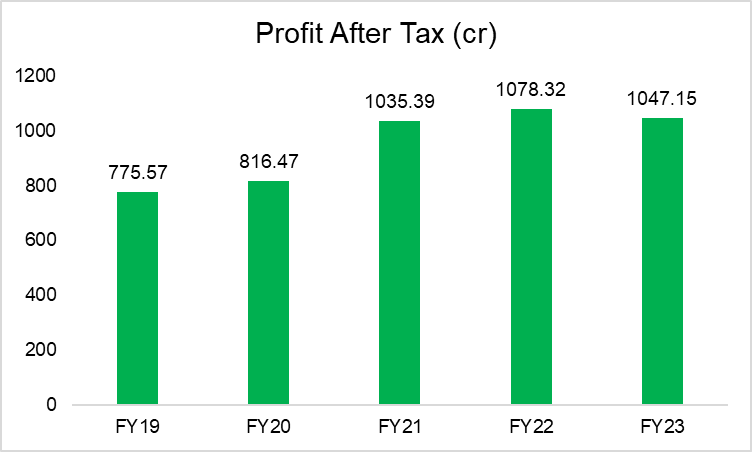

Profit After Tax

In FY23, the net profit declined by 2.8% to ₹1,047.15 crores, compared to ₹1,078.32 crores in FY22. And, in Q1FY24, the company reported a net profit of ₹273.3 crore, a growth of 30.5% as against the net profit of ₹209.7 crores in the same quarter the previous year.

Key Financial Ratios

Current Ratio: At the end of FY23, the current ratio of the company improved by 4% to 1.43 times from 1.37 times at the end of FY22.

Debt-to-equity Ratio: The company has no long-term debt on its book. The debt-to-equity ratio as of 31st March 2023 stands at 0.04 times compared to 0.05 at the end of 31st March 2022.

Interest Coverage Ratio: The interest service coverage ratio of the company at the end of FY23 was 281.82 times compared to 236.30 times at the end of FY22.

Inventory Turnover Ratio: The company’s inventory turnover ratio improved by 8% to 5.18 times on 31st March 2023, compared to 4.81 times on 31st March 2022.

Operating Profit Margin: The operating profit margin of the company in FY23 was 26%, compared to 27% in FY22.

Net Profit Margin: The net profit margin of the company in FY23 was 20%, compared to 21% in FY22.

Return on Capital Employed (ROCE): The ROCE of the company at the end of 31st March 2023 increased to 84% from 82% at the end of 31st March 2022.

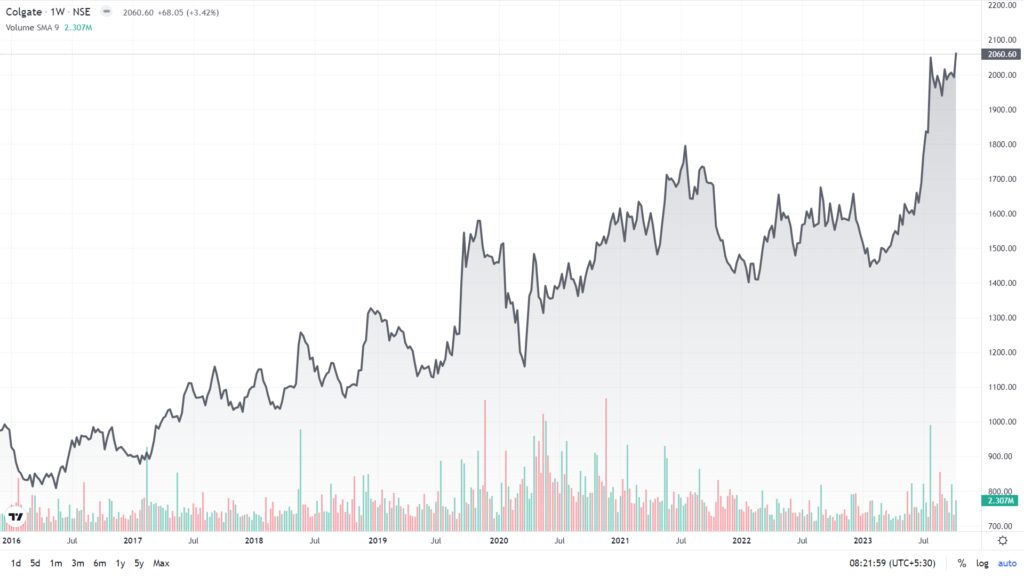

Colgate Share Price Analysis

Colgate has consistently generated compounded wealth for its shareholders over time and has shown the least volatility compared to other stocks in the category. The company has issued bonus shares in the past years and has a consistent track record of paying dividends to its shareholders. It paid dividends of ₹39 in 2021, ₹39 in 2022, and ₹21 in 2023 to its shareholders.

As of 28 October 2023, Colgate share price has grown at a CAGR of 14% and 11% in the last five and three years, respectively. It reached an all-time high level of ₹2,096 on 27th September 2023. The market cap of Colgate Palmolive (India) Ltd. is ₹56,587 crores.

Peer Comparison

| Company Name | Colgate Palmolive | Dabur | Hind. Unilever |

| Face Value | ₹1 | ₹1 | ₹1 |

| Share Price (as of 26 Oct 23) | ₹2032.5 | ₹506.65 | ₹2476.15 |

| P/E Ratio (as of 26 Oct 23) | 49.75 | 64.09 | 56.78 |

| Market Capitalization | ₹55,784 crores | ₹92,748 crores | ₹5,81,970 crores |

| Revenue | ₹5,188 crores | ₹11,529.9 crores | ₹58,154 crores |

| Operating Profit Margin (FY23) | 26% | 18.8% | 21.7% |

| Net Profit Margin (FY23) | 20% | 14.8% | 17.1% |

| ROCE (FY23) | 84% | 26.95% | 101.9% |

| Distribution Network (FY23) | 1.7 million retail stores | 7.7 million retail stores | 9 million retail stores |

Key Highlights

- Colgate is the most prominent oral care company in India, with more than 50% market share in the toothpaste category.

- The company has been ranked India’s most trusted oral care brand for the ninth consecutive year from 2011 to 2019 by the Economic Times- Brand Equity, conducted by Neilsen.

- For the quarter that ended on 30th June 2023, the company reported the highest-ever quarterly revenue growth in recent times, driven by early signs of recovery in the rural market. The toothpaste category witnessed double-digit sales growth during the period.

- The company is focusing on the premiumization of toothpaste products, which has been the cornerstone of its growth strategy. Total Sensitive Toothpaste, CLGT water flosser, Visible white O2 TP & Whitening Pen, and Colgate Periogard Toothpaste are all expected to contribute to long-term revenue growth.

- There is enough headroom for growth in the toothpaste category as the company, through its multiple awareness programs, focuses on increasing the frequency of brushing in India. 55% of rural households don’t brush daily, while only 20% of urban households brush twice daily.

- The per capita toothpaste consumption in India is low compared to other developing nations like Brazil, the Philippines, etc. Brazil’s per capita consumption of toothpaste is 3X more than what Indians consume annually.

- The company has also increased its focus to grow hand and body wash products under Palmolive brands faster than the average growth rate, given its low market penetration of 2%.

Brief Industry Overview

- The size of the Indian oral care market in 2022 was around $641 million in 2022 and is expected to expand at a CAGR of 9.2% between 2022 and 2030 to reach around $1.3 billion, according to insights10 report.

- With oral issues becoming more prevalent in India with changing lifestyles, increased consumption of sugar in daily diet, and living standards, demand for oral hygiene products will increase.

- The National Oral Health Programme (NOHP), the flagship program of the Government of India, will also contribute to expanding oral hygiene in India. This program aims to improve oral hygiene standards in India, provide accessible, affordable, and high-quality health care, and reduce morbidity associated with oral disease.

- With the entry of new players, the oral care industry is experiencing increased competition among players, which reduces pricing flexibility. Colgate benefits from its parent company, which has a strong R&D capability and can launch new and innovative products at greater speed.

FAQs

When was Colgate-Palmolive established in India?

Colgate was established in 1806 by William Colgate in New York City as a soap and candle company. Later, in 1873, Colgate added toothpaste to its product portfolio. The company started its operation in India in 1937 with the launch of dental cream.

How has Colgate share price performed in the last five years?

As of 13 October 2023, Colgate share price has given a CAGR return of 13% in the last five years. It reached an all-time high level of ₹2,096 on 27th September 2023.

Are Colgate and Colgate-Palmolive same?

Yes, Colgate and Colgate-Palmolive are the same. Palmolive-Peet acquired Colgate in 1928 to create Colgate-Palmolive-Peet Company. Later, in 1953, the company renamed itself to Colgate Palmolive.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 7

No votes so far! Be the first to rate this post.